November 2025 marks a turning point.

Bitcoin's "digital gold" narrative just collapsed under market pressure.

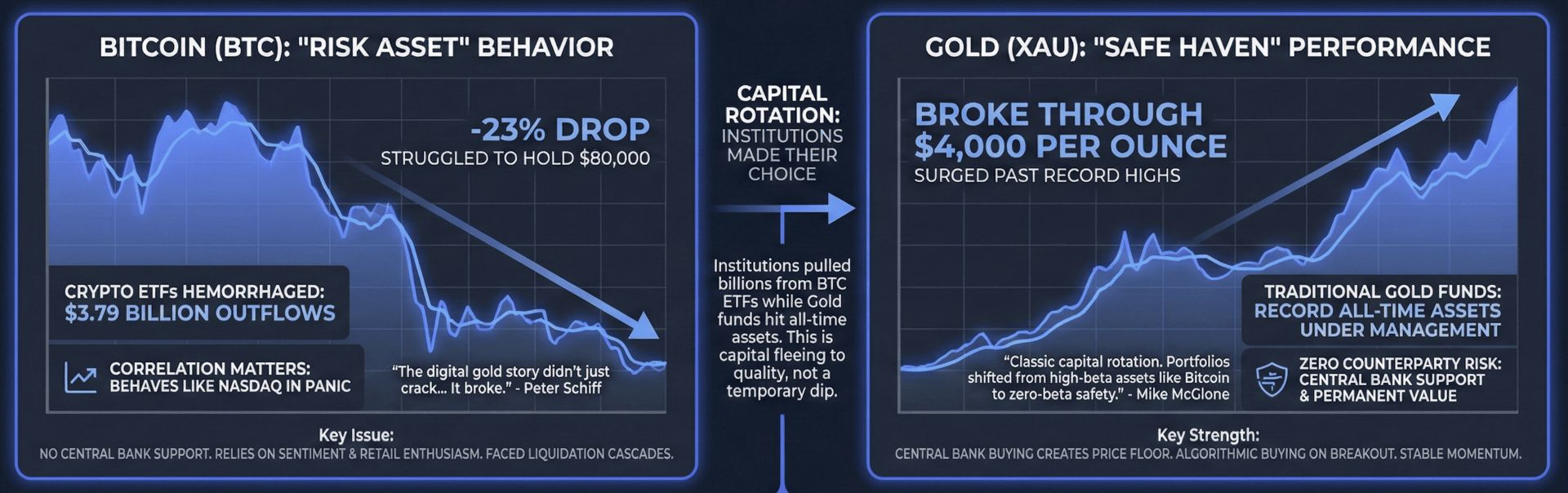

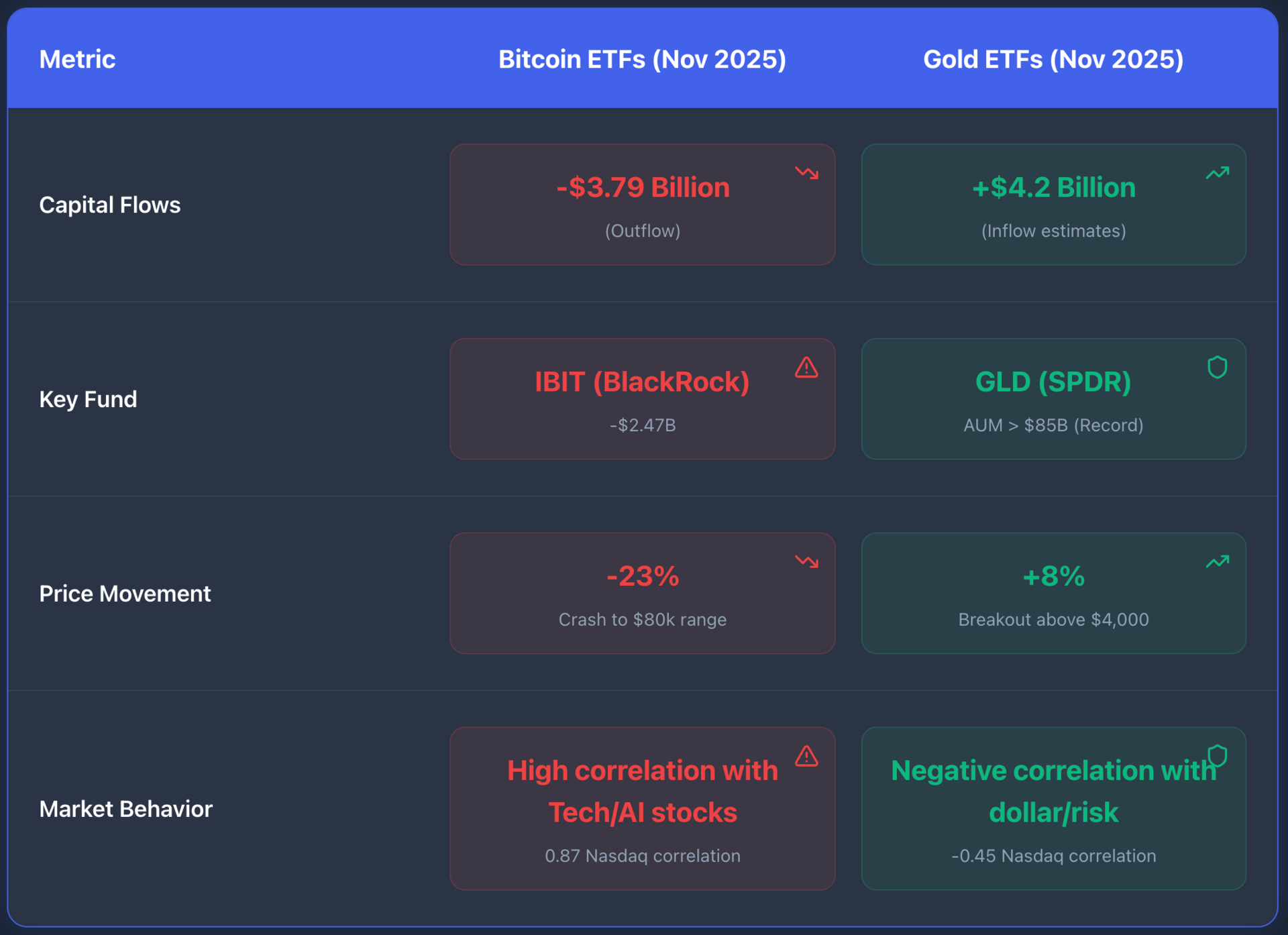

While crypto ETFs hemorrhaged $3.79 billion, traditional gold funds surged past record highs.

This isn't a temporary dip. This is capital fleeing to quality.

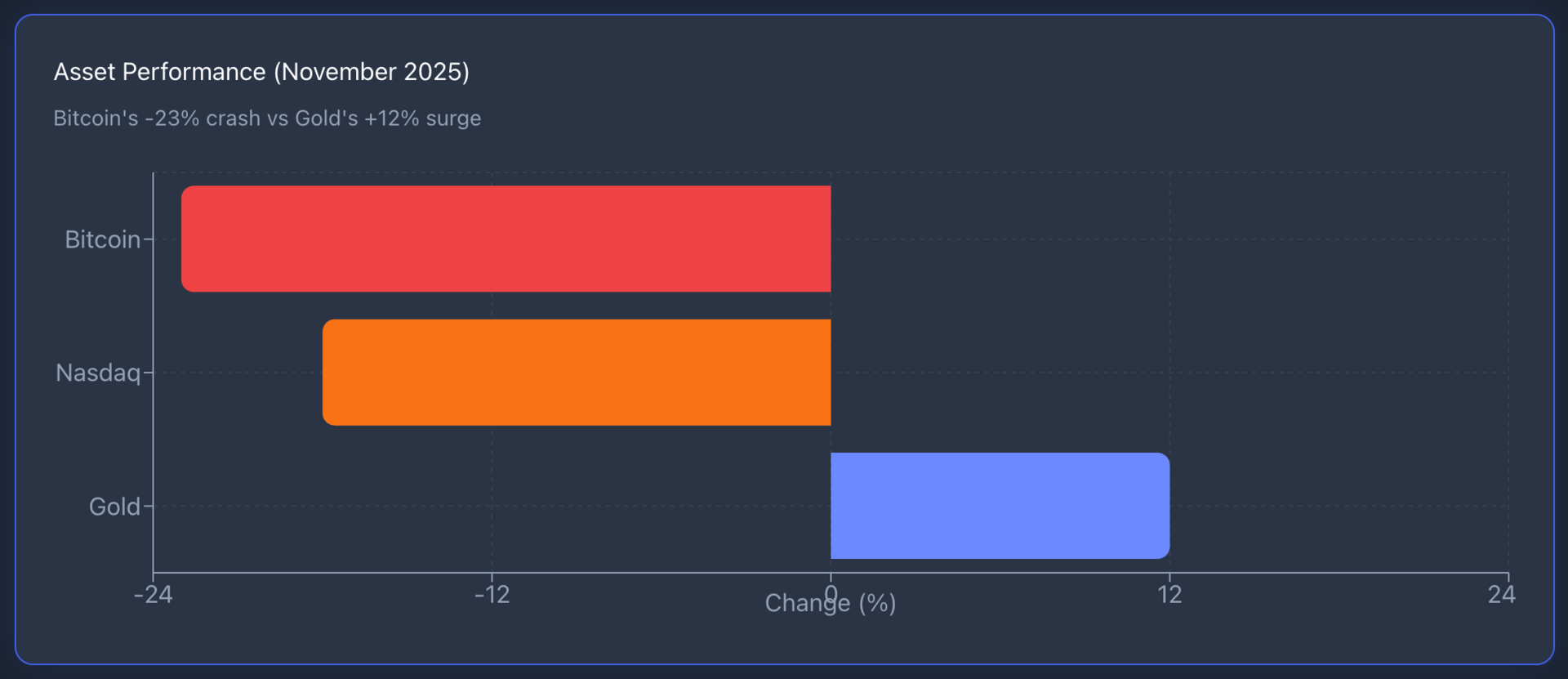

The Numbers Tell the Story

Bitcoin dropped 23% in lockstep with the Nasdaq.

That correlation matters more than you might think.

When markets panic, Bitcoin behaves like a tech stock, not a safe haven. The data is clear: investors pulled billions from BTC ETFs while gold funds hit all-time assets under management.

Gold broke through $4,000 per ounce. Bitcoin struggled to hold $80,000.

One asset proved its worth under stress. The other failed its first real test.

After the market events of November 2025, which asset do you trust more as a "safe haven"?

What Changed in November

When uncertainty hit, institutions made their choice.

Physical gold offered what Bitcoin couldn't—zero counterparty risk and central bank support. While retail investors held onto hope, professional money managers executed the rotation.

The market has spoken specifically and loudly: when real panic sets in, institutions don't want digital tokens, they want physical permanence. The 'digital gold' narrative didn't just crack this month; it shattered.

The digital gold story just broke this month.

This wasn't about sentiment or narrative. Experts described it as classic capital rotation. Portfolios shifted from high-beta assets like Bitcoin to zero-beta safety. At $4,000, gold isn't overpriced. It's repricing fiat currency devaluation.

Why Gold Won This Round

Central banks kept buying. That creates a price floor. Bitcoin has no such support structure. It relies entirely on investor sentiment and retail enthusiasm. When that sentiment turns, there's no backstop.

What was the biggest factor driving the rotation to gold?

Geopolitical tension and Federal Reserve uncertainty pushed institutional money toward assets with permanent value. Gold delivers that. Bitcoin, despite a decade of promises, still trades like a risk asset.

Technical analysts at Kitco News noted the divergence: Bitcoin faced liquidation cascades while gold's breakout above $4,000 triggered algorithmic buying. Money flows where momentum is stable.

The Institutional View

Large funds are rebalancing.

They're taking profits or cutting losses in crypto to move into gold's sustained uptrend. This matters for portfolio construction.

If your defensive allocation included Bitcoin, November exposed that strategy's weakness.

Bloomberg confirms the record ETF outflows. World Gold Council research shows ETFs driving gold's price discovery in Q4 2025.

What This Means

November 2025 tested the digital gold thesis. The thesis failed.

Bitcoin correlates with risk assets when correlation matters most. Gold proved it still functions as a monetary anchor during market stress.

Smart money recognized this. They adjusted their positions accordingly. The rotation from crypto to gold reflects a fundamental reassessment of what constitutes a safe haven in modern portfolios.

For investors, the lesson is straightforward: defensive assets must perform defensively. Bitcoin didn't. Gold did.

That gap between expectation and reality drove billions in capital flows. And that movement tells you everything you need to know about where institutional confidence lies right now.

If you want to dive deeper into what triggered Bitcoin’s failure to act as a safe haven, here’s my recent breakdown…

What's catching investor attention today: The Middle East and European AI Infrastructure Boom That Could Shift 38% of Global Cloud Market Share by 2028

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.