While equity markets wavered through late 2025, institutions quietly built positions in agricultural commodities.

The funds that added exposure between Q3 2024 and mid-2025 are watching those bets stabilize portfolios right now.

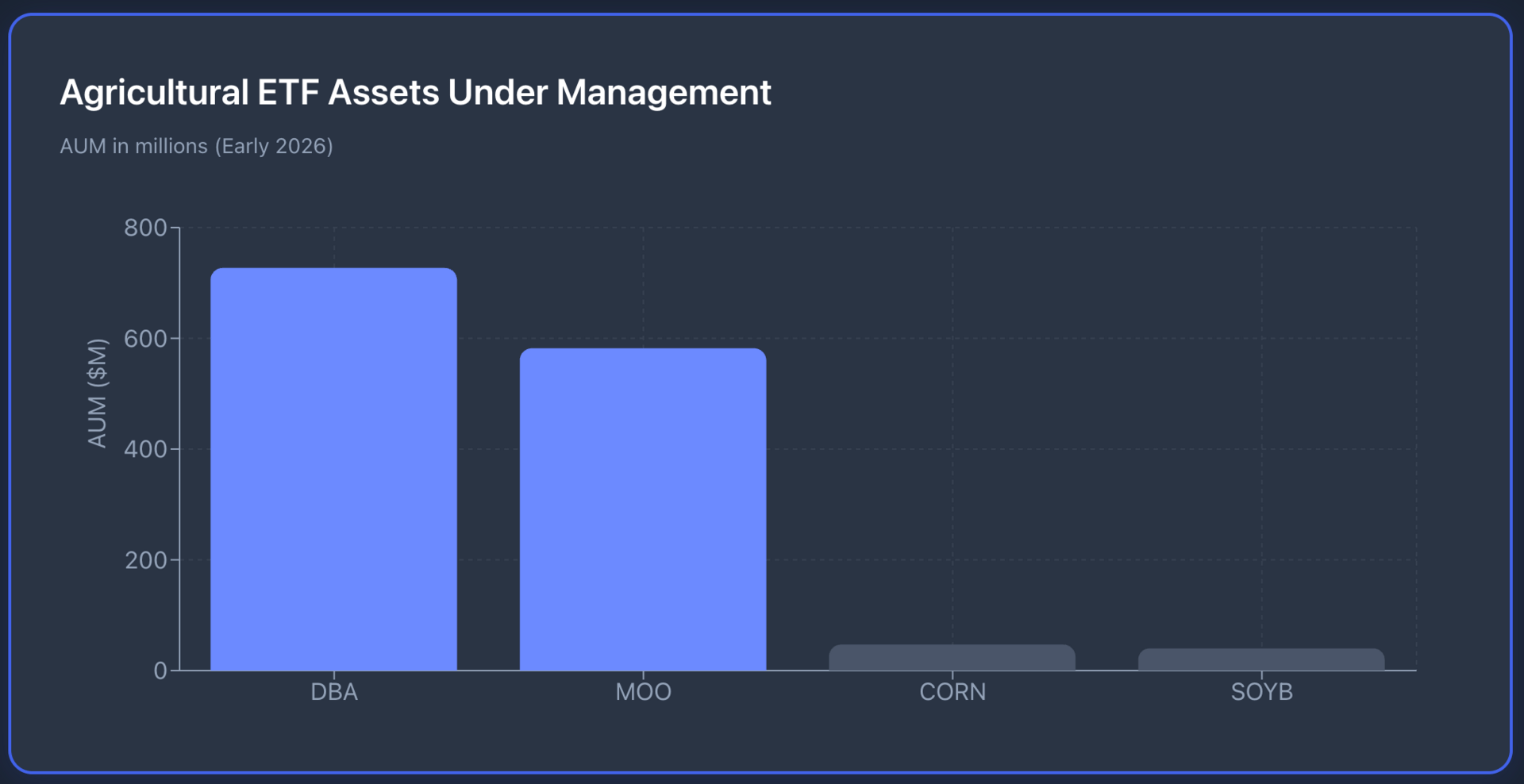

$DBA (Invesco DB Agriculture Fund) holds $727M in AUM as of early 2026.

$MOO (VanEck Agribusiness ETF) sits at $581-582M AUM with +1.2% YTD returns through January 2026. The performance isn't explosive, but that's not the point.

The point is diversification when it matters most.

The Numbers Behind The Positioning

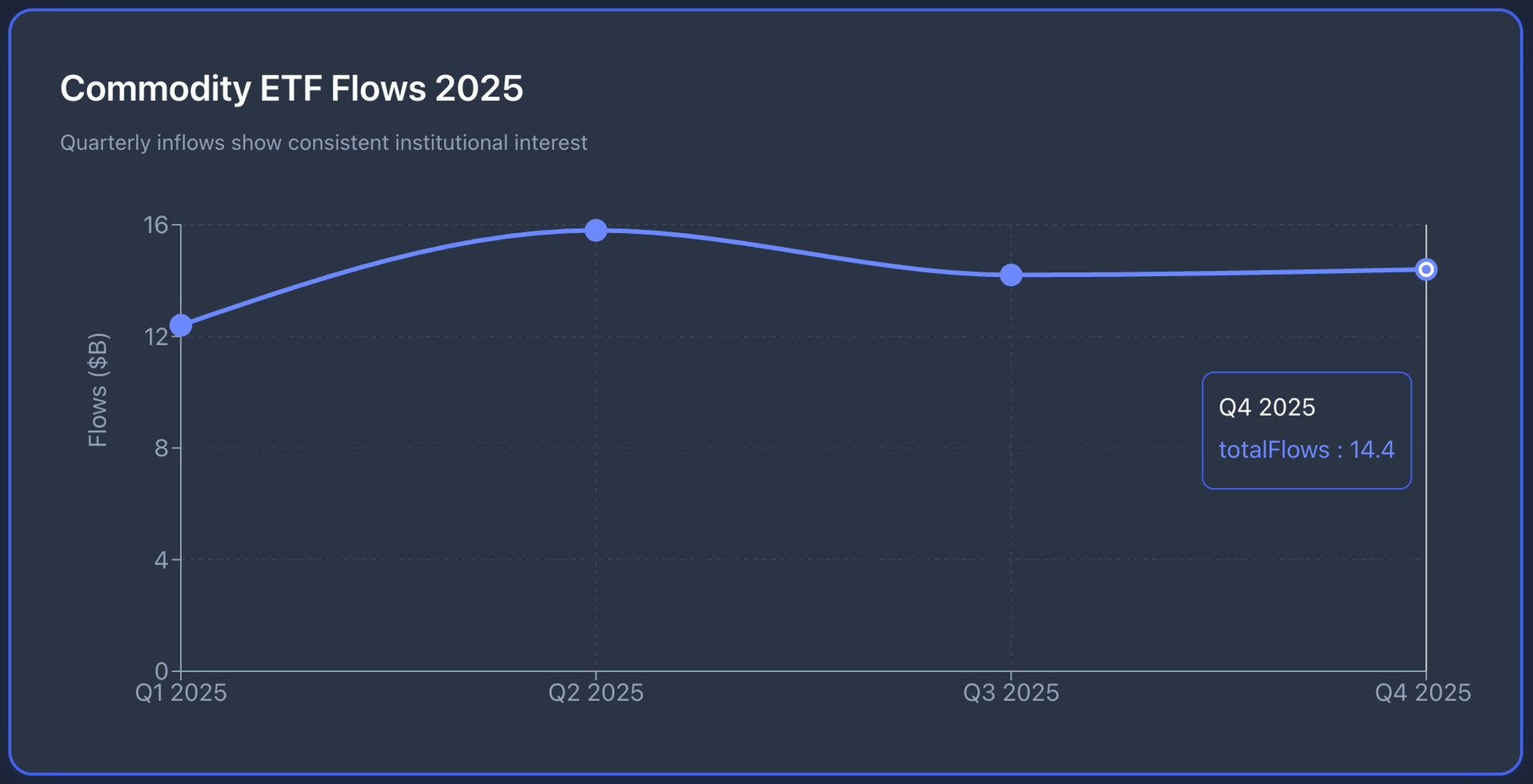

Commodity ETFs pulled in $56.8B in aggregate flows during 2025. Precious metals dominated that number, but agricultural exposure captured meaningful institutional attention.

$CORN (Teucrium Corn Fund) shows $47M AUM as of December 2025.

$SOYB (Teucrium Soybean ETF) holds $40M AUM. These single-commodity funds provide targeted futures exposure without the broad basket approach of DBA.

The allocation logic is straightforward: agricultural commodities show historically low correlation to equities and bonds. When portfolio construction requires non-correlated assets, ag futures and agribusiness equities fill that role.

MOO's holdings include Deere, Bayer, Zoetis, and Corteva, diversified exposure across equipment manufacturers, seed producers, and animal health companies.

Supply Dynamics Created The Setup

Global wheat stocks remained elevated through 2025, particularly outside China.

But domestic corn stocks told a different story: inventory levels dropped as U.S. corn exports rebounded. This created structural demand support alongside short-term volatility, exactly the environment where tactical positioning pays off.

Soybean markets experienced their own shifts. China paused purchases mid-2025, then resumed buying later in the year. Brazil increased its global soybean market share, intensifying competitive pressure. These supply-demand imbalances don't resolve quickly. They create multi-quarter trading opportunities for funds positioned ahead of the moves.

Biofuel mandates continued driving floor demand for corn. Energy policy in the U.S. and EU locked in ethanol blend requirements. That demand stays consistent regardless of price fluctuations, providing downside support during selloffs.

Macro Backdrop: Inflation Hedge Positioning

Agricultural commodities function as inflation hedges due to their real-asset characteristics and intrinsic pricing power. When inflation expectations shift, commodity allocations adjust portfolio exposure accordingly.

The 2025 environment featured persistent cost pressures, fertilizer prices tied to energy markets, transportation bottlenecks, and currency volatility.

A weaker dollar during portions of 2025 benefited agricultural exporters and commodity prices. Currency movements create relative pricing advantages for U.S. crops in international markets. When the dollar weakens, foreign buyers increase purchases. When it strengthens, demand softens. These currency dynamics layer additional complexity onto fundamental supply-demand analysis.

Fertilizer and input costs remained elevated, pressuring producer margins. This matters more for agribusiness equities in MOO than for futures-based exposure in DBA. Companies face operational leverage: rising input costs squeeze earnings unless crop prices rise proportionally.

Equipment manufacturers like Deere benefit when farmers invest in technology to offset labor costs, but suffer when commodity price crashes reduce farm income.

Flow Analysis Shows Strategic Accumulation

The institutional playbook wasn't about chasing momentum. Funds building agricultural exposure in late 2024 and early 2025 understood the diversification mathematics. When equity-bond correlations increase during market stress, portfolios need uncorrelated return streams. Agricultural commodities provide exactly that.

Hedge fund trend analysis from CAIA shows increased interest in alternative assets including commodities. Macro strategies blend commodity exposure within broader risk premia approaches. These allocations typically run 2-5% of portfolio weight—enough to capture diversification benefits without excessive volatility drag.

What percentage of your portfolio is allocated to "Real Assets" (Commodities/Land)?

The timing worked. Institutions positioned ahead of retail awareness. By the time agricultural ETF flows accelerated, early movers had already established positions at better entry points.

Futures vs Equities: The Structural Tradeoff

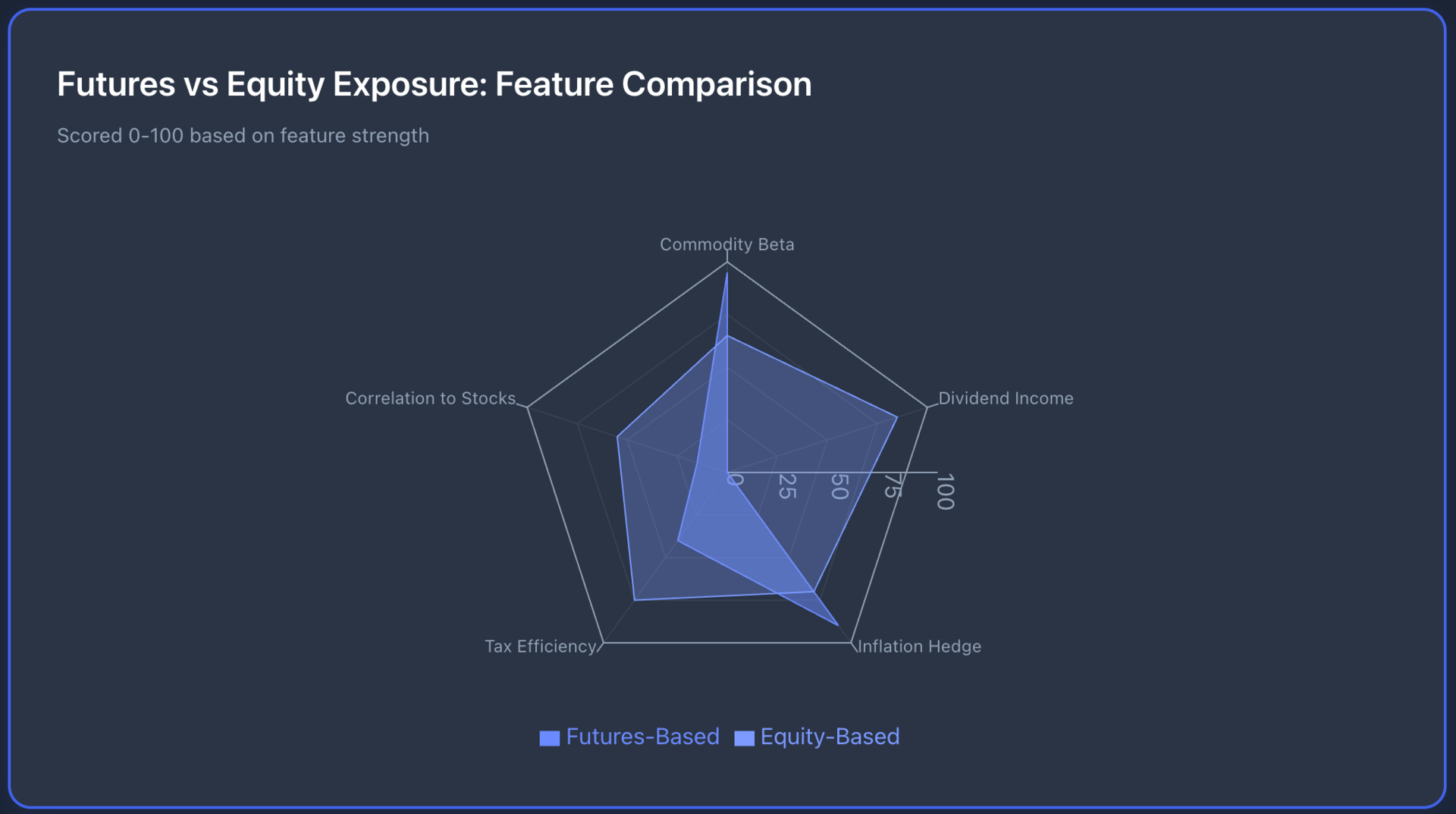

$DBA and single-commodity funds (CORN, WEAT, SOYB) offer direct futures exposure. This provides pure commodity beta but introduces roll yield considerations. In contango markets, roll yield creates drag. In backwardation, it generates gains. Futures-based ETFs deliver no dividend income and face daily rebalancing that reduces tax efficiency.

$MOO provides equity exposure with different characteristics. Companies generate earnings. Dividends provide income. But operational leverage amplifies both gains and losses. Currency exposure through global holdings adds another variable. Management quality matters, something irrelevant for futures contracts but critical for equity performance.

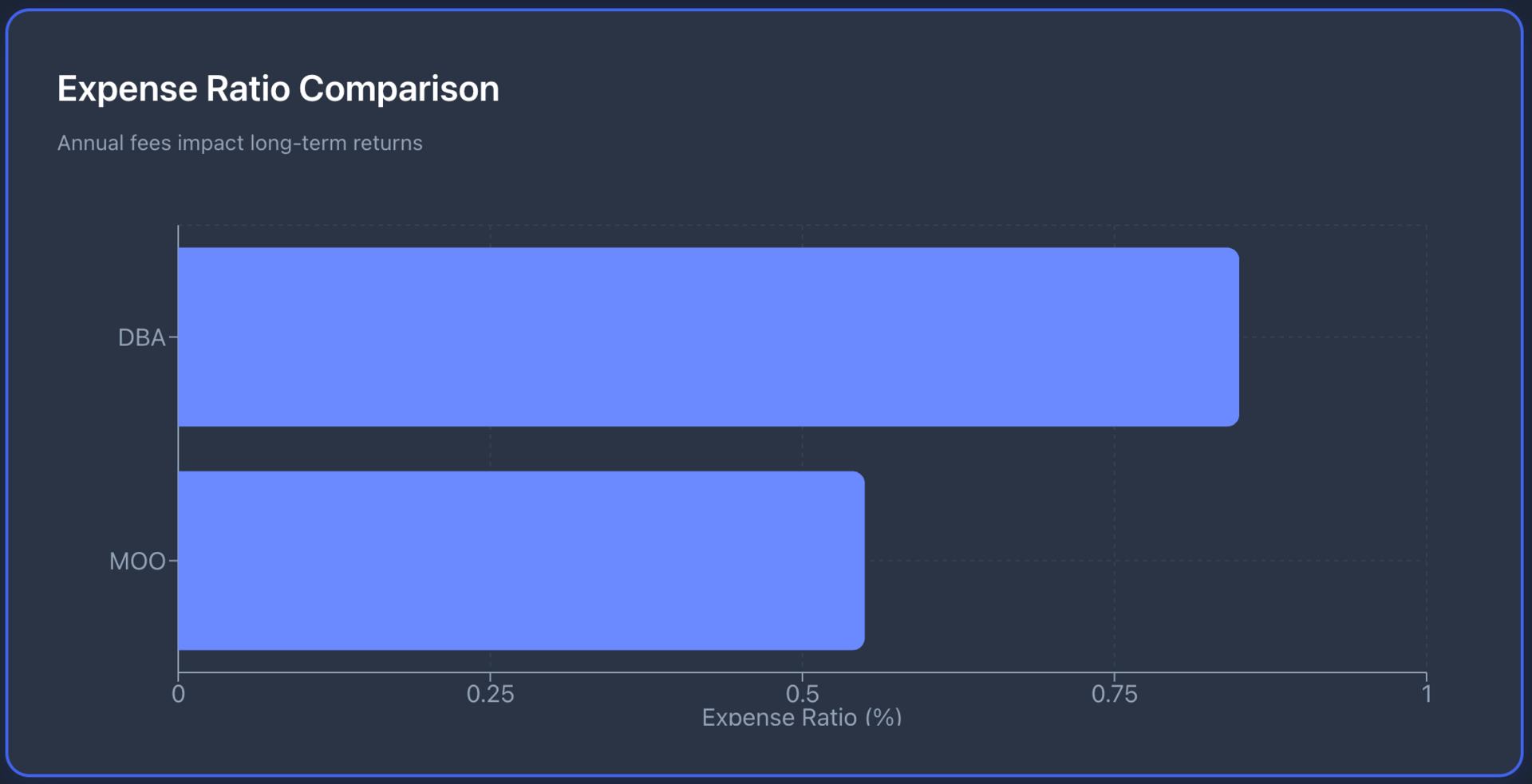

The expense ratio gap: DBA charges 0.85%, MOO charges 0.55%. Over multi-year holding periods, that difference compounds. But pure commodity beta costs more to replicate than equity exposure. Investors pay for what they get: futures purity versus operational leverage.

When hedging against equity volatility, which structure do you prefer for agricultural exposure?

Tactical Entry Windows

Agricultural markets follow planting and harvest cycles that create predictable volatility patterns. Corn planting runs March through May. Harvest hits September through November. Weather forecasts during these windows drive short-term price swings. Droughts, floods, heat waves, and frost all impact yields.

Smart institutional positioning anticipates these patterns. Building exposure before planting season captures upside if weather disrupts crops. Reducing exposure after harvest locks in gains before supply floods the market. This seasonal framework guides tactical allocation adjustments within strategic commodity holdings.

Some agricultural commodities recovered in 2025 while others lagged. Grains trended lower in late 2025, creating selective opportunities. Coffee and cocoa showed strength earlier in the cycle. This dispersion within the agricultural complex requires active management or diversified basket exposure through DBA.

Technology Impact on Agribusiness

$MOO's holdings include companies developing precision farming technology. GPS-guided tractors, drone crop monitoring, soil sensors, and AI-driven yield optimization reduce input costs while increasing output. Genetically modified seed technology improves drought resistance and pest tolerance.

These innovations create competitive advantages. Farms adopting technology faster capture market share. Their suppliers—companies like Corteva and Bayer—benefit from recurring revenue streams as farmers upgrade equipment and purchase new seed varieties annually. This technology adoption cycle drives long-term equity value beyond spot commodity price movements.

Deere's autonomous tractor rollout represents multi-billion dollar addressable market expansion. Zoetis benefits from increased livestock productivity as developing markets consume more protein.

These equity-specific growth drivers don't exist in futures-based commodity exposure. That's the fundamental difference between DBA and MOO: commodity price beta versus operational earnings leverage.

Energy-Agriculture Transmission Mechanism

Natural gas prices directly affect nitrogen fertilizer costs. Ammonia production requires substantial energy input. When natural gas rallied in prior cycles, fertilizer prices surged. Farmers reduced application rates. Crop yields suffered. Commodity prices rose to compensate.

This energy-agriculture linkage creates hedging complexity. Some institutional portfolios combine agricultural exposure with energy shorts to isolate crop-specific alpha. Others use agricultural commodities as inflation hedges alongside Treasury Inflation-Protected Securities. The correlation structure shifts based on macro regime—inflation, recession, expansion all produce different relative performance patterns.

Chinese Demand: The Variable Nobody Controls

China's economic trajectory determines global agricultural demand. Soybean imports, corn purchases, and pork consumption all depend on Chinese GDP growth.

When stimulus measures gain traction, commodity imports rise. When growth disappoints, demand falls.

The 2025 pattern illustrated this dynamic: mid-year pause in Chinese soybean purchases, then resumed buying later. These shifts create volatility that futures traders exploit but equity investors must tolerate.

Long-term structural trends matter more than quarterly fluctuations—rising middle class protein consumption, urbanization reducing domestic farmland, increasing import dependence.

Portfolio managers incorporating agricultural exposure must handicap Chinese policy decisions. That's a political risk variable impossible to model with precision. It's also why diversified exposure through DBA reduces single-country risk compared to concentrated positions in corn or soybeans.

Risk Factors Looking Forward

Brazilian soybean production continues gaining global market share. This intensifies competitive pressure on U.S. farmers. Currency movements between the real and dollar shift relative export competitiveness. South American weather patterns now matter as much as Midwest drought forecasts for global supply-demand balance.

Biofuel policy changes represent tail risk. Any rollback of ethanol mandates would crater corn demand. Agricultural subsidy reforms in the U.S. or EU could reshape production incentives. These policy variables create uncertainty that futures markets struggle to price efficiently until legislation passes.

Climate volatility adds another dimension. Extreme weather events increased in frequency over the past decade. This creates higher baseline volatility for agricultural commodities. Institutional allocations must size positions accounting for larger drawdowns and sharper rallies than historical patterns suggest.

The Diversification Payoff

Institutions that added agricultural exposure in late 2024 and early 2025 timed the allocation well. Not because commodity prices exploded higher, they didn't.

But because the low correlation to equities and bonds provided portfolio stabilization exactly when needed.

MOO's +1.2% YTD return through early January 2026 looks modest in isolation. But when equity markets faced uncertainty and bond yields fluctuated, that positive return from an uncorrelated asset improved overall portfolio metrics. Risk-adjusted returns increased. Sharpe ratios improved. Drawdowns decreased.

That's the institutional thesis: agricultural commodities aren't about hitting home runs. They're about portfolio construction mathematics. The funds that understood this three months ago are seeing the diversification benefit play out now.

Tactical Implementation Framework

Risk-adjusted returns favor different approaches based on investment horizon. Short-term tactical trades benefit from futures purity in $DBA, $CORN, or $WEAT. Long-term strategic allocations gain from equity earnings growth and dividends through MOO. The optimal mix depends on portfolio objectives, risk tolerance, and correlation requirements.

A 2-5% tactical allocation to agricultural commodities captures diversification benefits without excessive volatility drag. Rebalancing discipline matters: commodity rallies often overshoot fundamentals. Systematic trimming after 20-30% gains locks in profits while maintaining exposure. This approach requires patience—agricultural positions might underperform for quarters before delivering value during equity market stress.

Forward Looking Positioning

The easy money in agricultural commodities got made in 2024. Institutions positioned then are evaluating exposure now. The question facing portfolio managers: does agricultural commodity allocation still make sense, or has correlation changed?

DBA's $727M AUM and MOO's $581M AUM represent relatively small niche allocations within the broader ETF universe. Total commodity ETF flows of $56.8B in 2025 dwarfed agricultural-specific exposure. This suggests room for additional institutional adoption if macro conditions align.

The structural case remains intact: inflation hedging, diversification, real-asset exposure, and low correlation to traditional portfolios. The tactical case depends on supply-demand fundamentals, weather forecasts, Chinese policy, and currency movements. Neither argument guarantees outperformance, but both support maintaining exposure as a portfolio construction tool.

The Three-Month Window Closes

What institutions bought three months ago provided exactly what portfolio theory predicted: uncorrelated returns during uncertain market conditions. DBA's futures-based approach delivered commodity beta. MOO's equity approach added operational leverage and dividend income. Both fulfilled their portfolio roles.

The next opportunity in agricultural commodities requires different catalysts. Weather disruptions could tighten supply.

Chinese stimulus might boost demand. Currency weakness could benefit exporters. Until then, the funds positioned in late 2024 and early 2025 are collecting the diversification premium that justified the allocation from the start.

Identify structural advantages, establish positions before consensus forms, and monetize the edge through portfolio construction benefits rather than directional price gains. The three-month payoff window already opened.

The question is whether it stays open or closes as correlations shift and macro conditions evolve.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.