China's US Treasury holdings dropped to $682.6 billion. That's the lowest level since September 2008.

Not a typo. Lowest in 18 years.

China's been trimming for months. Down more than 10% since the start of 2025 alone. The peak was back in 2013 when they held $1.3 trillion.

They've shed roughly $600-700 billion since then.

What Actually Happened

Chinese regulators just advised banks to scale back US government bond holdings. The reason? "Concentration risk" and market volatility.

The guidance targeted commercial banks and financial institutions, not the central bank's official reserves. Meanwhile, China's been buying gold for 15 consecutive months through late 2025. That's the real signal.

When the news hit, US Treasury yields climbed. The 10-year touched around 4.23%. The dollar slipped, then stabilized. Tech stocks pulled back on the volatility.

The market didn't panic, but noticed.

Why This Matters

China isn't the only country holding US debt. Japan holds over $1.2 trillion now, roughly double China's stake. The UK sits at $888 billion. Total foreign holdings of US Treasuries actually hit record highs above $9.4 trillion in late 2025.

So if everyone else is buying, why does China selling matter?

Because when your biggest historical buyer becomes a seller, the price changes. Not overnight. But structurally.

Bond prices and yields move opposite. When a whale like China sells, prices drop. When prices drop, yields go up. Higher yields mean higher borrowing costs across the board.

That gap matters more than you might think.

The Geopolitics Aren't Subtle

China watched what happened to Russia in 2022. The US weaponized the dollar through sanctions. China took notes.

Now they're "sanction-proofing" their reserves. It's not about hating America or crashing markets. It's about not having all your eggs in one basket when that basket comes with geopolitical strings attached.

There's also the domestic angle. China's dealing with a property crisis and slowing growth. They need capital at home, not locked into 10-year US bonds.

Here's the structural shift: By reducing demand for US paper, China removes a buffer that historically kept yields artificially low. The market desperately wants rate cuts. China's selling adds upward pressure that fights against those cuts.

Real on-the-ground impact? Even if the Fed cuts short-term rates, long-term borrowing costs could stay uncomfortably high.

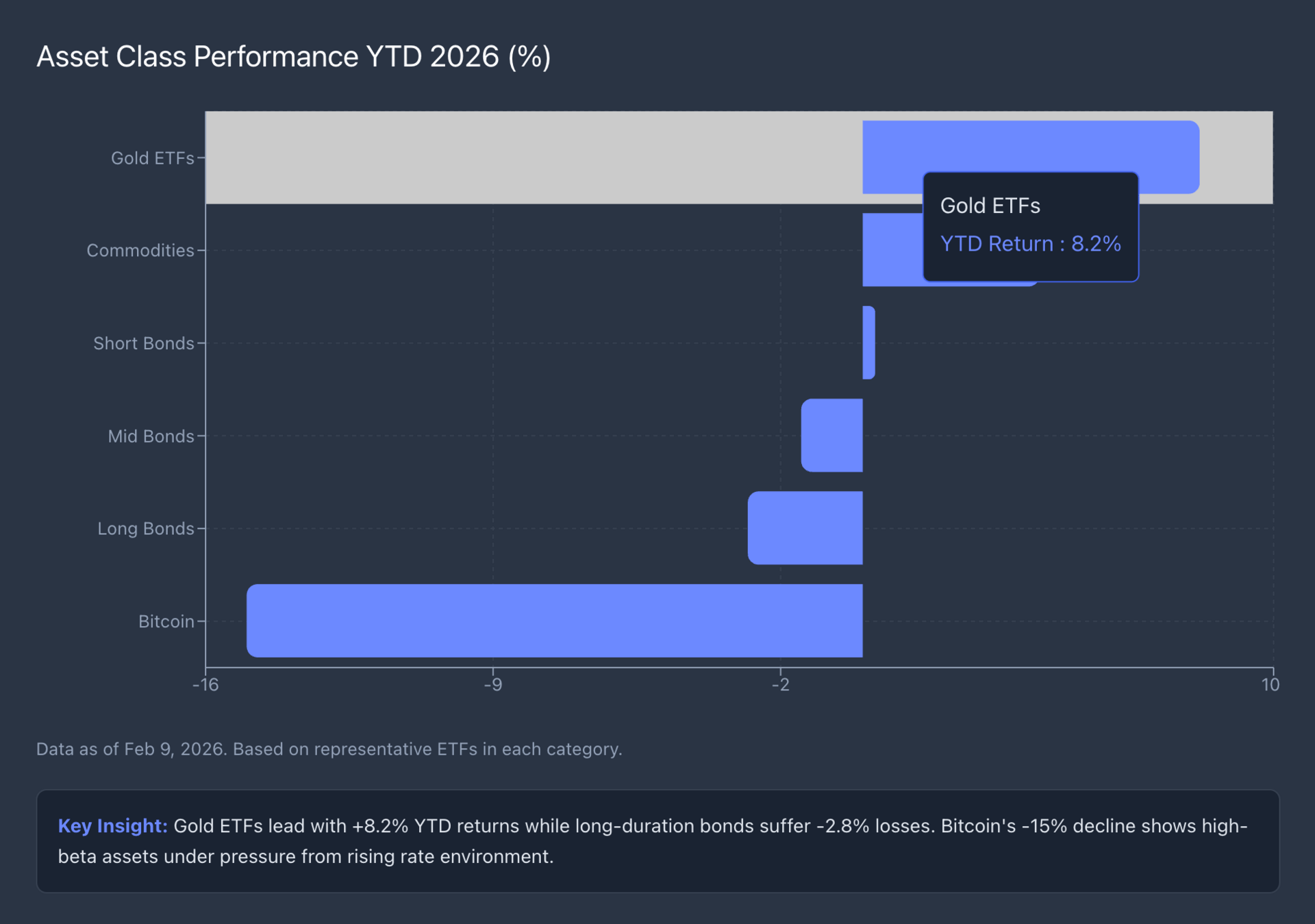

How This Hits Different Asset Classes

Mortgages and Real Estate: The 10-year Treasury yield drives 30-year mortgage rates. If the 10-year stays elevated because China isn't buying, mortgage rates stay sticky. Housing appreciation caps. First-time buyers stay squeezed.

Stocks: Higher risk-free rates compress valuations. Tech and growth stocks that trade on future earnings? They feel it first. When the "safe" return (Treasury yield) goes up, investors demand more from risky assets. PE ratios compress. We saw this play out in early 2026 with tech pullbacks.

Gold: Central banks globally bought over 1,000 tonnes of gold each year from 2022-2024. Three straight years above historical averages. Gold surpassed $5,000 per ounce in late January 2026 and briefly touched $5,110.50. If China isn't holding dollars, they're holding something. Gold's the obvious answer.

Crypto: Bitcoin dropped 15% in early 2026, briefly breaking below $61,000. High-beta risk assets are selling off alongside speculative tech. Crypto's trading is more like volatile tech stocks than a reserve asset right now.

Which asset class looks most attractive given rising geopolitical tensions around reserves?

What the Data Actually Shows

Let's be clear about the numbers:

China's holdings: $682.6B (Nov 2025, lowest since 2008)

Down $6.1B month-over-month

Down 10% YTD

Peak holdings: $1.32 trillion (2013)

Total decline: ~$640 billion from peak

But here's the nuance: Total foreign ownership is at record highs. Private investors and other countries are absorbing what China sells. Just at higher yields.

The shift isn't "nobody wants US debt." The shift is "China doesn't want as much, and new buyers want better compensation."

The Dollar Isn't Collapsing

Despite headlines about "de-dollarization," the dollar's reserve status is structural. IMF data shows the dollar's share of global reserves at roughly 57.7%. That's down from historical peaks.

China's diversifying, not abandoning. They still need dollars for trade. They're just reducing concentration risk and adding hard assets like gold.

This is a slow rebalancing, not a sudden break.

What Investors Should Watch

Track the 10-year yield: If it keeps climbing despite Fed cuts, that's your signal that structural demand has shifted. Higher term premiums are being priced in.

Watch gold and commodities: Central banks are telegraphing their moves. When they buy gold for 15+ straight months, they're telling you something about dollar-denominated assets.

Consider duration risk: Short-duration bonds might be safer than long-duration until this selling stabilizes. You don't want to be locked into low yields if rates drift higher.

Diversify currency exposure: Don't go all-in on dollar-only assets. Consider allocations that give you exposure beyond USD-centric positions.

With China reducing US Treasury holdings to 18-year lows, how are you adjusting your fixed income allocation?

Better prompts. Better AI output.

AI gets smarter when your input is complete. Wispr Flow helps you think out loud and capture full context by voice, then turns that speech into a clean, structured prompt you can paste into ChatGPT, Claude, or any assistant. No more chopping up thoughts into typed paragraphs. Preserve constraints, examples, edge cases, and tone by speaking them once. The result is faster iteration, more precise outputs, and less time re-prompting. Try Wispr Flow for AI or see a 30-second demo.

The Bottom Line

China isn't waging economic war. They're rebalancing risk. But that rebalancing creates friction.

The era of China absorbing unlimited US debt and keeping yields artificially low? That's over. We're moving into a world where geopolitics keeps rates elevated even when economics would argue for cuts.

The US bond market is deep and liquid. It can absorb China's selling. But the question isn't "who will buy." Buyers exist.

The question is: what yield will they demand?

For investors, that means adjusting to a higher-rate reality. Not panicking, but repositioning.

Watch the 10-year. Track foreign holdings data monthly. Pay attention to what central banks are buying (gold) and what they're selling (Treasuries).

The signal is clear. The game has changed.

Do you think the 10-year Treasury yield will be higher or lower in 6 months?

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: "Groundhog Day": Zelensky Torches Europe's Defense Inaction

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.