Saudi Arabia announced plans to create the first-of-a-kind "AI Zone" through a partnership between Humain and AWS.

Britain followed with its own "AI Growth Zones" initiative.

It's a coordinated shift in how nations view data sovereignty.

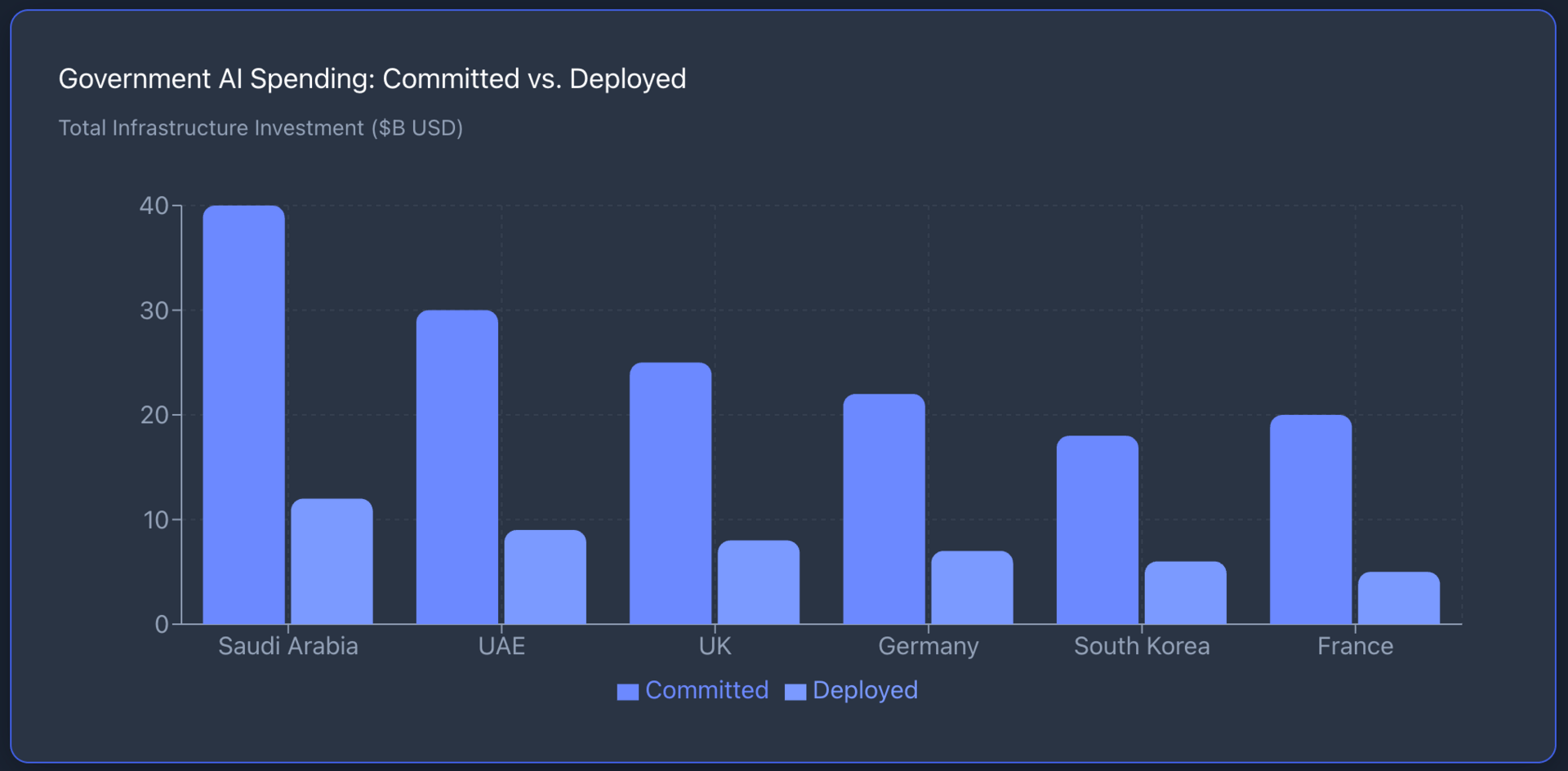

The numbers tell the story.

Saudi Arabia is investing billions in oil revenues to establish itself as the Middle East's AI hub, partnering with AWS and integrating Nvidia's AI infrastructure.

Europe is taking similar steps. Governments have made their position clear: they don't want their data stored in US-based systems.

This is digital sovereignty in action.

Government AI Spending

The geopolitics are straightforward.

Every major economy wants its own "AI fort." Data has become a strategic asset, and nations are treating it accordingly.

Saudi Arabia's approach demonstrates the scale of this shift. The country is using its oil wealth to build comprehensive AI infrastructure on its own terms.

Humain's partnership with Global AI aims to construct large-scale AI data centers and compute capacity both in the US and internationally, utilizing the latest Nvidia AI infrastructure.

HUMAIN to deploy NVIDIA AI infrastructure with up to 600,000 NVIDIA GPUs in Saudi Arabia and US over next three years.

But the key detail is control—these facilities operate under local jurisdiction.

Europe is following a parallel path. Britain's AI Growth Zones represent a policy framework designed to attract AI development while maintaining regulatory oversight. The underlying message is consistent across regions: strategic technology infrastructure should be domestically controlled.

This trend accelerated after years of tension over data privacy regulations.

The collapse of the EU-US Privacy Shield framework exposed fundamental disagreements about data governance. Governments concluded that relying on foreign cloud infrastructure created unacceptable dependencies.

Will the trend of "digital sovereignty" lead to a more fragmented or a more secure global internet?

Who's Actually Building These Systems

The infrastructure players are familiar, AWS, Nvidia, Microsoft, but the terms of engagement have changed. These companies are deploying technology on local terms, not their standard global operating model.

AWS is building regional cloud capacity tailored to specific regulatory requirements. Nvidia is supplying the compute hardware. But ownership structures and data governance follow local rules. This represents a significant shift from the centralized cloud model that dominated the past decade.

Regional telecommunications companies and sovereign wealth funds are also entering the space. They're providing capital and local expertise. The result is hybrid infrastructure that combines global technology with local control.

The Investment Angle

This infrastructure buildout creates opportunities in regional technology exposure. Investors have historically concentrated on US-based cloud providers. That made sense when centralization was the dominant model. But localization changes the equation.

Regional technology ETFs offer exposure to this shift.

$EMQQ ( ▼ 0.62% ) provides access to emerging market technology companies that will benefit from local data center construction.

$VGK ( ▲ 0.85% ) covers European equities, including firms positioned to support AI infrastructure development.

The thesis is simple: if governments are mandating local infrastructure, the companies building and operating that infrastructure should see revenue growth.

As an investor, where would you put your money to capitalize on this trend?

The spending is real. Saudi Arabia alone has committed billions. Europe is allocating substantial public and private capital.

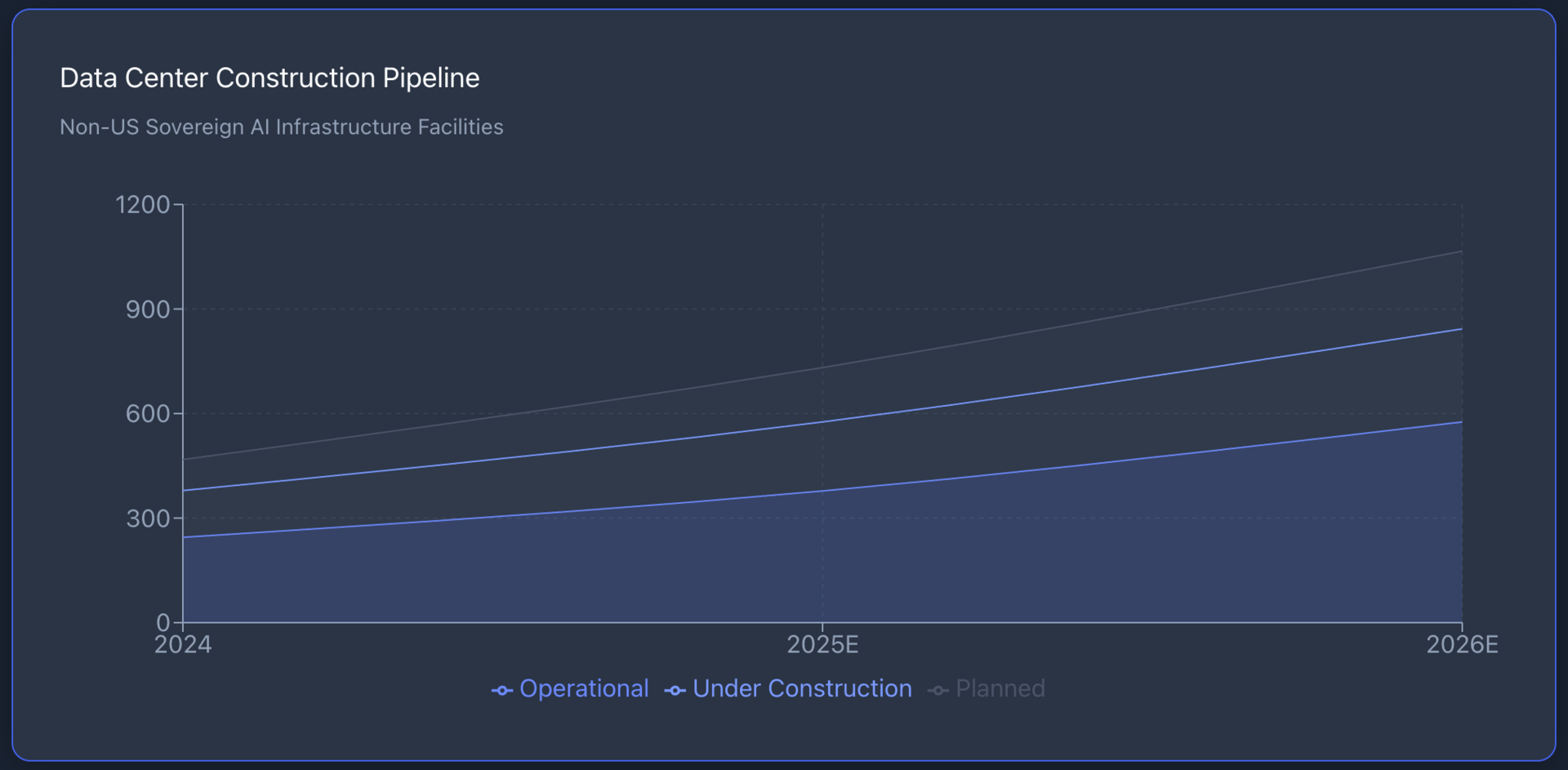

But this isn't a short-term trade. Infrastructure projects take years to complete.

Regulatory frameworks are still being defined. The companies best positioned to benefit may not be obvious yet.

What This Means

The move toward sovereign AI infrastructure fragments the global technology market.

Instead of a few dominant cloud providers serving worldwide customers, we're heading toward regional ecosystems with different standards and capabilities.

That fragmentation creates both opportunities and complications. Companies operating across multiple jurisdictions will need to navigate varying regulatory requirements.

Data portability between regions becomes more complex. But domestic technology providers gain competitive advantages in their home markets.

The investment implication is that regional diversification matters more than it did five years ago. A portfolio concentrated in US technology giants captures one piece of this trend. But the growth happening in localized infrastructure requires exposure to regional players.

This is a structural shift, not a temporary policy response. Governments have decided that data sovereignty is non-negotiable.

The infrastructure spending will continue for years. Investors who understand this shift early have positioning advantages.

What's catching investor attention today: Amazon's $50 Billion Bet on Government AI Infrastructure

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.