The numbers are staggering.

Taiwan just committed $250 billion to U.S. semiconductor production, the largest foreign tech investment in American history.

This isn't expansion. This is a complete recalibration of global chip manufacturing.

Here's what investors need to know right now.

US-Taiwan Deal

Taiwan and the United States finalized a trade agreement that fundamentally alters semiconductor supply chains. Taiwanese companies pledged at least $250 billion in U.S. investments, backed by another $250 billion in credit guarantees from Taiwan's government.

The U.S. cut tariffs on Taiwanese goods from 20% to 15%. Specific categories, generic drugs, aircraft parts, got full exemptions. But the real incentive runs deeper: chipmakers building U.S. capacity can import equipment and materials tariff-free during construction and operation.

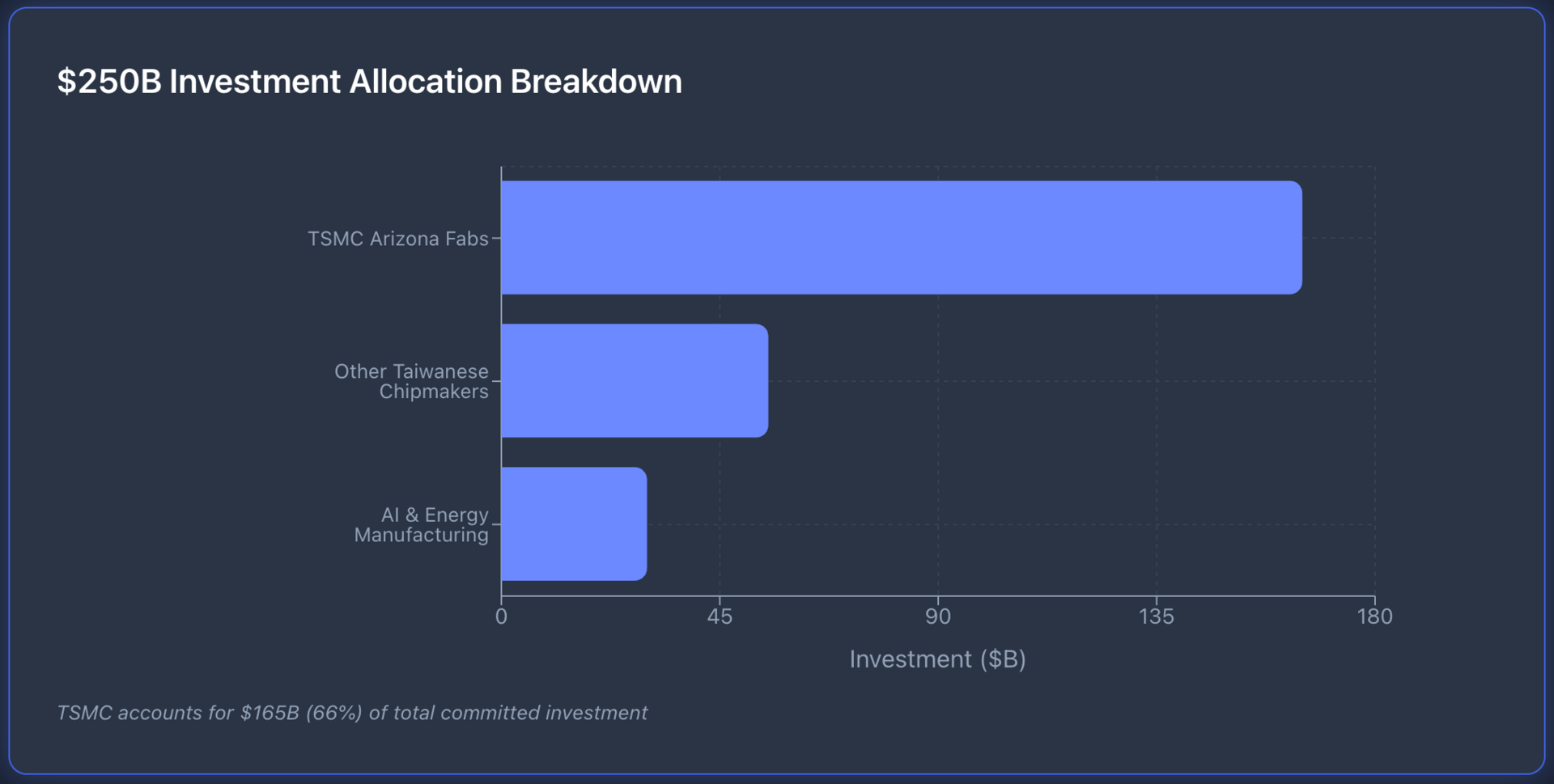

TSMC leads the charge with $165 billion earmarked for Arizona fabs. That's not a typo. One company. One state. More capital than most countries spend on infrastructure in a decade.

Why This Matters

The semiconductor industry operates on a simple principle: whoever controls advanced chip production controls the future of AI, defense systems, and economic competitiveness. For 30 years, that control sat primarily in Taiwan.

Not anymore.

Taiwan is building a "gigafab cluster" in Arizona—multiple fabrication plants, advanced packaging facilities, and R&D centers designed to match its home operations. TSMC is dedicating 70% of its capital expenditure to advanced nodes and high-performance technology, with significant portions tied directly to U.S. expansion.

This shift addresses a vulnerability that kept Pentagon officials awake at night: over 90% of the world's most advanced chips came from a single island 100 miles from mainland China.

The new deal doesn't eliminate that risk. But it creates redundancy where none existed.

The Defense Angle

Defense contractors need advanced semiconductors for everything from fighter jets to missile guidance systems. The F-35 alone contains chips that can't be manufactured in most countries.

China's semiconductor ambitions ran straight into U.S. export controls over the past three years—restrictions on advanced computing technology, manufacturing equipment, and expertise transfers. Those controls had one problem: they assumed reliable access to Taiwan's production.

That assumption just got insurance.

Companies with defense exposure and semiconductor integration stand to benefit as U.S. production scales. The Pentagon's budget allocations for next-generation weapons systems depend on domestic chip access. Taiwan's investment creates that access.

What the Numbers Tell Us

Let's break down the key ETFs positioned around this shift:

Defense & Semiconductor ETF Comparison

ETF Ticker | AUM | 1-Week Return | YTD 2026 | Expense Ratio | Defense Exposure |

SMH | $18.2B | +3.8% | +4.1% | 0.35% | Low (5%) |

SOXX | $9.7B | +3.2% | +3.7% | 0.35% | Low (3%) |

XSD | $1.1B | +4.1% | +4.9% | 0.35% | Low (2%) |

ITA | $5.8B | +2.1% | +2.8% | 0.40% | High (85%) |

PPA | $3.2B | +1.9% | +2.4% | 0.58% | High (78%) |

SMH (VanEck Semiconductor ETF) tracks the industry's largest players. TSMC represents roughly 12% of holdings—meaning this week's news directly impacts fund performance. The ETF jumped 3.8% in one week as the trade deal details emerged.

SOXX (iShares Semiconductor ETF) offers similar exposure with slightly lower concentration. Both funds carry 0.35% expense ratios and focus on pure semiconductor plays rather than defense integration.

XSD (SPDR S&P Semiconductor ETF) targets equal-weight exposure across the sector, reducing concentration risk. Its 4.1% weekly gain suggests smaller-cap semiconductor firms rallied harder on the news—a pattern that typically signals broad industry optimism.

ITA (iShares U.S. Aerospace & Defense ETF) and PPA (Invesco Aerospace & Defense ETF) provide high defense exposure (85% and 78% respectively) with embedded semiconductor dependencies. These funds lagged semiconductor-pure plays this week but could catch up as defense procurement adjusts to domestic chip availability.

The performance gap matters. Semiconductor ETFs outpaced defense funds by 1.7-2.2 percentage points in one week. That spread rarely holds when geopolitical tensions drive both sectors.

After Taiwan's $250B chip commitment, where are you adding exposure?

Investment Scenarios

Scenario One: TSMC Executes Flawlessly

Arizona fabs come online on schedule. Advanced packaging facilities start production by 2027. U.S. customers shift orders to domestic operations, reducing logistics costs and geopolitical risk premiums.

Result: SMH and SOXX see sustained outperformance. Defense contractors secure reliable chip access. Semiconductor margins improve as tariff advantages compound.

Scenario Two: Construction Delays and Cost Overruns

Building advanced fabs in a new country with different labor markets and supply chains proves harder than projected. Timeline stretches to 2029-2030. Capital costs exceed estimates.

Result: Short-term volatility in semiconductor ETFs. Defense stocks outperform as Pentagon prioritizes existing suppliers. Alternative chipmakers in Japan and South Korea gain market share.

Scenario Three: China Responds Aggressively

Beijing views the deal as economic containment and retaliates through trade restrictions, rare earth mineral controls, or pressure on Taiwan. Taiwan's parliament rejects the agreement or waters down commitments.

Result: Both sectors face headwinds. Safe-haven positioning favors diversified defense contractors over semiconductor specialists. Gold and treasury positions spike.

The market is currently pricing Scenario One at roughly 65% probability based on options activity and sector rotation patterns.

Investment Patterns

Three patterns emerged in institutional trading this week:

Pattern One: Rotation into semiconductor equipment makers. Applied Materials, Lam Research, and ASML saw heavy accumulation. The logic runs simple: TSMC's U.S. buildout requires billions in fabrication equipment. These companies supply that equipment.

Pattern Two: Increased positions in ETFs with both semiconductor and defense exposure. Funds that previously ran concentrated semiconductor bets added defense contractors with chip dependencies. This hedges against timeline uncertainty while maintaining sector exposure.

Pattern Three: Geographic diversification within Asia. Smart money didn't abandon Taiwan exposure, they added Japan and South Korea semiconductor positions as portfolio ballast. If U.S.-Taiwan relations face headwinds, other Asian producers benefit.

The cleanest way to capture all three patterns: a core SMH position (for direct semiconductor exposure), a smaller ITA allocation (for defense integration), and individual positions in equipment makers.

The Tariff Math

Taiwan's tariff reduction from 20% to 15% sounds modest. It's not.

A 5% tariff cut on billions in semiconductor imports translates to hundreds of millions in annual savings for U.S. tech companies. Apple, Nvidia, AMD, and Intel all use TSMC chips. Lower import costs flow straight to gross margins or get reinvested in R&D.

But the real advantage sits in the construction phase. Chipmakers building U.S. capacity can import tariff-free during buildout. That's specialized equipment from Japan, rare materials from Australia, precision tools from Germany, all entering duty-free for the next five years.

Construction cost advantages compound. Lower upfront capital requirements mean faster break-even timelines. Faster break-even means more aggressive capacity additions. More capacity means greater leverage over chip pricing.

TSMC's Arizona fabs could achieve profitability 18-24 months earlier than originally projected. That timeline compression matters enormously for investor returns.

The Risk Nobody's Discussing

Taiwan's parliament still needs to approve the deal. Some lawmakers worry about hollowing out domestic semiconductor leadership. Others question whether $250 billion in outbound investment drains capital from Taiwan's economy.

Those concerns carry weight. Taiwan built its chip industry through decades of concentrated investment, government support, and engineering talent development. Shifting that capacity to Arizona means shifting jobs, expertise, and economic value.

If Taiwan's parliament rejects or substantially modifies the agreement, semiconductor ETFs face immediate 5-7% corrections. Defense stocks probably hold steady—the Pentagon's chip needs don't disappear if the deal falls through.

Current odds of parliamentary approval sit around 75-80% based on political dynamics and public statements. But that's not certainty. It's probability.

Biggest risk to Taiwan's $250B U.S. chip investment?

Smart positioning accounts for that 20-25% downside scenario.

What This Means

The semiconductor sector just received validation that U.S. policy will support domestic production through tariff incentives, infrastructure investment, and trade agreements. That's a multi-year tailwind.

Defense contractors gained assurance that chip supply chains won't constrain next-generation weapons development. That removes a significant uncertainty from valuation models.

Both sectors benefit from the same driver: strategic competition with China over technology leadership.

Investors need exposure to both sides of this trade. The question isn't whether to own semiconductor or defense positions, it's how much of each and through which vehicles.

For most portfolios, a 60/40 split between semiconductor and defense ETFs captures the opportunity while hedging execution risk. SMH provides pure semiconductor exposure. ITA covers defense integration. Both benefit if the Arizona fabs deliver on schedule.

If you're more aggressive, tilt toward 70/30 semiconductors. If you're more conservative, flip to 40/60 favoring defense. But zero exposure to either sector means missing the decade's largest reallocation of advanced manufacturing capacity.

What's your current semiconductor vs defense allocation?

The Bottom Line

Taiwan just bet a quarter-trillion dollars that the future of semiconductor manufacturing runs through the United States. TSMC is building production capacity in Arizona that rivals its Taiwan operations. The U.S. government is backing that shift with tariff cuts and policy support.

This isn't a one-quarter story. This is a structural realignment that plays out over five to ten years.

The chips powering AI models, autonomous vehicles, and defense systems will increasingly carry "Made in USA" labels. Companies positioned along that supply chain, from fab equipment makers to defense contractors to the chipmakers themselves, face sustained demand growth.

The question isn't whether this matters. The question is whether your portfolio reflects that reality.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Greenland: Trump’s Vision of the New World Order

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.