Global manufacturers are pulling $300 billion in production capacity out of China.

That's not a forecast, it's already happening.

And most of that money is landing in India.

The Geopolitical Risk

Here's what we know: investing in China carries material political risk that wasn't there five years ago.

Taiwan tensions escalated in 2024. Beijing's regulatory crackdowns wiped out billions in shareholder value across tech and education sectors. Western governments are restricting technology transfers.

This isn't just about headlines. CFOs at Fortune 500 companies are redesigning supply chains because single-country dependence on China became a board-level liability.

Apple $AAPL ( ▲ 0.77% ) now manufactures 14% of its iPhones in India, up from zero in 2021.

The "China Plus One" strategy shifted from corporate buzzword to operational mandate. Companies aren't abandoning China entirely. They're building backup production in a second location. And India is winning that competition.

Which factor do you think is the biggest driver behind the manufacturing shift from China to India?

India's Economic Engine

India's GDP grew 7.2% in 2024, outpacing every major economy.

The IMF projects 6-7% annual growth through 2029. China's forecast sits at 3-4% over the same period.

The demographics tell you why. India's median age is 28. China's is 39 and rising fast. India adds 15 million working-age adults to its labor force every year. China's working-age population is shrinking, by 5 million annually.

This creates a labor cost advantage that compounds over time. Indian manufacturing wages are 40-50% lower than China's. That spread isn't closing anytime soon.

India's government spent $130 billion on infrastructure in 2024.

New highways, ports, and manufacturing zones are making it easier to actually build things there. Five years ago, logistics were a real problem. That's changing fast.

What do you see as the biggest headwind to India's continued growth?

The iShares MSCI India ETF (INDA) gives you exposure to 100+ of India's largest companies. The sectoral breakdown shows where India's growth is concentrated.

Financials make up 24% of the portfolio. HDFC Bank and ICICI Bank are capturing a massive shift—India's banking penetration is still only 80%, compared to 95%+ in developed markets. Credit growth is running at 15% annually.

Technology accounts for 18%. Infosys and TCS aren't just outsourcing shops anymore. They're building AI infrastructure and cloud services for global clients. The Indian IT sector exported $200 billion in services last year.

Energy and infrastructure combined represent 16%. Companies like Reliance Industries are building refineries, telecom networks, and retail chains. India's energy consumption is projected to double by 2035.

Consumer discretionary sits at 12%. As India's middle class expands—400 million people are expected to enter it by 2030—domestic consumption becomes a growth driver independent of exports.

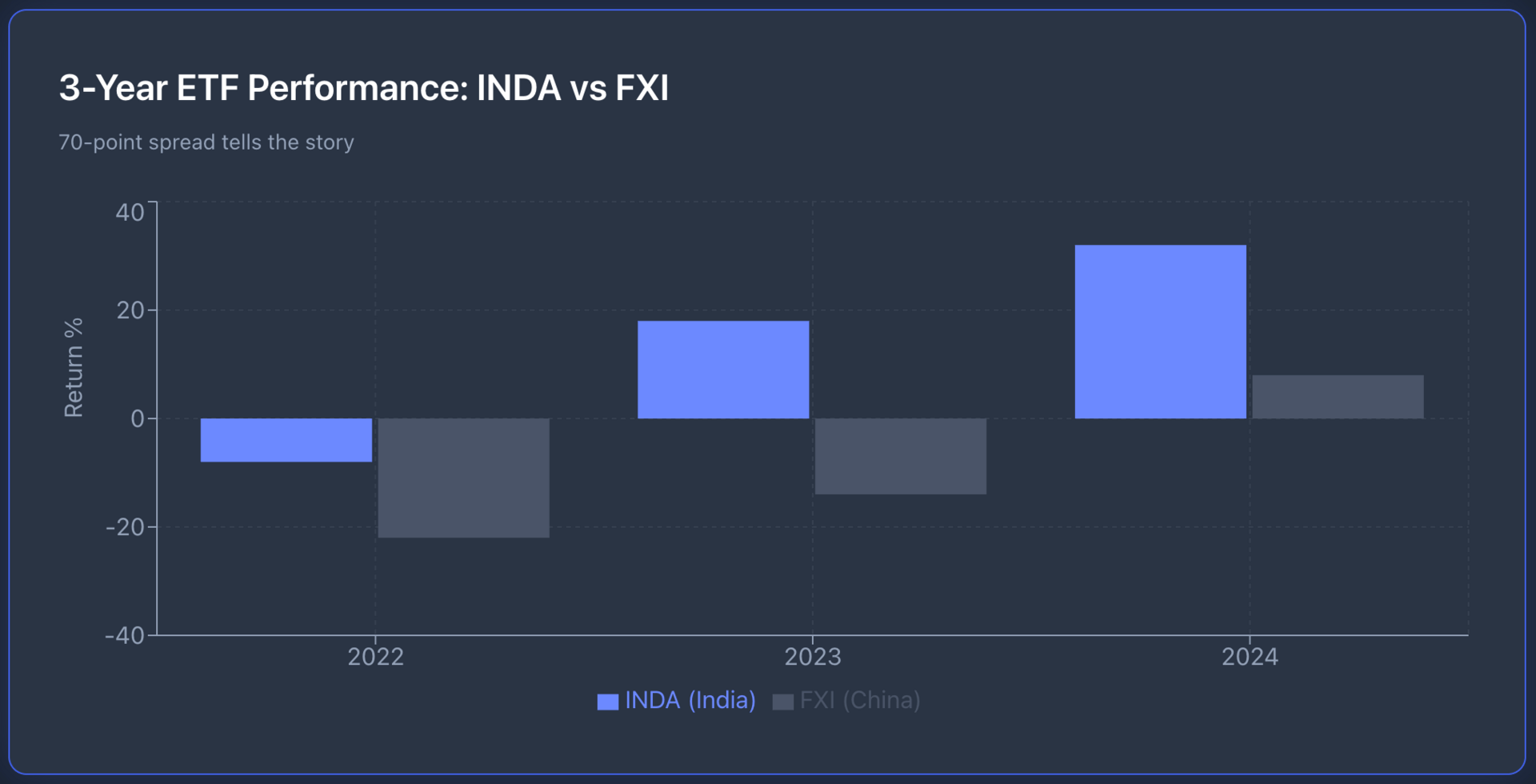

INDA vs. FXI

$INDA ( ▲ 0.13% ) returned 42% over the past three years. $FXI, the iShares China Large-Cap ETF, lost 28% over the same period. That's a 70% spread.

$FXI ( ▲ 0.13% )'s struggles reflect China's structural challenges. Real estate debt problems, regulatory uncertainty, and demographic decline are weighing on investor confidence. The Chinese government's policy responses have been reactive rather than predictive.

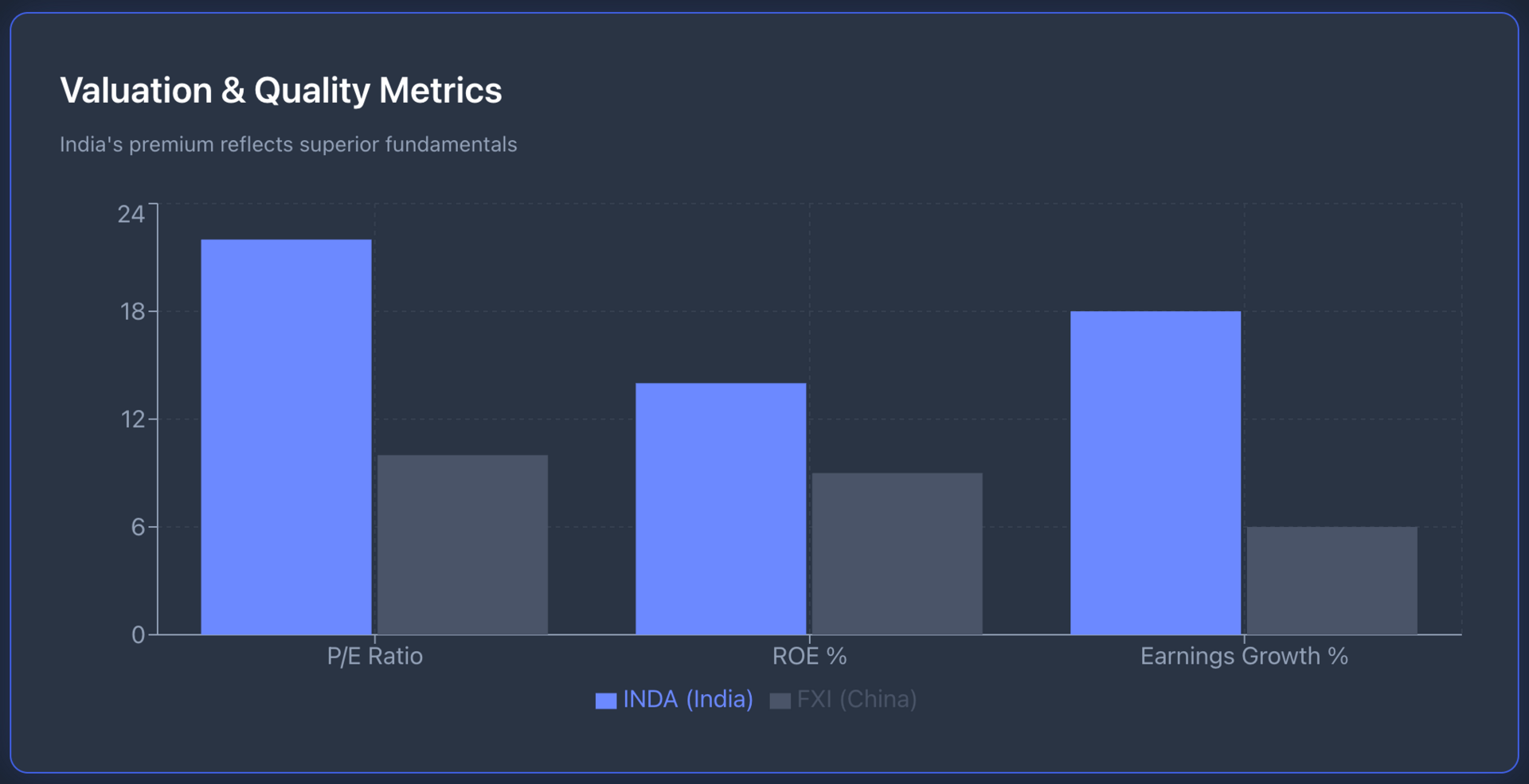

INDA's outperformance isn't just about China's problems. India's corporate earnings grew 18% annually from 2021 to 2024. Return on equity for Indian large-caps averages 14%, compared to 9% for Chinese peers.

What This Means

This is a 10-year macro trend, not a trade. Factory relocations take years to execute. Infrastructure investments compound slowly. Demographic advantages play out over decades.

India faces real challenges—bureaucracy, income inequality, and infrastructure gaps remain significant. But the direction is clear.

Global capital is reallocating toward India because the risk-reward profile shifted.

For investors building emerging market exposure, India offers growth at a reasonable price. INDA trades at 22x forward earnings, compared to FXI's 10x. That premium exists because India's earnings are growing faster and are perceived as more sustainable.

The question isn't whether India will outperform China in the next decade.

The question is how much exposure makes sense in your portfolio right now.

What's catching investor attention today: The Great Rotation: When Digital Gold Lost to the Real Thing

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.