US ETF assets hit $13.22 trillion by the end of November.

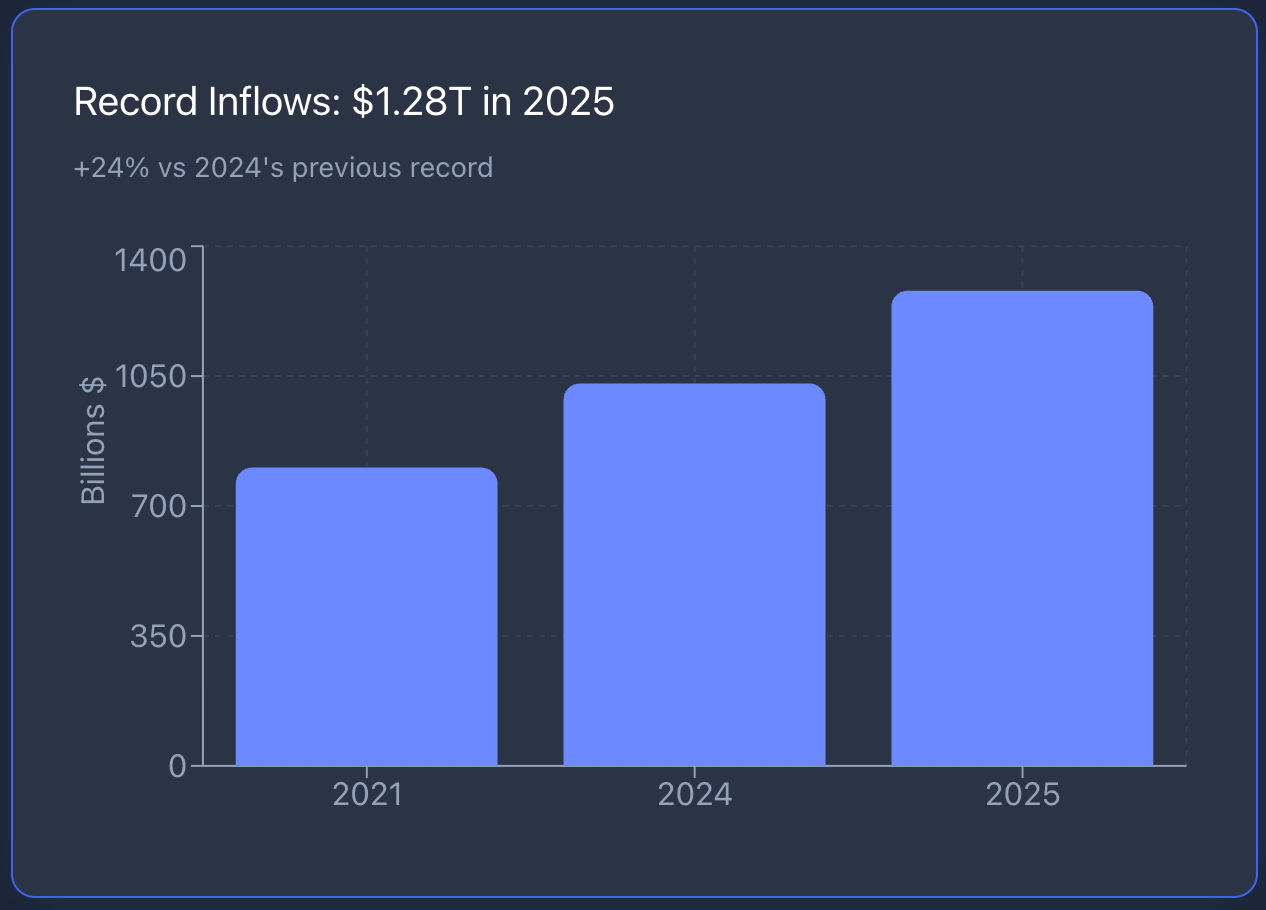

That's $1.28 trillion in net inflows this year alone, crushing the previous record of $1.03 trillion set just last year.

Here's what we know.

Investors poured money into ETFs for 43 straight months. No interruption. No panic selling.

Just consistent, month-after-month accumulation that pushed the industry to heights nobody anticipated twelve months ago.

The Numbers That Matter

Assets grew 27.8% from $10.35 trillion at the start of 2025. That kind of expansion in a single year doesn't happen by accident. It reflects a fundamental shift in how capital gets allocated.

November alone brought in $143.7 billion. Equity ETFs grabbed $71.2 billion of that. Fixed income took $27.5 billion.

Active ETFs pulled in $45.4 billion. Commodities rounded out the picture with $2.0 billion. But the year-to-date story shows where the real momentum sits.

Equity ETFs collected $507.9 billion, roughly matching 2024's pace.

Fixed income ETFs gathered $234.4 billion, up 33% YoY.

Commodities ETFs exploded to $47.0 billion from just $2.9 billion the prior year. That's a 1,515% jump.

Who Controls the Market

Three companies control 72.2% of all ETF assets in the United States.

iShares sits at the top with $3.92 trillion and a 29.7% market share.

Vanguard holds $3.81 trillion at 28.8%.

State Street SPDR commands $1.81 trillion at 13.7%.

The remaining 446 providers fight over what's left—each controlling less than 7% individually.

This concentration isn't new. But it's getting more pronounced.

When three companies manage nearly three-quarters of the market, they set the pricing, the innovation curve, and the competitive dynamics for everyone else.

Money Moves

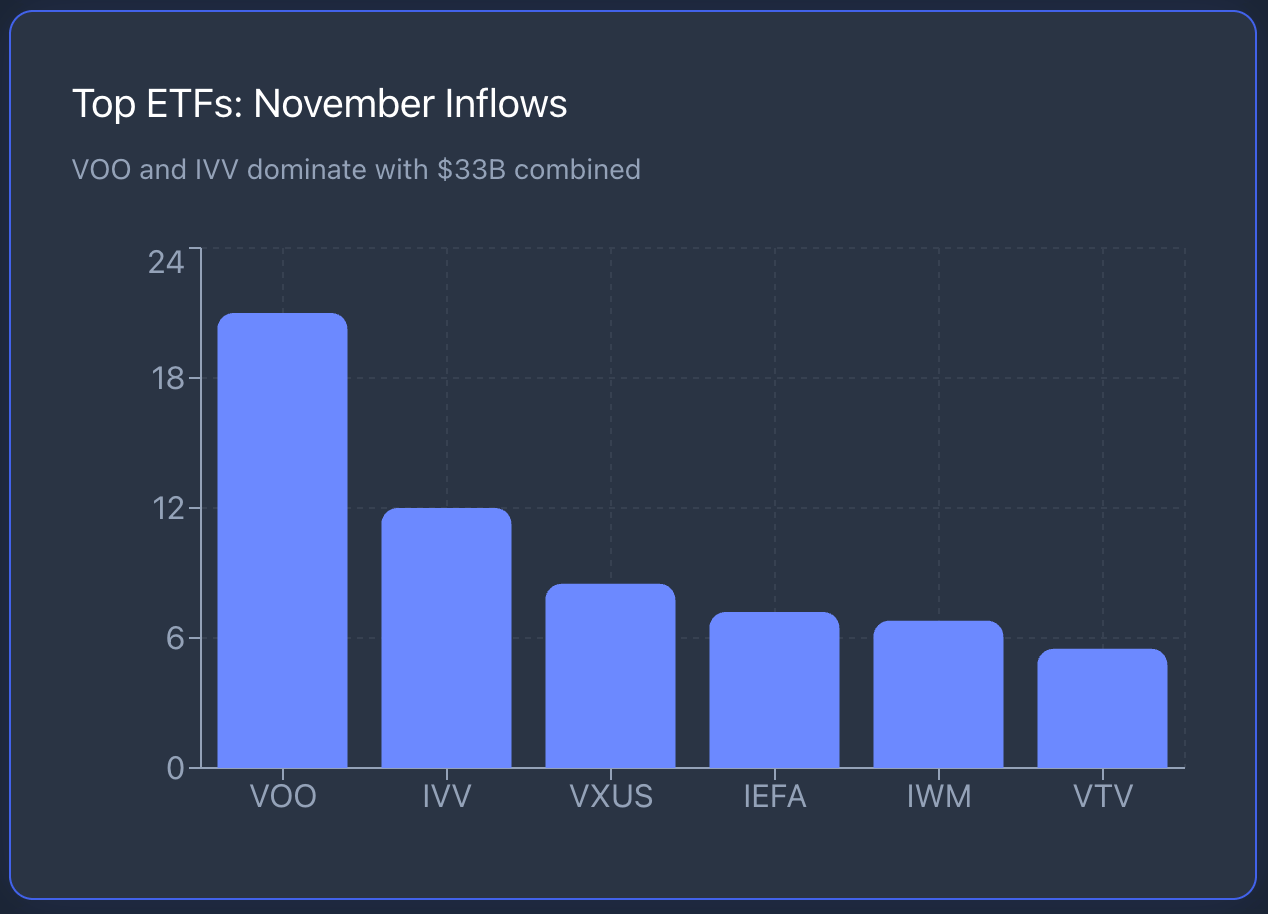

The top 20 ETFs pulled in $79.2 billion during November.

That's more than half the month's total inflows going to just 20 products out of 4,773 available funds.

Vanguard's S&P 500 ETF $VOO led with $21.0 billion.

iShares Core S&P 500 $IVV added $12.0 billion. Treasury and cash-equivalent funds like SGOV, IEF, BSV, and BIL also ranked among the leaders.

The inflow list tells you what investors actually think right now. They're buying core S&P 500 exposure through VOO and IVV. They're adding international equity exposure through $VXUS and $IEFA.

They're rotating into value stocks via $VTV and $IVE.

They're positioning in small and mid-caps through Russell 2000 exposure $IWM. And they're maintaining Nasdaq exposure through $QQQM.

It's systematic portfolio construction at scale.

The Macro Backdrop

Markets delivered strong returns across the board. The S&P 500 gained 17.8% YTD. Developed markets outside the US rose 30.8%. Emerging markets added 22.4%.

Those returns created a feedback loop.

Strong performance attracted inflows, which pushed prices higher, which attracted more inflows. ETFs became the primary vehicle for riding that momentum.

The commodities surge ties directly to gold and silver rallies plus expectations around Federal Reserve rate cuts.

Investors used ETFs to gain exposure without the operational complexity of holding physical metals or futures contracts.

Fixed income ETF demand reflects something different. After the longest rate-hiking cycle in recent history, investors finally see yield worth capturing. They're using bond ETFs to lock in rates before the next cutting cycle potentially compresses spreads.

What Changed in 2025

This year marked the point where ETFs stopped being an alternative investment vehicle and became the default choice. The 43 consecutive months of inflows prove that.

Active ETFs took a meaningful share of November's flows—$45.4 billion. That challenges the narrative that ETFs only work for passive strategies. Fund managers now launch active strategies in ETF wrappers because that's where investor demand sits.

The market now hosts 4,773 ETFs from 449 providers. But growth increasingly concentrates in the largest funds from the largest providers. Scale matters. Liquidity matters. Tight bid-ask spreads matter. Investors pay attention to these factors.

Reading the Flow Patterns

Professional investors are balancing multiple objectives through their ETF allocations.

They want core beta exposure, hence the massive flows into $VOO and $IVV. They want geographic diversification, explaining the $VXUS and $IEFA inflows.

They want factor tilts, shown by the value ETF accumulation. And they want tactical flexibility, demonstrated by the Treasury and cash-equivalent fund usage.

This isn't retail speculation. This is institutional money making deliberate allocation decisions through exchange-traded products.

The small-cap positioning through $IWM suggests expectations for broadening market participation beyond mega-cap tech.

The international equity flows indicate a view that US outperformance might moderate. The commodity exposure reflects inflation concerns and geopolitical risk hedging.

What This Means

The ETF industry just posted $1.28 trillion in net inflows during a year when assets grew to $13.22 trillion. That's not a temporary trend. That's a structural shift in how capital markets function.

Traditional mutual funds continue losing market share. ETFs offer better tax efficiency, intraday liquidity, transparency, and generally lower costs. Once investors make that switch, they rarely switch back.

For portfolio managers, the question isn't whether to use ETFs anymore. It's which ETFs to use and how to deploy them most effectively within a broader strategy.

The concentration among top providers will likely increase. iShares, Vanguard, and State Street have economies of scale that smaller providers can't match. They can price more aggressively, invest more in technology, and offer broader product suites.

Looking Forward

2025 set records that will be hard to top.

But there's no indication the structural drivers behind ETF growth are weakening. If anything, they're accelerating.

The 43-month streak of positive flows reflects deep conviction, not momentum chasing. Investors across institutions, advisors, and individuals have decided ETFs deliver what they need. Until that calculation changes, expect the trajectory to continue.

The data shows where smart money is positioning right now.

Core equity exposure, selective international allocation, value tilts, small-cap participation, and fixed income yield capture, all executed through exchange-traded funds.

That's the market we're trading in.

And that's the infrastructure through which capital increasingly flows.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.