It’s been a year!

Tesla planned to build 10,000 humanoid robots in 2025. This isn't a tech demo. This is a manufacturing problem with a trillion-dollar prize attached.

Here's what we know: Two Optimus robots are already working autonomously inside Tesla factories right now. They're loading sheet metal onto welding lines. They're adapting in real time. And Tesla's pilot production line in Fremont became operational in Q1 2025.

The timeline matters. Low-volume production starts this year for internal Tesla use. Musk expects several thousand units by year-end, with the full 10,000-unit target as the upper bound. High-volume production for external customers launches in 2026. That's a 12-month gap between internal deployment and commercial scale.

That gap matters more than you might think.

The Technical Edge

Optimus isn't just another research project.

Tesla's vertical integration creates a structural advantage. They control the AI stack, the manufacturing infrastructure, and the battery technology. They're not sourcing components from a fragmented supply chain. They're building the entire system in-house, which means faster iteration cycles and tighter cost control.

The current capabilities include real-time task adaptation and autonomous operation without human supervision. These machines are already performing actual factory work, not simulated demonstrations. That's the difference between vaporware and production-ready technology.

Market Sizing

Musk claims humanoid robots will eventually outnumber humans. Put aside the hyperbole. Focus on the addressable market: every repetitive industrial job, every dangerous workplace task, every role where labor shortages create bottlenecks.

Elon Musk says robots will outnumber humans. How does that make you feel?

Manufacturing alone represents millions of roles. Add warehousing, logistics, construction, and hazardous environment work. The total addressable market exceeds $1 trillion. That's a conservative estimate based on current labor economics and wage structures.

But here's the thing: consumer applications remain largely undefined. If Optimus hits the right price point and capability threshold, the TAM expands exponentially. We're talking about elder care, home assistance, and service roles that don't exist yet because the economics never worked with human labor.

The Competition Landscape

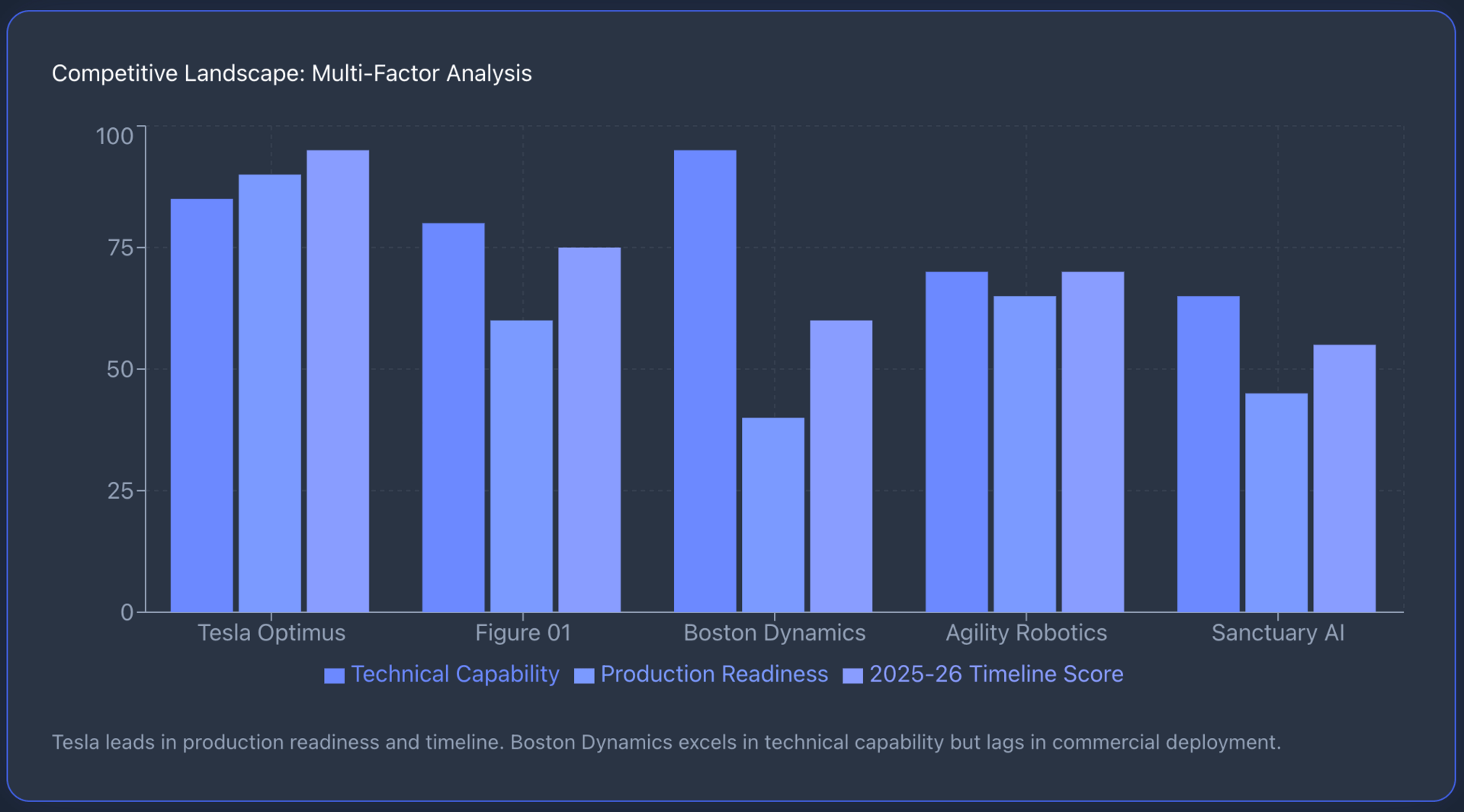

Figure AI's Figure 01 is the closest competitor. They've demonstrated similar capabilities and secured significant venture backing. Boston Dynamics' Atlas remains the technical benchmark for mobility and dynamic movement. Agility Robotics' Digit targets warehouse logistics specifically.

Add Sanctuary AI and 1X Technologies to the mix. This isn't a monopoly play. It's a market formation event. Multiple competitors validate the opportunity while fragmenting development risk across different approaches and philosophies.

The winner won't be determined by who builds the best demo. It'll be determined by who reaches commercial scale first while maintaining acceptable unit economics. Tesla's manufacturing muscle gives them an edge, but Figure AI's specialized focus could yield advantages in specific verticals.

ETF Exposure Analysis

$KOID (KraneShares Global Humanoid and Embodied Intelligence ETF) offers pure-play exposure to humanoid robotics. This is the most direct bet on the thesis. The fund concentrates holdings in companies developing humanoid platforms and enabling technologies.

$ROBO (Robo Global Robotics & Automation) and $BOTZ (Global X Robotics & AI ETF) provide broader robotics exposure with some humanoid overlap. These funds capture the supply chain: actuators, sensors, AI chips, and control systems.

The supply chain angle deserves attention. Humanoid robots require sophisticated components that relatively few suppliers can produce at scale. Companies manufacturing precision actuators, force-torque sensors, and specialized AI inference chips will see demand spikes as production ramps.

Holdings analysis reveals exposure patterns. Look for companies supplying motion control systems, computer vision hardware, and battery management systems. These components sit upstream from the headline-grabbing robots but capture margin and volume as the market scales.

How are you playing the Humanoid Robotics boom?

Investment Thesis

Humanoid robotics sits at the inflection point between R&D and commercial deployment. The technical barriers are falling. The manufacturing infrastructure exists. The economic case strengthens as labor costs rise and capabilities improve.

Tesla's advantages stack up clearly:

Proven manufacturing scale (they build millions of complex products annually)

In-house AI development (same team building FSD builds Optimus neural nets)

Battery technology leadership (energy density and cost matter for mobile robotics)

Existing factory network (built-in test environment and initial customer base)

If Optimus works at scale, we're looking at a TAM that exceeds $1 trillion within a decade. That's not speculative. That's based on current labor market structures and conservative penetration assumptions.

The risks are real. Technical execution could falter. Competitors could leapfrog capabilities. Regulatory frameworks could constrain deployment. Unit economics might not work at commercial scale. Market adoption could lag expectations.

But the setup is clear: 2025 is the proof-of-concept year. 2026 is the commercialization test. Tesla either validates the manufacturing thesis or exposes the gaps between prototype and production.

What This Means

Broad robotics ETFs provide diversified exposure with lower volatility. You're betting on the category, not the winner. $ROBO and $BOTZ fit this profile.

$KOID concentrates the bet on humanoid robotics specifically. Higher potential return, higher execution risk. This is the choice if you believe the inflection point is now.

Component suppliers offer leveraged exposure without picking winners. If multiple humanoid platforms scale, the suppliers win regardless. Look for holdings in precision manufacturing and specialized semiconductors.

The timeline matters for position sizing. If you believe the 2025-2026 deployment timeline is real, the window for early-stage positioning is closing. Once external customer deployments begin, the market will reprice expectations rapidly.

The Bottom Line

Humanoid robotics is moving from science fiction to manufacturing reality. Tesla's 10,000-unit target for 2025 isn't a goal. It's a manufacturing commitment backed by operational pilots and functioning prototypes. The trillion-dollar market exists. The technology is arriving. The investment vehicles are available.

The question isn't whether humanoid robots will reach commercial scale. The question is whether you're positioned when they do.

What's catching investor attention today: Berkshire's $150B Secret: How Insurance Float Just Became a 5% Money Machine

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.