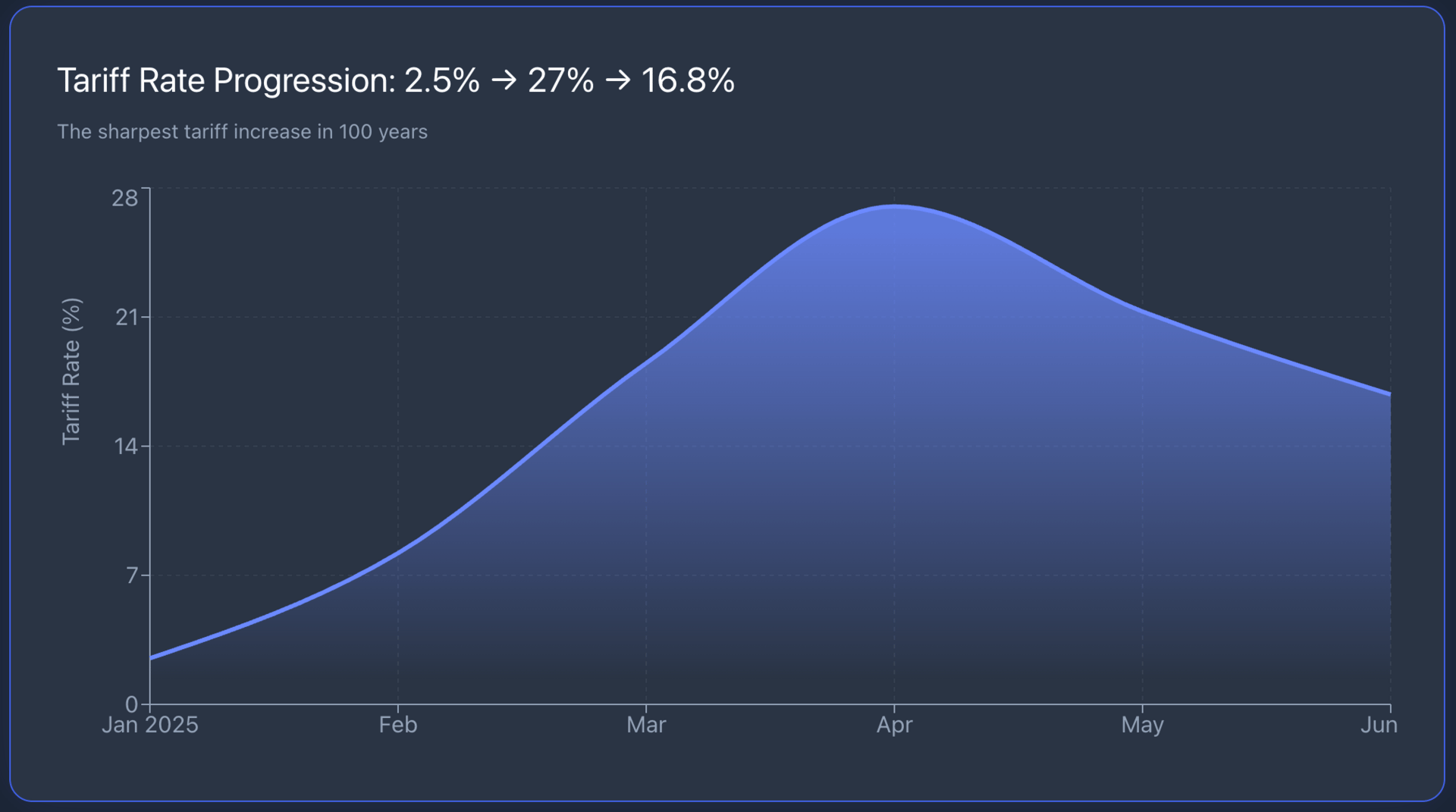

US tariff rates jumped from 2.5% to 16.8% in under a year.

That's the highest level in a century. The federal government collected over $250 billion in new tariff revenue, but the cost of this experiment might be significantly higher.

Trump's return to the White House means a radical shift in trade policy. The administration is using tariffs as its primary tool of economic leverage.

This isn't just a trade war, it's an attempt to rebuild global supply chains from scratch.

The Tariff Reality

The first months of 2025 shocked markets.

In January, the average tariff rate stood at 2.5%. By April, it had spiked to 27%. After negotiations and rollbacks, it settled at 16.8%.

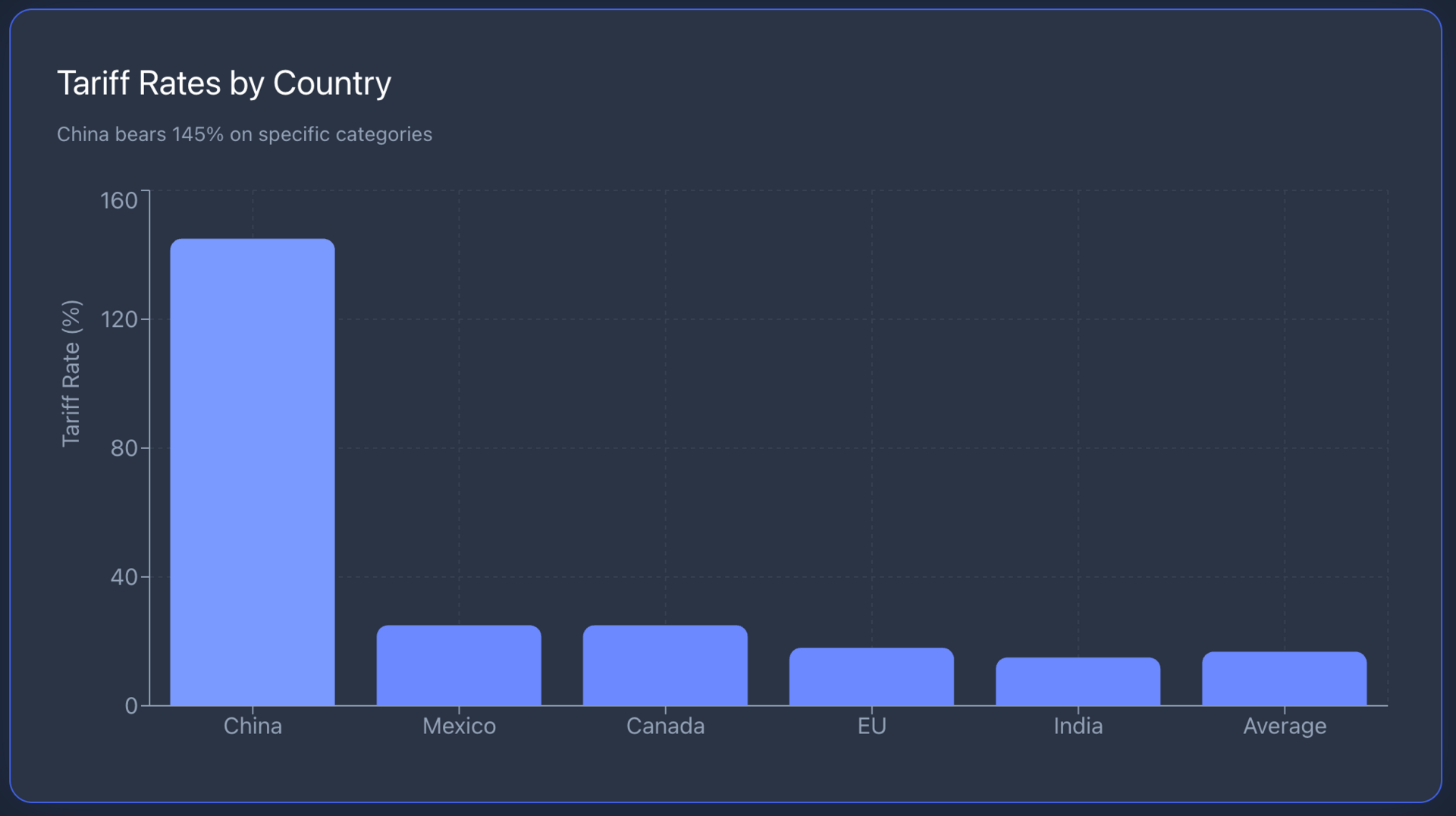

China took the hardest hit—145% on specific categories. Mexico and Canada faced 25% on goods that don't comply with USMCA terms. Europe, India, Switzerland—all felt the pressure.

The Federal Reserve cut its GDP growth forecast from 2.1% to 1.4%. PCE inflation is now projected at 3.1% instead of 2.8%. The OECD expects 2.2% growth in 2025 and 1.6% in 2026.

The data is clear: tariffs function as a consumption tax.

The average American household pays an extra $1,200 per year.

PPI rose 3.8%—the fastest pace since 2023.

The Fiscal Policy

Alongside tariffs, Trump signed the One Big Beautiful Bill Act.

The Congressional Budget Office estimates a $3.4 trillion impact on the debt over a decade. If temporary provisions become permanent—$5 trillion including interest.

The national debt topped $38 trillion. The debt-to-GDP ratio sits at 120% and keeps climbing. Moody's downgraded the US credit rating. Debt servicing costs now exceed the defense budget.

Jay Powell called the situation "manageable now, but impossible long-term."

Tariff revenue was supposed to cut the deficit by $3.3 trillion. After tariff softening, that number dropped to $2.5 trillion. That's $800 billion in expected revenue—gone.

The problem is obvious: tariffs can't replace income taxes. The Treasury Department confirms, even the most ambitious tariff scenarios cover less than 25% of equivalent revenue.

The Geopolitical Risk Map

BlackRock Geopolitical Risk Indicator (BlackRock)

Trade policy operates against a backdrop of escalating geopolitical tension. S&P Global and BlackRock highlight several key threats.

US-China: Neither side wants a crisis this year. Xi Jinping faces economic problems and military disorganization. Trump doesn't want market crashes. But structural rivalry remains. Potential deal attempts in the second half, though tech competition continues.

Taiwan: Appointment of hawks to cabinet positions signals a hard line. But Trump's transactional style makes Taiwan a possible bargaining chip. Uncertainty is maximum.

Ukraine: Growing pressure for ceasefire negotiations. Trump threatened 100% tariffs if no peace deal materializes. The Alaska meeting with Putin produced nothing, but signals about shifting approaches remain.

Middle East: Conflict could de-escalate, lowering oil prices. But the risk of broader conflict with Iran persists. This threatens supply through the Strait of Hormuz.

Venezuela: Trump designated Maduro's regime a foreign terrorist organization on December 17. The US military assembled what Trump called "the largest Armada ever assembled in the History of South America" to blockade sanctioned oil tankers.

New sanctions hit three of Maduro's nephews and six companies shipping Venezuelan oil.

Trump claims Venezuela "stole" US oil assets during nationalization decades ago and wants them back. The endgame remains unclear—regime change, oil recovery, or narco-trafficking pressure. What's certain: this adds another layer of supply risk to energy markets.

Which geopolitical hot zone presents the biggest risk to the market in 2026?

ETF Strategies

Trade and geopolitical developments create clear sector winners and losers.

Defense: Global X Defense Tech ETF $SHLD gained 65.9% YTD.

iShares U.S. Aerospace & Defense ETF $ITA with $12.4 billion in assets remains the largest. European Rheinmetall and Leonardo doubled on $840 billion in modernization spending.

NATO is increasing spending to 5% of GDP by 2035. Cyber defense, drones, AI for defense—all receiving funding. Palantir $PLTR dominates defense ETF portfolios with 10% weighting.

Reshoring and Industrials: First Trust RBA American Industrial Renaissance ETF $AIRR delivered 30% vs 16% for the S&P 500.

GMO Domestic Resilience ETF $DRES focuses on companies bringing production back to the US.

Tema American Reshoring ETF $RSHO tracks $3 trillion in announced reshoring investments.

Comfort Systems USA jumped 123% on demand from new manufacturing facilities. C.H. Robinson gained 65% on logistics complexity. Nucor and other steel producers got 20% boosts from tariff protection.

Energy: The "drill baby drill" policy supports traditional producers. The EU deal calls for $750 billion in US energy purchases through 2028.

Small and mid caps: Under tariff protection and reshoring, they gain advantages over multinational giants. Concentrated portfolios show stronger results.

Emerging Market Risks

The flip side is harsh. Tariffs strengthen the dollar and keep US rates elevated. This creates capital outflows from emerging markets.

Central banks face a choice: raise rates to defend currencies or cut them to support growth. China-focused ETFs are under pressure from 145% tariffs and structural economic problems.

Export-oriented Asian economies feel margin pressure. Auto and construction sectors dependent on imports lose profitability. Caterpillar absorbed $250-350 million in Q2 losses.

Portfolio Preparation

The key idea—diversify within trends, not bet on single themes.

Prioritize companies with domestic supply chains and pricing power.

Semiconductors for defense applications have long-term prospects. But avoid sector concentration.

Hedge through options on sector downside. Commodity positions offset inflation pressure. Defensive sectors—utilities, healthcare—balance volatility.

ETFs provide diversification without needing to guess individual policy decisions. ITA, SHLD, RSHO, AIRR—all offer exposure to reshoring and defense trends with reasonable risk distribution.

The stagflation risk is real: high inflation plus slowing growth. In that scenario, even protected sectors suffer. Position sizes should be conservative.

We are heading into 2026. What is your primary outlook?

Court decisions also remain an uncertainty factor. The Supreme Court is reviewing tariff legality under IEEPA. A negative ruling could mean returning $100 billion.

Trumponomics 2.0 is a bet on domestic production through tariff protection.

Whether it works remains to be seen. But the trend creates specific opportunities for those who understand where to look.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.