The S&P 500 is closing out the year at record highs, above 6,900 points.

Nasdaq jumped 22% for the year. The Dow Jones hits new records every week.

But investors aren't celebrating.

Here's the paradox of this Santa Rally: the market climbs, but trust doesn't. The CNN Fear & Greed Index shows 59 points, that's "greed" territory, but far from euphoria.

Retail investors in the AAII survey registered just 37% optimism in late December. Below the historical average.

Professional asset managers talk about an "owl market," cautious watchers waiting on the sidelines.

What's Happening

The market gained 17% in 2025.

That's the fourth consecutive year with returns above 15%.

Three straight years with returns over 20%, rare in market history. But this growth breeds skepticism, not enthusiasm.

December data showed the U.S. economy in surprisingly strong shape. Third-quarter GDP expanded 4.3%, double the forecast. Consumer spending held firm. But consumer confidence dropped.

The Consumer Confidence Index fell to 89.1 in December, losing nearly 4 points in a month. That's significantly lower than year-start levels.

The gap between reality and sentiment matters.

Investors see elevated multiples. They see risks. But money keeps working.

The S&P hits 6,900. How are you feeling about your portfolio right now?

Three Drivers of the Rally

AI. Nvidia $NVDA tripled from late 2022. But this year, other AI infrastructure players delivered the biggest gains. S&P 500 companies invested $380 billion in data centers over the year. Broadcom $AVGO, Micron Technology $MU, TSMC $TSM–all showed gains for the year.

Rate cuts. The Fed executed three cuts in 2025, in September, October, and late December. Rates fell from the peak but remained higher than markets expected. Investors priced in more aggressive monetary easing. Looking forward to 2026.

Stock buybacks. Corporations continue repurchase programs at record pace. This supports prices even without mass retail interest.

Who Won 2025

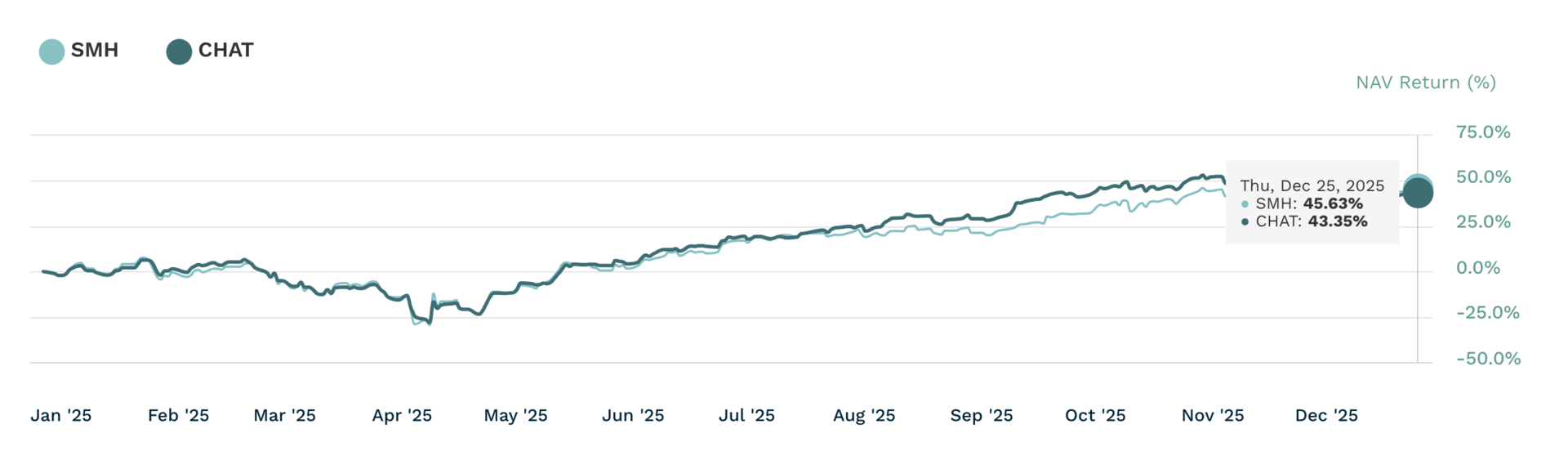

ETF Comparison, SMH vs CHAT (etf.com)

The top performer sector in 2025, driven by AI investments and Mag7 stocks like Nvidia $NVDA, Microsoft $MSFT, and Apple $AAPL, along with semiconductor giants.

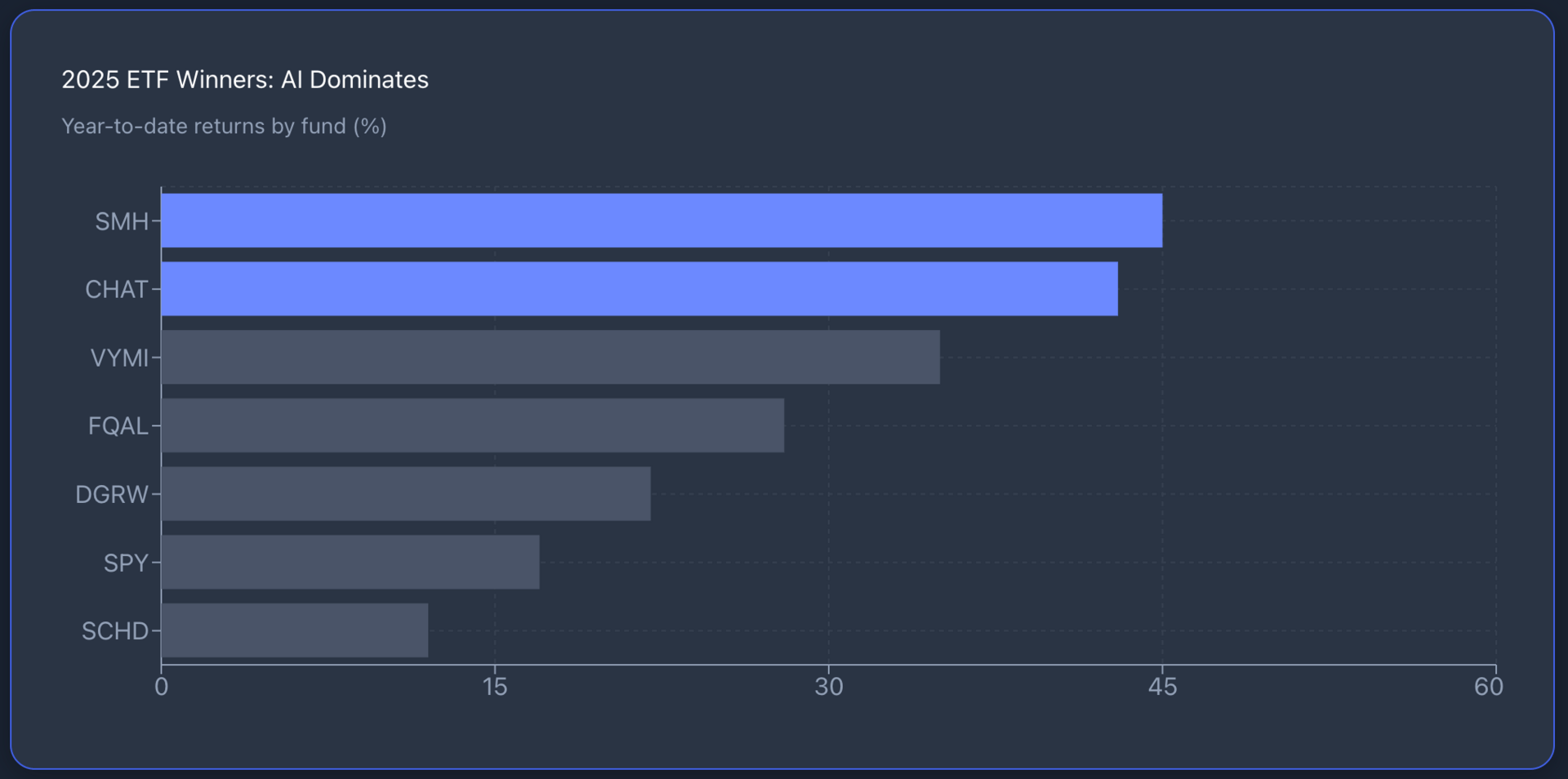

VanEck Semiconductor ETF $SMH posted +45% for the year, doubling the S&P 500.

Roundhill Generative AI & Technology ETF $CHAT gained 43%. Five stocks in the S&P 500 showed gains over 200%, all tied to AI in some way.

Tech giants stayed center stage. Alphabet and Nvidia led the "Magnificent Seven." Amazon and Apple lagged but still posted positive returns. The market focused on companies building AI infrastructure. Chips, data centers, power for them.

Defensive sectors lost appeal. Dividend funds trailed the broad market. The Morningstar Dividend Yield Focus Index gained less than the general index. Value strategies lost to growth. Energy and healthcare looked boring against technology.

What Investors Should Do

The main question now: is it too late to get in. The market is at peaks. Multiples stretched. The S&P 500 P/E ratio runs well above five-year and ten-year averages. But history shows: bull markets lasting over three years typically continue for nearly seven years with average cumulative gains of 234%.

Morgan Stanley projects the S&P 500 at 7,500 in 2026, another 10% gain.

Bank of America points to continued growth potential from cash on the sidelines.

Around $6 trillion in cash waiting for the right moment. If this money starts flowing into stocks, the rally continues.

Risks are obvious too.

Goldman Sachs warns of a possible "lost decade" for U.S. stocks, forecasting just 3% annual returns over the next ten years due to high starting valuations. The first quarter of 2026 could test corporate earnings. If reports disappoint, the market could correct 10-20%.

If you had $10k to deploy today for 2026, where does it go?

ETF Strategy for 2026

Diversification matters more now than ever. If the AI theme runs out of steam, defensive positions become critical.

The quality factor looks smart.

Fidelity Quality Factor ETF $FQAL holds large tech companies with strong balance sheets: Nvidia, Apple, Microsoft. If tech continues climbing, the fund wins. If correction starts, quality assets hold better than others.

Dividend growth over pure yield. WisdomTree U.S. Quality Dividend Growth ETF $DGRW focuses on companies with solid fundamentals and growing dividends. This bridges growth and value. It contains more tech companies than typical dividend funds, but emphasizes cash flow and financial stability.

For more conservative positions: Schwab U.S. Dividend Equity ETF $SCHD. The fund holds energy, consumer staples, and healthcare. These sectors lag now but could lead when the cycle turns. Yield above 3% adds a safety cushion.

International markets are recovering. Vanguard International High Dividend Yield ETF $VYMI posted +35% in 2025 on dollar weakness and falling rates abroad.

Emerging markets trade at a P/E around 13, half the S&P 500. The IMF forecasts 4% growth in developing economies for 2026 vs 2.1% in the U.S.

The Bottom Line

This is an odd bull market. It rises, but most don't believe in its staying power. Sentiment remains cautious even at record highs. Maybe this skepticism itself provides the best support for continued growth.

Investors should stay in the market, but with reasonable diversification. Don't try to time the exit. You ride bull markets, not wait them out. But prepare for possible volatility from Fed chair changes in 2026 and U.S. midterm elections.

If corporate earnings meet expectations, the rally continues. If not, dividend and quality assets help you stay afloat.

In both scenarios, a balanced portfolio combining growth exposure with defensive positions looks like the smartest choice.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.