What a day after Christmas!

Geopolitical shifts don't move oil prices anymore.

That's the uncomfortable truth investors learned in 2025.

While conflicts raged across Ukraine and the Middle East, Brent crude stayed trapped in a narrow range.

Gold and defense ETFs? They absorbed every dollar of fear premium that oil used to claim.

Oil Prices See Decline in Global Markets

Brent Crude Oil, December 26, 2025 (TradingEconomics)

Brent crude oil prices are down from $81 to $60, down about 15.75% compared to the same time last year. Light crude trading at $58.32 per barrel.

That's remarkable, considering the year included an Israel-Iran war and Ukrainian strikes on Russian refineries.

Compare that to 2022, when Russian tanks crossed into Ukraine and oil spiked from $70 to nearly $130 in weeks.

The June Israel-Iran conflict provides the clearest example. Israel bombed Iranian nuclear sites on June 12. The U.S. joined with Operation Midnight Hammer ten days later. Oil traders had long called a U.S. strike on Iran a doomsday scenario. The theory said Iran would block the Strait of Hormuz, choking off a fifth of global oil and gas supplies. Prices should have hit triple digits.

Instead, Brent rose from $69 to $78.85 over a week, then dropped back to pre-war levels by June 24 when a ceasefire was signed.

The volatility index (VIX) spiked to its highest level since early 2022, but prices barely moved.

Oil Oversupply

Here's what changed: the world has too much oil.

U.S. production hit a record 13.84 million barrels per day in September, driven by the Permian shale basin and Gulf of Mexico output.

OPEC+ reversed years of production cuts throughout 2025. Argentina, Canada, Brazil, and Guyana all boosted production.

The International Energy Agency now expects a massive oversupply of nearly 4 million barrels per day in 2026, extending into 2027.

That surplus fundamentally altered how markets respond to geopolitical risk.

The IEA predicts a massive oil glut through 2027. How are you positioning your Energy allocation?

When Ukraine attacked Russian oil refineries and export terminals in April, prices barely reacted. Refining margins surged on supply fears, but crude prices stayed flat.

The market learned that even direct attacks on major oil infrastructure wouldn't create actual supply disruptions. Russia kept exporting, and global supplies remained abundant.

This marks a structural shift in energy markets. Geopolitical events still trigger short-term volatility spikes. But without real changes to physical volumes, those spikes fade quickly.

Traders now require clear evidence of sustained production losses before repricing risk.

Gold Absorbed What Oil Rejected

JPMorgan Global Research, Will gold prices break $5,000/oz in 2026? (JPMorgan)

While oil ignored geopolitical stress, gold soared above $4,500 per ounce this month, up around 70% YTD. That made it one of the year's top-performing major assets.

The numbers tell the story. Total gold demand including OTC reached 1,313 tonnes in Q3, the highest quarterly total on record. But the value measure matters more: $146 billion in Q3 demand, up 44% YoY.

Year-to-date demand hit $384 billion, a 41% annual increase.

Gold ETFs drove this surge. Q3 saw $24 billion in gold ETF inflows, with holdings adding 222 tonnes. That's 134% higher than Q3 2024. North American funds led with average trading volumes of $6.5 billion per day, up 78% month-over-month.

Global gold ETF assets reached $472 billion by the end of Q3, a record high. Holdings climbed to 3,838 tonnes, just 2% below the November 2020 peak of 3,929 tonnes.

Central banks reinforced this trend. They added 220 tonnes in Q3, 28% above the prior quarter.

Poland, China, Turkey, Kazakhstan, and India led purchases. Brazil's central bank returned to gold buying after a four-year absence, adding 15 tonnes.

The safe-haven narrative shifted. Gold now serves multiple roles: debasement hedge, non-yielding competitor to Treasuries, and protection against geopolitical uncertainty.

That flexibility attracted different investor types simultaneously.

J.P. Morgan forecasts gold prices toward $5,000 per ounce by end-2026, climbing to $5,400 by end-2027.

The Price Prediction

Their research shows gold's share of total global financial assets increased to 2.8% in Q3 2025, up from lower levels in 2010.

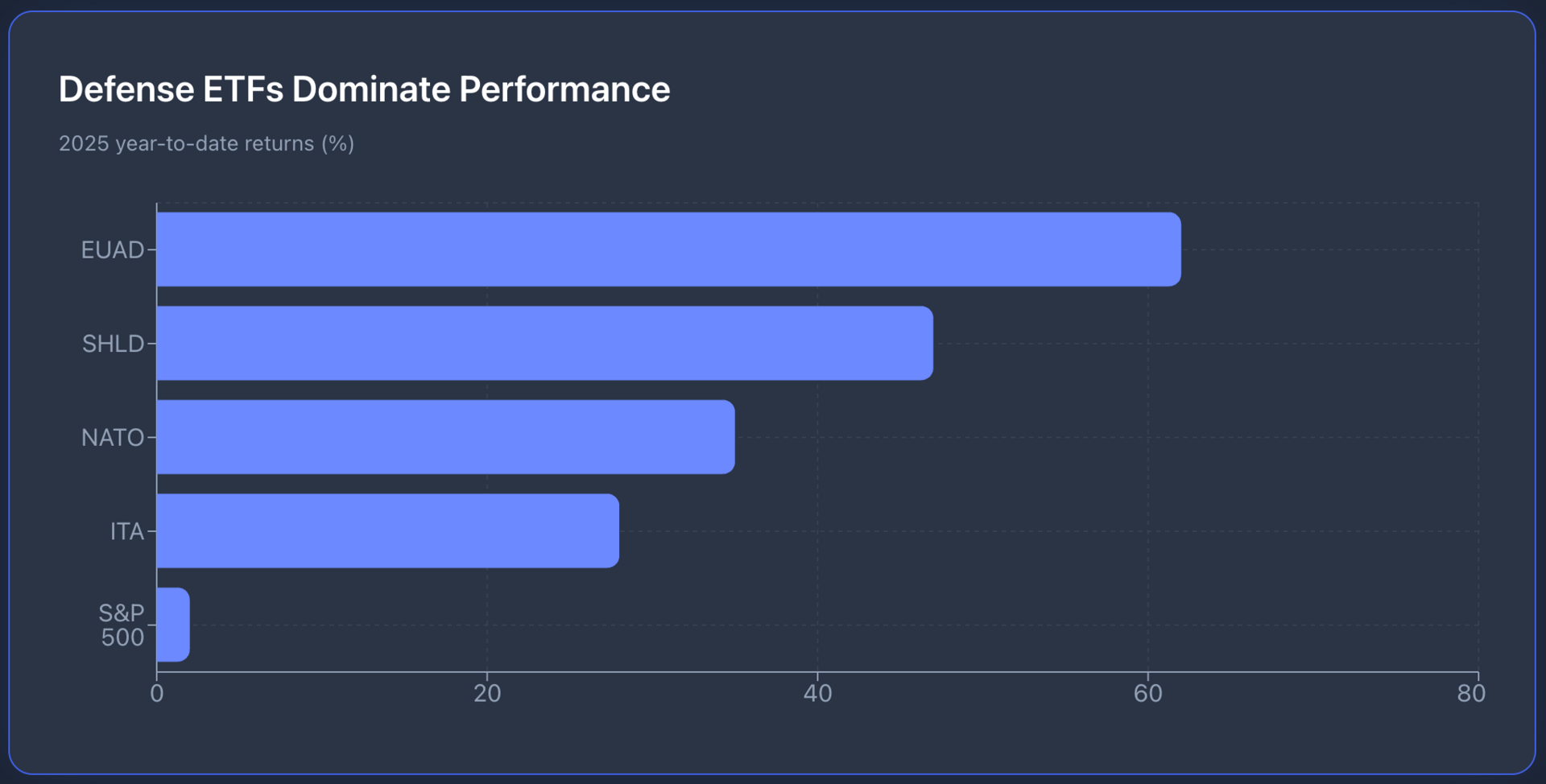

Defense ETFs Captured the Security Premium

Defense ETFs became 2025's surprise outperformers.

Two defense-focused funds ranked among the top five best-performing nonleveraged ETFs: the STOXX Europe Aerospace & Defense ETF $EUAD gained 62%, while the Global X Defense Tech ETF $SHLD rose 47%.

European defense spending drove this performance. NATO members committed to invest 5% of GDP annually on core defense requirements by 2035.

Germany, Poland, and Japan all announced significant budget increases. The Russia-Ukraine war created sustained demand for military equipment and technology.

ETF issuers responded by launching six new global defense ETFs in 2025.

The Themes Transatlantic Defense ETF $NATO surged 35% while the S&P 500 gained roughly 2% over the same period.

HANetf's Future of Defence UCITS ETF accumulated over $2.8 billion in assets since its July 2023 launch.

Defense companies offer characteristics that appeal during geopolitical stress: resilient cash flows, long-term government contracts, and exposure to rising security budgets. These contracts typically span multiple years, providing predictable revenue even during broader market volatility.

The sector also benefits from technology trends.

Companies like Palantir and Raytheon Technologies are integrating AI, robotics, and cybersecurity into defense applications. This creates growth potential beyond traditional hardware manufacturing.

Traditional U.S. defense ETFs like iShares U.S. Aerospace & Defense ETF $ITA posted double-digit year-to-date gains with several billion dollars in inflows.

But the more interesting development was how quickly non-U.S. budgets caught up. European and Asian allies modernized and expanded their militaries, creating new investment opportunities.

The New Geopolitical Trade

The old equation—geopolitical tension equals higher oil prices—no longer holds. Abundant supplies mean energy markets need actual supply disruptions, not just threat of disruption.

Capital flows tell us where investors see real risk. Gold and defense absorbed what oil rejected: the geopolitical risk premium.

Gold ETF inflows hit records. Defense ETFs topped performance charts.

Oil traded sideways.

This pattern should persist. The IEA's 4 million barrel per day oversupply forecast for 2026 suggests oil will remain well-supplied.

Central bank gold buying shows no signs of slowing. Defense budgets across NATO and Asia continue rising.

For portfolio construction, this matters.

Energy ETFs missed the geopolitical boost many expected. Gold and defense ETFs captured it instead.

That's not a temporary shift; it reflects structural changes in how markets price geopolitical risk in an era of energy abundance and rising security concerns.

The Geopolitical Hedge

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.