Did you know that AI uses three times more electricity than a regular Google search?

By 2030, data centers will double their power consumption. And here's the problem: the world doesn't have enough copper to make that happen.

While everyone's buying shares of Big Tech, the real money is being made on what nobody sees—the metal that powers this entire AI revolution.

The Energy Crisis

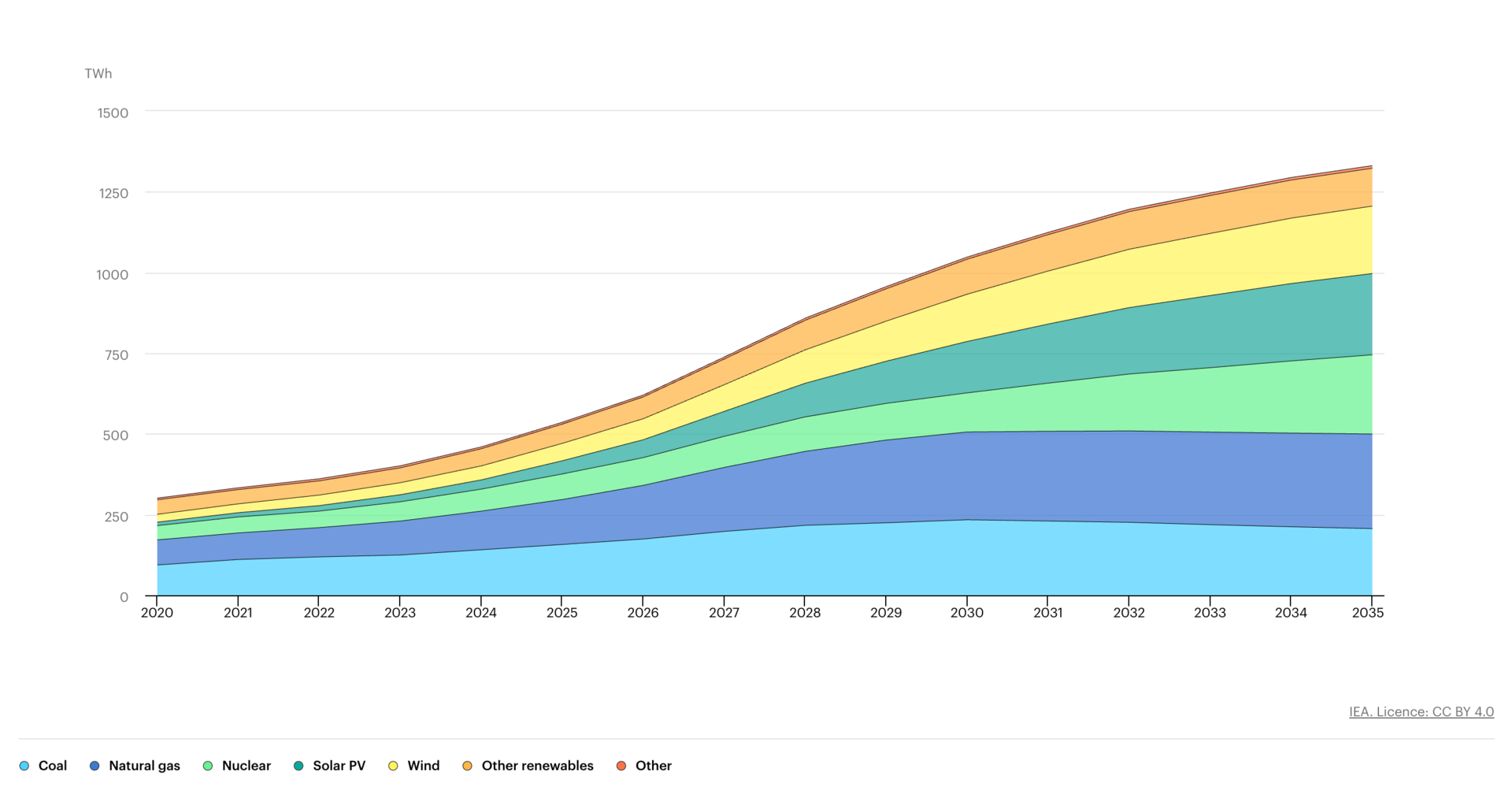

Sources of global electricity generation for data centres, Base Case, 2020-2035 (IEA)

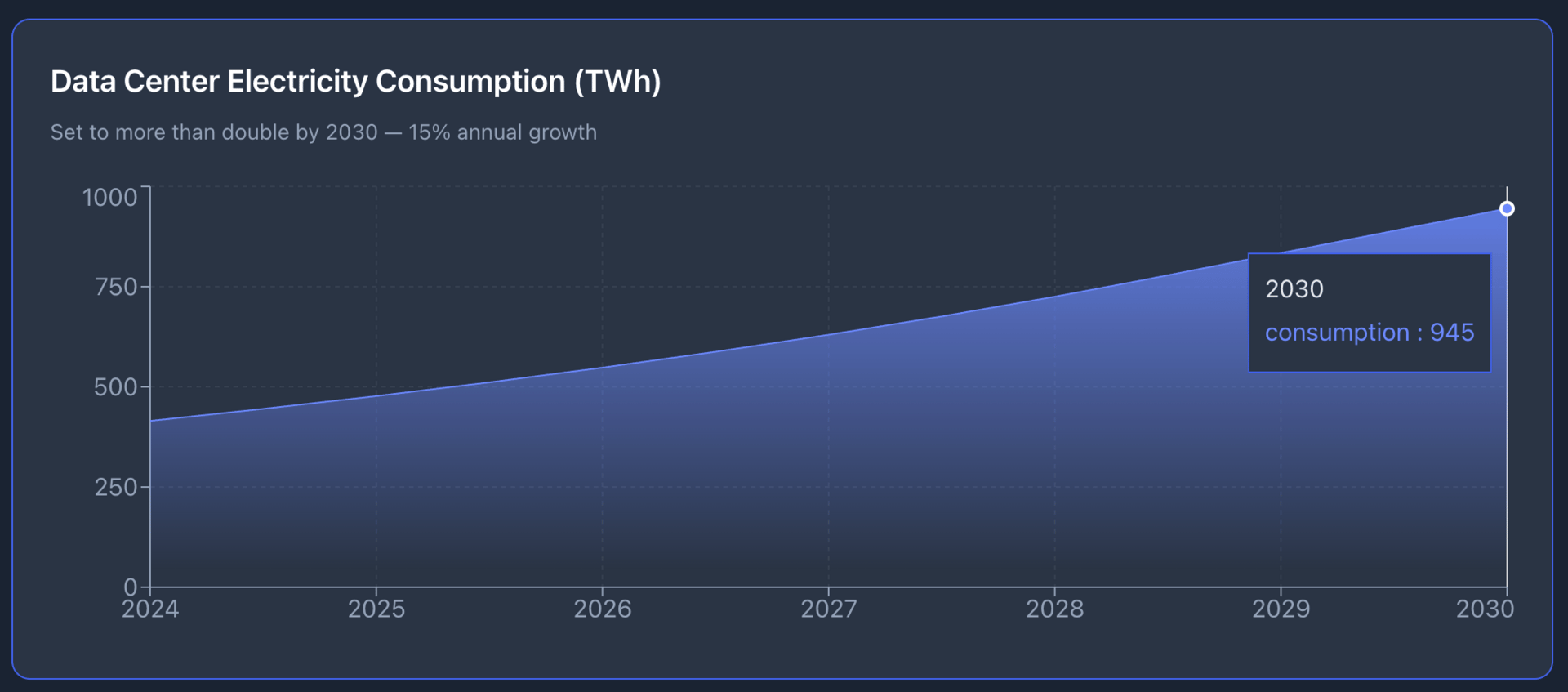

Data centers today consume about 415 TWh of electricity annually.

That's roughly 1.5% of global consumption. But artificial intelligence is changing the game.

According to the International Energy Agency (IEA), data center electricity consumption will grow 15% per year through 2030. That's four times faster than growth in every other sector combined.

Why? AI models need specialized accelerators—powerful GPUs installed in servers.

These accelerated servers are projected to grow electricity consumption at 30% annually.

Nearly half of the total increase in global data center power demand through 2030 comes from these machines alone.

Now the question is: where does this power come from? And how do you get it there?

What do you think is the biggest bottleneck for the AI industry's growth?

The Infrastructure Problem

Nearly 80% of global growth in data center electricity consumption through 2030 comes from the US and China.

In the US, per-capita consumption is already the highest in the world. In 2024, that's 540 kWh per person. By the end of the decade, that number jumps to 1,200 kWh. That's roughly 10% of the annual electricity consumed by an average American household.

How is the US meeting this demand? Natural gas remains the largest source of electricity for data centers—over 40%. And natural gas will add over 130 TWh of generation capacity by 2030.

Renewables (wind and solar) will meet nearly half of the additional demand. But the other half? Natural gas and coal will still cover over 40% of additional demand.

This means one thing: the energy problem isn't waiting.

It needs to be solved now. And that requires physical infrastructure—wires, transformers, substations.

All of this requires metal. Primarily copper.

Why Copper is the New Oil

Copper is the lifeblood of the power system. It's used in transmission lines, transformers, and cables. Without it, electricity can't reach data centers.

Here's the harsh reality: opening a new copper mine takes 10+ years. The world isn't ready for demand growth this steep. A copper shortage is inevitable.

While the Tech sector is overheated $XLK ( ▼ 1.6% ) is trading at all-time highs), copper miners $COPX ( ▲ 1.32% ) remain undervalued. Investors are chasing chips, forgetting that without copper, those chips are just silicon.

COPX vs CPER

There are two main ways to invest in copper: through a miners ETF $COPX or through futures $CPER.

$COPX ( ▲ 1.32% ) (Global X Copper Miners ETF) invests in companies that mine copper. When copper prices rise, miners' profits rise faster. That gives you leverage. Plus dividends.

$CPER ( ▲ 0.41% ) (United States Copper Index Fund) tracks copper futures contracts. It's a purer exposure to the metal's price, but without leverage and without dividends.

For long-term investors, COPX looks more attractive. Miners benefit not just from price increases, but also from operational efficiency gains.

Simple Math

The world needs over 1,000 TWh of electricity for data centers by 2030. To deliver that power requires tons of copper. This isn't hype. It's physics.

AI can't grow faster than the grid can support it. And while everyone's looking at the cloud, the real money is being made on the ground—in what powers those clouds.

Investing in copper now is a bet not on technology, but on the basic infrastructure without which that technology can't exist. The Tech sector is already expensive. Copper isn't. Yet.

While the market chases the next AI chip, smart money is going into metal.

What's catching investor attention today: Why NVIDIA Still Rules the AI Chip Market in 2025

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.

After reading this, where do you think the bigger investment opportunity is?