Global government debt just crossed $100 trillion.

Political divisions in major economies are at levels not seen in decades. And central banks bought 1,136 tonnes of gold in 2022 alone—the highest annual purchase on record.

Investors are fundamentally changing how they think about gold.

This isn't the old "buy gold and forget it for 20 years" approach.

Today's investors are using gold ETFs as an active cash management tool, a liquid alternative to Treasury bills and money market funds when political and geopolitical risks spike.

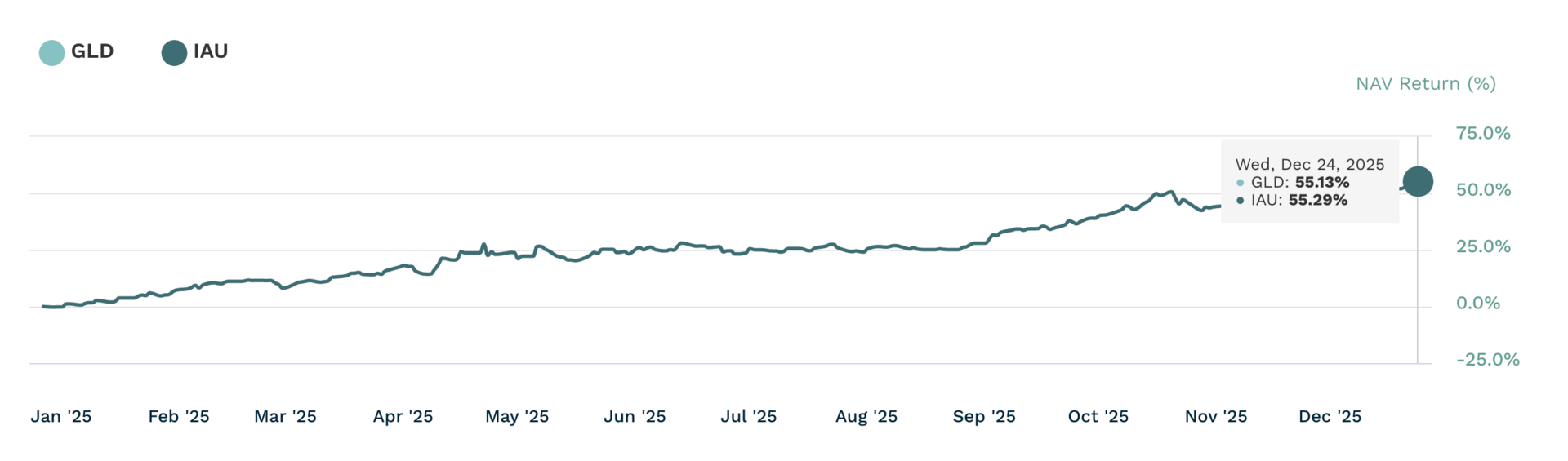

The Numbers Tell a Clear Story

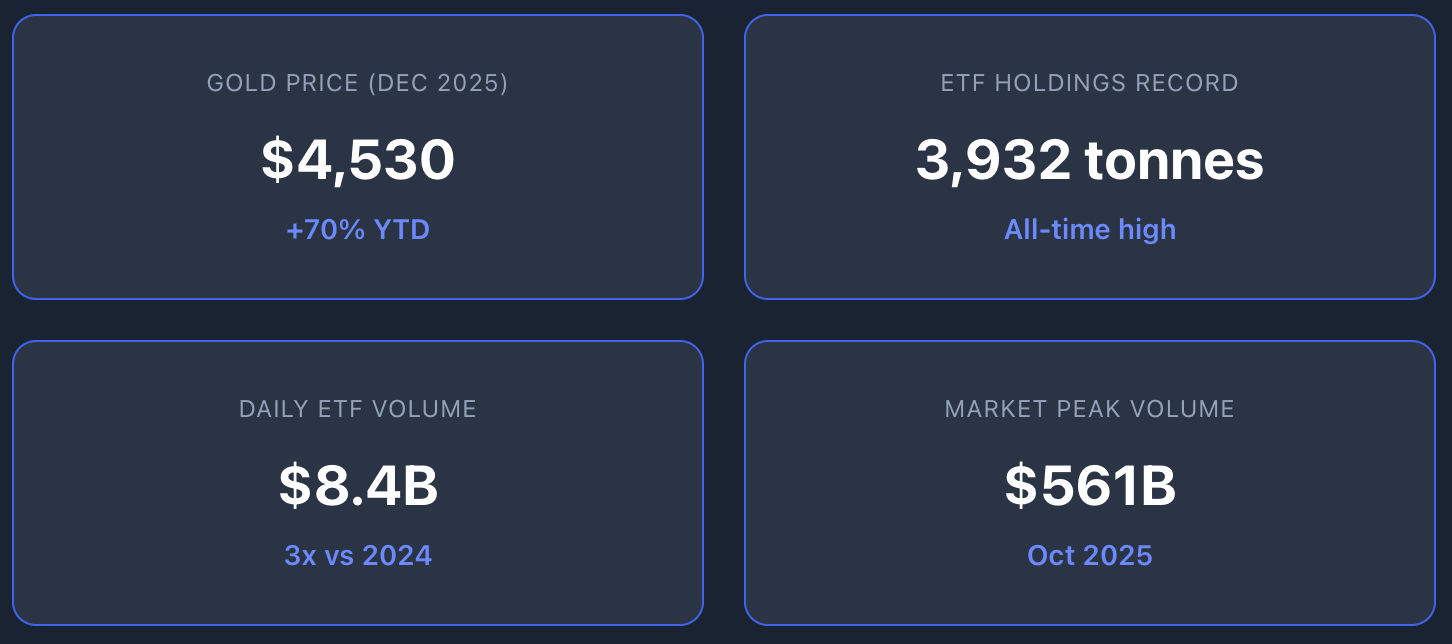

Global gold-backed ETF holdings reached 3,932 tonnes by November 2025, marking an all-time month-end record.

This represents a dramatic reversal from the market's trajectory just two years earlier, when holdings had fallen to 3,112 tonnes in March 2024, the lowest level since February 2020.

Gold prices surged to $4,530 per ounce on December 26, 2025, up more than 70% for the year and marking the strongest annual performance since 1979.

The metal broke $4,000 for the first time on October 8, 2025, then continued climbing through year-end.

Gold just crossed $4,530 after a 70% run this year. Where do we go in 2026?

Trading activity confirms the shift in investor behavior. Gold ETF volumes tripled to $8.4 billion daily in November 2025 vs the 2024 average of $2.9 billion.

Total market volumes peaked at $561 billion per day in October before settling at $417 billion in November. This isn't panic buying. It's strategic repositioning.

Why Cash Alternatives Are Under Pressure

Traditional cash equivalents face a specific problem right now. Treasury bills and money market funds offer yield, but they carry embedded political risk that many investors no longer want to ignore.

Consider the recurring debt ceiling debates in the United States. Each cycle creates uncertainty about the government's ability to meet obligations on time. Add in fiscal trajectories that show no sign of improvement, and you have a scenario where "risk-free" assets carry more risk than the label suggests.

If the US Government faces another debt ceiling standoff next month, what is your safest asset?

European sovereign debt presents similar concerns. Political fragmentation across the EU means coordinated fiscal policy remains difficult. Individual member states face their own challenges—Italy's debt-to-GDP ratio exceeds 140%, and France is struggling with budget deficits that breach EU rules.

When investors question the stability of government obligations, they need alternatives that don't depend on political promises. Gold offers that independence.

How Gold Responds to Political Shifts

Bonds and gold both move when risk increases, but they don't move for the same reasons.

Government bonds typically rally when investors seek safety, but only if they trust the issuer. When political dysfunction threatens the issuer itself, bonds lose their safe-haven appeal.

We saw this during the 2023 US debt ceiling standoff when credit default swaps on Treasury securities briefly spiked to unusual levels.

Gold doesn't have a counterparty. No government can default on it, no central bank can print more of it into existence overnight, and no political party can vote to change its value. When investors worry about the system itself, gold becomes the logical alternative.

The data supports this pattern. During the period when geopolitical tensions escalated in multiple regions, gold prices rose steadily while traditional safe-haven government bonds showed mixed performance. Asian investors particularly increased their gold ETF allocations, with flows into the region's funds accelerating in the fourth quarter.

This isn't just about hedging inflation or currency debasement anymore.

Investors are hedging political risk—the risk that governments can't or won't honor their obligations, that policy becomes erratic, or that international cooperation breaks down.

Gold ETFs as Strategic Cash

Using gold ETFs as a cash alternative requires accepting higher volatility than money market funds. Gold can drop 5-10% in a month during calm periods. But that's the trade-off for removing political counterparty risk.

Most investors implementing this strategy allocate 5-15% of their liquid reserves to gold ETFs.

This sizing allows them to benefit from gold's risk-hedging properties without exposing their operations to excessive volatility. The allocation typically comes from what would otherwise sit in short-duration government bonds or enhanced cash strategies.

Would you consider replacing a portion of your "Emergency Fund" or Cash with a Gold ETF?

The time horizon matters significantly. Gold ETFs work as cash alternatives for capital you don't need in the next 90-180 days. For truly overnight needs, traditional money market funds remain more appropriate. But for reserves held against medium-term contingencies or strategic opportunities, gold ETFs offer a viable option.

The drawdown risk is real. Gold fell roughly 20% from its peak in August 2020 to March 2021. Investors using gold as strategic cash need to size positions so they can withstand similar moves without forced selling.

Comparing Gold ETF Structures

ETF Comparison, GLD vs IAU (etf.com)

Three main types of gold ETFs exist, and the structure affects how they work as cash alternatives.

Physical gold ETFs hold actual bullion in vaults.

SPDR Gold Shares $GLD and iShares Gold Trust $IAU follow this model. They offer direct exposure to spot gold prices minus management fees. Liquidity is excellent—you can trade millions of dollars without meaningful price impact.

Synthetic gold ETFs use derivatives to track gold prices rather than holding metal. These funds are more common in European markets due to regulatory structures. Counterparty risk exists because performance depends on swap agreements with banks, but this risk is typically managed through collateral requirements.

Currency-hedged gold ETFs eliminate foreign exchange exposure for non-US investors. If you're based in Europe and buy an unhedged gold ETF denominated in dollars, you're taking both gold price risk and EUR/USD risk. Hedged versions remove the currency component.

For use as strategic cash, physical ETFs with high liquidity make the most sense. The direct connection to bullion, combined with tight bid-ask spreads, means you can move in and out efficiently when risk conditions change.

Portfolio Implementation

Here's how this works in practice.

An investor holds $10 million in liquid reserves. Previously, $8 million sat in Treasury bills and $2 million in a money market fund for immediate needs.

Today, that investor might restructure to $6 million in T-bills, $2 million in money market funds, and $2 million in physical gold ETFs.

The gold position represents 20% of liquid reserves—enough to provide meaningful political risk protection, but not so much that normal gold volatility disrupts operations.

The investor sets clear rules for when to increase or decrease the gold allocation. If debt ceiling negotiations stall, or if geopolitical tensions spike, the allocation might increase to 25-30%.

When political risk recedes, it drops back to the baseline 15-20% range.

This approach requires active monitoring. Gold as strategic cash isn't a passive hold.

You need to track political developments, watch gold's technical price levels, and adjust positioning as conditions evolve.

What This Means

The shift toward gold ETFs as cash alternatives reflects deeper concerns about political stability and government reliability.

Investors are essentially saying they trust a metal more than they trust political systems to function predictably.

This trend appears durable. Political polarization isn't declining. Debt levels aren't falling. Geopolitical competition between major powers continues to intensify. These conditions support sustained demand for assets that sit outside the traditional financial system's political dependencies.

Gold ETFs won't replace conventional cash management tools entirely. But they're carving out a permanent role as the option you choose when political risk exceeds your comfort level. That makes them worth understanding, sizing appropriately, and incorporating into institutional liquidity frameworks.

The question isn't whether gold belongs in cash reserves anymore.

The question is how much, in what form, and under what conditions you adjust the allocation.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.