A big game is going on.

Meta is in talks to buy AI chips from Google.

Not Nvidia. Google.

This move just erased nearly $120 billion from Nvidia's market value in a single trading session.

The Deal That Breaks the Rules

Meta and Google are finalizing a multi-billion dollar chip deal.

Meta will rent Google's TPU capacity starting in 2026, then buy physical chips by 2027. The deal includes Google's ARM-based Axion processors for general computing.

Hyperscalers don't do this. Amazon builds Trainium for Amazon. Google builds TPUs for Google. Microsoft builds Maia for Microsoft. They don't sell to each other.

Until now.

Nvidia Official Statement, Nov. 25, 2025 (X/Nvidia)

Meta is expected to spend nearly $72 billion on capex this year. Most of that goes to AI infrastructure.

If even 20% shifts from Nvidia to Google, that's $14 billion in redirected purchases. And that's just one customer.

Meta’s Capacity Problem

Google and Meta compete directly in digital advertising. They sue each other. They lobby against each other. They don't help each other.

Except when Nvidia's margins hit 70%+.

That margin isn't just profit. It's an opportunity cost. For companies spending tens of billions on chips, every percentage point matters.

Google's TPUs have run production workloads for seven years. The technology works. Google can price below Nvidia while still making money.

Meta has another problem. Its internal chip program, Artemis, is behind schedule. Building competitive AI chips takes 3-5 years minimum. Meta needs capacity now. Google has it ready.

The math is simple: buy proven chips today at lower cost, keep developing your own for tomorrow.

Market Reacts

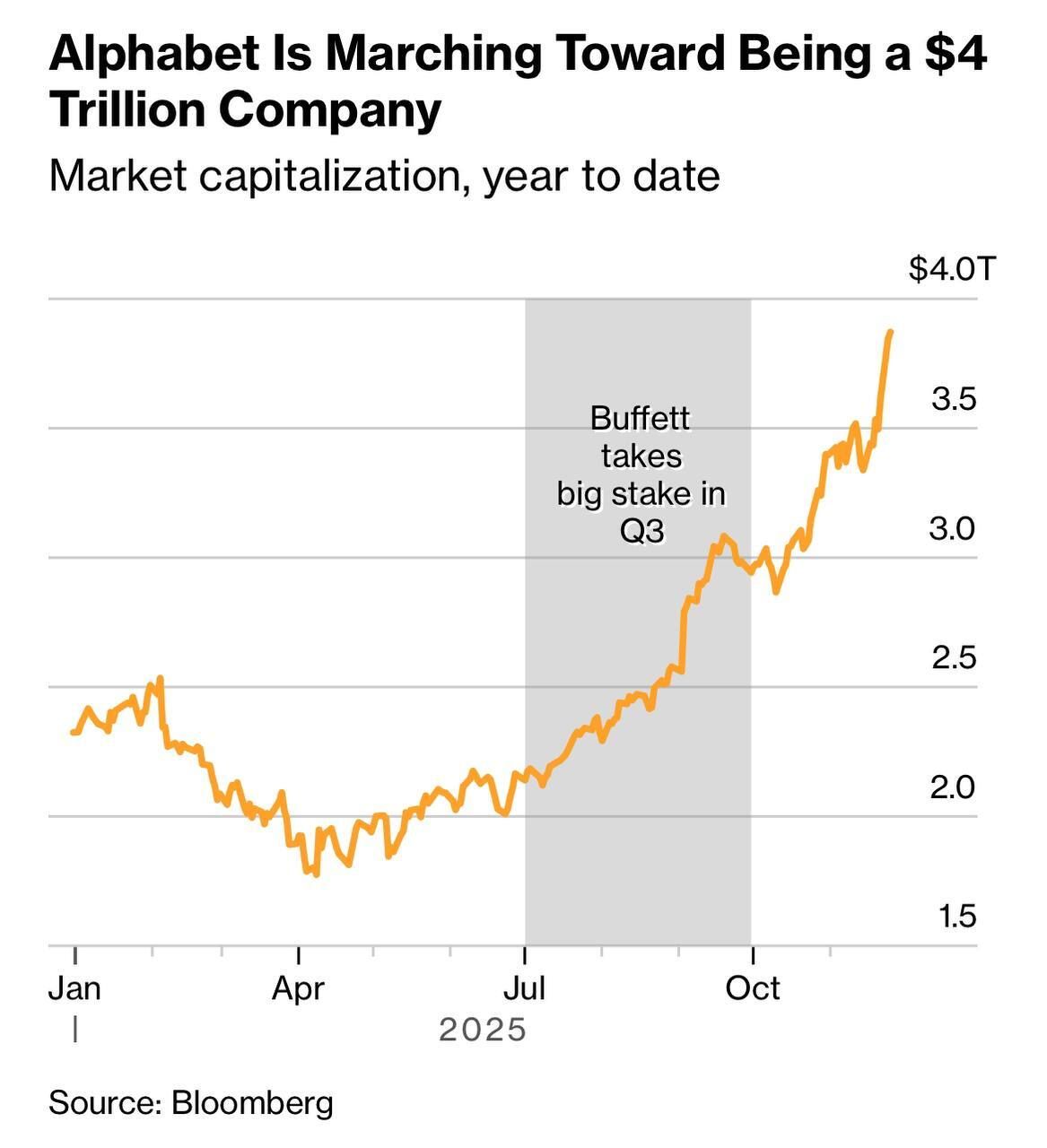

Alphabet Is Marching Toward Being a $4 Trillion Company (Bloomberg)

$NVDA ( ▲ 1.02% ) dropped 3.5% to 7% across sessions.

$GOOGL rose 2% to 5%, rallying to a $4 trillion market cap.

$AMD ( ▼ 1.58% ) fell sharply. The company positioned its MI300 chip as the Nvidia alternative.

Google's TPU commercialization changes that narrative. Meta could have bought AMD chips. They chose Google instead.

Broadcom went up. They design Google's chips and earn royalties on every unit sold. They also work with other hyperscalers on custom silicon. Broadcom wins regardless of who takes market share from Nvidia.

What This Means

Check your semiconductor ETF holdings.

$SMH ( ▲ 1.18% ) and $SOXX ( ▲ 1.01% ) both carry 20-25% Nvidia positions. That concentration just became a liability. When one name moves 5-7%, it drags the whole fund.

Equal-weight alternatives like $XSD ( ▲ 0.62% ) spread exposure more evenly. No single stock dominates. You still get semiconductor exposure without the single-name risk.

Based on this news, what's your next investment move?

For direct equity holders: Nvidia still leads in performance and has the most mature software ecosystem.

But the pricing power that justified premium valuations? That just got challenged. When customers have alternatives, margins compress.

$AMD faces tougher questions. The "only alternative to Nvidia" story doesn't work when Google, Amazon, and Microsoft all sell competitive chips. Being the second option mattered when there were only two options.

The Real Pattern Emerging

This isn't about one deal. It's about what comes next.

What will be the next major move in the AI chip market?

If Meta can buy Google's chips, Amazon can sell Trainium to outside customers. Microsoft can commercialize Maia.

Every hyperscaler spent billions developing custom silicon. Now they can turn cost centers into revenue streams.

That changes the competitive map. Nvidia competed against one or two alternatives. Now it's competing against five, all backed by companies with deep pockets and existing customer relationships.

The infrastructure spending continues. AI compute demand is real and growing. But the assumption that one vendor captures most of that spending? That assumption just got repriced.

What to Watch Next

Look for similar announcements from other hyperscalers.

If this deal works economically for both sides, others will follow.

Watch Nvidia's next earnings call. Management will address competitive dynamics and pricing. Listen for changes in language around market share and pricing power.

Track Broadcom's design win announcements. They work across multiple custom chip programs. More wins mean the trend is accelerating.

And pay attention to ARM's datacenter revenue. The shift from x86 to ARM in servers is slow but directional.

Each new chip program using ARM architecture adds to their royalty stream.

The chip war just got more competitive. Position accordingly.