Table of Contents

What a day!

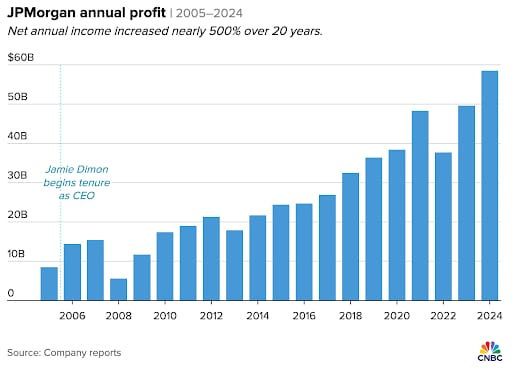

JPMorgan Chase just announced it's deploying AI across every corner of its operations.

We're talking about 60,000+ AI models already in production and a new internal platform called LLM Suite that puts an AI assistant in front of every single employee.

This isn't a pilot program. It's a fundamental restructuring of how a $600 billion bank operates.

Follow The Numbers

JPMorgan spends about $18 billion a year on tech. More and more of that budget is now funding AI projects.

The bank has already registered over 400 AI patents and built proprietary systems that handle everything from fraud detection to equity research.

But here's the thing: they're not alone.

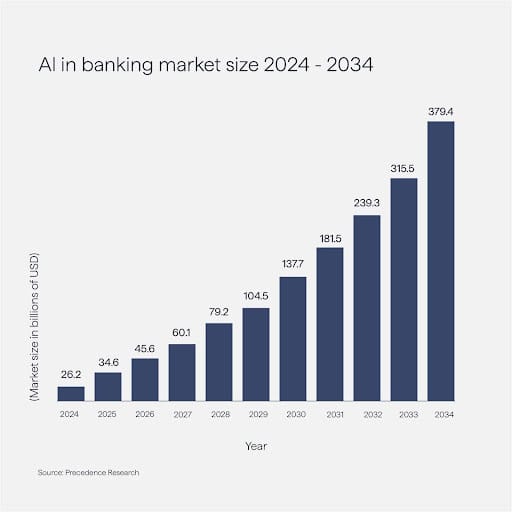

The global banking sector is expected to pour ~$67 billion into AI by 2028, up from $30 billion today. That's exceeding 20% CAGR.

What Changed This Week

JPMorgan rolled out its LLM Suite platform. It currently uses models from OpenAI and Anthropic, but trained on decades of proprietary financial data.

Early reports suggest it can draft client presentations in seconds and execute complex analytical tasks that previously required hours of human labor.

Every employee will have their own personalized AI assistant…

Exactly, entry-level analyst roles are about to shrink. Fast.

The AI-First Banking

JPMorgan is also building what it calls an "AI concierge" for retail and institutional clients. The goal is automated service delivery at scale—fewer human touchpoints, faster execution, lower operational costs.

The broad vision that we’re working towards is one where the JPMorgan Chase of the future is going to be a fully AI-connected enterprise.

For wealth management clients, this means AI-driven portfolio suggestions.

For corporate banking clients, it means instant credit assessments and risk modeling.

That gap between human-driven service and AI efficiency matters more than you might think. Banks that can't match this speed will lose clients to those that can.

What This Means

Financial services employment is already under pressure.

JPMorgan employs over 300,000 people globally. If even 5% of roles become redundant due to automation, that's 15,000 positions.

About 250,000 JPMorgan employees have access to the platform today, which is the entire workforce except for branch and call center staff, said Waldron. Half of them use it roughly every day, he said.

Scale that across all the major banks, and thousands of entry-level jobs could disappear, especially roles where people spend their days pulling data and running basic reports.

But there's a flip side.

AI infrastructure providers are seeing a surge. Companies building enterprise AI tools, cloud computing platforms, and specialized financial models are positioned to capture a share of that $67 billion spending wave.

As an investor, how are you positioning your portfolio for the rise of AI in finance?

The Investment Angle

Two areas worth watching:

Fintech ETFs with AI exposure.

Funds like ARKF and FINX hold positions in companies supplying the technology banks are buying. As spending accelerates, these suppliers benefit directly.

Cloud infrastructure plays.

JPMorgan's AI systems run on massive compute resources. The shift to AI-first banking means sustained demand for cloud services from providers like Microsoft Azure and Amazon Web Services.

Watch the earnings calls from major banks over the next two quarters.

If JPMorgan's AI deployment shows measurable cost savings or revenue gains, competitors will accelerate their own timelines. That creates a compounding effect across the sector.

The Risk Nobody's Talking About

AI models require continuous retraining.

They're only as good as the data they consume. If a bank's AI makes a material error—say, misclassifying credit risk or generating a flawed trading recommendation—the legal and regulatory fallout could be severe.

We still don't yet have clarity on how regulators will treat AI-generated financial advice or automated lending decisions.

So this one introduces some potential risks that aren't fully priced into bank valuations.

What is your biggest concern about JPMorgan's AI program?

The Bottom Line

JPMorgan isn't just trying to work faster.

They're building something no other bank has attempted, a system where AI touches every function, every employee, every client interaction.

And once they prove it works, every competitor will have to match it or lose ground. Sounds great, isn’t it?

For investors, the question isn't whether AI will reshape banking. It's which companies will capture the value that shift creates.

Keep an eye on fintech ETFs, cloud infrastructure providers, and any bank that announces a credible AI strategy in the coming months.

The capital is moving. The only question is where you'll position yourself before it does.