Looking for the absolute cheapest way to invest in the S&P 500?

This might be it.

The SPDR Portfolio S&P 500 ETF (SPLG) pulled in $23.1 billion in net inflows during 2025, making it the second most popular S&P 500 tracker this year.

With a razor-thin expense ratio of just 0.02%, this fund offers one of the lowest-cost entries into S&P 500 investing you'll find anywhere.

$SPLG it's a compelling alternative to popular options like $VOO, letting you keep more of your returns where they belong: in your pocket.

Focus on Numbers

Key Metrics:

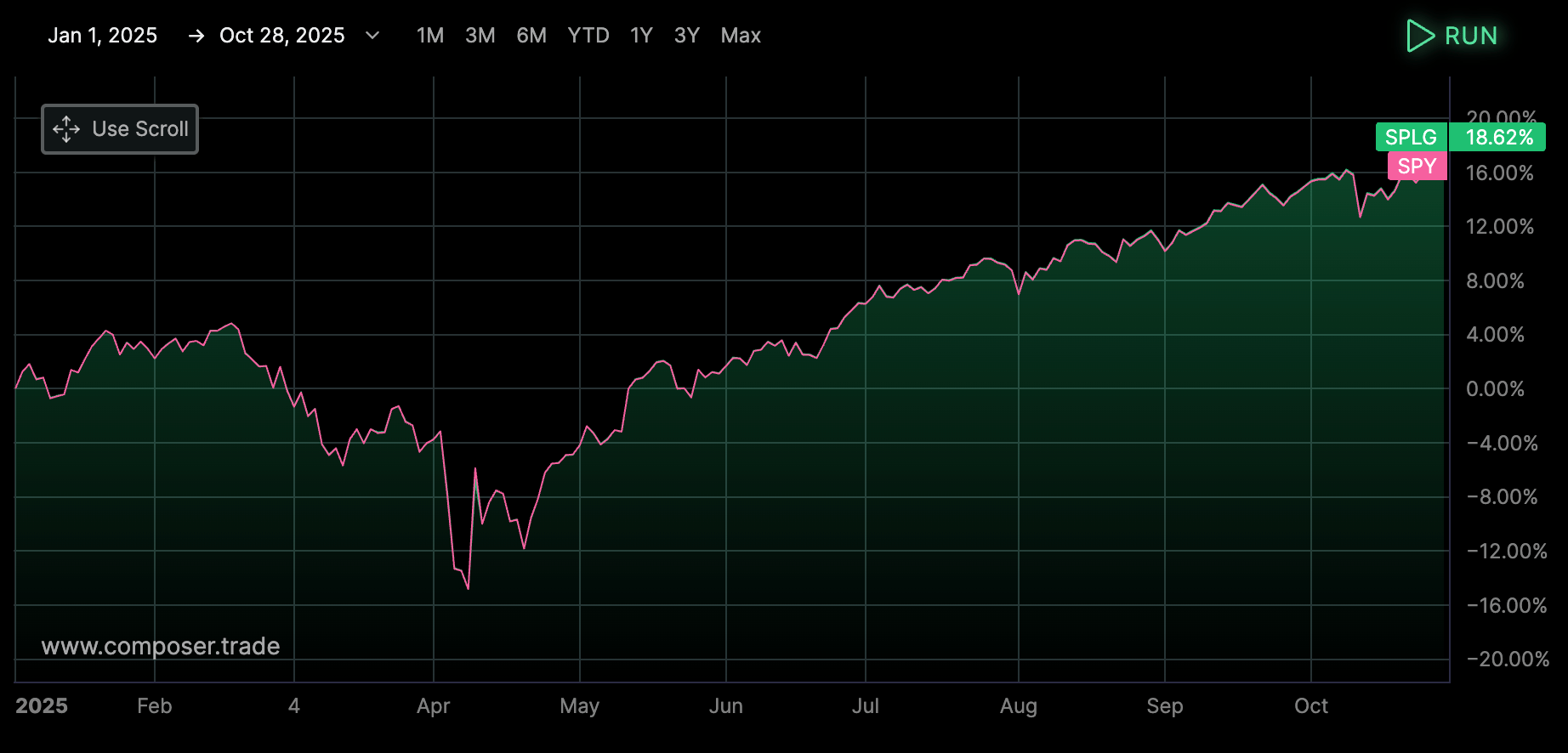

YTD Return: +18.62%

Net Assets: 86.83B

Expense Ratio: 0.02%

Dividend Yield: 1.12%

The fund tracks the S&P 500 index with minimal tracking error.

Year-to-date, it's matching the benchmark almost perfectly, missing by less than 3 basis points.

Analysts’ Comments

SPLG has become the go-to option for cost-conscious investors who want S&P 500 exposure. The 0.02% expense ratio removes essentially all friction from long-term wealth building.

But here's the thing: price isn't the only consideration.

Jennifer Walsh from Goldman Sachs Asset Management points out that "while SPLG offers exceptional value, investors should also evaluate liquidity. The bid-ask spread, though tight, is slightly wider than VOO or SPY during volatile sessions."

Todd Morrison, ETF strategist at JPMorgan, sees continued strength:

"We expect SPLG to capture market share from higher-cost competitors. The math is simple—every basis point saved compounds over decades."

The Direct Comparison

When you stack SPLG against VOO (Vanguard's S&P 500 ETF at 0.03%), the difference seems tiny.

The fund holds identical positions to other S&P 500 ETFs—Apple, Microsoft, Amazon, and the rest.

You're buying the same portfolio.

The only real differences are cost and trading volume.

Worth Considering

$SPLG works particularly well for systematic investors building positions over time.

SPLG ETF Holdings (finance.yahoo)

The low cost structure means less drag on returns, especially valuable in tax-advantaged accounts where you can compound without interruption.

Average daily volume sits around 3.5 million shares.

That's enough liquidity for most retail investors, though institutions moving large blocks might prefer SPY's deeper liquidity.

For investors focused purely on cost efficiency in S&P 500 exposure, $SPLG delivers exactly what it promises.

Nothing more, nothing less.

What's catching investor attention today:

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing