Prices don't run in one direction forever.

They stretch too far, then snap back. That means reversion, and the RSI helps you see it coming.

What RSI Actually Measures

RSI tracks momentum.

It compares recent gains to recent losses over a set period, usually 14 days, and spits out a number between 0 and 100.

The math behind it is simple. When gains outpace losses, the number climbs. When losses dominate, it drops. J. Welles Wilder Jr. designed it as a momentum oscillator to measure the speed and magnitude of price changes.

What matters for traders: RSI tells you when a security has moved too far, too fast. And that's when reversals happen.

The Strategy: Reading the Extremes

Two numbers drive the RSI playbook.

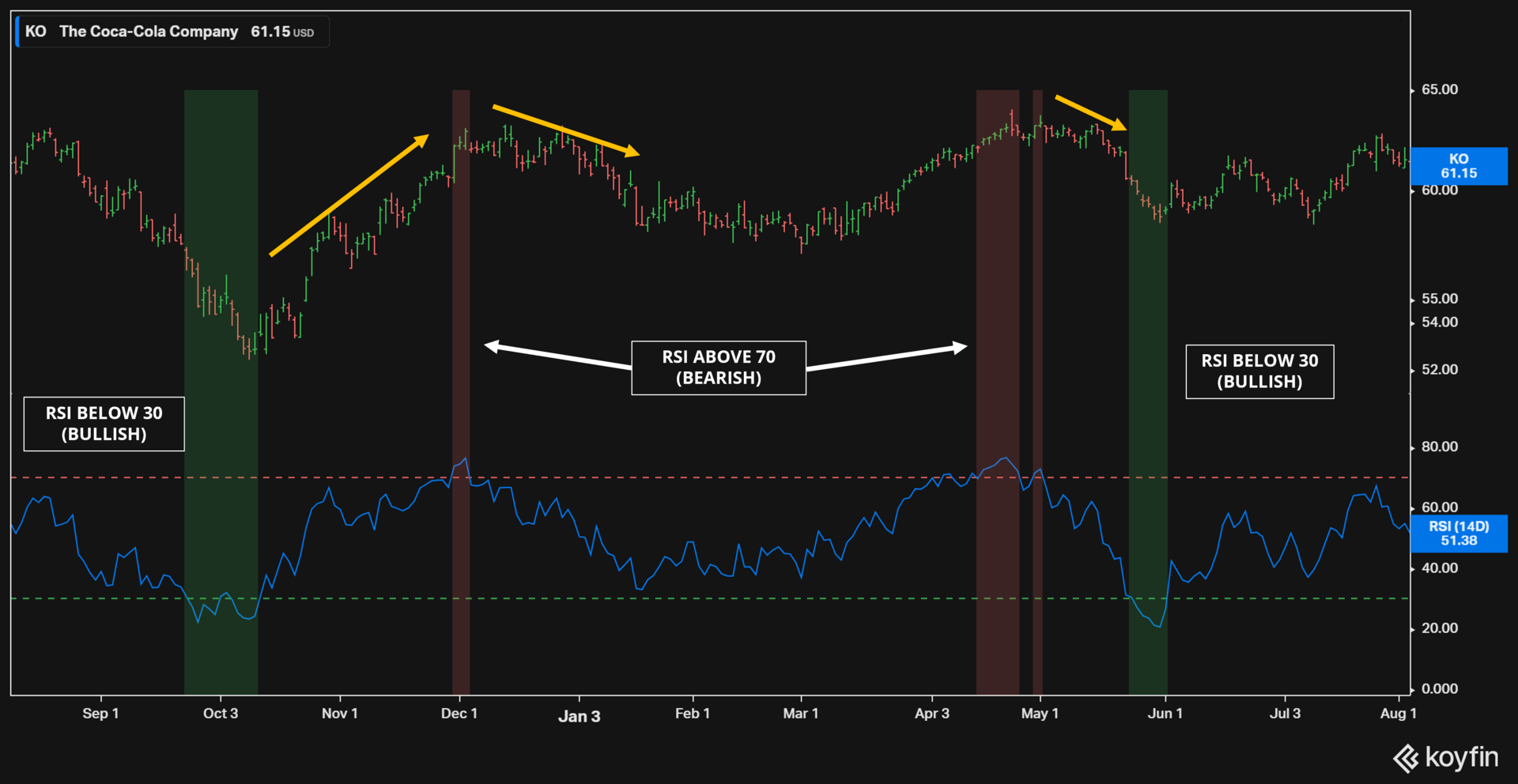

Below 30 signals oversold (RSI < 30).

This reading suggests the asset has become undervalued and may be positioned for a price bounce or rally. Fear has pushed the price down. Sellers are exhausted. That's your entry.

Above 70 signals overbought (RSI > 70).

The security is overvalued, anticipating a pullback as market participants begin selling. Greed has driven the price up. Buyers are running out. That's your exit.

This framework works especially well for swing traders using leveraged ETFs, where volatility amplifies these moves. You're not trying to catch long-term trends. You're exploiting the snapback.

But here's the thing: RSI isn't a standalone system. Strong trends can keep an asset overbought or oversold for weeks. Signal and reversal matters more than you might think.

Here’s the graph for Coca-Cola $KO with its share prices expanded.

Coca-Cola Company, RSI indicator explained (Investorplace)

It’s the classic “buy low, sell high” way of making money.

The Execution: Building a Reliable System

You need more than RSI alone.

Strong market trends can maintain overbought or oversold conditions for extended periods, making isolated signals potentially premature. Cross-reference it with volume data, moving averages, or other oscillators like stochastics.

Set alerts at the 30 and 70 thresholds.

Most platforms let you automate this. You don't need to watch every tick. Let the system notify you when conditions align.

Test your strategy. Backtest it across different market cycles. Not every oversold reading leads to a bounce. Not every overbought reading triggers a selloff. You're looking for probability, not certainty.

The goal isn't perfection. It's putting the odds in your favor.

RSI shows you when prices have stretched beyond normal ranges. What you do with that signal determines whether you profit from the reversion or get caught in a false move.

Mean reversion is real. RSI helps you see it.

But execution—timing, confirmation, risk management—that's what separates profitable traders from the rest.

What's catching investor attention today: Silver's 72% Gain Still Isn't Enough: Why the Gold/Silver Ratio at 81 Signals a $75+ Breakout

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.