The Federal Reserve cuts rates again this week.

The second cut of 2025.

CME FedWatch shows 97% probability of a 25-basis-point reduction.

Inflation has cooled to 3.0% YoY.

Unemployment ticked up to 4.1%. The Fed has room to move.

This recalibrates every asset in your portfolio.

Market Response

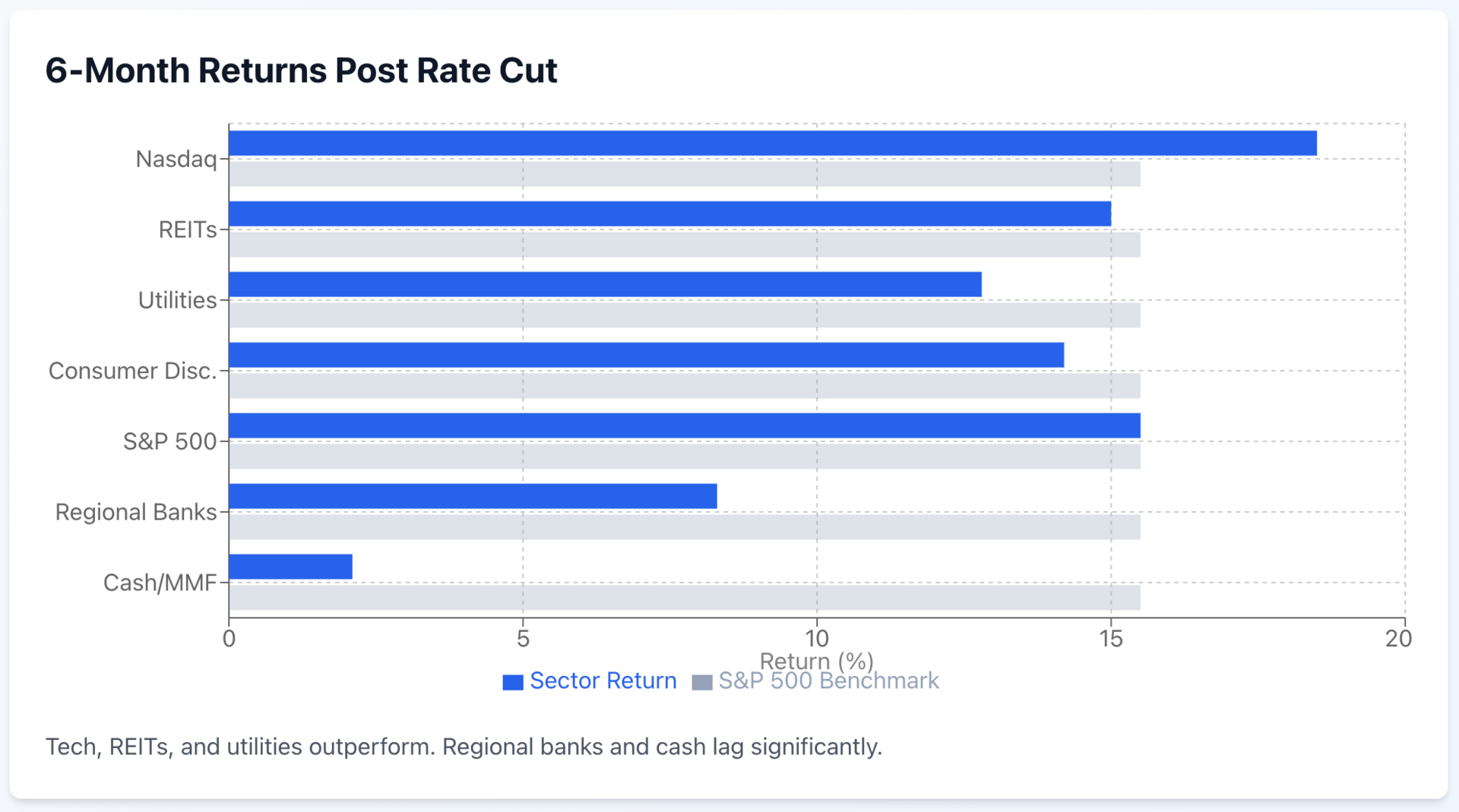

When rates fall, specific sectors consistently outperform.

Markets move on Fed signals, not perfect data.

By the time clarity arrives, the trade is crowded.

Rate cuts trigger predictable sector rotations. Tech and growth stocks rally first—lower interest rates boost the present value of future earnings.

REITs get a double lift: cheaper debt and higher valuations as Treasury yields fall.

Utilities turn into yield plays when the 10-year drops below 4%.

Financials split. Regional banks get squeezed on net interest margins. Goldman Sachs, JPMorgan and Morgan Stanley—print money from M&A activity and trading volume that spikes during rate cycles.

Consumer discretionary catches a bid. Lower rates mean cheaper car loans, smaller mortgage payments, accessible home equity. Big-ticket spending unlocks.

Fixed income is straightforward: Long-duration bonds capture the most upside when rates fall.

Which asset class do you believe has the most upside after this rate cut?

Companies refinance expensive debt while yields stay compelling versus Treasuries.

Here's the costly mistake: sitting in cash.

The Fed creates winners and losers every cycle.

The only question is which side of that trade you're on when the cuts hit.

The Bigger Question

Source: x.com/Delta_Exchange

The Fed faces a balancing act.

Inflation at 3.0% remains above their 2% target.

Cut too fast and inflation could accelerate again.

Cut too slowly and economic weakness might deepen.

Rising unemployment gives them cover to ease policy without appearing to prioritize markets over price stability.

Here's the setup: Cheaper borrowing supports corporate earnings without overheating the economy. The soft-landing scenario stays intact—until it doesn't.

That assurance has limits.

ETF Implications

Volatility will spike again—and it won't matter.

The VIX jumped to 38 in August on weak jobs data, then collapsed back to 15 within a week. That's the pattern: episodic panic, not systemic breakdown.

When economic surprises hit or geopolitical tensions flare, the fear gauge jumps. If fundamentals hold—earnings growth, Fed easing, no recession—markets recover fast.

The mistake isn't experiencing volatility. It's selling quality positions during temporary drawdowns, then sitting in cash while the S&P 500 climbs another 10%.

Looking Forward

This second cut confirms the pivot toward policy easing.

Markets priced it in weeks ago.

The critical question: where do you position now?

Long-duration bonds capture the most price appreciation as rates fall.

Following the Fed's rate cut, what's your primary portfolio adjustment?

A 100-bp decline in the 10-year Treasury historically drives 8-10% returns on 20+ year bonds.

Investment-grade corporates offer risk-adjusted returns with credit spreads at 95 basis points, near 10-year tights.

Companies refinance expensive debt. Yields stay attractive relative to Treasuries.

But cash is quietly bleeding value.

Money market funds yielding 5.0% today will drop to 4.2% after this cut, and below 4.0% by Q1 2026 if the Fed follows through on projected cuts.

That's not just lower income, it's opportunity cost while equities and bonds rally.

Every month parked in cash is a month missing 8-12% annualized returns from risk assets during easing cycles.

Hold core allocations. Use spikes to rebalance into strength.

What's catching investor attention today: The US Government's Been Shut Down for Three Weeks. Why Isn't Anyone Panicking?

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.