Defense spending just locked in $1 trillion through 2029.

Three ETFs returned 34-44% this year tracking it.

But the contract backlog tells you which one to buy now.

The Numbers Behind the Surge

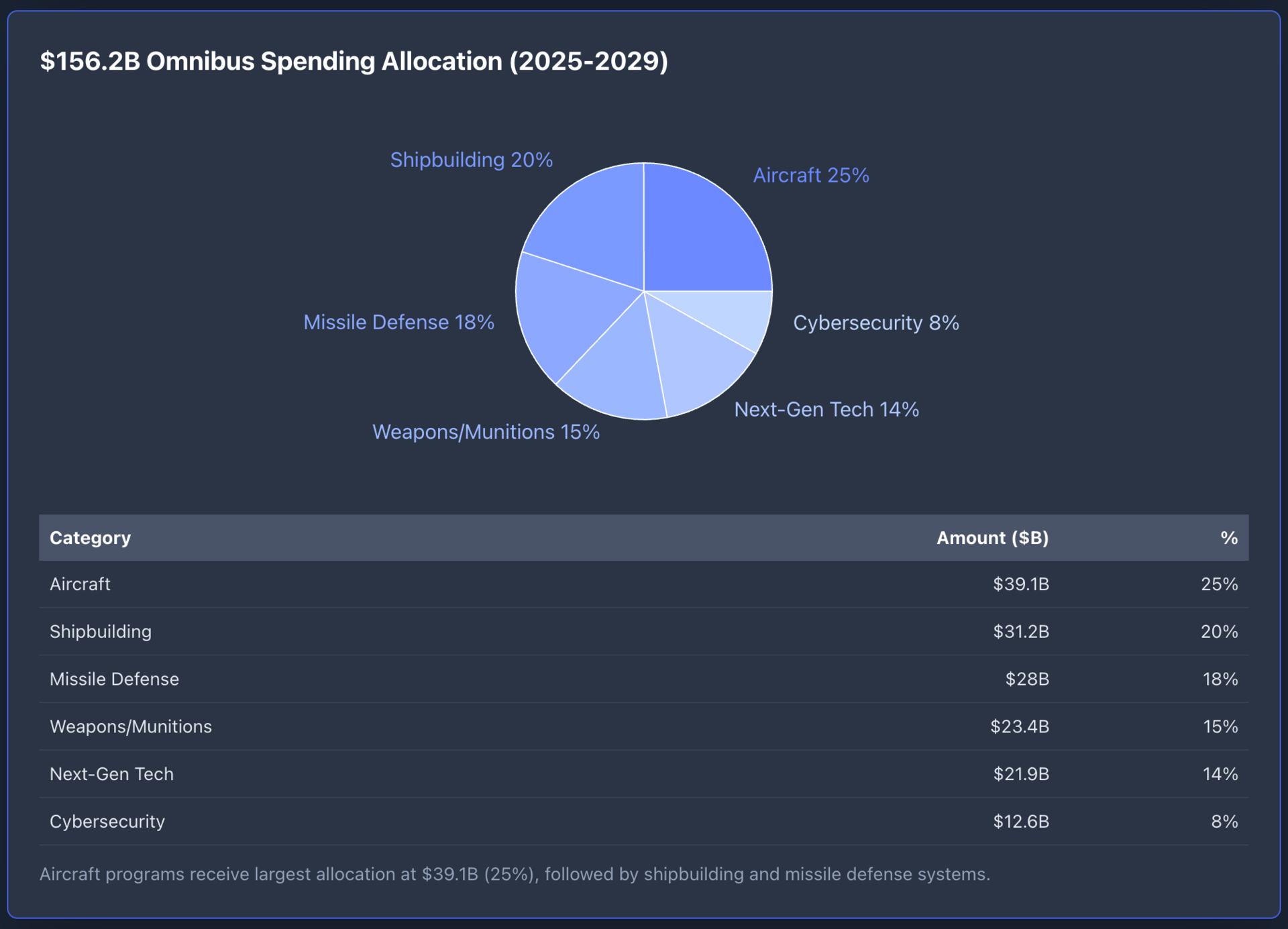

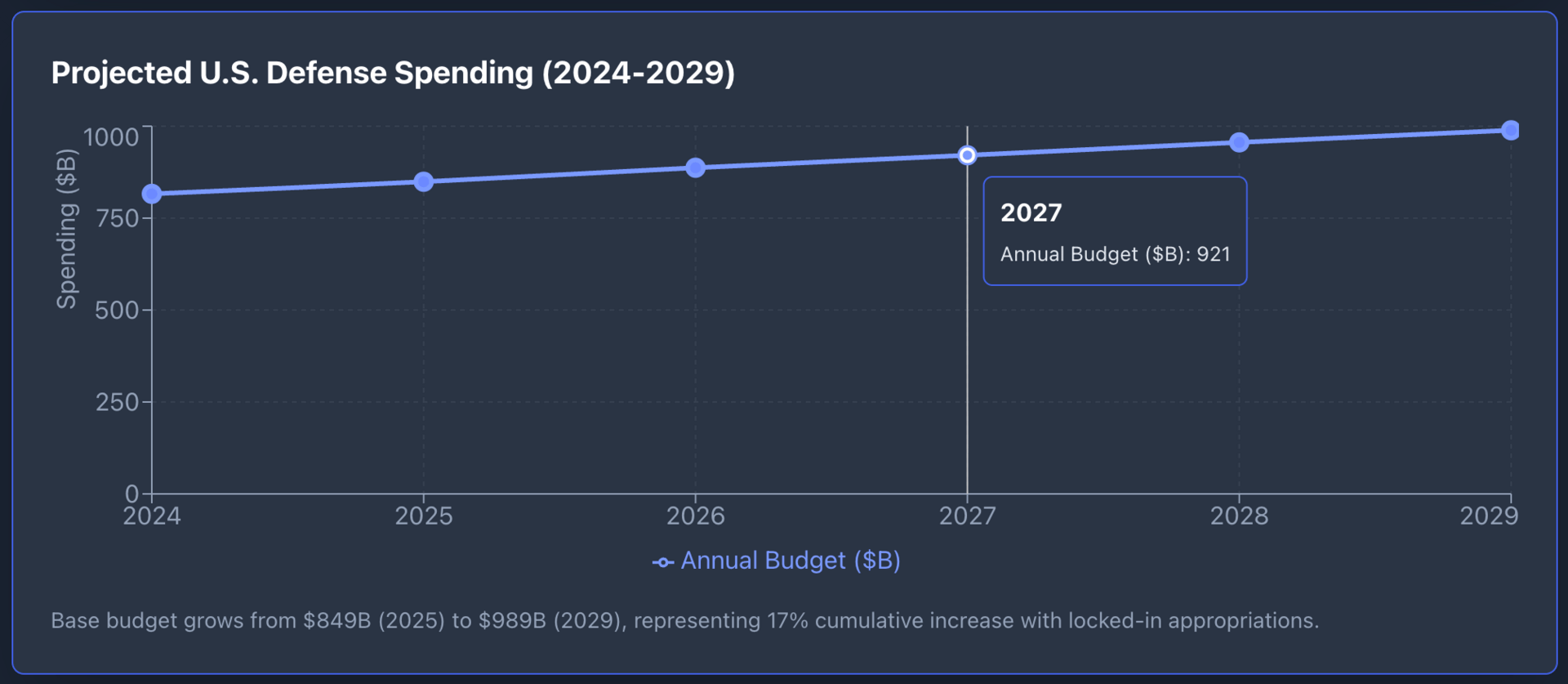

Defense spending hit $849 billion in 2025. Add the $156.2 billion Omnibus package through 2029, and you're looking at over $1 trillion committed to U.S. defense infrastructure.

That's not speculation, it's allocated capital with multi-year contract visibility.

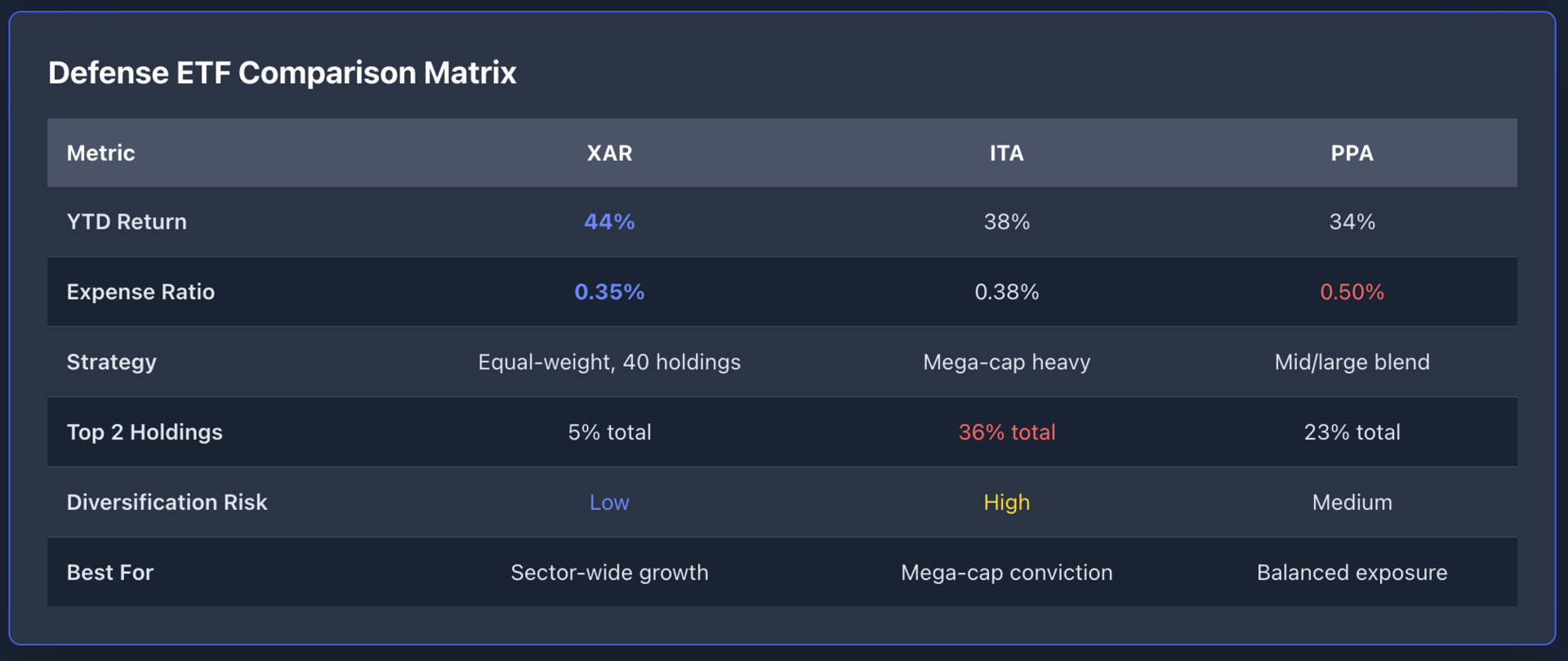

Here's what we know: $XAR returned 44% YTD, $ITA posted 38%, and $PPA delivered 34%.

Those aren't crypto moonshots. They're established funds tracking companies with Pentagon contracts and predictable revenue streams.

Defense Spending Cycle

Most budget increases fade after a fiscal year. This one doesn't.

The $156.2 billion covers shipbuilding programs, F-35 production ramps, hypersonic missile development, and drone warfare systems through 2029. Congress locked in funding for platforms that take 3-5 years to build. That creates earnings visibility you don't usually get in equity markets.

Lockheed Martin holds a $140 billion backlog. RTX's defense segment grew 8% last quarter while commercial aerospace added another layer of growth.

GE Aerospace split from its parent specifically to capitalize on both defense modernization and the commercial aircraft shortage. These aren't bets on future policy—they're positions in companies already executing on signed contracts.

Portfolio Construction Matters

The main defense ETFs take different approaches.

$XAR spreads capital equally across 40 holdings, limiting single-stock risk.

$ITA concentrates 36% between GE Aerospace and RTX, amplifying returns when mega-caps outperform.

$PPA sits in the middle with broader mid-cap exposure but higher fees at 0.50%.

If you're building exposure now, expense ratios matter less than strategy fit.

XAR's equal weighting makes sense when you expect the spending to lift the entire sector rather than just prime contractors.

ITA works if you believe scale wins—GE and RTX have the engineering resources to dominate next-generation programs.

PPA offers a compromise but hasn't matched XAR's performance this year.

Risk Assessment

Defense stocks don't move in a vacuum.

Ukraine's conflict has already stressed supply chains for titanium and rare earth elements. If that war escalates or spreads, procurement costs rise and delivery schedules slip. Lockheed's F-35 program faced a $1.7 billion overrun last year due to labor shortages and inflation in raw materials.

Regulatory compliance adds another layer. The Omnibus bill includes stricter oversight provisions for contractors. Companies that miss milestones face penalties. Boeing's recent production issues show how execution risk can override sector tailwinds.

There's also valuation. RTX trades at 22x forward earnings—not extreme for defense, but higher than its 5-year average. If interest rates stay elevated or recession fears return, these multiples compress fast. Defense spending is stable, but stock prices aren't.

Positioning for 2026

The tactical case for XAR comes down to diversification at a point where smaller contractors are winning more bids. The Pentagon has openly stated it wants to reduce dependency on five prime contractors. That favors equal-weight strategies over concentration.

But if you think scale and program complexity determine winners, ITA's tilt toward RTX and GE makes sense. Those companies have the lobbying power, engineering depth, and balance sheets to dominate trillion-dollar programs.

Either way, this isn't a momentum trade. It's a position in multi-year federal appropriations with quantifiable contract values. The defense budget isn't getting cut in an election year, and the geopolitical backdrop supports sustained spending through the end of the decade. That's the setup. Whether these ETFs justify current valuations depends on execution and whether inflation eats into contractor margins.