Most investors think they're diversified when they buy SPY. They're not.

Here's what you're actually buying: a concentrated bet on Mag7 companies.

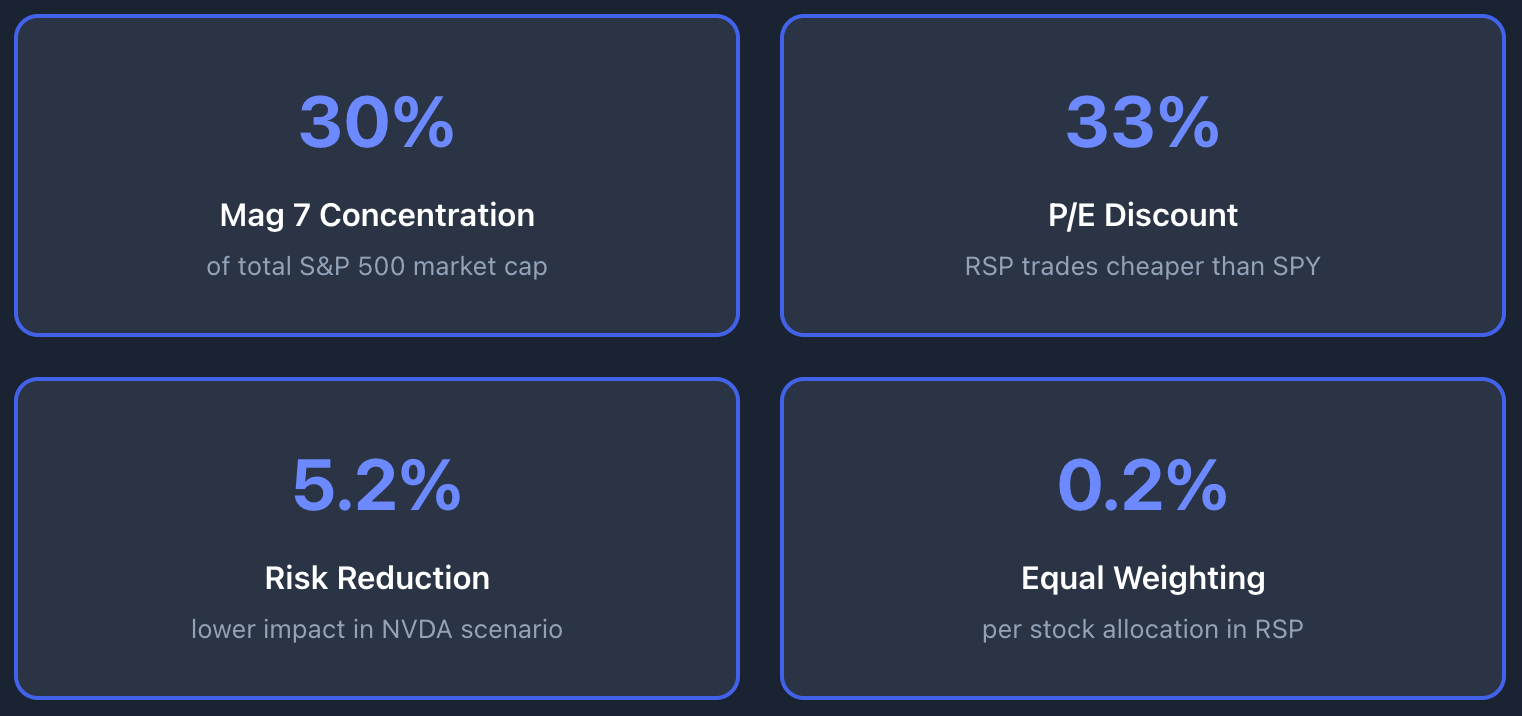

The Magnificent 7 now make up nearly 30% of the S&P 500's total value.

That's not diversification. That's a tech fund with some other stocks mixed in.

This matters because the math has changed.

When you own the cap-weighted S&P 500 today, you're not getting exposure to the broad American economy.

You're betting that AI valuations hold up.

What Happens When Concentration Breaks

Let's run a simple scenario.

Nvidia trades at a premium multiple today.

If $NVDA drops 20%, not unusual for a high-growth stock, the ripple effect hits your entire portfolio harder than you'd expect.

Why? Because cap-weighting amplifies idiosyncratic risk. The biggest stocks get the biggest allocation. When they move, your portfolio moves.

That's not diversification working. That's concentration risk playing out in real time.

The gap between perceived diversification and actual diversification has widened significantly. And that gap matters more than you might think.

What's your biggest concern with the S&P 500's current structure?

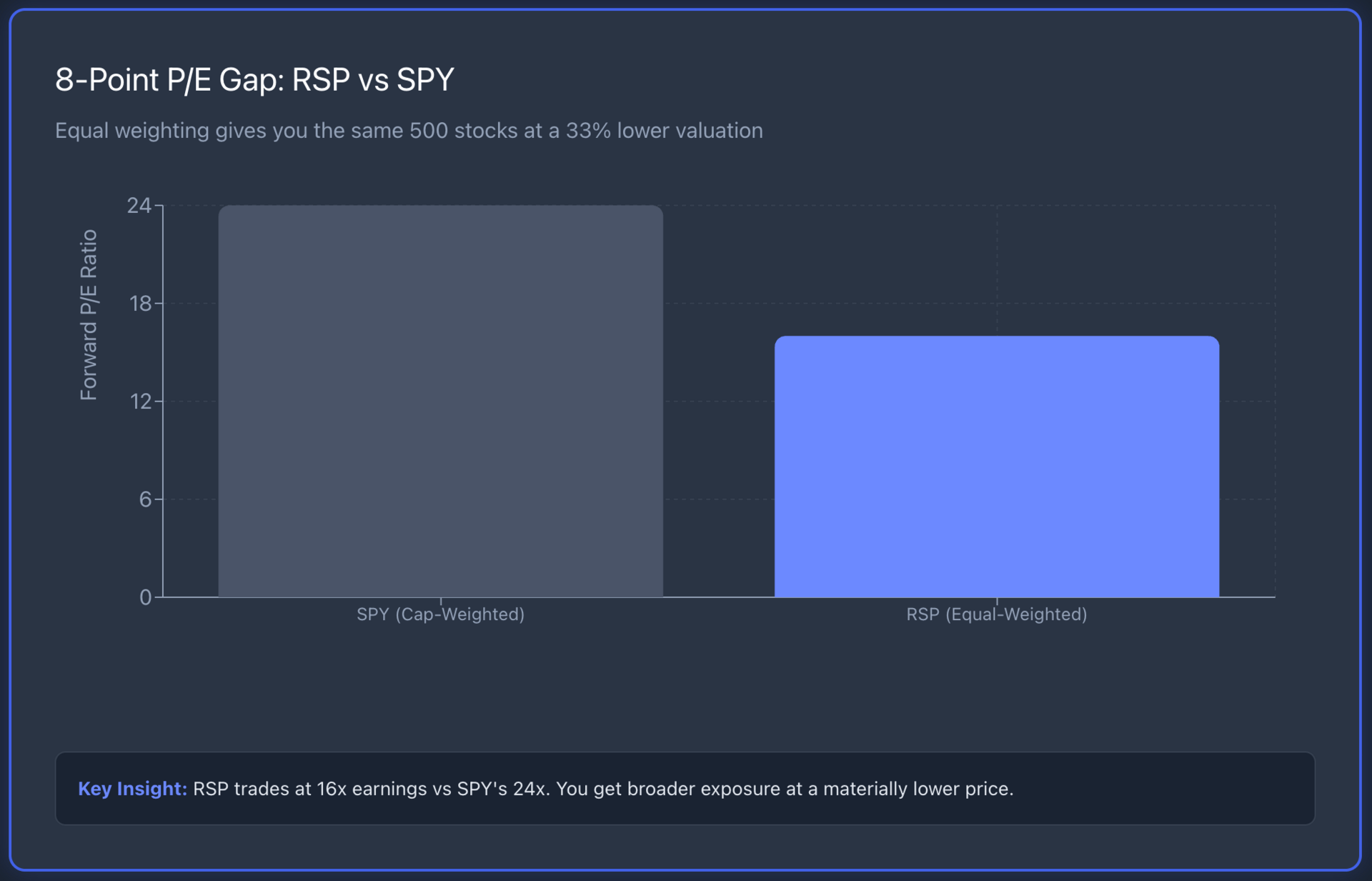

The Valuation Tells the Story

Compare two approaches side by side. Both track the S&P 500. But their valuations diverge sharply.

The cap-weighted S&P 500 $SPY currently trades at a forward P/E of ~24. That multiple reflects the high valuations of mega-cap tech stocks driving the index.

The Invesco S&P 500 Equal Weight ETF $RSP trades at a forward P/E ~16. Same 500 companies. Different weighting method. Each stock gets 0.2% allocation regardless of market cap.

That's an 8-point P/E differential. $RSP is objectively cheaper.

It gives you access to the same index components, but with heavier exposure to the "real economy" stocks trading at more conservative valuations.

After learning about the difference between market-cap and equal-weight S&P 500 ETFs, what are you most likely to do?

Equal Weighting

Equal weighting isn't a performance gimmick.

It's a structural hedge against concentration risk.

When you equal-weight, you're mechanically rebalancing away from the stocks that have run up the most. You're adding exposure to mid-cap components that haven't participated in the AI rally. You're reducing your dependency on a handful of names to carry the entire portfolio.

For investors managing capital preservation mandates, that matters. For financial professionals building client portfolios, it matters. For executives managing corporate treasury allocations, it matters.

RSP isn't trying to beat the market. It's trying to give you actual diversification, the kind that cap-weighted indices used to provide before concentration reached current levels.

The Risk Management Case

Markets don't stay concentrated forever. Historically, periods of extreme concentration eventually revert.

When they do, equal-weighted indices tend to outperform because they're not overexposed to the stocks that got overvalued.

But even if mean reversion doesn't happen soon, $RSP still serves a function: it lowers your portfolio's sensitivity to single-stock volatility in the mega-caps.

That reduced beta to concentration risk has value in itself.

You're paying for broad market exposure. You should actually get it.

The cap-weighted S&P 500 made sense when the top holdings were diversified across sectors. Today, with 30% in Big Tech, the premise has broken down. Equal weighting restores the diversification that cap-weighting once delivered but no longer does.

For investors seeking portfolio diversification and navigating market volatility, RSP offers a methodical alternative.

Lower P/E. Broader exposure. Reduced concentration risk. That's the trade.

What's catching investor attention today: Silver's 72% Gain Still Isn't Enough: Why the Gold/Silver Ratio at 81 Signals a $75+ Breakout

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.