What a wild week!

President Trump plans to share a proposal at Davos that could redirect $350 billion from retirement accounts into housing markets. The mechanics are simple but the implications run deep for anyone holding real estate ETFs.

Americans would tap their 401(k) accounts for home down payments without the standard 10% early withdrawal penalty. This isn't a loan. This is an outright withdrawal taxed as ordinary income but without the penalty surcharge.

The immediate market reaction tells the story.

Top REIT ETFs dropped 0.8% last week. Residential-focused funds fell harder, some down 1.4%. Meanwhile, industrial and data center REITs posted gains.

This creates three distinct pressure points for ETF investors: residential REIT headwinds, mortgage REIT complications, and commercial REIT insulation.

Position accordingly.

The Policy Shift

President Donald Trump, Jan. 6, 2026, in Washington. (AP/Evan Vucci)

Current law treats early 401(k) withdrawals harshly. Pull money out before age 59½, and you face a 10% penalty plus ordinary income tax.

The only exceptions are narrow: permanent disability, medical expenses exceeding 7.5% of income, or qualified first-time home buyer distributions from IRAs capped at $10,000.

Trump's plan would remove that penalty for home purchases. Kevin Hassett, Director of the National Economic Council, confirmed the administration will push this through Congress, likely packaged with broader retirement legislation.

The mechanics matter. This isn't a loan against your 401(k)—those already exist with different rules. This would be an outright withdrawal, taxed as ordinary income but without the 10% penalty surcharge.

Real Numbers That Matter

Current 401(k) system holds roughly $7 trillion in assets

Even if 5% of account holders withdrew funds for housing, that's $350 billion flowing into real estate

A household with $100,000 in their 401(k) could pull $20,000 for a down payment

That's a $2,000 savings on penalty alone (10% of $20,000)

Multiply across millions of potential buyers—market dynamics shift fast

Real On-the-Ground Impact

Housing demand dynamics shift immediately. First-time buyers struggling with down payments suddenly gain access to capital. A household with $100,000 in their 401(k) could pull $20,000 for a down payment, paying only their marginal tax rate instead of the additional 10% penalty.

That's a $2,000 savings on a $20,000 withdrawal. Multiply that across millions of potential buyers.

But the downstream effects get complicated fast. Retirement accounts exist for retirement. Financial advisors have spent decades warning against raiding these funds. Now policy may explicitly encourage it.

The math works differently for different age brackets:

35-year-old withdrawing $20,000: Loses 30+ years of compound growth. That $20,000 could become $150,000+ by retirement at 7% annual returns.

55-year-old withdrawing $20,000: Only 10-15 years until typical retirement age. Less compound growth sacrificed, but also less time to recover the principal.

Capital Flows

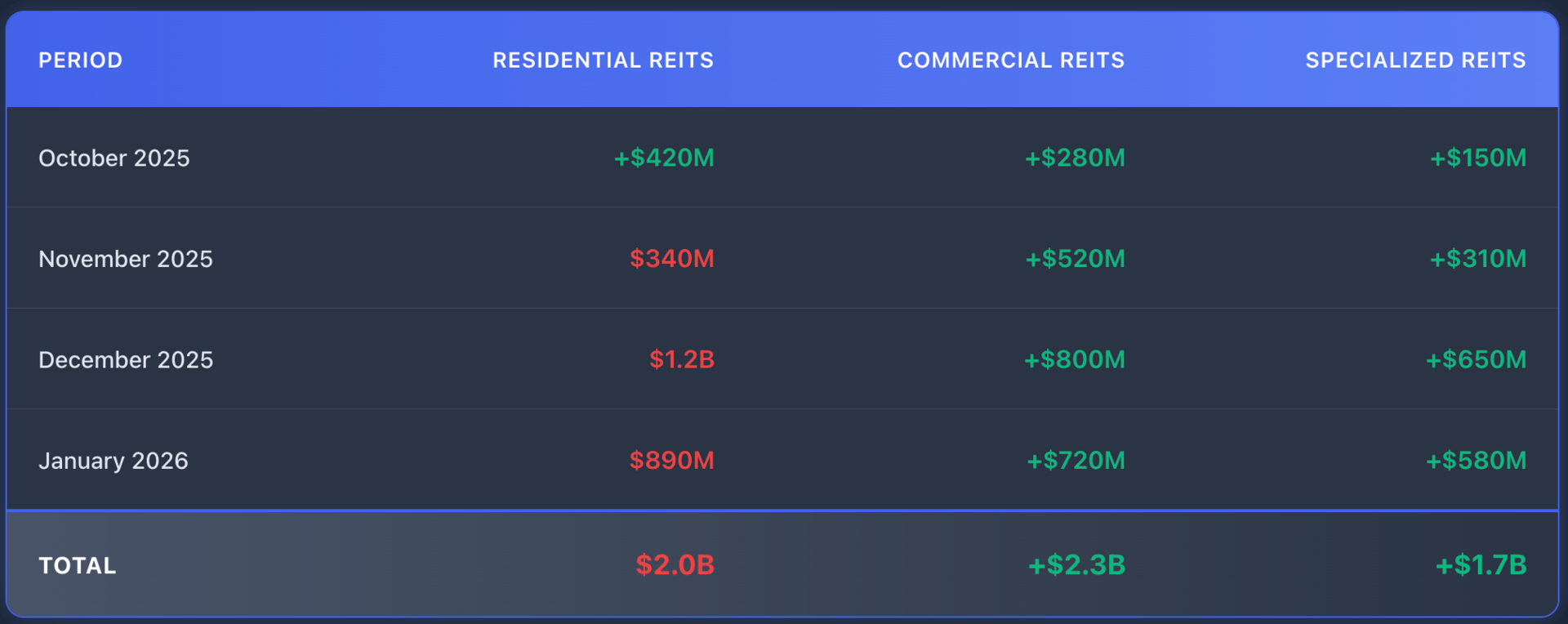

December 2025 and January 2026 fund flow data reveals institutional positioning.

Institutional money is already repositioning. Large pension funds and endowments started reducing residential REIT exposure in Q4 2025 based on preliminary policy signals.

Residential REIT ETFs saw $1.2 billion in outflows during December 2025, while commercial REIT ETFs attracted $800 million in new capital. Professional investors are voting with their wallets before policy clarity emerges.

Financial advisors surveyed in December 2025 reported 62% recommend subsector-specific positioning over broad REIT exposure in the current environment. That's a major shift from the traditional "own VNQ and forget it" approach.

How are you adjusting your REIT ETF holdings after Trump's 401(k) housing proposal?

What This Means

Residential REITs Face Direct Headwinds

More Americans buying homes means fewer renters. Single-family rental REITs and multifamily apartment REITs could see occupancy rates decline. That gap matters more than you think—REIT valuations depend heavily on stable cash flows from rent payments.

Tactical move: Reduce or eliminate positions in funds heavily weighted toward apartment complexes and single-family rentals. Companies like Invitation Homes and American Homes 4 Rent face maximum policy exposure.

The headwinds build slowly, not overnight. Don't panic sell, but consider trimming positions gradually over 4-6 weeks.

Commercial REITs Remain Insulated

Office buildings, retail centers, industrial warehouses: these asset classes don't compete directly with residential home buying. Amazon needs distribution centers whether Americans rent or own homes. 5G buildout requires cell towers independent of housing policy.

Defensive positioning: Rotate capital into property types with zero correlation to residential markets. Industrial vacancy rates sit below 4% nationally—the tightest market in decades.

Maintain commercial REIT allocations. Industrial and data center REITs show strong fundamentals independent of housing policy. These subsectors benefit from e-commerce growth and AI infrastructure demand.

Mortgage REITs Get Complicated

Increased home buying boosts mortgage origination volume, but if buyers use retirement funds for larger down payments, loan-to-value ratios drop. Lower LTVs mean less mortgage debt in the system, potentially reducing mREIT investment opportunities.

Watch mortgage REIT spreads carefully. If the policy passes and down payments increase substantially, mortgage origination patterns shift. mREITs need to redeploy capital, and spread compression could hurt returns.

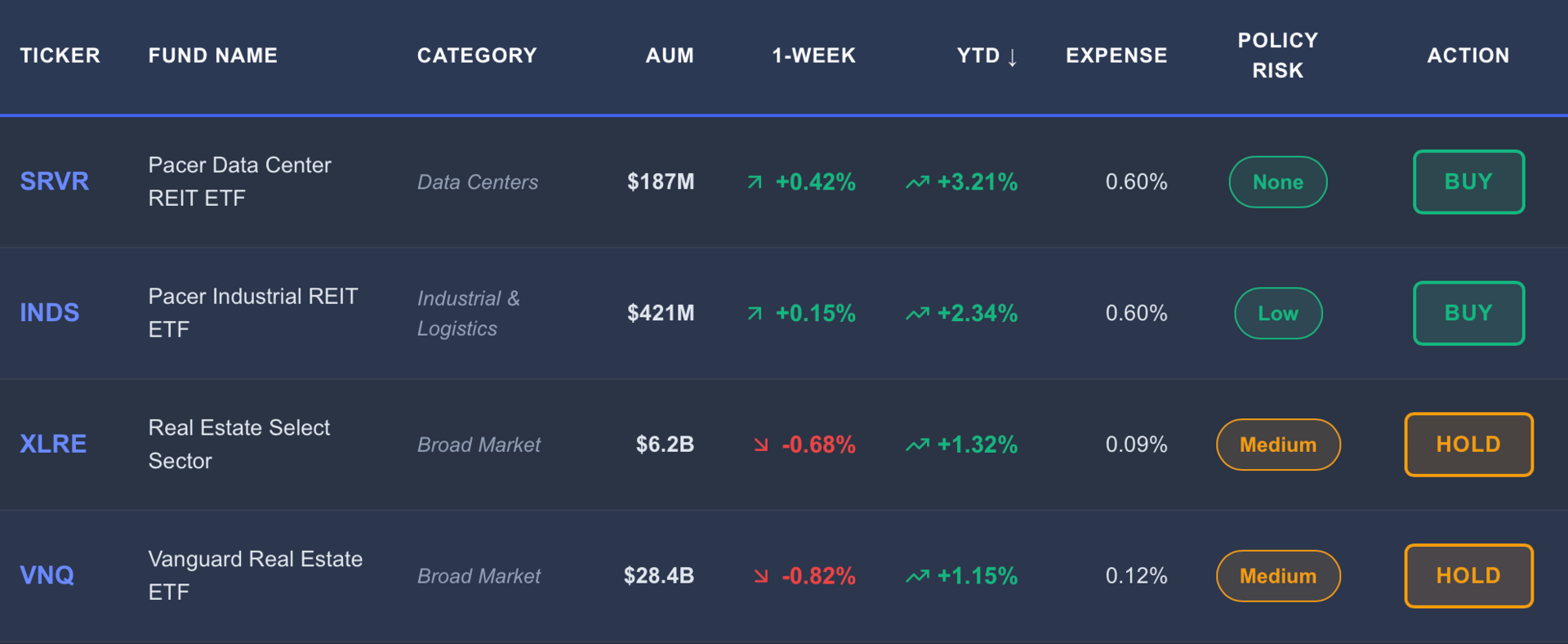

Specialized REIT ETFs

INDS (Pacer Industrial REIT ETF) posted a +0.15% gain last week while VNQ dropped -0.82%. That's a 97 basis point outperformance in five days. The market is pricing in subsector divergence right now.

SRVR (Pacer Data Center REIT ETF) achieved +3.21% YTD returns vs VNQ's +1.15%. Data center subsector benefits from AI infrastructure spending completely independent of housing markets.

HOMZ (Hoya Capital Housing ETF) fell -1.42% last week, the worst performer among all REIT categories. Direct homebuilder and single-family rental exposure creates maximum policy sensitivity.

Strategic Portfolio Positioning Framework

Industrial & Logistics REITs

Amazon doesn't care about 401(k) withdrawals. Neither does Walmart. These companies need distribution centers within 50 miles of major metropolitan areas to deliver packages in 24-48 hours. That demand is non-negotiable.

The Numbers: Industrial vacancy rates sit below 4% nationally—the tightest market in decades. Rental rates increased 8-12% annually from 2020-2025 in major logistics hubs. This trend continues regardless of housing policy.

ETF Focus: $INDS offers pure-play exposure to logistics properties near ports, airports, and population centers. These facilities command premium rents because location advantages can't be replicated.

Data Center REITs

ChatGPT, Claude, Gemini—these AI models require massive computational power. Microsoft, Google, and Meta are locked into long-term data center leases. Training GPT-5 or Claude 4 needs thousands of GPUs running 24/7.

The Numbers: Data center REIT revenue grew 18% annually from 2022-2025. Power consumption per facility jumped 40% as AI workloads replaced traditional cloud computing. Hyperscalers are pre-leasing capacity 3-5 years in advance.

ETF Focus: $SRVR concentrates in Northern Virginia (largest data center market globally), Phoenix, and Dallas—markets with fiber connectivity and cheap electricity critical for AI infrastructure.

Healthcare Facility REITs

10,000 Americans turn 65 every day through 2030. Older populations need medical office buildings, outpatient surgery centers, and senior housing facilities.

The Numbers: Healthcare REIT occupancy rates consistently exceed 92%. Triple-net lease structures mean tenants pay property taxes, insurance, and maintenance. Cash flows are predictable and inflation-protected through rent escalators.

ETF Focus: Medical office buildings near major hospital systems offer the most stability. Senior housing provides higher yields but comes with operating risk.

Cell Tower REITs

Wireless data consumption doubles every 30 months. 5G buildout requires denser tower networks. Verizon, AT&T, and T-Mobile pay rent under 10-15 year contracts with annual escalators.

The Numbers: Cell tower REITs maintain 99%+ rent collection rates—among the highest in any real estate category. The major carriers can't reduce tower usage without degrading network quality, creating non-discretionary demand.

ETF Focus: American Tower, Crown Castle, and SBA Communications dominate this oligopoly. Funds overweight these three companies capture most of the subsector's returns.

Which REIT subsector offers the best risk-adjusted returns if this policy passes?

The Legislative Reality Check

This requires Congress to act. That means negotiations, amendments, and potential failure.

Republicans generally support expanding retirement account flexibility.

Democrats worry about Americans depleting retirement savings and creating future social safety net burdens. Getting 60 Senate votes looks challenging.

The retirement industry—plan administrators, financial advisors, fiduciaries—will likely push back. Their business model depends on assets staying in retirement accounts for decades.

Even with Republican control of Congress, complex retirement legislation takes months minimum.

Implementation could stretch into 2027 or beyond.

When will you rebalance your real estate ETF allocation?

Risk Management Tools

Defensive Measures:

✓ Diversify across subsectors: Don't concentrate in residential—spread exposure across industrial, data centers, healthcare, and cell towers

✓ Hedging with inverse ETFs: Consider tactical positions in inverse REIT ETFs during volatile periods (short-term tool, not long-term investment)

✓ Monitor implied volatility: Watch REIT options markets for early warning signs of institutional positioning changes

What to Monitor:

Legislative updates: Congressional committee markups or hearings on retirement account legislation

Housing market data: Pending home sales and first-time buyer statistics from the National Association of Realtors

REIT fund flows: Weekly ETF flow data showing institutional positioning changes

Mortgage rates: 30-year fixed rates—if they drop while 401(k) access opens, housing demand could surge

The Bottom Line

Trump's 401(k) housing proposal isn't law yet. It might never become law. But markets price in probabilities, not certainties.

Real estate ETF investors need to assess exposure now. Residential REITs face the clearest headwinds. Commercial and specialized REITs offer better risk-adjusted returns in this environment.

The proposal highlights a broader tension in retirement policy, balancing current needs against future security. For ETF portfolios, that tension creates both risks and opportunities depending on positioning.

The opportunity is clear: Reduce VNQ/IYR/SCHH to 2-3% core holdings, then add 3-4% in specialized ETFs like INDS and SRVR for defensive real estate exposure without residential correlation.

Markets reward preparation. This policy debate just started.

Position accordingly.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Taiwan's $250 Billion Chip Bet Just Rewrote the Semiconductor Playbook—Here's What Investors Need to Know

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.