Japan's equity markets delivered an unusually precise signal.

Kawasaki Heavy Industries surged 17% to a record intraday high.IHI and Mitsubishi Heavy Industries each climbed more than 5%. The Nikkei 225 gained 2.9%.

Behind all of it was a single political event: Prime Minister Sanae Takaichi's Liberal Democratic Party securing a two-thirds supermajority in Sunday's snap election, without reliance on a single coalition partner.

This wasn't a sentiment trade. It was the market pricing in a structural shift in Japan's defense policy architecture that has been building for three years and just cleared its largest political obstacle.

What Just Changed

Japan's constitution has constrained its military posture since 1947.

Article 9 formally renounces war and prohibits the maintenance of war potential. For decades, defense spending hovered near 1% of GDP, weapons exports were functionally prohibited, and the Self-Defense Forces operated under persistent legal ambiguity.

That framework is now under direct legislative pressure. With a two-thirds majority in the 465-seat lower house, Takaichi's coalition clears the constitutional amendment threshold. The LDP can now put constitutional revision to a national referendum without opposition consent, a procedural barrier that had previously blocked any serious attempt.

The proposed changes include formally recognizing Japan's right to maintain a military and removing the legal ambiguity that has encircled the Self-Defense Forces since the postwar settlement.

The constitutional question is not the investment thesis.

But it removes the legal ceiling that has suppressed defense industrial expansion. That matters enormously for what comes next.

The Revenue Story

Analysts flagged it clearly: Japan is all but certain to loosen weapons export restrictions as part of Takaichi's defense reform agenda. That has a direct and sizable revenue implication for Japan's defense industrial base, one the market has begun pricing but has not yet fully captured.

Until recently, Japan's major defense manufacturers operated in a closed domestic procurement loop. Mitsubishi Heavy, Kawasaki Heavy, and IHI built exclusively for the Japanese Self-Defense Forces. Export was tightly restricted. International competition was structurally inaccessible.

That changes now. Japanese defense firms are positioned to compete directly with South Korean manufacturers, Hanwha Aerospace, Korea Aerospace Industries, on regional and global arms contracts. Schroder's head of Japanese equities put it plainly: the strengthened administration makes it easier to view Japanese defense companies' plans to expand overseas operations more positively going forward."

It is a legally-unlocked structural revenue expansion for companies that were, until this administration, prohibited from pursuing it. The market has barely started pricing the international order book.

The Budget Outlook

Takaichi's commitment to reaching 2% of GDP on defense spending ahead of schedule is near-term fiscal reality, not a campaign position. Japan's Cabinet has already committed to hitting that target within the current fiscal cycle.

In dollar terms: Japan's GDP runs approximately $4.2 trillion. Two percent equals roughly $84 billion in annual defense outlays, nearly double Japan's spending from just three years prior. The next defense buildup program, expected by the end of 2026, is widely projected to target further expansion, potentially toward 3.5% of GDP, a trajectory aligned with pledges made by South Korea and Taiwan under regional security pressures.

That spending lands directly on the order books of Mitsubishi Heavy, Kawasaki, and IHI. Their procurement backlogs are already elevated. This buildup adds years of forward revenue visibility at a scale these companies have never operated at before. That alone justifies a fundamental rerating, independent of any election premium.

Where do you think Japan's defense budget lands by 2028?

What the Market Has Priced

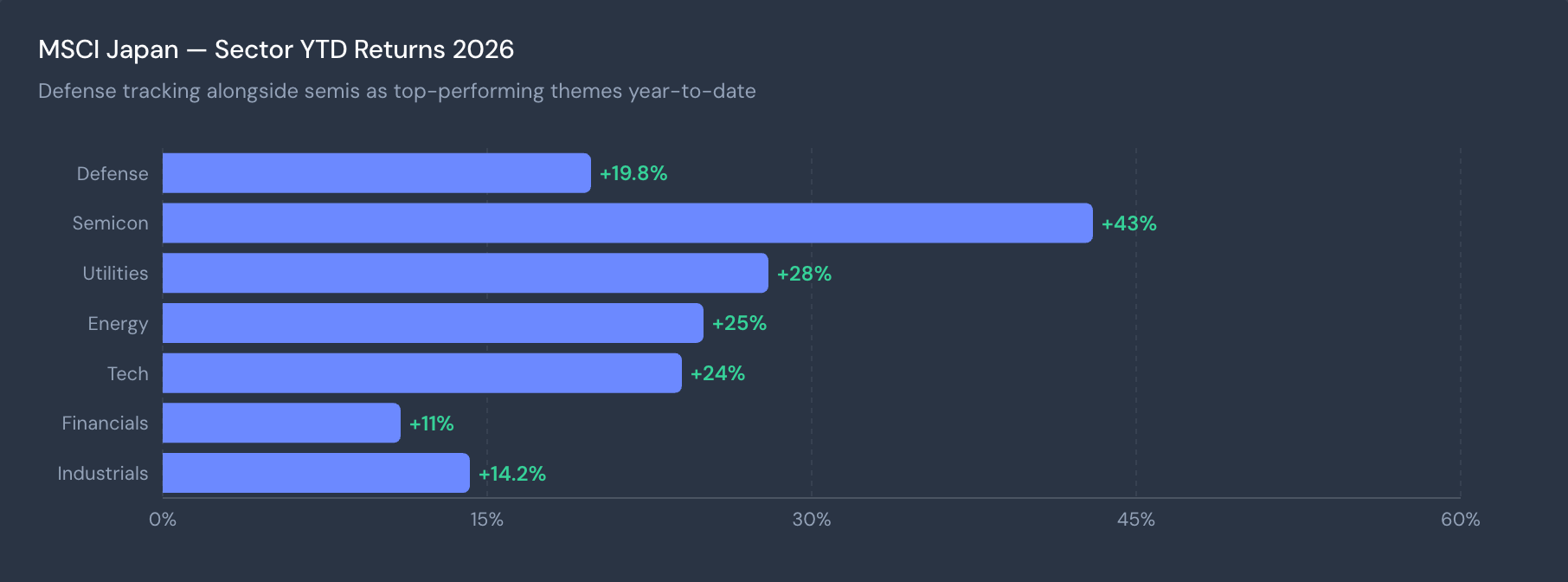

The equity momentum was established well before Sunday's vote. MSCI Japan's Energy and Utilities sectors were up 25% and 28% respectively YTD through early 2026. Technology led by semiconductors gained 43%. Defense tracked alongside these numbers: Mitsubishi Heavy rose 72% in the first seven months of 2025, Kawasaki gained 27%, ShinMaywa Industries climbed 34%.

These were not momentum-driven trades. They reflected a sustained rerating as the political trajectory clarified.

Sunday's result accelerates the timeline and removes the critical political risk overhang. With a supermajority, there is no plausible scenario where Takaichi's defense agenda gets blocked in the lower house. The legislative uncertainty that previously constrained institutional position-sizing in this sector is materially reduced. A supermajority removes a risk premium. A removal of risk premium, all else equal, supports continued equity rerating.

ETF Exposure

For investors seeking exposure without single-stock concentration risk, the ETF landscape is limited but navigable.

The iShares MSCI Japan ETF (EWJ) provides the broadest Japan equity coverage at $16.2B in AUM, though its defense weighting is diluted by financials and consumer holdings. The WisdomTree Japan Hedged Equity Fund (DXJ) adds currency hedging, a meaningful consideration given yen positioning post-election, with $4.8B in AUM and a 0.48% expense ratio.

On pure defense, U.S.-listed funds including ITA (iShares U.S. Aerospace & Defense, $7.5B AUM) and XAR (SPDR S&P Aerospace & Defense, $2.1B AUM) capture global defense sentiment but skew heavily toward American names. They reflect the macro defense cycle rather than the specific Japan equity and export liberalization story.

The structural gap in the market is a dedicated Japan defense ETF listed for U.S. investors.

That product does not yet exist at a meaningful scale. For investors with direct Japan market access, 7011.T (Mitsubishi Heavy), 7012.T (Kawasaki Heavy), and IHI remain the primary vehicles to capture the specific thesis.

How are you currently positioned in the Japan defense trade?

Three Catalysts to Track

First: the weapons export policy announcement, expected within Takaichi's first 100 days, will define the magnitude of the international revenue opportunity. Watch for specific country-level contract announcements from Kawasaki and Mitsubishi as the single most actionable near-term signal.

Second: the next defense buildup program (scheduled by end of 2026) sets the long-term spending trajectory. Anything above 2.5% of GDP would represent a meaningful upside surprise for defense contractors' revenue visibility into the early 2030s.

Third, and this is the principal risk, the bond market. Japan carries the world's highest debt-to-GDP ratio among advanced economies at approximately 240%. If JGB yields move materially in response to expanded fiscal commitments, the discount rate on defense equity cash flows shifts accordingly. HSBC's chief Asia economist has flagged this constraint explicitly.

What's your biggest concern about Japan's defense investment thesis?

Bottom Line

Sunday's election did not create Japan's defense investment thesis. It validated and accelerated it.

The LDP supermajority removes the key legislative overhang, unlocks constitutional flexibility, and clears the path for export restriction changes that could fundamentally reshape the revenue profile of Japan's defense industrial base.

Kawasaki's 17% single-day move was not irrational exuberance. It reflected a real, politically-secured change in the operating environment for a company that spent decades constrained to a single domestic client.

The structural case: defense spending tracking toward 2%+ of GDP, export restrictions loosening, constitutional barriers falling, regional security pressures accelerating procurement timelines—was built over years. The political authorization to act on it arrived Sunday.

For investors positioned correctly, the window it creates is measured in years, not quarters.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: The Great Unwinding: Why China's $640 Billion Treasury Reduction Could Keep Rates Higher for Longer

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.