Most investors lose money trying to "buy the dip" because they're guessing at entry points instead of analyzing them.

Every market pullback looks like an opportunity until it turns into a 20% drawdown. The difference between catching a bargain and catching a falling knife comes down to one skill—reading support levels.

“Buy the Dip” Timing

Buying the dip works. But only when you know where the dip ends.

Most investors see a 5% decline and jump in. The stock drops another 10%. They bought momentum, not value. They mistook a downtrend for standard volatility.

A dip is a temporary pullback in an upward trend. A downtrend is a structural shift lower. One bounces back quickly. The other erodes capital for months.

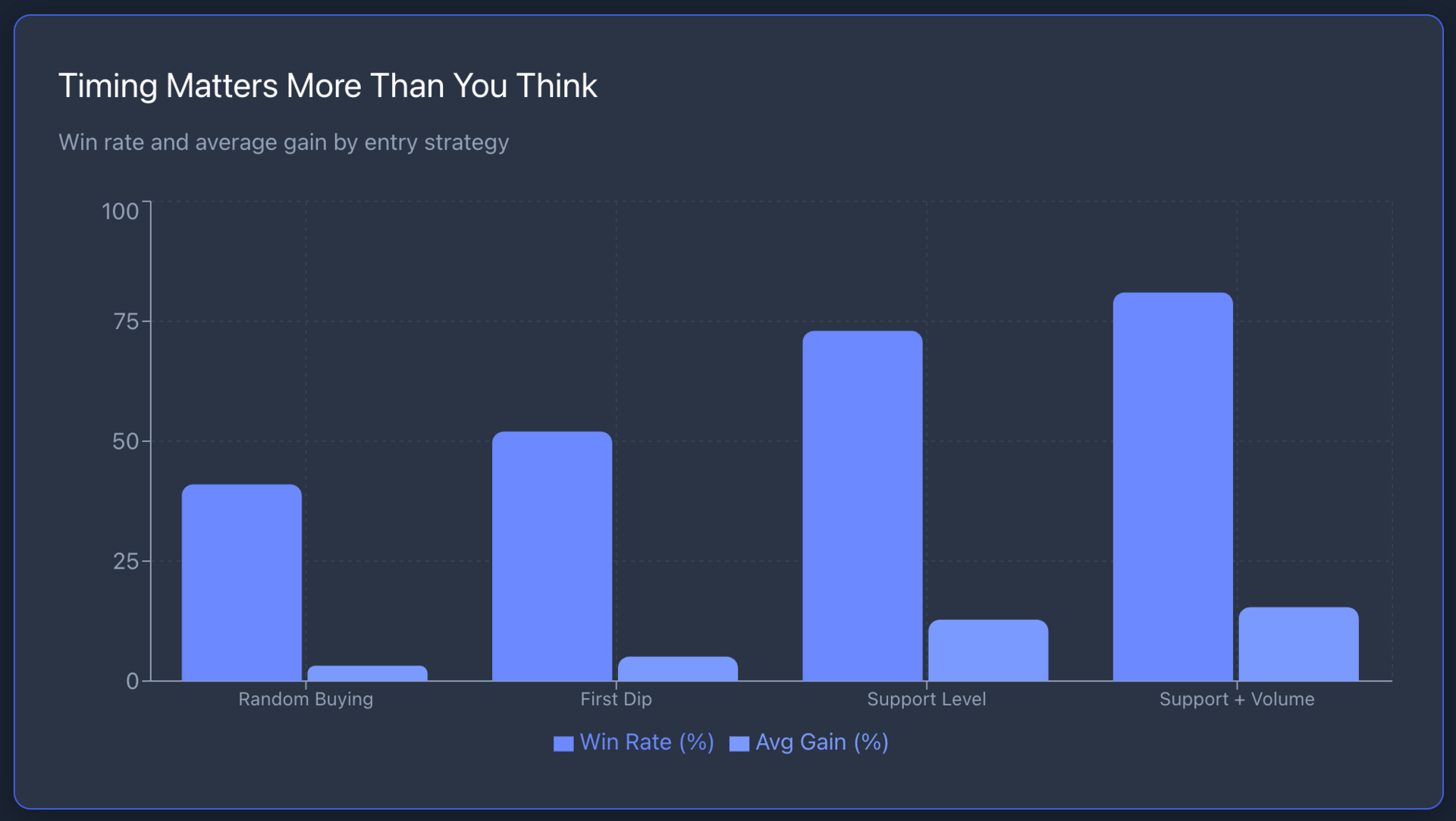

Without a framework, you're gambling on timing. With support levels, you're analyzing probability.

Support Levels

Support levels are price floors where buying pressure historically outweighs selling pressure.

These aren't random numbers. They're proven zones where demand has absorbed supply before.

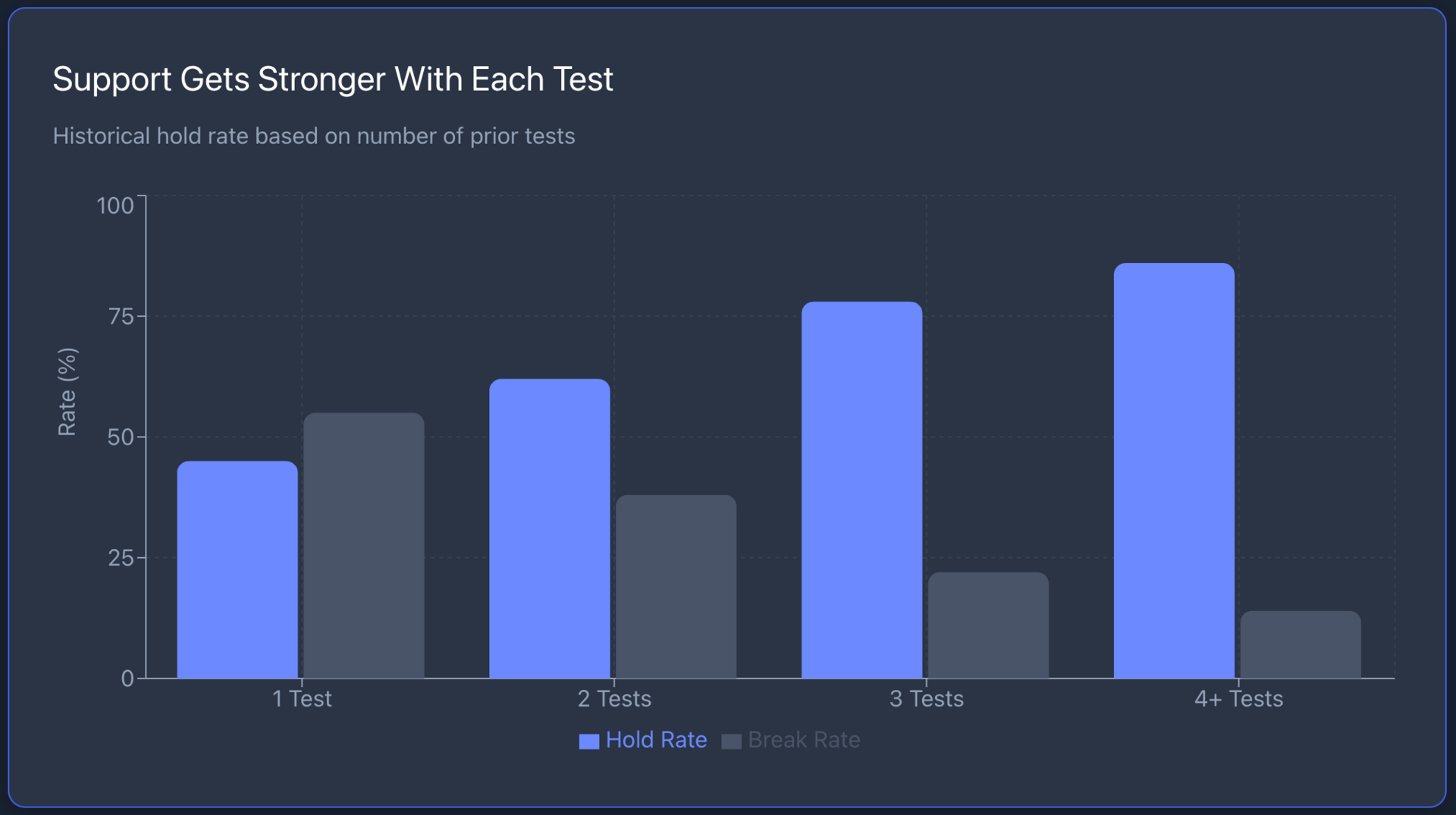

Here's what we know: Markets have memory. Prices that held once tend to hold again. Not always, but often enough to shift odds in your favor.

Pull up a six-month chart. Look for horizontal zones where price bounced multiple times. That's your first support level.

The more times price is tested and held, the stronger the support.

Next, check volume. High volume at a support level means real buyers stepped in. Low volume bounces are fragile.

You want confirmation that institutional money entered, not just retail speculation.

Support isn't a single price point. It's a zone, usually spanning 2-3% around a key level.

Set your entry near the bottom of that zone, not at the first sign of decline.

Price Alerts

This is where discipline separates performance from loss.

Open your brokerage platform. Set a price alert at your identified support level. Not a market order. Not a limit buy. Just an alert.

When price hits that level, evaluate again. Is volume increasing? Are other technical indicators confirming support? Is the broader market stable or deteriorating?

If conditions check out, then you buy. If not, you wait for the next support level down.

The advantage is clear: You remove emotion from the equation.

No panic buying during a selloff. No FOMO when everyone else is piling in. Just data-driven entries at predetermined levels.

Support analysis won't catch every bottom. But it will keep you from buying tops disguised as dips.

What's catching investor attention today: Inside NVIDIA's $57 Billion Quarter: Why Insiders Are Selling While Retail Doubles Down

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.