A U.S. “birthright” claim worth trillions - activated quietly (from Behind the Markets)

This week delivered key catalysts demanding immediate analytical attention: precious metals volatility testing critical psychological thresholds, bilateral trade framework recalibration with tariff regime modifications, and transatlantic alliance deterioration accelerating European strategic autonomy.

It’s a tactical noise. These structural inflection points with portfolio ramifications extending through 2029.

Precious Metals & Volatility Surge

Key Takeaways:

$4,900-$5,000 range establishes critical support zone determining trend persistence versus reversal

Equity correlation surge during Thursday selloff undermines diversification assumptions during synchronized risk-off episodes

Fed rate trajectory recalibration on employment strength compresses monetary accommodation timeline supporting precious metals valuations

Gold prices recovered 1.3% to $4,982.59 per ounce Friday following Thursday's 3% collapse that breached the $5,000 psychological floor, a near one-week low triggered by equity market contagion and robust employment data compressing Federal Reserve rate-cut expectations.

Spot silver showcased volatility, surging 2.5% to $77.02 per ounce after Thursday's 11% plunge.

Analysts identified the core dynamic: elevated volatility clustering around key price levels, with precious metals exhibiting correlation breakdown relative to historical diversification patterns. The structural uptrend remains intact under accommodative monetary policy scenarios, but near-term technical deterioration challenges bullish thesis continuity.

Markets discount two cuts versus prior three-cut baseline, with timing pushed to mid-year implementation.

Gold tested $5,000 and recovered to $4,982. What's your technical read?

Aluminum Tariffs Rollback Initiative

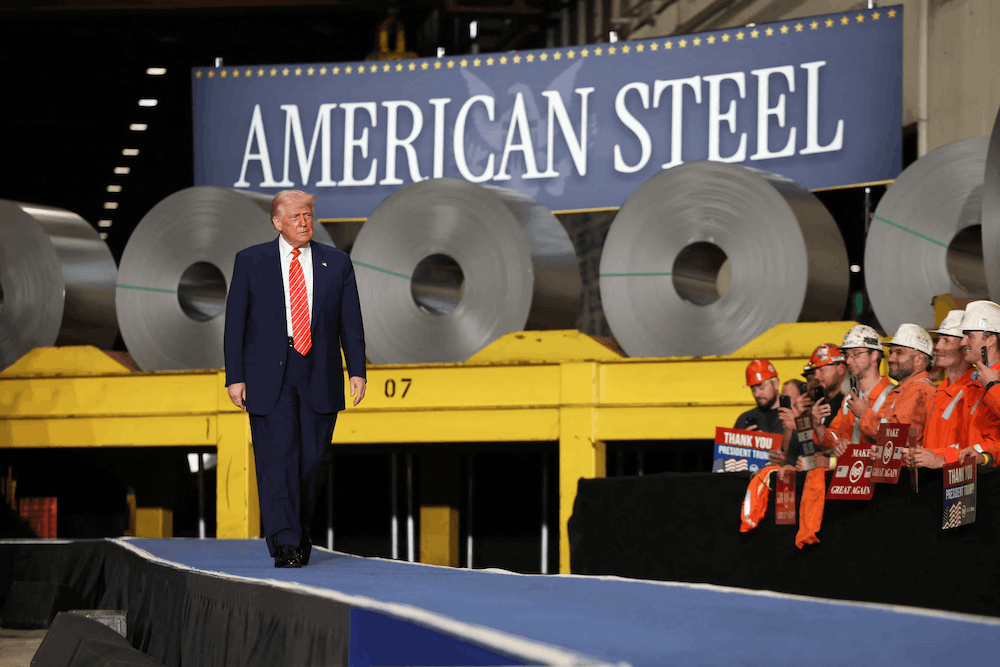

U.S. President Donald Trump (REUTERS)

Key Takeaways:

Enforcement complexity rather than economic merit drives policy reversal, exposing implementation bandwidth constraints

Household goods exemptions and halted tariff expansions signal tactical retreat from comprehensive protection framework

Midterm political calculus introduces electoral considerations into trade policy formulation previously framed as strategic necessity

President Trump's planned rollback of select steel and aluminum tariffs, previously imposed at rates reaching 50%, represents material trade policy recalibration driven by affordability pressures preceding midterm elections and Commerce Department enforcement capacity limitations.

Aluminum prices declined immediately on rollback news as markets reduced trade friction for household goods categories and expanded exemption frameworks. The policy shift follows Congressional pushback on Canada tariff applications and bilateral truce negotiations with China.

This development matters because it exposes the gap between trade policy rhetoric and administrative execution reality. Markets monitoring tariff regime evolution should anticipate additional modifications as implementation friction mounts across commodity categories.

Trump's tariff rollback reflects enforcement capacity failure. What happens next?

Venezuela Energy Resurgence

Venezuelan acting President Delcy Rodriguez greets U.S. Energy Secretary Chris Wright, Caracas, Venezuela, Feb. 11, 2026. (AP/Ariana Cubillos)

Key Takeaways:

Current 1 million bpd baseline positions Venezuela for 300,000-400,000 bpd supply addition if 30-40% targets materialize

Sanctions relief architecture enables Vitol, Trafigura, and Chevron participation in extraction and export logistics

Heavy crude concentration matters for Gulf Coast refinery complex configured for Venezuelan grade processing capacity

U.S. Energy Secretary Chris Wright outlined plans for a "dramatic increase" in Venezuelan crude output tied to relaxed sanctions and export operations. The projected 30-40% production increase within 12-18 months from the current 1 million bpd baseline implies movement toward 1.3-1.4 million bpd under optimistic scenarios.

This represents potential 300,000-400,000 bpd additional supply entering global markets. Venezuela reversed earlier production declines through authorizations granted to traders including Vitol and Trafigura to operate alongside Chevron in exporting crude and clearing storage capacity constraints.

EIA estimates suggest output climbing above 1 million bpd by mid-2026, potentially reaching 1.2-1.3 million bpd over subsequent 12 months, consistent with Wright's 30%+ increase scenario.

US-Taiwan Trade Framework

Key Takeaways:

Energy security dominance reflected in $44.4B LNG/crude allocation addressing Taiwan's import dependency vulnerabilities

Aerospace commitment provides five-year revenue pipeline for Boeing and supplier ecosystem amid commercial aviation recovery

Immediate tariff elimination on agricultural products creates market access expansion for U.S. farm commodity exporters

The finalized reciprocal trade deal caps U.S. tariffs on Taiwanese imports at 15% while Taiwan commits $84+ billion in purchases through 2029.

The purchase architecture reveals strategic priorities: $44.4 billion allocated to LNG and crude oil, $15.2 billion to aircraft and engines, and $25.2 billion to grid infrastructure, marine equipment, and steelmaking technology. Taiwan immediately eliminates agricultural tariffs previously reaching 26% on U.S. beef, dairy, and corn exports.

Representative Jamon Greer characterized the deal as supply chain resilience enhancement in high-technology sectors, acknowledging persistent geopolitical tensions while establishing economic interdependence frameworks.

The deal provides multi-year revenue visibility for U.S. exporters across energy, aerospace, and industrial equipment categories.

European Capital Markets Integration

Ursula Von der Leyen (Shutterstock)

Key Takeaways:

€10T capital reallocation from bank deposits to equity/debt markets represents structural liquidity injection supporting valuations

Enhanced cooperation mechanism creates bifurcation risk between integration participants and peripheral resistors

June deadline establishes binary outcome framework: comprehensive adoption or fragmented implementation via coalition

Commission President Ursula von der Leyen announced March delivery of comprehensive single market deepening initiatives targeting 450 million consumers, featuring Capital Markets Union advancement designed to deploy €10 trillion in idle bank deposits currently yielding negligible returns.

Phase one of the Savings and Investment Union, encompassing market integration, supervisory harmonization, and securitization framework modernization, faces a June completion deadline. Von der Leyen issued an explicit warning: insufficient progress triggers enhanced cooperation provisions enabling minimum nine member states to proceed independently.

The initiative includes merger framework modifications facilitating European champion creation and strategic procurement preferences favoring domestic suppliers. This represents forced acceleration of integration objectives stalled since 2015 initial Capital Markets Union proposals.

The political economy dimension matters as much as financial architecture. Von der Leyen's enhanced cooperation threat signals frustration with unanimity requirements blocking integration progress, potentially establishing precedent for circumventing resistant member states across policy domains.

EU faces June deadline for Capital Markets Union progress. Most likely scenario?

Munich Security Conference

Secretary of State Marco Rubio (AP)

Key Takeaways:

"Old world is gone" declaration represents official acknowledgment of post-war order dissolution

European autonomy acceleration manifests in defense spending commitments and indigenous capability development independent of U.S. systems

Gulf pivot signals European recognition of Middle East economic significance amid reduced American reliability assumptions

The Munich Security Conference convened February 13 with 70 world leaders under the "Under Destruction" theme—explicit reference to President Trump's new world order through tariff deployment and alliance relationship recalibration.

U.S. Secretary of State Marco Rubio declared en route that "the old world is gone," urging allies to fundamentally re-examine geopolitical assumptions amid shifting power balances. His bilateral agenda includes meetings with China's Wang Yi and Ukraine's Zelenskyy, alongside European counterparts navigating alliance uncertainty.

German Chancellor Friedrich Merz's opening address called for European relationship expansion beyond exclusive Atlantic orientation, citing Gulf Cooperation Council engagement as a model for diversified partnership architecture. The autonomy imperative, European strategic independence from U.S. security guarantees, dominated preliminary discussions.

The conference dynamics reveal widening transatlantic gap on fundamental security architecture questions. European leaders increasingly frame autonomy as necessity rather than preference, a strategic shift with implications for defense procurement, energy infrastructure, and technology cooperation frameworks extending through the 2030s.

The Bottom Line

Trade architecture recalibration, monetary accommodation compression, and geopolitical realignment operate simultaneously—creating correlation instability across traditional diversification frameworks.

European Capital Markets Union progress toward the June deadline will determine whether integration acceleration represents credible policy trajectory or political signaling without enforcement mechanisms. Enhanced cooperation activation would mark significant precedent for EU decision-making architecture.

Risk management requires scenario planning across divergent outcomes: precious metals trend continuation vs reversal, tariffs rollback, European integration success vs fragmentation.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: The Great Unwinding: Why China's $640 Billion Treasury Reduction Could Keep Rates Higher for Longer

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.