Since August 2025, the ETF market has shown a clear trend.

Money is moving out of bonds and into sectors that promise higher returns.

$SPY experienced its largest single-ETF outflow of 2025 at $10.79 billion in August, while growth-oriented and leveraged ETFs attracted a combined $119.3 billion.

That's not a small shift. It's a strategic repositioning that tells us where institutional money expects opportunity to be.

Numbers That Matter

The iShares S&P 500 Value ETF added $3.2 billion in a single day on November 19, its highest one-day flow of 2025.

At the same time, systematic bond funds like SYSB saw institutional allocations rise sharply. But the overall direction is clear—fixed income is losing its appeal relative to equity sectors with momentum.

Federal Reserve Policy

Rate policy explains most of this movement.

When the Fed signals potential cuts, investors don't stay in broad market benchmarks. They move toward sectors that benefit from lower borrowing costs. Energy, housing, and small-cap equities became preferred over broad-market holdings as the Federal Reserve signaled a potential September rate cut.

Households held nearly $20 trillion in cash and liquid assets in the first half of 2025, allocating more to cash than stocks or bonds over the past three years. As front-end rates decline, that cash needs somewhere to go. Investors are choosing sector-specific plays over traditional bond allocations.

But there's nuance.

BlackRock's model portfolios reduced growth overweights and pivoted from quality to momentum factors in mid-November. This wasn't about abandoning bonds entirely. It was about getting tactical. Bond valuations are stretched, with spreads near historical lows. That limits upside and increases risk.

ETF Inflows

Technology and energy led sector inflows.

Cryptocurrency ETFs captured $1.4 billion as Ethereum reached an all-time high of $4,900.

Energy funds posted double-digit returns in August, driven by geopolitical tensions and supply constraints. Healthcare leveraged products gained 21% on regulatory optimism.

Leveraged ETFs saw mixed results but significant volume. Some products like regional bank ETFs returned 13% on Fed dovishness.

Others faced outflows during volatility spikes. The key insight: these aren't speculative tools anymore. Leveraged ETFs have become part of a tactical arsenal for investors seeking to capitalize on sector rotation.

Factor rotation within equities also accelerated.

The iShares MSCI USA Momentum Factor ETF pulled in $1.3 billion on November 19, its highest inflow in over a year. This reflects a shift from defensive positioning to seeking returns where momentum exists now.

How to Position Portfolios

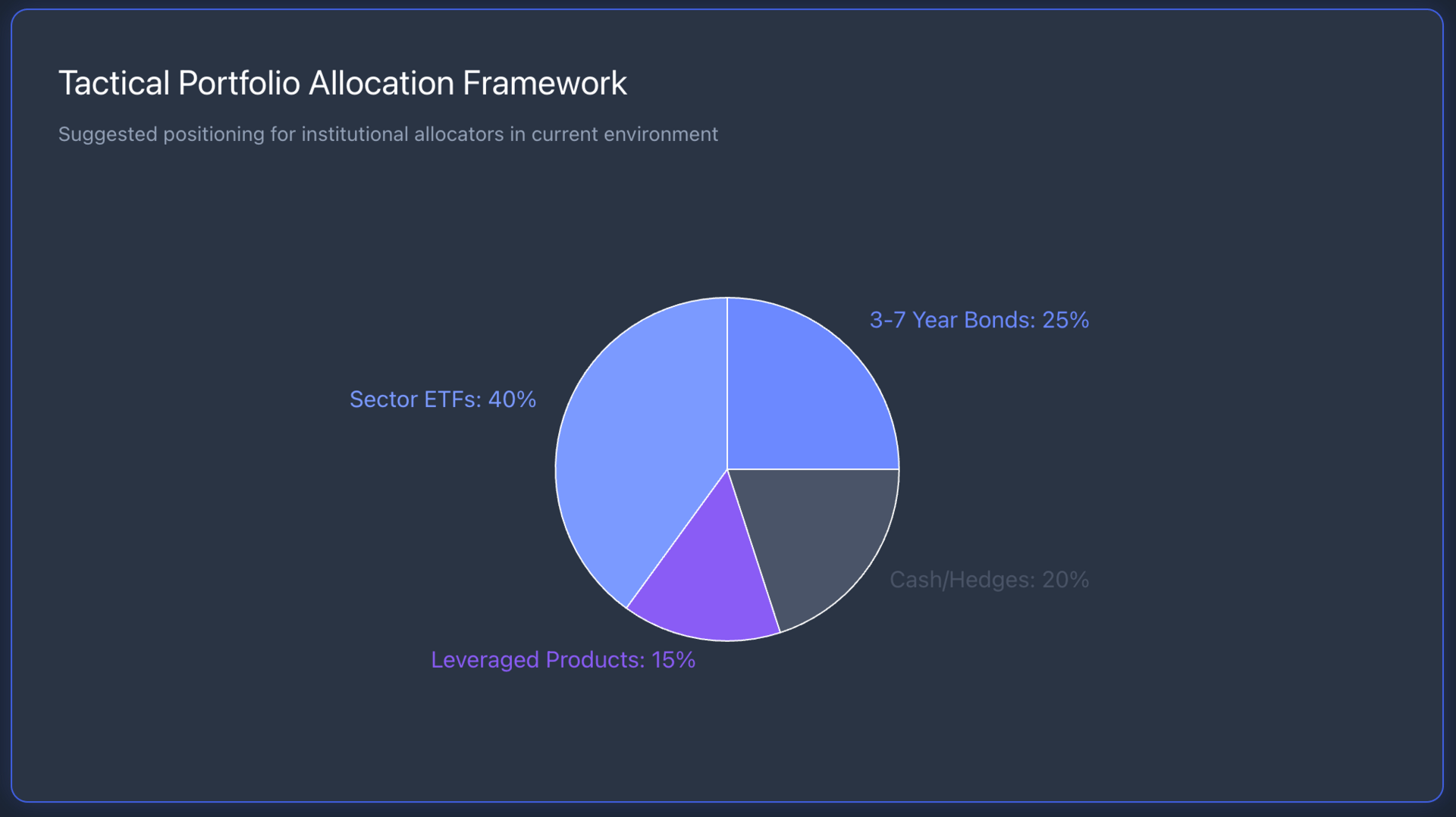

The evidence suggests three adjustments for institutional allocators:

First, reduce duration in fixed income. Investors are abandoning the long end of fixed income markets, with outflows continuing since November 2024. Focus on the 3- to 7-year maturity range where risk-adjusted returns remain viable. Avoid the long end unless hedging tail risks.

Second, allocate to sector-specific exposures rather than broad indexes. The S&P 500's diversification isn't capturing the outsized returns available in targeted sectors. Energy, technology infrastructure, and healthcare offer clearer catalysts. Use ETFs that concentrate exposure where structural trends support growth.

Third, manage factor exposure actively. BlackRock allocated to a systematic bond fund that dynamically adjusts credit exposures, screening for value and quality while maintaining diversification. Static allocations underperform when market leadership shifts this quickly. Use products that rotate based on forward-looking signals, not historical averages.

Risk management remains critical. Leveraged products amplify both gains and losses. They work in trending markets but suffer during mean reversion.

Set clear stop-losses and rebalance frequently. And keep a portion of portfolios in short-term Treasuries or gold as hedges against policy errors or geopolitical shocks.

The data shows a market moving away from "buy and hold" toward "buy and rotate."

The winners will be those who position ahead of policy changes and sector momentum, not those who wait for confirmation.

Fixed income still has a role, but it's smaller and more tactical than it was 12 months ago.

What's catching investor attention today: Sam Altman's AI Hardware Has a Launch Window. Here's What We Know

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.