Gold just made history. And the money flowing into gold ETFs tells us this isn't over yet.

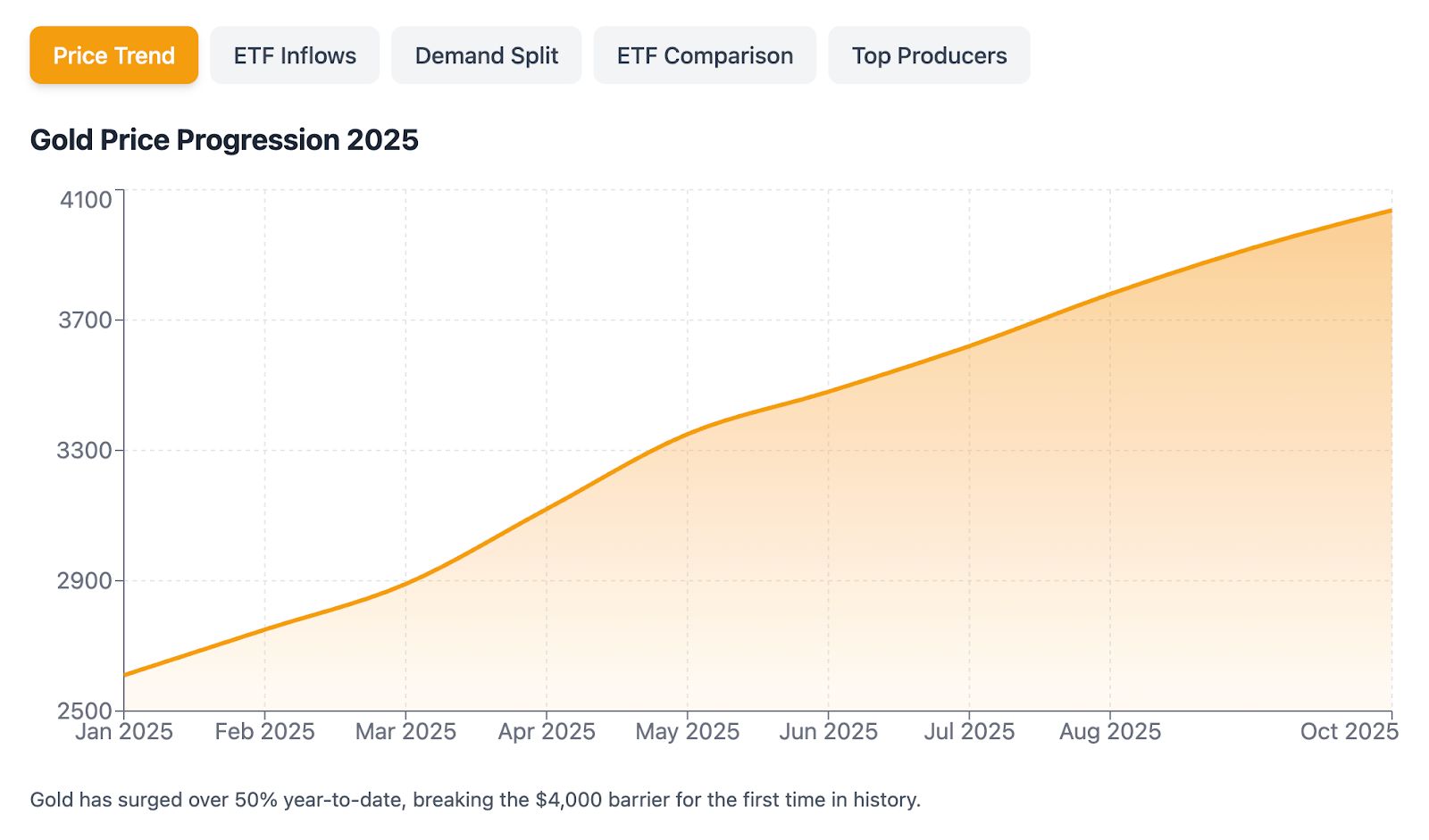

Gold crossed $4,000 per ounce on October 8th, 2025, hitting an all-time high of $4,071.60 (October 9th, 2025).

That's a 54% gain in one year.

This isn't just another milestone. It's a signal that something fundamental has shifted in how investors think about safety.

What's Driving This Rally

The Federal Reserve is keeping rates low. The U.S. government shutdown is now in its second week, freezing economic data and creating a vacuum of information.

Political crises in France and Japan aren't helping.

But here's what really matters: Central banks are buying gold like never before. China's central bank has purchased gold for 11 straight months.

These aren't retail investors chasing trends. These are the institutions that manage trillions in reserves.

And then there's the ETF money.

The ETF Effect

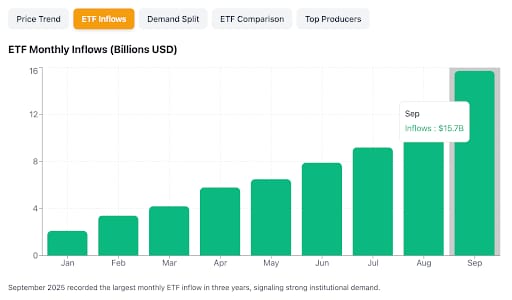

September 2025 saw the largest monthly inflow into gold ETFs in three years.

According to the World Gold Council, these ETF purchases have become a primary driver of gold's price surge.

Here's why that matters.

When you buy a gold ETF like SPDR Gold Shares $GLD ( ▼ 0.25% ) or iShares Gold Trust $IAU ( ▼ 0.24% ), those funds have to purchase physical gold to back your shares. That creates real demand for physical metal, not futures contracts, not paper promises, but actual gold bars sitting in vaults.

State Street Global Advisors says this ETF demand has created a shortage of physical gold.

The only way to fix that shortage? Higher prices or more supply from recycled gold. But recycling can't keep up with institutional demand.

Roukaya Ibrahim from BCA Research puts it plainly: "Institutional investor interest is just getting started."

Which ETFs Should You Watch

If you're looking at gold exposure, here are the main options:

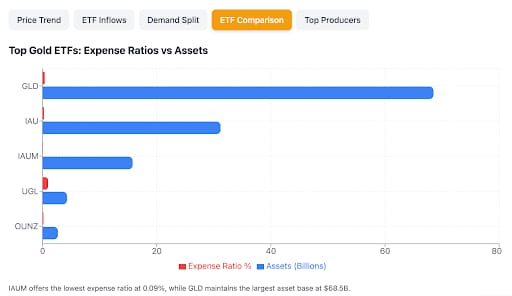

SPDR Gold Shares $GLD ( ▼ 0.25% ) remains the largest and most liquid gold ETF. It tracks the price of gold bullion and charges 0.40% annually.

iShares Gold Trust $IAU ( ▼ 0.24% ) does the same thing with slightly lower fees at 0.25%.

IAUM from iShares offers the lowest expense ratio at just 0.09% per year—worth considering if you're buying and holding.

ProShares Ultra Gold $UGL ( ▼ 0.49% ) gives you 2x leveraged exposure if you want amplified returns. But that leverage cuts both ways.

OUNZ from Eckk Gold lets you exchange shares for physical gold bars. No delivery fees. That's unique if you eventually want the metal itself.

What the Experts Are Saying

Gold, one of the oldest financial assets, is rising alongside bitcoin, one of the newest. Both are decentralized assets that act as stores of value not linked to any government.

Gold prices could exceed $5,000 per ounce by 2026 and I advise to allocate at least 5% of portfolios to gold.

Brandon Aversano from The Alloy Market expects gold to hold its value through late 2025, though he's not predicting new highs without fresh economic risks.

Goldman Sachs sees central bank demand staying elevated. Their analyst Daan Struyven points to the 2022 freeze of Russian reserves as a wake-up call for emerging markets. Gold doesn't carry the same counterparty risk as Treasury bonds.

The Bigger Picture

Gold is up 50% YTD.

Bitcoin is also surging. Both are decentralized stores of value that don't depend on any single government.

That parallel isn't an accident. When investors lose confidence in traditional monetary policy, they look for alternatives.

Right now, they're finding two: one that's 5,000 years old, and one that's 16 years old.

Nobody's saying gold rises forever without pullbacks.

Volatility is part of this trade. But if you believe we're entering a prolonged period of monetary uncertainty and geopolitical tension, gold deserves a serious look.

The ETF flows suggest professional money managers already reached that conclusion months ago.