Japan just weaponized its stock exchange.

The Tokyo Stock Exchange mandate forcing 1,000+ companies to boost returns or face delisting by 2028 represents the largest coordinated capital return program in market history. This isn't guidance. This is compulsory corporate restructuring backed by regulatory threat.

Here's what we know: In March 2023, the TSE issued compliance requirements targeting companies trading below book value.

Any company with a P/B ratio under 1.0 must now publish detailed plans to improve ROE and capital efficiency.

Miss the deadline? You're out of the TOPIX Index. Roughly 1,000 companies currently sit in that danger zone.

The numbers tell the real story. Japan's corporate sector holds ¥506 trillion ($3.4 trillion) in cash and deposits as of Q3 2025. That's 92% of GDP sitting idle on balance sheets. The TSE's message is direct: deploy that capital to shareholders or watch your institutional investor base evaporate.

The Regulatory Framework

The TSE restructured its market segments in April 2022, creating the Prime Market with stricter listing standards focused on shareholder value creation. Companies in the Prime segment face ongoing scrutiny of their capital allocation policies. The 2023 mandate escalated that pressure into binary outcomes.

The Financial Services Agency backs this push with consistent criticism of strategic cross-shareholdings. Japan's corporate cross-ownership structure historically locked up capital in non-productive holdings. Companies owned each other's stock for relationship reasons, not returns. That's unwinding fast.

Japan's three largest insurance companies committed to complete disposal of their strategic equity holdings. Nippon Life, Dai-ichi Life, and Meiji Yasuda collectively hold positions representing hundreds of billions in market value. Their forced selling creates both dislocation and opportunity as these shares move from passive holders to return-focused investors.

But here's the thing: this isn't just about insurance companies. Board independence requirements jumped across the Prime Market, with independent director ratios rising from 29% in 2022 to 42% by mid-2025. Independent boards ask different questions. They challenge management on cash hoarding. They demand capital efficiency metrics.

The data on annual general meetings shows the shift. Companies with ROE below 5% saw average shareholder support for management proposals drop from 87% in 2022 to 71% in 2024. That decline matters. Japanese companies traditionally enjoyed near-unanimous shareholder backing. Institutional investors are now voting against management at rates unseen in modern Japanese corporate history.

Activist investors smell blood. Foreign activists historically struggled in Japan's consensus-driven corporate culture. Not anymore. Activist campaigns in Japan reached record levels in 2024, with 45 public campaigns compared to single digits five years earlier. The TSE mandate gives activists regulatory cover to push for immediate capital returns.

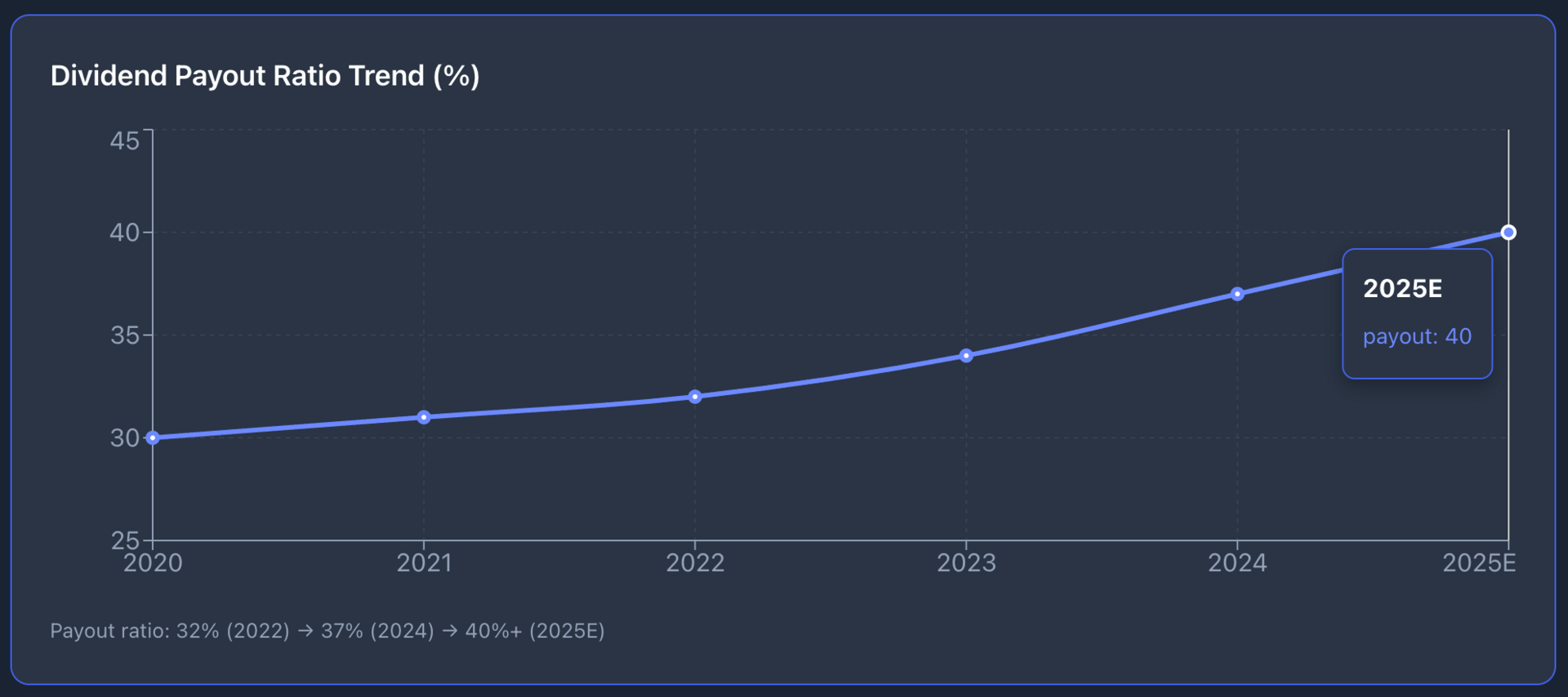

Sony announced a ¥250 billion buyback program in November 2024, directly citing the need to maintain Prime Market standing. Toyota committed to ¥1 trillion in shareholder returns through fiscal 2026. Mitsubishi Corporation increased its dividend payout ratio target from 30% to 40% while simultaneously initiating buybacks.

These aren't anomalies. These are the visible moves from high-profile names. The real action happens in mid-cap and small-cap companies where P/B ratios have languished below 0.8 for years. Over 600 companies in the TOPIX Small Index trade below book value. Each faces the same deadline. Each holds excess cash. Each must act.

Do you believe Japanese management teams will actually comply by 2028?

The ETF Angle

Broad Japan exposure through EWJ (iShares MSCI Japan ETF) provides baseline access to this dynamic. The fund holds ¥18.2 billion in AUM and tracks the MSCI Japan Index across large and mid-cap stocks. Expense ratio sits at 0.50%, reasonable for Japan equity exposure. Top holdings include Toyota, Sony, and Mitsubishi UFJ Financial Group.

But currency matters. The yen's volatility creates return drag for dollar-based investors. DXJ (WisdomTree Japan Hedged Equity Fund) eliminates that variable. The fund hedges yen exposure back to dollars while maintaining equity market participation. $5.8 billion in AUM and a 0.48% expense ratio make it the largest currency-hedged Japan vehicle. The strategy delivered 180 basis points of outperformance versus unhedged exposure over the past 24 months as the yen weakened.

DBJP (Xtrackers MSCI Japan Hedged Equity ETF) offers a lower-cost alternative at 0.45% expenses with similar hedging methodology. Smaller AUM at $1.3 billion means slightly wider spreads but material cost savings over multi-year holding periods.

The real opportunity sits in Japan's small-cap value segment. Small-cap companies face disproportionate pressure from the TSE mandate. They lack the global institutional shareholder base of mega-caps. They face higher delisting risk. They hold the highest cash-to-market-cap ratios. And they've delivered the strongest response to regulatory pressure.

Japanese small-cap value funds captured 28% of net inflows into Japan equity ETFs in 2024, up from 12% in 2022. The category includes specialized vehicles targeting companies with P/B ratios below 1.0 and ROE improvement catalysts.

The Capital Return Pipeline

Aggregate buyback announcements from Japanese companies hit ¥9.1 trillion in fiscal 2024, shattering the previous record of ¥7.2 trillion set in 2021.

Dividend payout ratios across the TOPIX increased from 32% to 37% over the same period. These aren't mature market norms yet, but the trajectory is clear.

The gap between Japanese and global capital return rates remains substantial. S&P 500 companies maintain dividend payout ratios above 40% with total shareholder yield averaging 6% annually. Japanese firms sit at roughly half that level. That gap matters more than you might think.

Japan's corporate sector generates operating margins of 6.8% with net margins of 5.2% as of Q3 2025. Profitability isn't the constraint. Return on equity across the TOPIX averages 8.9%, up from 7.1% in 2022 but still materially below the 15%+ targets the TSE mandate implies for Prime Market membership.

The math is straightforward. If 1,000 companies must improve ROE by 300-500 basis points, they need to either boost profitability or shrink equity bases. Operating margin expansion takes years. Buybacks and dividends work immediately. The median company trading at 0.85x book value with 7% ROE could reach 10% ROE through a 25% reduction in equity via buybacks, assuming stable earnings.

Timeline and Execution Risk

The 2028 deadline creates urgency. Companies face interim checkpoints in 2025 and 2026 requiring published improvement plans and demonstrated progress. Those missing interim milestones face immediate index weighting reductions ahead of formal delisting.

But execution risk is real. Japanese management teams historically prioritized stakeholder balance over shareholder primacy. Cultural resistance to aggressive capital return persists. Labor unions opposed buyback programs at 23% of companies announcing such plans in 2024. Some management teams will choose delisting over compliance.

And macro headwinds complicate the picture. Japan's economic growth forecast for 2025 sits at 1.2%, creating limited organic earnings expansion. Companies can't simultaneously boost ROE through operational improvement and return massive cash to shareholders in a low-growth environment. The mandate forces a binary choice.

The Bank of Japan's policy normalization adds another variable. As rates rise from ultra-low levels, the opportunity cost of cash holdings changes. Management teams face different trade-offs when deposits earn 1.5% versus 0.1%. Higher rates could paradoxically slow capital return momentum.

Which is the bigger risk to your Japan exposure right now?

The Investment Case

Japan's forced capital return program offers systematic exposure to regulatory-driven value realization. The TSE created a deadline. Companies must act. Shareholders benefit. The mechanism is clear, the timeline is fixed, and the capital pool is measured.

Currency hedging matters for dollar-based investors given yen volatility. Small-cap value exposure provides the most direct path to mandate beneficiaries. Broad market ETFs capture the trend but dilute the impact across compliant and non-compliant companies.

This plays out over 2-3 years, not quarters. Companies announce programs throughout 2025-2026. Index reconstitutions happen in stages. The capital deploys incrementally. Patient capital with Japan equity exposure positions for systematic revaluation as corporate Japan converts cash holdings into shareholder returns under regulatory compulsion.

The $3.4 trillion cash pile is real. The mandate is enforceable. The deadline is fixed.

What remains uncertain is which companies execute effectively and which miss the window.

What's catching investor attention today: Berkshire's $150B Secret: How Insurance Float Just Became a 5% Money Machine

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.