This isn't about jets.

Yesterday's headlines screamed about the US approving F-35 fighter sales to Saudi Arabia.

Markets read it as a win for defense contractors like Lockheed Martin.

But you're looking at the wrong thing.

What's the real story behind the latest US-Saudi deal?

The F-35s are dessert.

The main course of this geopolitical deal is lifting the ban on exporting Nvidia's top chips (H100/Blackwell).

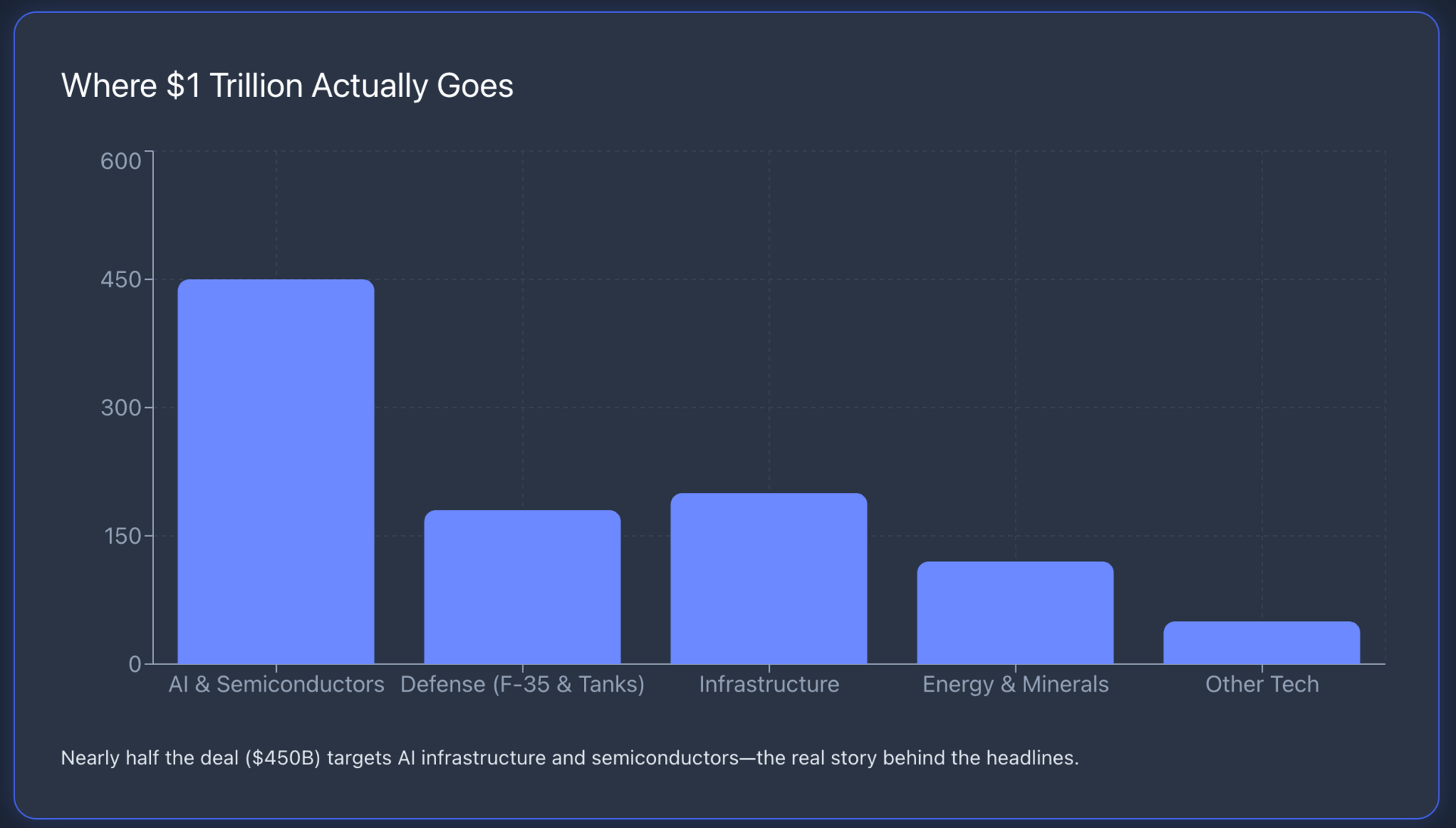

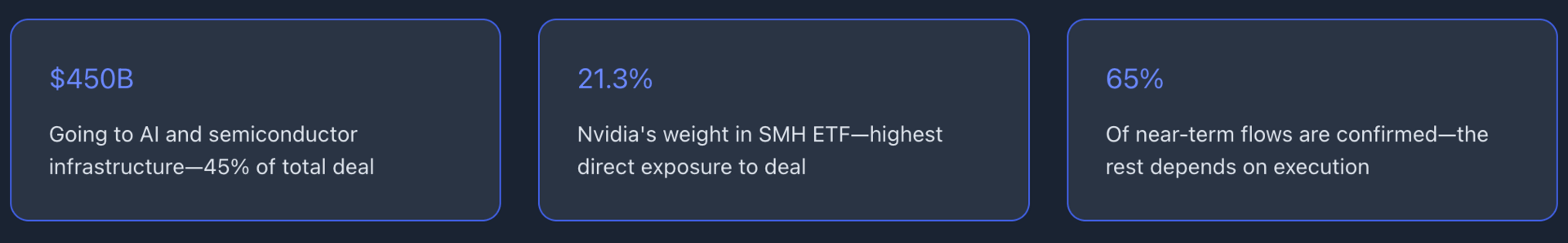

Saudi Arabia announced plans to invest up to $1 trillion in the US, and most of that won't go into real estate. It's going into "Sovereign AI" infrastructure.

Geopolitical Barter

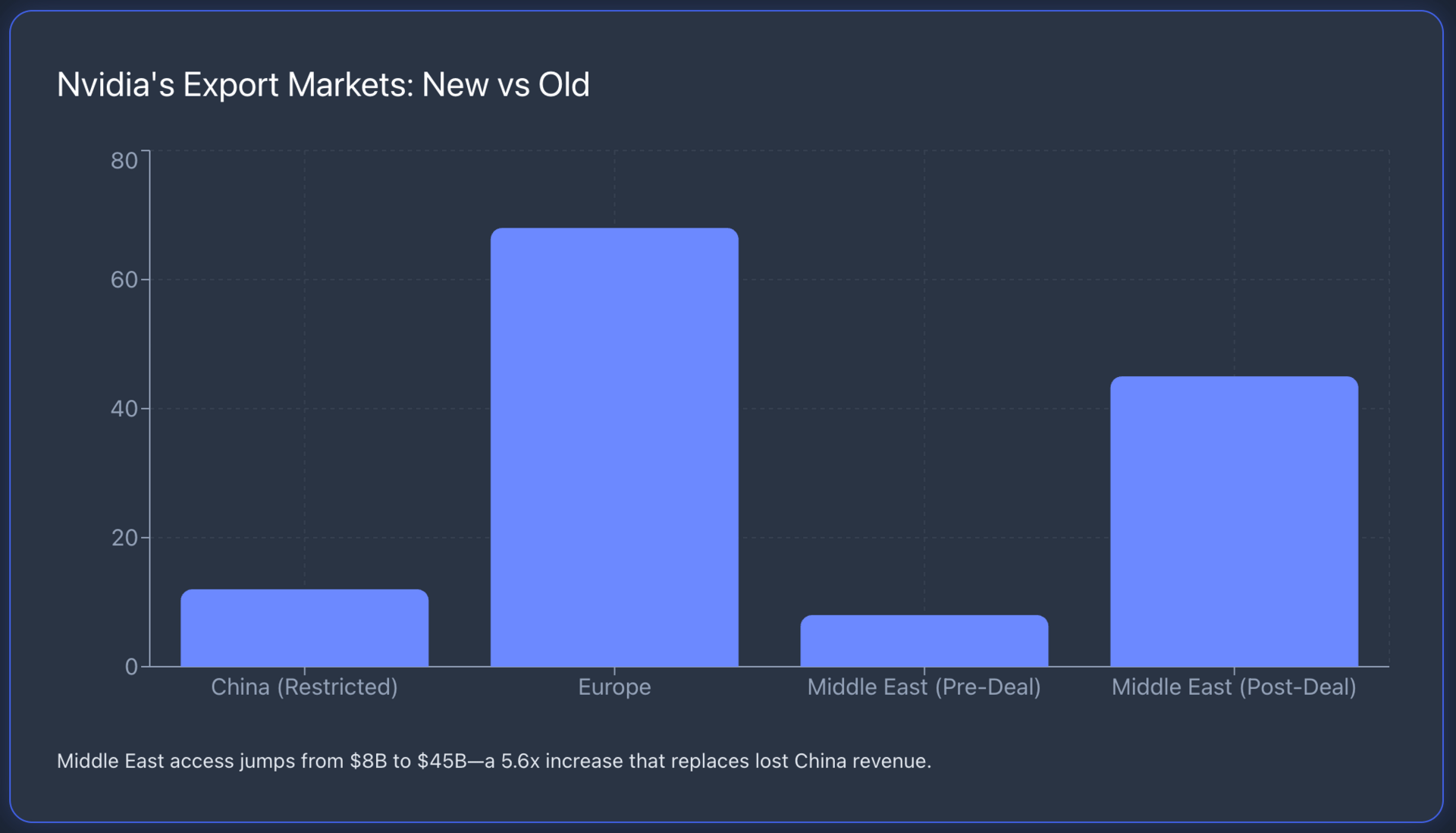

The US kept Saudi Arabia in a "technology ban," worried that China would gain access to advanced computing through Saudi data centers.

Yesterday's deal changed everything. Classic quid pro quo:

Saudi Arabia gets: Cutting-edge weapons (F-35) and the green light to purchase tens of thousands of Nvidia chips for projects like GAIA and Project Transcendence.

The US gets: Complete technological blockade of China in the region. The Saudis commit to dropping Chinese tech (Huawei, Alibaba Cloud) in favor of American alternatives.

A market for Nvidia that was closed last year is now wide open. And they're paying cash.

Nvidia ($NVDA)

Saudi Arabia doesn't want to just use ChatGPT.

They want to own the infrastructure. This is the "Sovereign AI" concept Jensen Huang keeps talking about.

For Nvidia $NVDA ( ▲ 1.41% ) , this means a guaranteed buyer who isn't price-sensitive. They don't care if chips cost $30k or $40k—they need to build data centers faster than their neighbors (UAE).

Inside track: Expect new contracts between Nvidia and Saudi Aramco/PIF in coming months. This will support Nvidia's margins even if demand from Microsoft or Meta starts slowing.

The numbers back this up.

Nvidia is building AI infrastructure directly with the Saudis, positioning itself as the primary supplier for a client with essentially unlimited budget.

Intel (INTC)

This is the most interesting part that the media is ignoring.

Where will these Saudi dollars go inside the US? Washington won't allow simple stock purchases. The money goes into real sector capEx.

The US is actively pushing Nvidia to manufacture more chips on American soil.

And who's building the biggest plants in Arizona and Ohio? Intel.

There are credible indications that part of the "Saudi package" will support Intel Foundry Services capacity, possibly through joint ventures or direct orders from Nvidia subsidized by these investments.

For Intel $INTC ( ▲ 1.65% ) , this is a chance to get liquidity they desperately need to complete factory construction.

What Should Investors Do?

This news creates a clear 2025 trend: US-Persian Gulf tech alliance against China.

Here's how to play it through ETFs:

Aggressive Play: Semiconductors

$SMH ( ▲ 1.67% ) (VanEck Semiconductor ETF): Nvidia weighs over 20%. This is the direct beneficiary of export unlocking.

$SOXX ( ▲ 1.65% ) (iShares Semiconductor ETF): More balanced approach, includes Broadcom $AVGO ( ▲ 2.1% ) and Intel $INTC.

Infrastructure and Intel Play

Direct INTC purchase: Risky, but if political winds favor American factories, Intel could find its bottom.

$XAIX ( ▲ 1.88% ) (Alternative AI & Data): Focuses on infrastructure that wins from the data center boom.

Defense Sector

$PPA ( ▼ 1.09% ) (Invesco Aerospace & Defense): Better than ITA because it has less Boeing concentration and more focus on tech defense suppliers (RTX, LMT) who benefit from Saudi military modernization.

The Bottom Line

$1 trillion isn't just a number.

It signals that "oil money" is betting on American tech.

Saudi Arabia is buying its post-oil future, and that future runs on Nvidia chips.

The commitment encompasses infrastructure, advanced technology including semiconductor and AI investments, defense purchases, energy, and critical minerals.

Your move: Don't short chip manufacturers when a whale with an unlimited budget enters the market.

But here's what matters more than the headline figure. While the $1 trillion pledge includes confirmed deals, forward commitments, and potential future transactions, analysts caution that fiscal realities and oil price fluctuations may affect actual disbursement.

Some economists consider parts of the figure "highly unrealistic" given Saudi fiscal constraints.

It means we're seeing political signaling mixed with real capital flows. The smart play isn't betting everything on the full trillion materializing. It's positioning for the portion that will—and that portion still runs into hundreds of billions flowing into American semiconductor and AI infrastructure.

The defense contracts are real.

The technology partnerships spanning AI, data centers, and critical minerals are confirmed.

What remains unclear is the exact disbursement schedule and binding nature of every announced agreement.

For investors, this creates opportunity in the confirmation phase.

As specific contracts get signed and capital actually flows over the next 12-18 months, we'll see which companies are genuine beneficiaries vs which were just mentioned in press releases.

What's catching investor attention today: Defense Sector Growth: Pentagon Locks In $1 Trillion Through 2029. Why XAR Beats ITA

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.