Gold reached $4,381 per ounce in October 2025. Silver hit $50.94 on the same day.

That 86:1 ratio tells you everything about the opportunity ahead.

Gold functions as portfolio insurance. When geopolitical risk rises, gold climbs.

But silver operates differently. It's both a precious metal and an industrial commodity. That dual nature creates leverage most investors overlook.

The Gold/Silver Ratio

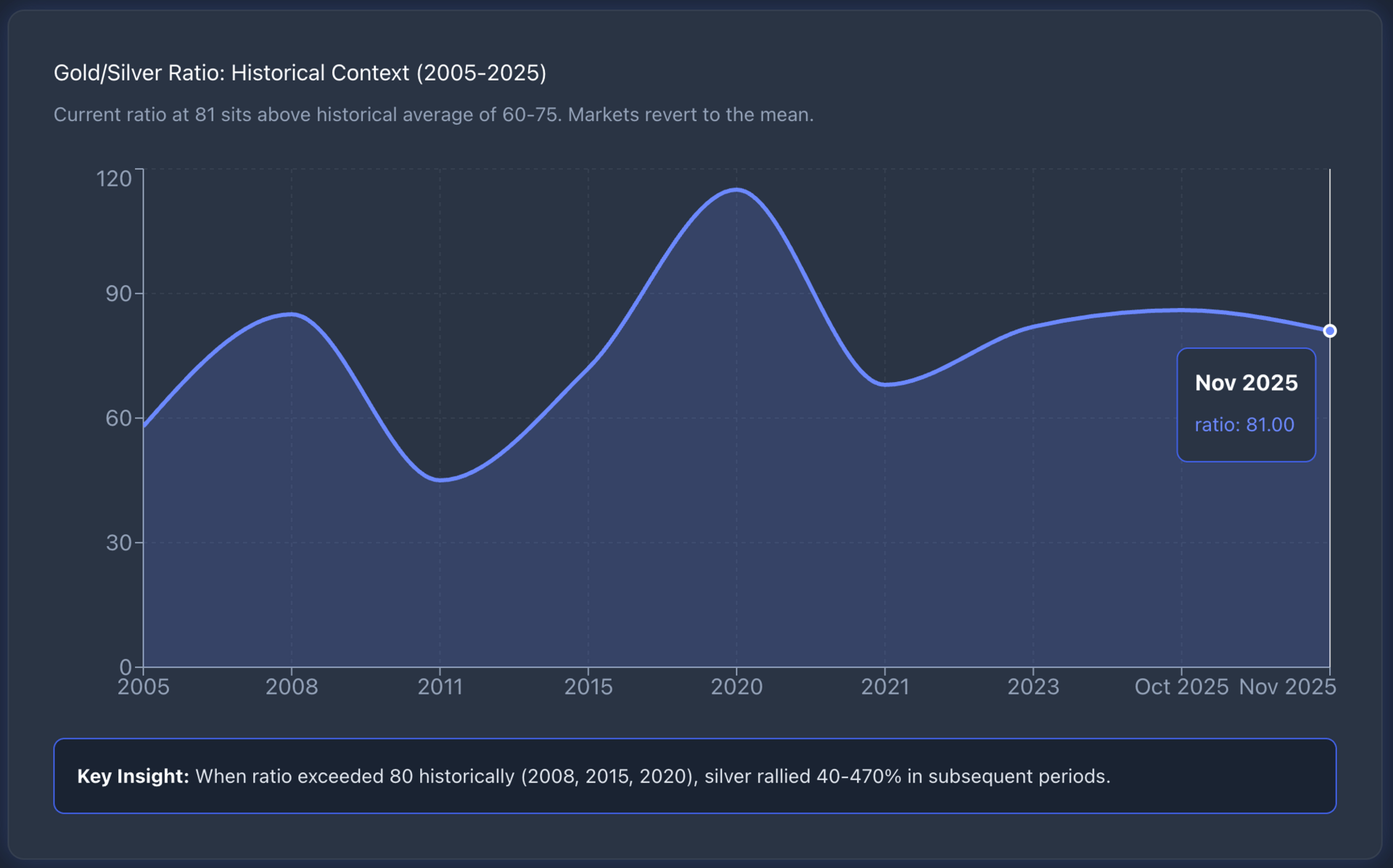

The Gold/Silver Ratio measures how many ounces of silver equal one ounce of gold.

Currently sitting around 80 to 83 in November 2025, this reading sits above the historical average of 60:1 to 75:1.

Markets revert to historical means. This gap matters more than you might think.

The past three times this ratio topped 80, silver rallied 40%, 300%, and 400%. Not predictions, just historical pattern recognition.

But here's the thing. Gold and silver currently show their weakest price correlation in over two decades.

Gold ran on central bank buying and safe-haven flows.

Silver lagged because the market still views it primarily as an industrial metal. That perception creates the mispricing.

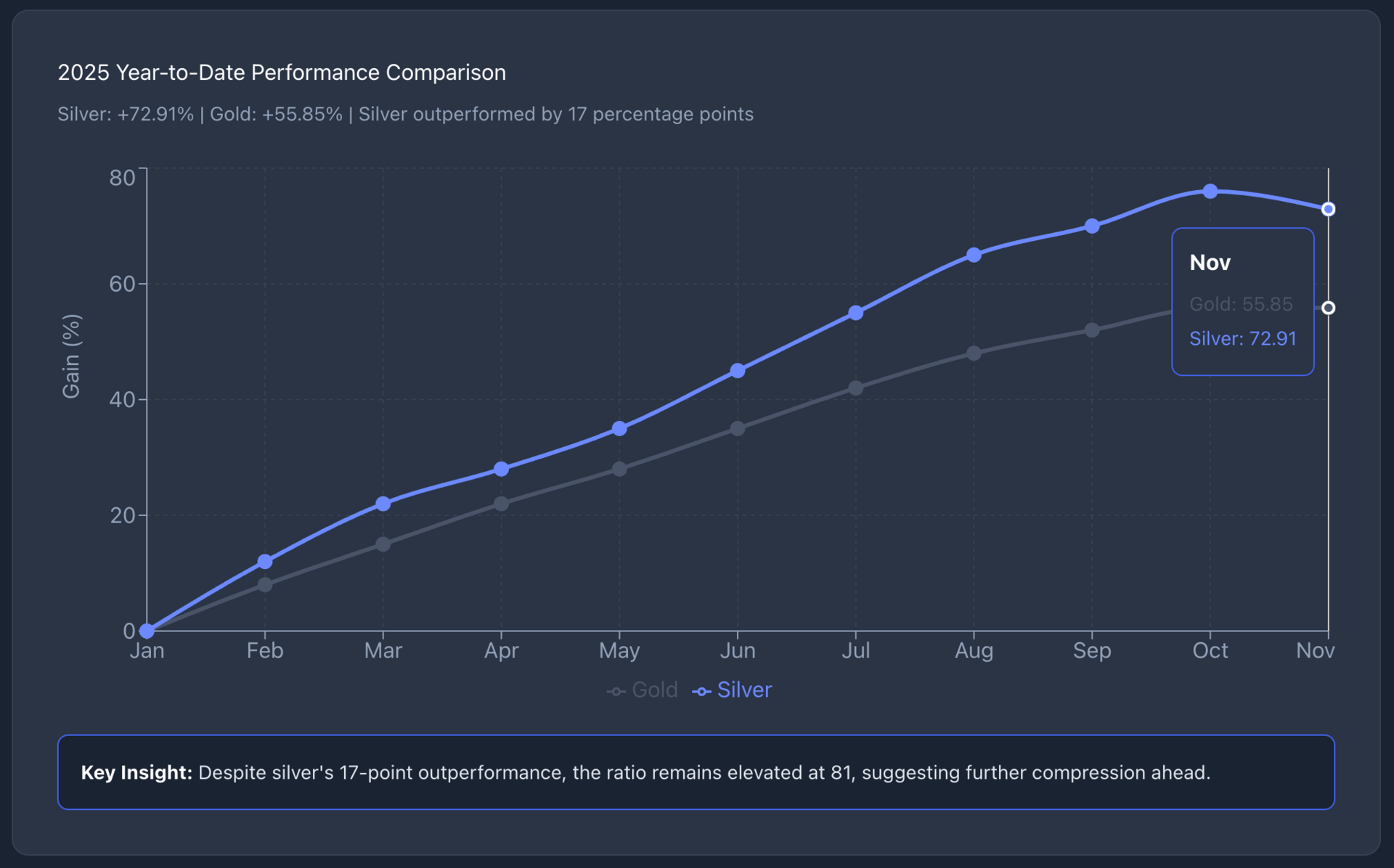

Data shows silver's extraordinary YTD performance. Silver runs from $28.92 on January 1 to $50.94 by October 10 showcases a 76% gain.Gold gained 55.85% in the same period.

Silver outperformed, yet the ratio remains historically elevated.

Industrial Demand

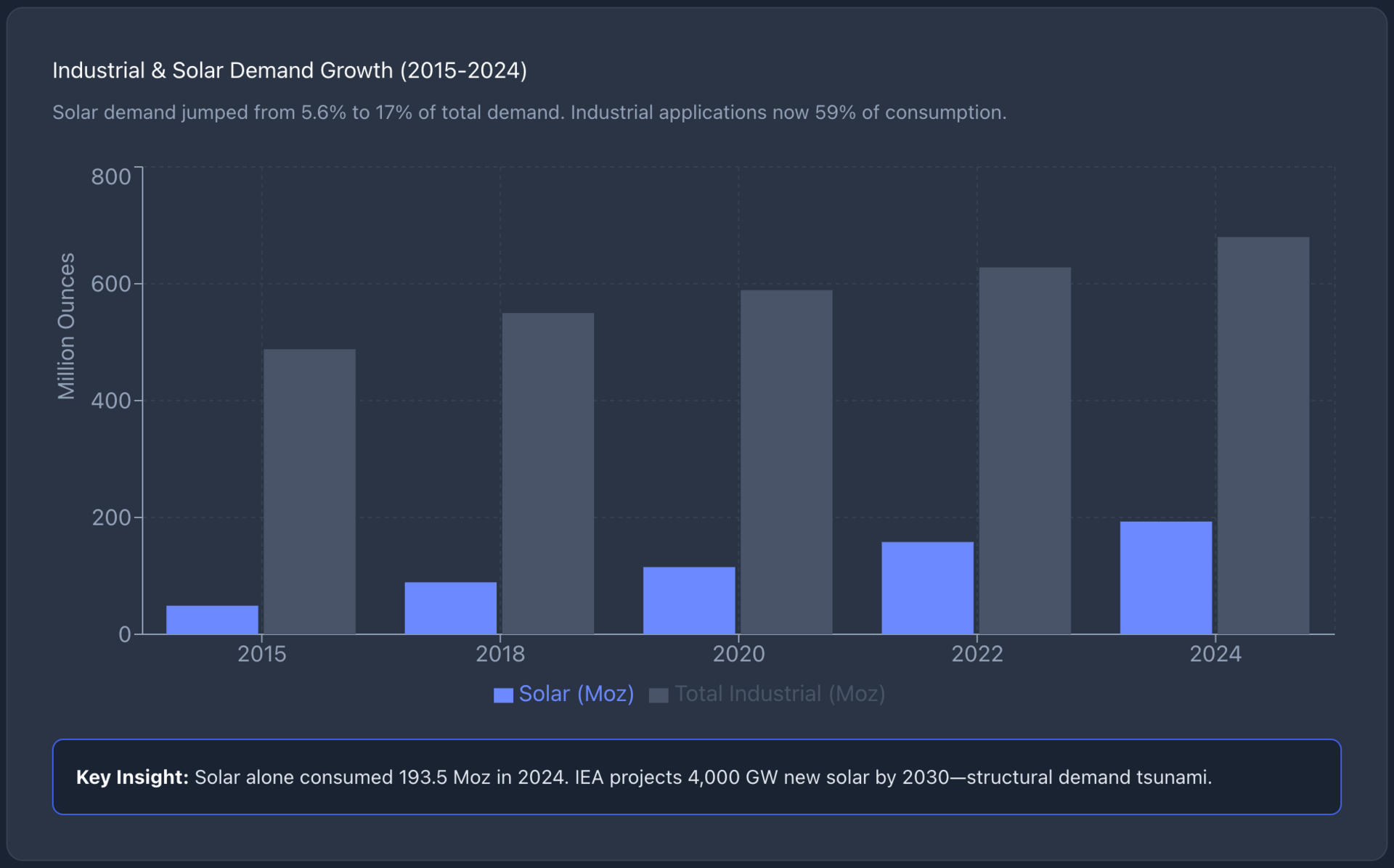

Industrial applications consumed 680.5 million ounces in 2024, with industrial demand now representing 59% of total silver consumption. A decade ago, that figure was 50%. This shift fundamentally changes silver's risk profile.

The photovoltaic sector drives this demand surge.

Solar panel manufacturing consumed 193.5 million ounces in 2024, and solar-specific demand now accounts for 17% of total silver demand, compared to just 5.6% in 2015.

Each solar panel requires 15-25 grams of silver. The International Energy Agency projects 4,000 gigawatts of new solar capacity through 2030. Do that math.

EVs create additional pressure. An EV uses roughly 50 grams of silver vs 25 grams for traditional vehicles.

As production scales, automotive silver demand could triple by 2030.

Add AI infrastructure, 5G networks, and consumer electronics, and you're looking at structural demand growth that mine supply cannot match.

In 2025, silver received critical mineral designation, acknowledging its strategic importance for national security applications.

This reclassification could influence government stockpiling policies, further tightening supply availability for commercial markets.

What do you believe is the single biggest catalyst for silver's price in 2026?

The Supply Problem

The silver market recorded its fourth consecutive year of supply deficit in 2024, with shortfalls totaling 678 million ounces from 2021-2024—equivalent to 10 months of global mine production. Mine production increased just 0.9% last year despite surging prices.

The constraint is structural.

70% of silver comes as a byproduct from copper, lead, and zinc operations.

Primary silver miners can't simply ramp up production in response to price signals. New mine development requires 5-8 years. The supply response is impaired.

Meanwhile, $COMEX silver stocks have declined 70% since 2020. Freely tradable inventories are being drawn down. Silver-backed ETPs absorbed 95 million ounces in the first half of 2025, pushing global holdings to 1.13 billion ounces.

That metal isn't coming back to market.

The Trade Setup

Watch the Gold/Silver Ratio at 80 to 83 as of early November 2025.

When it decisively breaks below 80, silver typically begins outperforming gold. That inflection point signals tactical opportunity.

For exposure, consider $SLV (iShares Silver Trust) for direct price participation or $SIL (Global X Silver Miners ETF) for leveraged exposure through mining equities.

Mining stocks historically amplify silver price movements by multiples. Both up and down.

Based on the current market, if you had to allocate $10,000 right now, where would you put it?

The risk case is straightforward. If global industrial activity slows significantly, silver demand weakens.

If gold surges during a crisis, the ratio could widen further before compressing. Timing matters.

But the base case looks compelling. Record industrial demand provides a price floor. Supply deficits continue through at least 2026.

The Gold/Silver Ratio sits well above historical norms at 80-83. These conditions favor ratio compression—meaning silver outperforms gold on a percentage basis.

Silver's 76% gain YTD demonstrates the metal's explosive potential when momentum builds. Based on past behavior and historical lows, a further drop in the ratio toward the 60-65 range appears likely. That would require silver to significantly outperform gold from current levels.

The Gold/Silver Ratio currently sits around 81:1. Where do you predict it will be in 12 months?

Gold protects. Silver grows.

That distinction defines the opportunity set as we move through 2025 and into 2026.

What's catching investor attention today: The "Buy the Dip" Guide: Setting the Perfect Entry

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.