Over $1 billion has poured into XRP ETFs in just weeks.

Bitcoin ETFs pulled in $6.96 billion annually. And the entire digital asset space is shifting from volatile speculation to something resembling traditional equity allocation.

Here's what's happening.

From Wild Tokens to Structured Exposure

The launch of multiple crypto ETFs, Bitcoin, Ethereum, Solana, XRP, has changed how institutions access digital assets.

No more wrestling with private keys or custody headaches. No more regulatory gray zones. ETFs brought crypto into the same infrastructure that handles trillions in traditional securities.

This matters because the barrier that kept pension funds, endowments, and wealth managers out of crypto wasn't skepticism about the technology. It was operational friction.

ETFs removed that friction.

BlackRock's $IBIT dominates the Bitcoin ETF market with approximately $50 billion in AUM, representing nearly half the market.

Professional investors now hold over a quarter of the total U.S. Bitcoin ETF market. The institutionalization is real and accelerating.

The Rotation Pattern

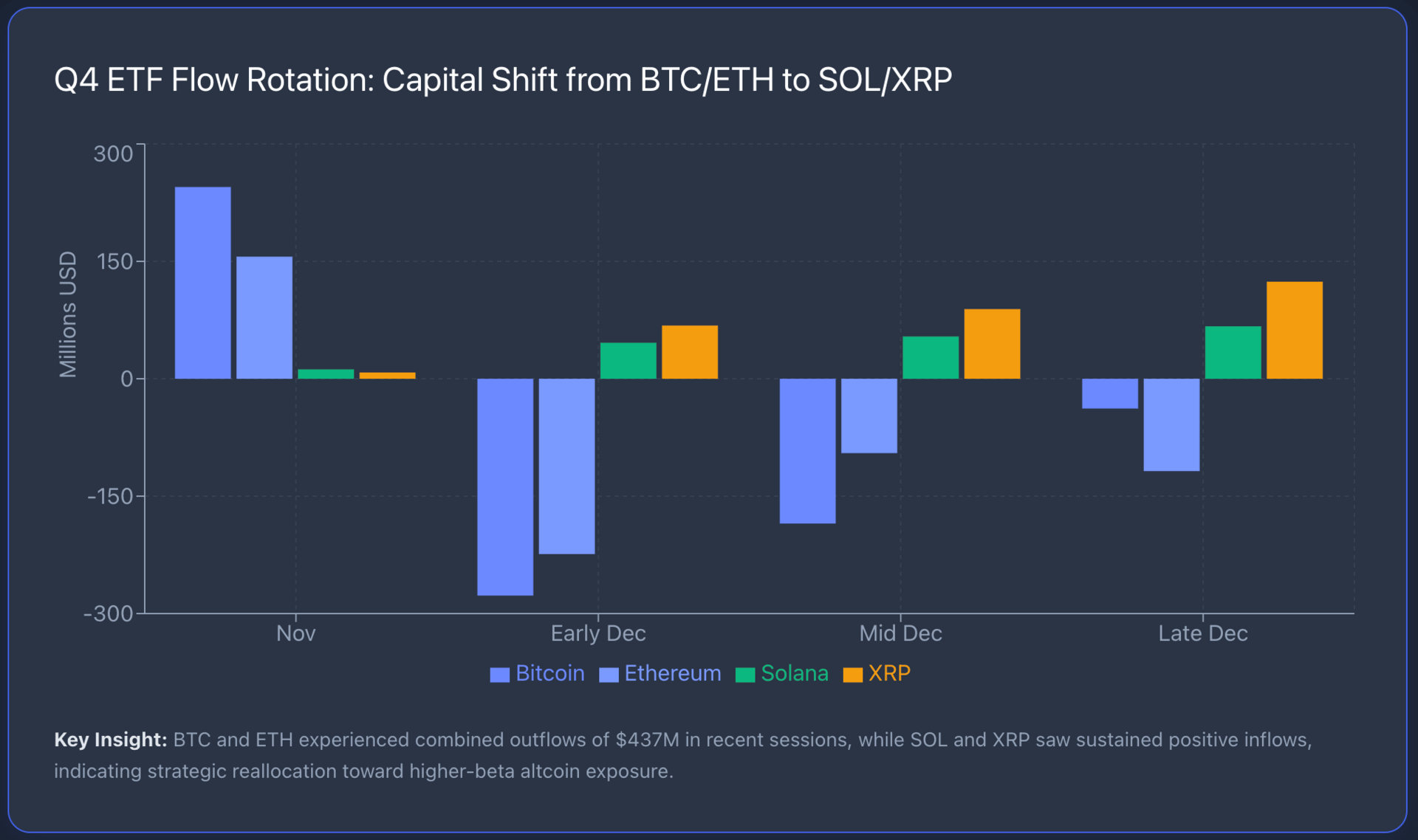

Q4 data shows a clear shift in capital allocation.

Bitcoin ETFs recorded over $500 million in outflows across two sessions, including $277 million in a single day, while Ethereum ETFs saw $224 million in redemptions. Meanwhile, Solana and XRP ETFs saw positive inflows, $3.57M and $13.21M respectively.

The pattern isn't isolated. On December 2, XRP ETFs pulled in $67.74 million, and Solana ETFs attracted $45.77 million, while Ethereum ETFs experienced $9.91 million in outflows. This represents a strategic reallocation, not panic selling.

Recent weeks confirmed the trend. Bitcoin and Ethereum ETFs saw a combined net outflow of $437 million on Monday, while recently launched Solana, XRP and Litecoin ETFs saw positive flows, potentially signaling early capital rotation toward altcoins.

What's driving this? Institutions are diversifying beyond the two dominant assets. They're hunting for growth. And they're doing it through regulated vehicles that offer cleaner access than on-chain trading.

The XRP Disconnect: $1 Billion Inflows, $2 Resistance

Here's where the data gets interesting.

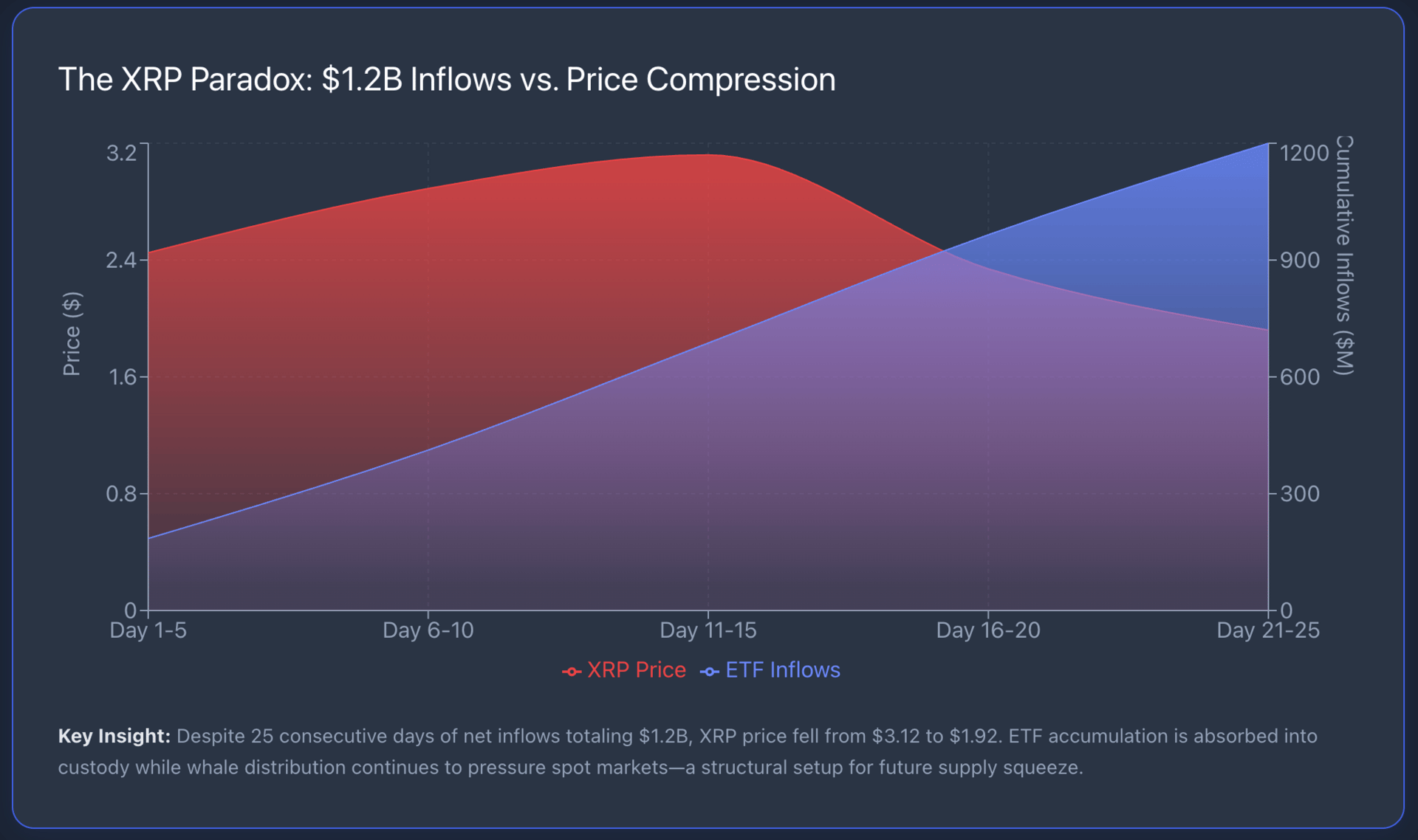

XRP ETFs recorded inflows for 20 consecutive days, totaling $1.2 billion. Zero outflow days. XRP spot ETFs have logged 25 consecutive days of net inflows, accumulating about $1.07 billion. The institutional demand is undeniable.

But the persistent demand for XRP ETFs has failed to hold its price above $2.

XRP currently trades around $1.92, down from highs above $3.

This disconnect raises questions about market mechanics. While ETF inflows are material, they are not yet overpowering selling pressure in spot and derivatives. Taker buy–sell data in XRP futures has been persistently skewed toward sells, which means most aggressive market orders have been hitting the bid.

The explanation: ETF accumulation is deliberate, gradual, and largely invisible. XRP acquired by ETFs is steadily absorbed and locked into custodial structures, where it doesn't trade, flip, or respond to short-term price swings. Meanwhile, large holders continue distributing supply into the market.

ETF demand does remove XRP from active trading over time, but it does not eliminate short-term volatility. The slow accumulation by ETFs is being offset by faster distribution from whales.

This creates a structural setup. ETFs keep buying as long as inflows continue.

Whales eventually finish selling. When that happens, the supply-demand balance shifts. But timing that inflection point is impossible.

Portfolio Construction in ETF Era

The rotation data points to a two-tier allocation framework emerging among institutional investors.

Core holdings: Bitcoin and Ethereum

These remain the foundation. Bitcoin's 50% compound annual return since 2017 makes it a safe haven for conservative investors. Ethereum's role in DeFi and smart contracts keeps it relevant despite recent turbulence.

Bitcoin and Ethereum retain their dominance, with the rise of Solana, XRP, and other altcoins signaling a maturing market where institutional capital is increasingly willing to bet on innovation and compliance.

Satellite positions: Solana and XRP

These function as high-beta exposures. Altcoin surges (SOL +32%, XRP +58%) highlight maturing crypto markets prioritizing innovation and compliance. Institutions use them to capture growth that Bitcoin and Ethereum can't deliver at their current market caps.

XRP and Solana are winning because they address real-world problems—cross-border payments and scalability—while offering the technical robustness and ecosystem growth that Bitcoin and Ethereum, for all their strengths, cannot yet match.

The risk-return profile supports this structure. Bitcoin and Ethereum provide relative stability with moderate upside.

Solana and XRP offer higher volatility with potential for outsized gains.

How are you adjusting your portfolio for the 2025 "Rotation"?

How ETFs Changed Institutional Behavior

The ETF structure solved three problems that kept institutions out of crypto.

Custody and security

ETF shares trade like stocks. Multi-Party Computation and interoperable multi-asset custody platforms have addressed long-standing security concerns, enabling institutions to hold Bitcoin with the same rigor as traditional assets. No need to manage private keys or worry about exchange hacks.

Regulatory clarity

The SEC's cryptocurrency ETF guidance has opened the floodgates to the largest pool of institutional capital in history, positioning cryptocurrencies as a legitimate investment asset class. The approval process established a regulatory framework that financial advisors and compliance officers can work within.

The passage of the CLARITY Act in 2025 and the anticipated bipartisan crypto market structure legislation in 2026 have further solidified a framework where institutions can operate with confidence.

Operational simplicity

Buying ETF shares through existing brokerage relationships is straightforward. 60% of institutional investors prefer ETFs for crypto exposure. The familiarity of the vehicle reduces internal friction and speeds approval processes.

This has accelerated adoption timelines. Financial institutions have been waiting years for regulatory clarity. Now they have it, along with Bitcoin ETFs, digital asset custody solutions, and compliance frameworks.

Crypto Allocation Through ETFs

For investors looking to gain exposure without dealing with on-chain complexity, ETFs provide a clean entry point. Here's how to think about portfolio construction.

Start with core exposure

Allocate to Bitcoin and Ethereum ETFs first. These provide baseline exposure to the asset class with relatively lower volatility than smaller tokens. Standard institutional allocation models suggest 2-5% positions in crypto within diversified portfolios.

Add satellite positions selectively

Consider Solana and XRP ETFs for growth potential. Keep these allocations smaller than core holdings. The higher volatility requires position sizing discipline.

Monitor flows, not just price

ETF flow data reveals institutional behavior. Sustained inflows indicate ongoing demand regardless of short-term price action. ETF flows indicate a rotation from large-cap coins to altcoins with growth potential.

Understand the disconnect between flows and price

As the XRP example shows, strong inflows don't guarantee immediate price appreciation. Market structure, derivatives positioning, and existing holder behavior all influence price. ETFs are building long-term supply dynamics, not triggering short-term rallies.

Use ETFs to avoid operational complexity

The entire point of ETF exposure is to skip wallet management, exchange accounts, and custody concerns. If you're comfortable with on-chain transactions, you don't need ETFs. If you want clean, regulated exposure through existing investment accounts, ETFs deliver that.

What This Rotation Signals

The movement of capital from Bitcoin and Ethereum into Solana and XRP isn't a rejection of the established assets. It's diversification within a maturing asset class.

Institutional investors now have multiple entry points across the risk spectrum. They can build portfolios that balance Bitcoin's stability with altcoin growth potential. And they can do it through regulated products that fit existing compliance frameworks.

Institutional investors are increasingly adopting index-based strategies to mitigate risk. Products like the Bitwise 10 Crypto Index ETF include exposure to XRP and Solana alongside Bitcoin and Ethereum, reflecting balanced portfolio construction.

The data shows this trend accelerating. Total corporate cryptocurrency treasury holdings have surged past $6.7 billion. 68% of institutional investors are either already allocating to Bitcoin ETPs or planning to do so.

It's asset allocation. And the rotation patterns we're seeing in Q4 reflect institutions building diversified crypto portfolios through the same vehicles they use for every other asset class.

The crypto market is starting to look less like a frontier and more like a sector.

ETFs made that transformation possible.

In 5 years, how will the majority of the world own crypto?

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.