Gold delivered the ultimate Santa Rally: 69% in 2025.

While markets took holiday vacations, gold wrote its best calendar year since 1979.

Bitcoin? Still nursing October's hangover.

These two numbers defined the 2025 debasement trade.

What Happened to "Digital Gold"

At the start of the year, many analysts predicted Bitcoin would be the main beneficiary of the debasement trade. The logic was simple: rising government debts, central bank money printing, dollar weakness. All these factors should push investors toward "hard assets."

But physical gold beat digital.

The gold price has hit another record high, trading nearly $4,452 per ounce for the first time.

Through August 2025, both assets showed similar returns, around 30%. Then the paths diverged.

Gold shot up sharply and confidently.

Bitcoin rolled down 36% from its October peak.

It now trades around $88,000, down 30% from the all-time high of $126,000.

Why Gold Won

Central banks voted with their wallets.

They bought gold massively throughout the year. Geopolitical tensions didn't ease. US government debt exceeded $37 trillion in August and reached $37.86 trillion by October. The Congressional Budget Office projects debt will grow from 99% of GDP in 2024 to 116% by 2034.

Institutional investors bet on the time-tested asset. Gold doesn't have Bitcoin's volatility. It hasn't dropped 36% in a few months. That matters to pension funds and sovereign wealth funds.

JPMorgan popularized the term "debasement trade" in their October 2025 research.

Analysts described how investors are losing faith in the long-term value of the dollar, euro, and yen. They're moving to gold, silver, and Bitcoin as "harder" stores of value.

Gold proved the hardest of them all.

Gold ETF Data

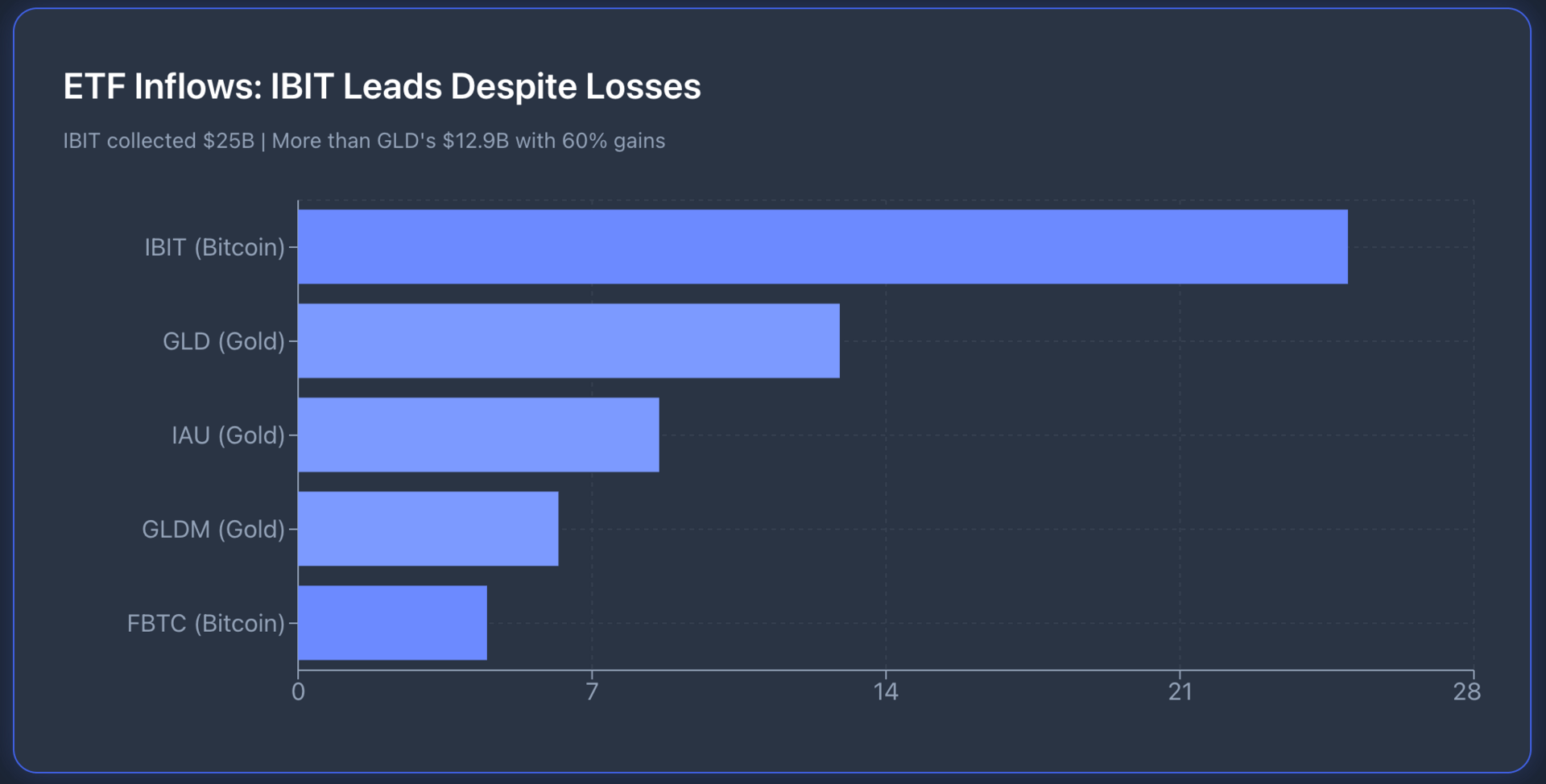

Global gold ETFs pulled in $57.1 billion in 2025. That's the strongest showing since 2020. US-listed ETFs collected $32.7 billion. That's half the total global demand.

SPDR Gold Shares $GLD recorded its largest single-day inflow in 21 years of history — $2.2 billion. The three biggest daily inflows in GLD's entire history happened in 2025. For the year, GLD attracted $12.9 billion, approaching the 2020 record of $15.1 billion.

iShares Gold Trust $IAU received $8.6 billion in inflows.

SPDR Gold MiniShares Trust $GLDM added $6.2 billion.

iShares Gold Trust Micro $IAUM brought in $2.2 billion.

Global gold ETF assets hit $445 billion. They could break through $500 billion if inflows continue.

The third quarter was the strongest quarter in history for gold ETFs. September showed the biggest monthly inflows ever. Western funds dominated — North America and Europe led by volume.

Gold is up about 69% in 2025. This is the best calendar year since 1979. The price exceeded the 1980 all-time high adjusted for inflation.

Bitcoin ETF Data

Bitcoin ETFs tell a different story. Bitcoin's price fell 36% from the October peak. But assets under management in Bitcoin ETFs dropped just 3.6%.

BlackRock's iShares Bitcoin Trust $IBIT pulled in roughly $25 billion in 2025. That's sixth place among all US ETFs by inflows. IBIT is the only fund in the top 25 with negative annual returns. It attracted more capital than GLD, which gained 60-65%.

Fidelity's $FBTC showed mixed flows. In September, FBTC recorded a $315.2 million single-day inflow. In November, there were $33.3 million outflows. Volatility runs higher than IBIT.

Data from Checkonchain shows: US ETFs held 1.37 million BTC at the October peak. As of December 19, they still hold around 1.32 million BTC. The difference: roughly 50,000 BTC or 3.6% from peak.

The selloff didn't come from ETF holders.

Long-term Bitcoin holders took profits. Institutional investors through ETFs stayed steady. Bradley Duke from Bitwise noted: inflows into Bitcoin ETPs exceeded gold ETP inflows in 2025, despite gold's stellar year.

$IBIT holds nearly 60% market share among Bitcoin ETFs with approximately 780,000 BTC under management. IBIT's liquidity surpasses all other Bitcoin funds. Daily trading volumes often exceed $2 billion.

Institutional Analysis

Why do institutions still trust gold more?

Volatility. Bitcoin can drop 36% in a few months. Gold rarely shows such moves. For fiduciary investors, that's critical.

Regulatory certainty. Gold has existed for thousands of years. The regulatory environment is clear. Bitcoin regulation is still forming. That adds uncertainty.

Market infrastructure. The gold market is more mature. Central banks can buy tons of gold without moving the price 10%. With Bitcoin, that's impossible.

Strategic hedge. Gold has worked as a currency devaluation hedge for decades. Bitcoin has only existed since 2009. For many institutions, history matters.

Central banks. They bought gold massively in 2025. Central banks don't buy Bitcoin. That's a fundamental difference in demand.

Investors through ETFs didn't sell Bitcoin during the 36% correction.

AUM fell only 3.6%. That signals long-term conviction. They don't panic from volatility.

Why Bitcoin Lagged

Several factors explain Bitcoin's lag behind gold.

Association with risk assets. Bitcoin still trades like a tech stock, not a defensive asset. When tech stocks fall, Bitcoin falls.

Structural selling. Long-term Bitcoin holders took profits throughout the year. They bought at $10,000-$20,000 in previous cycles. Selling at $90,000-$120,000 makes sense.

Options strategies. A growing share of institutional exposure goes through options overlays and covered call strategies. They trade upside potential for regular income.

2024 front-load. Bitcoin rose over 120% in 2024. Much of the potential was realized in advance. 2025 functions as a consolidation phase.

Macroeconomics. The Fed kept rates higher for longer. A strong dollar early in the year pressured all alternative assets. Gold proved more resilient.

ETF Comparison

$GLD vs $IBIT shows the basic difference between assets.

GLD: 0.40% fee, $76 billion AUM, stable daily trading volume, low volatility, up 60-65% in 2025.

IBIT: 0.25% fee, roughly $50 billion AUM, daily volumes often exceed $2 billion, high volatility, down 9.6% in 2025.

IAU offers a lower fee for gold — 0.25%. It attracted $8.6 billion in 2025. For investors seeking the lowest gold costs, IAU competes with GLD.

FBTC has a 0.25% fee, same as IBIT. It holds around 201,000 BTC. Flows are more volatile than IBIT's. On August 19, FBTC recorded $246 million in redemptions — one of the largest single-day outflows.

For investors, the difference between GLD and IAU is minimal. Both track gold with minimal error. GLD has greater size and liquidity. IAU has a lower fee.

For Bitcoin, the difference between IBIT and FBTC is also small on fees. Both charge 0.25% annually. But IBIT dominates on liquidity and size. That matters for large institutional blocks.

Signals for 2026

Historical patterns show: gold peaks often precede Bitcoin rallies by 100-150 trading days. Bitfinex analysts indicate: Bitcoin's current consolidation may be a transitional phase.

Recovery could come in 2026.

Charlie Morris from Bytetree said: "I remain bullish on silver, but it won't last forever. I suspect when the rally ends, Bitcoin will take its place."

Gold trades near all-time highs.

Goldman Sachs raised their December 2026 forecast from $4,300 to $4,900 per troy ounce. Analysts point to "sticky" ETF flows and central bank purchases.

We expect gold demand to push prices toward $5,000/oz by year-end 2026.

Bitcoin trades 30% below peak. The Fear and Greed Index sits at 20: deep in "extreme fear" territory. But Bitcoin's daily volume remains above $50 billion.

The question for 2026: can Bitcoin catch up to gold when gold peaks?

Citigroup's base case for Bitcoin (BTC) is a rise to $143,000 in 2026.

Analysts highlight $70,000 as key support, with the potential for a sharp rise due to revived ETF demand and positive market forecasts.

Gold-ETF & Crypto-ETF Mix

First: define your investment horizon.

For a 5+ year horizon, Bitcoin volatility is less critical. For 1-2 years, gold is more stable.

Second: assess risk tolerance. Bitcoin can fall 50% at any moment. Gold rarely falls more than 20%. If you can't handle a 50% drawdown, limit your Bitcoin allocation.

Third: diversify between ETF providers. Don't put everything in one fund. GLD + IAU for gold. IBIT + FBTC for Bitcoin. This reduces concentration risk.

Fourth: use dollar-cost averaging. Buy a fixed amount each month. This smooths entry price volatility. Especially important for Bitcoin.

Fifth: rebalancing. Set target weights. For example: 70% gold, 30% Bitcoin. When Bitcoin grows to 40% of the portfolio, sell some and buy gold. When it falls to 20%, do the opposite.

Sixth: consider tax implications. ETFs generate taxable events on sale. Plan rebalancing with taxes in mind.

Seventh: don't forget correlation with your main portfolio. If your portfolio is 80% tech stocks, adding Bitcoin may not diversify risk. Gold will provide better diversification.

Conservative mix example: 80% GLD or IAU, 20% IBIT. This gives exposure to both assets with emphasis on stability.

Balanced mix example: 60% gold, 40% Bitcoin. This increases growth potential at the cost of higher volatility.

Aggressive mix example: 40% gold, 60% Bitcoin. For investors with high risk tolerance and long horizons.

Bottom Line

Gold won the 2025 debasement trade on price. A 65% gain beat Bitcoin's 7% decline. Institutional investors trusted gold as the primary strategic hedge against devaluation and political risk.

But the full story is more complex. Bitcoin ETFs attracted massive capital despite falling prices. IBIT collected $25 billion, more than GLD with its 60% gain. ETF holders didn't sell during the 36% correction. AUM fell only 3.6%.

This means: institutional capital views Bitcoin as a long-term bet. Short-term volatility doesn't make them exit. They're not trading. They're holding.

For 2026, both assets remain relevant. Gold will continue winning from central bank purchases and geopolitical uncertainty. Bitcoin could catch up when gold peaks and investors start seeking higher-beta assets.

The optimal strategy: hold both. Use gold ETFs as a stability foundation. Add Bitcoin ETFs for growth potential. Rebalance regularly. Don't panic from volatility.

The debasement trade doesn't end in 2025. It's just getting started.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.