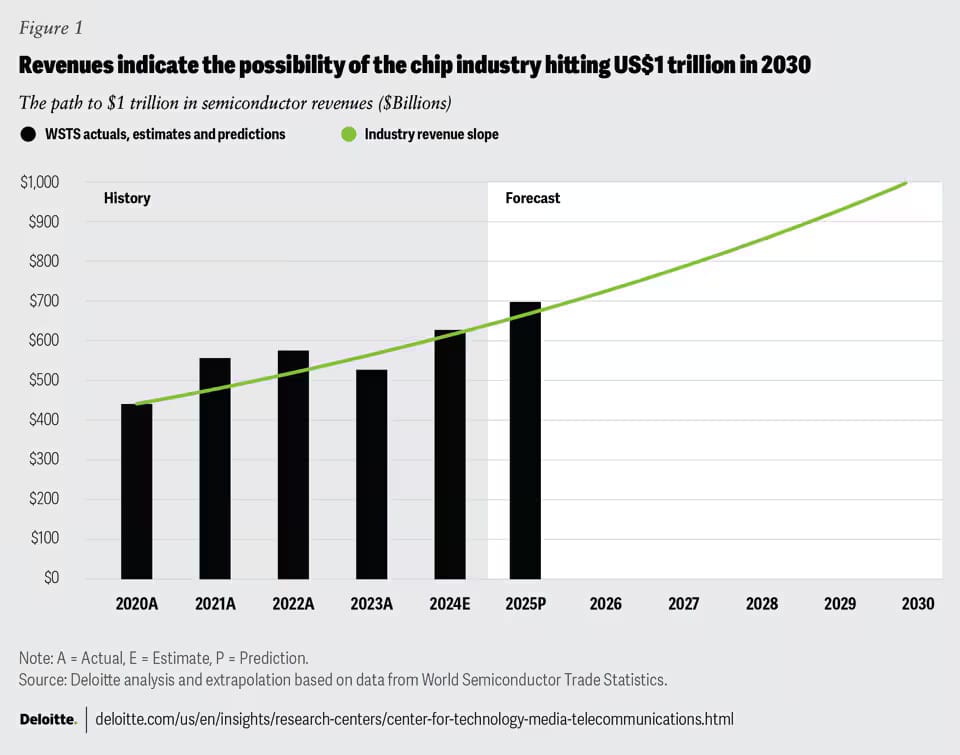

The chip sector is heading toward $697 billion in global sales by year-end and indicates a possibility to hit $1 trillion in 2030, according to Deloitte's 2025 outlook.

Yet several quality names remain priced as if the industry's structural growth doesn't exist.

Here's what we know.

While everyone chases the AI chip designers trading at 40x earnings, the companies actually building the infrastructure and enabling the technology are sitting well below.

That gap matters more than you might think.

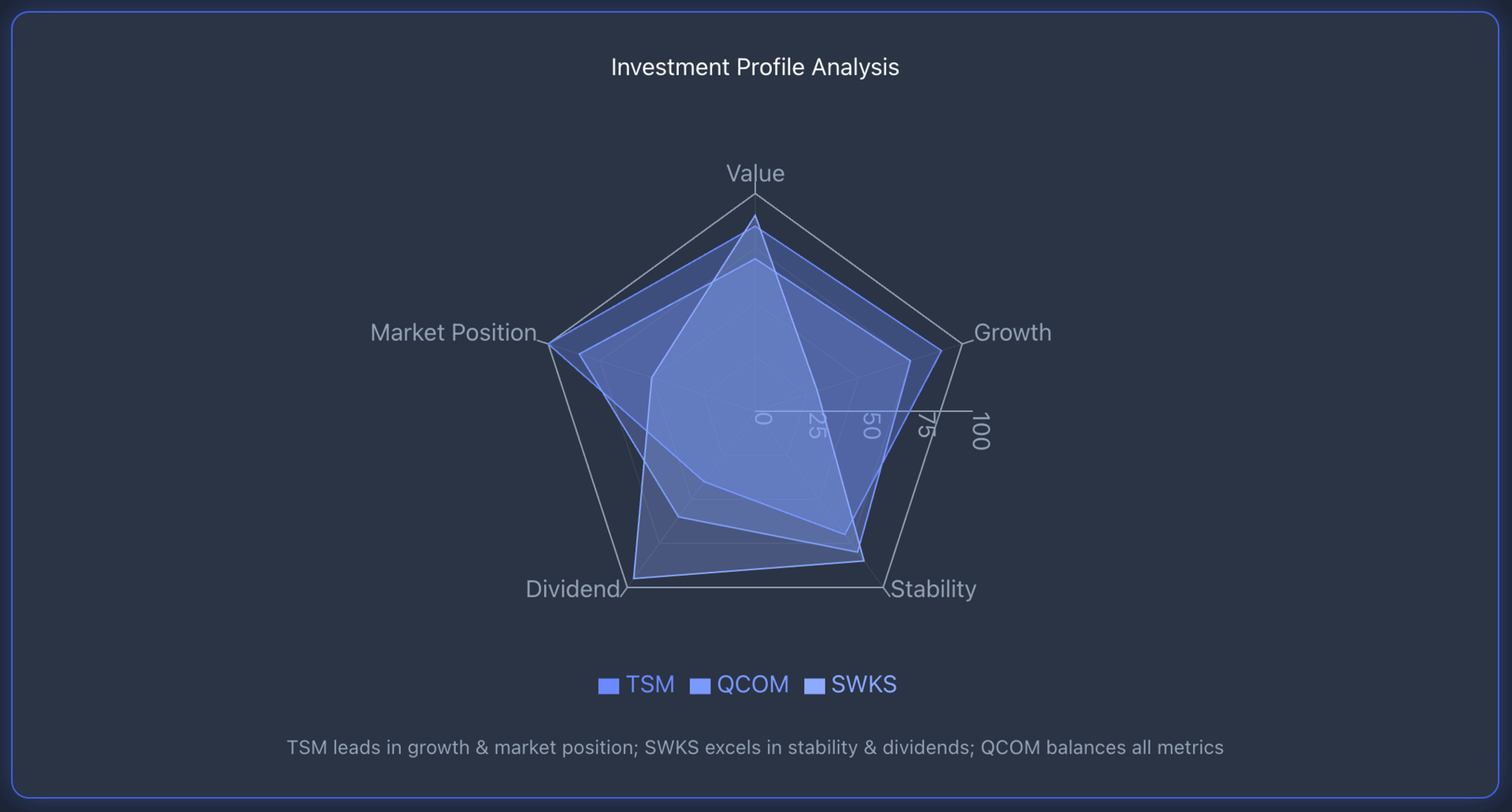

TSMC: (NYSE: TSM)

Key Financial Metrics:

YTD Return: +46.82%

Market Cap: $1.19T

P/E Ratio: 29.72

Dividend Yield: 0.85%

Taiwan Semiconductor manufactures chips for Nvidia, Apple, and AMD.

It's the only foundry producing advanced AI chips at scale. $TSM trades at a P/E ratio well below the companies it supplies.

The market discounts TSMC heavily for geopolitical risk. Fair enough. But it also ignores a basic fact: there is no alternative supplier for cutting-edge chips.

TSMC sells the picks and shovels in the AI gold rush without the premium valuation attached to pick users.

Current valuation: underpriced relative to monopoly position in 3nm and 2nm production.

Qualcomm (NASDAQ: QCOM)

Key Financial Metrics:

YTD Return: +7.50%

Market Cap: $176.86B

P/E Ratio: 33.77

Dividend Yield: 2.16%

Qualcomm $QCOM has been stuck in the "smartphone stock" box for years. The market missed its pivot into AI PCs and automotive chips.

The smartphone business isn't going away. It's stable and profitable.

But the growth is now coming from Windows laptops with neural processing units and advanced driver-assistance systems.

Revenue from these segments is climbing double digits while $QCOM reflects zero optimism.

For investors looking at growth without paying growth multiples, this is the setup.

ON Semiconductor (NASDAQ: ON)

Key Financial Metrics:

YTD Return: -21.27%

Market Cap: $19.97B

P/E Ratio: 64.78

ON Semi $ON leads in power management chips for EVs and industrial automation. The stock got hammered over the past year as EV demand slowed and industrial buyers worked through inventory.

Here's the thing: cyclical downturns in chips don't last forever. Inventory corrections end. EV adoption is a decade-long trend, not a quarterly story. ON Semi is trading at trough valuations while its automotive design wins are already locked in for 2026-2027 production.

If you're comfortable with short-term volatility, current prices offer a fair entry point.

GlobalFoundries (NASDAQ: GFS)

Key Financial Metrics:

YTD Return: -17.80%

Market Cap: $19.5B

Morningstar rates GlobalFoundries $GFS as a 4-star undervalued stock.

It's a key Western foundry backed by CHIPS Act funding, critical for supply chain resilience in defense, automotive, and IoT chips.

It doesn't make the most advanced AI chips. It doesn't have extreme ultraviolet lithography. It just produces essential semiconductors and generates steady cash flow.

The market treats boring as worthless. That's the opportunity. With government support and multi-year customer contracts, GFS offers downside protection most high-flyers don't.

Skyworks Solutions (NASDAQ: SWKS)

Key Financial Metrics:

YTD Return: -26.32%

Market Cap: $9.71B

P/E Ratio: 21.22

Dividend Yield: 4.35%

Skyworks $SWKS is tied to Apple, which makes growth investors nervous.

But look at the numbers: strong balance sheet, consistent cash generation, and a valuation that assumes permanent stagnation.

For defensive positioning in a volatile sector, Skyworks provides a downside cushion without sacrificing upside if Apple's device cycle improves.

It's not going to triple. It's also unlikely to fall apart.

The Bottom Line

The chip sector is on track for $697 billion in sales this year. Analysts forecast nearly $1 trillion by 2030. These five stocks trade below that trajectory.

TSMC controls advanced manufacturing with no real competition.

Qualcomm is growing in AI PCs while priced like a declining phone supplier.

ON Semi sits at cyclical lows with multi-year auto contracts already secured.

GlobalFoundries has government backing. Skyworks prints cash.

The structural growth is measurable. These valuations reflect temporary concerns, not fundamentals.

That creates opportunity.

What's catching investor attention today: Meta Buys Google Chips: The $250 Billion Market Signal You Can't Ignore

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.