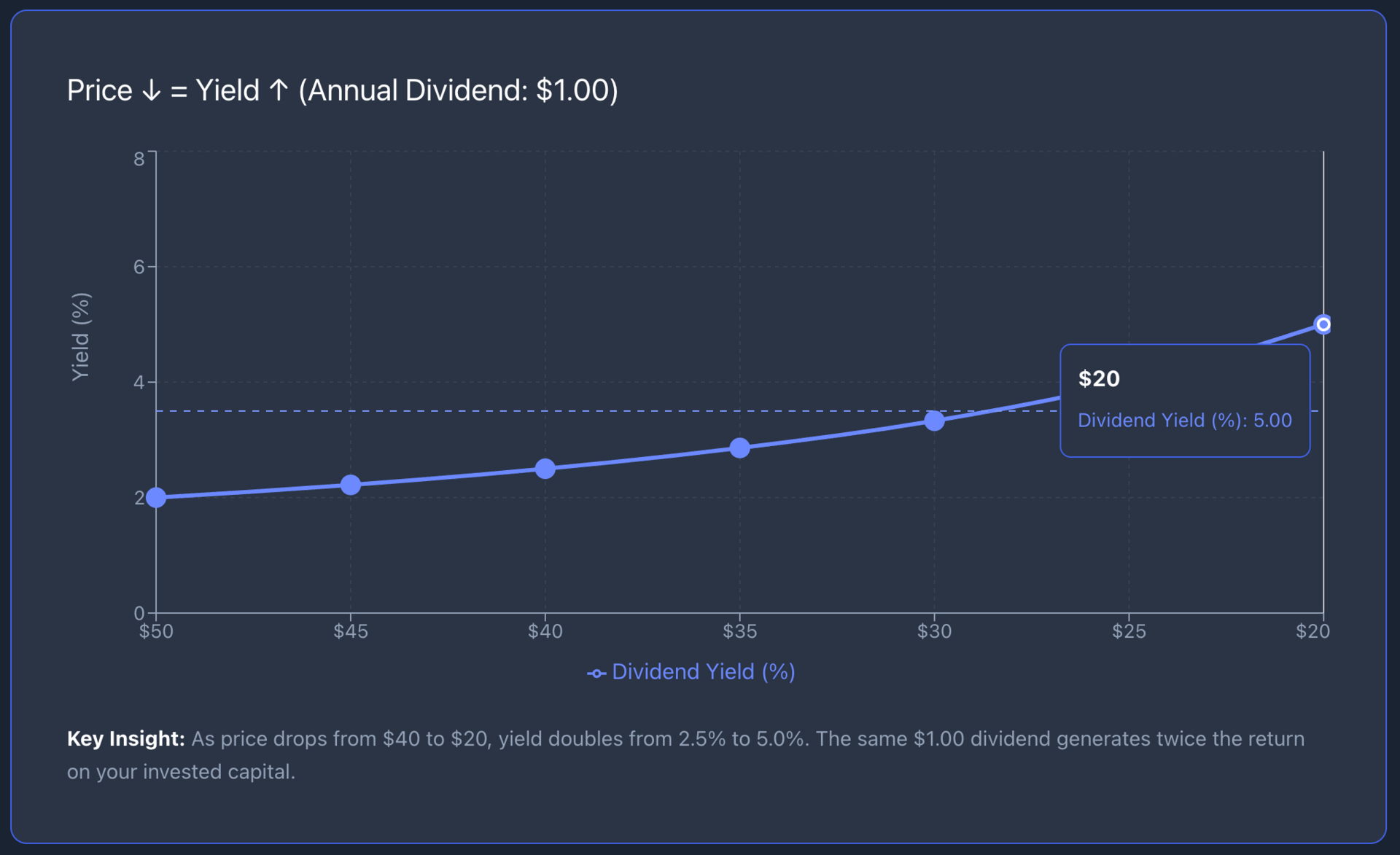

Here's what most income investors miss: when a stock price drops, your potential dividend return goes up.

That's not a problem. It's an opportunity.

The math is simple. Dividend yield equals annual dividends divided by share price.

When price falls and the dividend stays constant, yield rises. A $40 stock paying $1 annually yields 2.5%. That same stock at $20 yields 5.0%.

Same dollar dividend, double the return on your capital.

Why Price Drops Matter

Market selloffs create temporary dislocations between price and value.

For dividend-focused portfolios, these moments represent tactical entry points. You're buying the same income stream at a discount. The company still pays the same dividend. You just pay less to receive it.

This isn't about catching falling knives.

It's about identifying when quality dividend payers temporarily trade below their income value. The key word is temporary.

If the dividend itself is at risk, the elevated yield is a warning signal, not a buying opportunity.

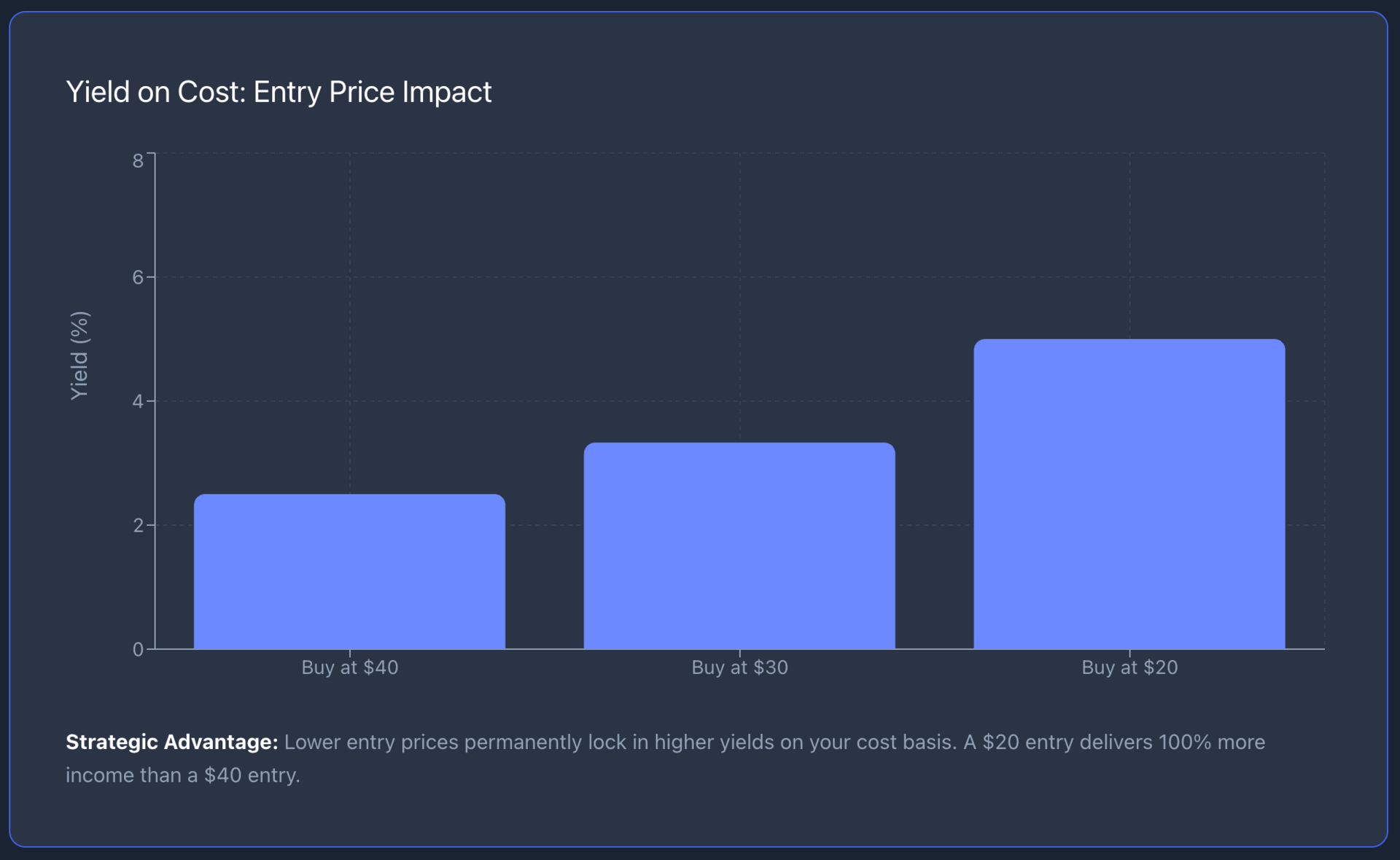

Locking In Your Yield on Cost

When you purchase shares, you lock in your personal yield on cost. That figure stays fixed to your entry price, regardless of subsequent market fluctuations.

Analytically, reframing a price decline involves assessing the resulting locked-in yield on cost.

The foundational formula is defined as:

Buy $VYM at $95 with a 3.2% yield, and that 3.2% return on your $95 investment remains constant even if the ETF later trades at $110.

Historical data supports the dividend capture approach.

According to Hartford Funds analysis of market returns from 1973 through recent periods, dividends and their reinvestment have accounted for approximately 80% of total equity returns over extended timeframes.

That contribution becomes even more pronounced during periods of market volatility when capital appreciation stalls.

Setting Strategic Alerts

The practical implementation requires reverse engineering your target yield.

If you want a 3.5% yield from $VYM and its current annual dividend is $3.20, divide $3.20 by 0.035. Your maximum purchase price is $91.43. Set an alert at that level.

This systematic approach removes emotion from the equation.

You're not guessing at valuations or trying to time bottoms. You're simply waiting for the price to meet your required income threshold.

When it does, you deploy capital. When it doesn't, you wait.

But here's the critical qualifier: confirm dividend safety before buying.

A stock yielding 7% sounds attractive until you examine the payout ratio. If the company distributes 95% of earnings as dividends, there's minimal cushion for business disruption. Yields above 4% warrant additional scrutiny. Review the dividend history, payout ratio, and free cash flow coverage.

Check the company's track record.

Dividend aristocrats with 25+ years of consecutive increases rarely cut payments during temporary downturns. That stability matters more than chasing the highest advertised yield.

Price declines paired with stable dividends create measurable opportunities. The inverse relationship between price and yield isn't theoretical. It's arithmetic.

Use it systematically, validate dividend sustainability.

Let market volatility work in your favor rather than against it.

What's catching investor attention today: Your Brain Is Wired to Lose Money. Here's How to Fix It

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.