While you chase the next AI winner, Axon is already monetizing AI in nearly every police department across the US with 123% net revenue retention.

Here's what we know.

Axon closed 2024 with $2.1 billion in revenue, up 33% YoY. That marks three consecutive years of 30%+ annual growth. 2025 continued the growth trajectory.

Annual recurring revenue hit $1.1 billion. But these top-line numbers miss the real story.

The Margin Migration

Axon Body 3 (Source: Axon)

Axon $AXON controls 85% of the body camera market. That dominance is well-known.

What's less understood is how the company has methodically shifted its revenue composition toward high-margin software. Cloud and Services revenue reached $806 million in 2024, growing 44% YoY. That's now 40% of total revenue, up from roughly 30% just three years ago.

The margin profile tells you everything.

2024–2025 Financial Performance:

Axon closed 2024 with ~$2.1 billion in revenue, up ~33% YoY, marking its third consecutive year of 30%+ growth.

Q3 2025 revenue was $711 million (+31% YoY), continuing top-line growth and showing software & services is a key driver.

Hardware gross margins sit around 60%. Cloud and Services margins exceed 77%. Software-only margins have already crossed the 80% target threshold. This isn't a hardware company experiencing some software tailwinds. This is a deliberate business model transformation that's accelerating.

And it's working. Net revenue retention at 123% means existing customers are spending 23% more each year. That's not price increases. That's expanded product adoption across the software stack.

Axon Public Safety SaaS Ecosystem

Axon Records (Source: Axon)

Axon built a moat that starts with hardware and ends with software dependency. The body cameras are the entry point.

Once a department deploys Axon Body 4 cameras, they need Evidence.com to store and manage footage.

Evidence.com then becomes the central repository for all departmental evidence, not just video.

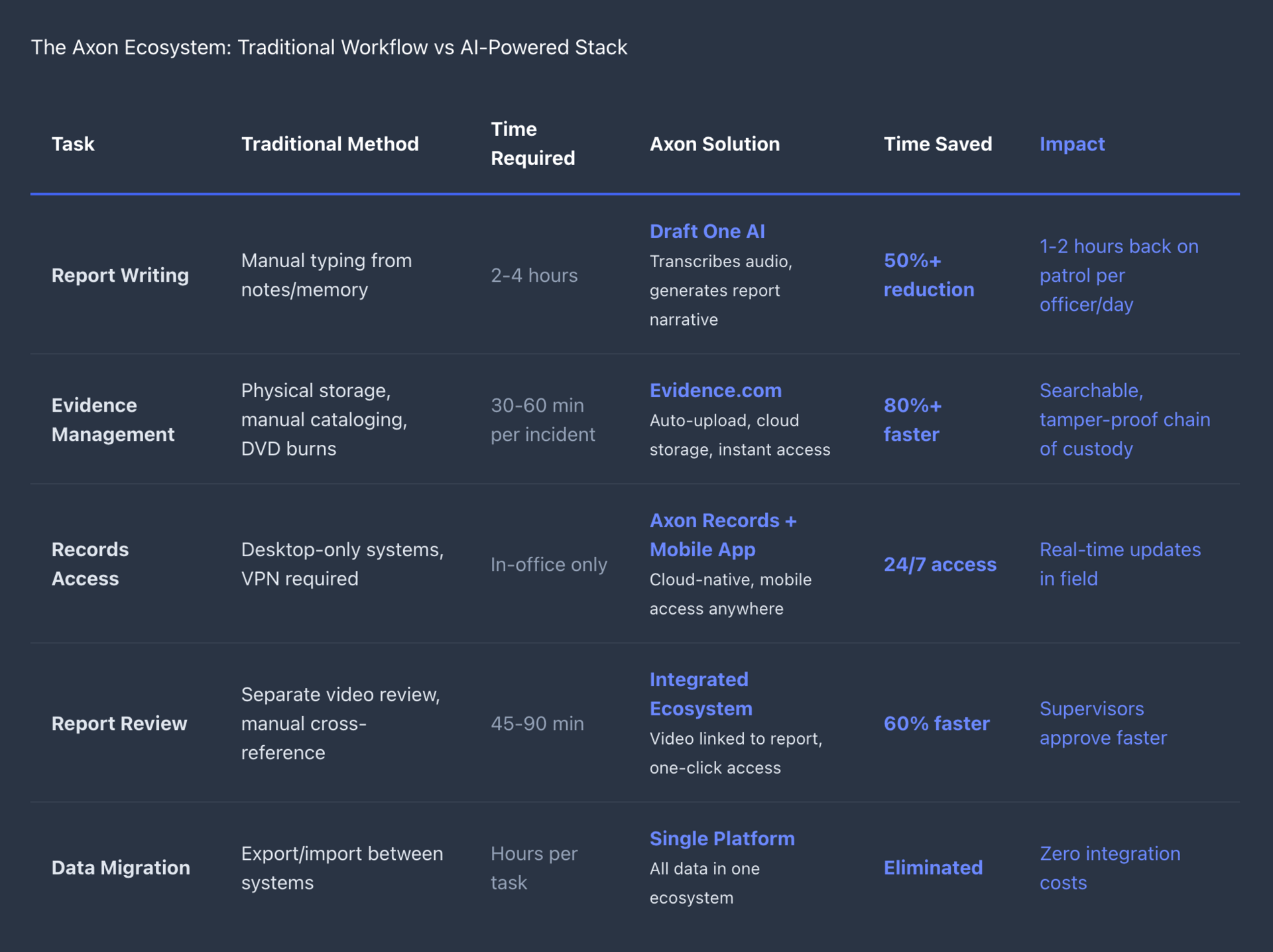

From there, departments add Draft One, Axon's Records and Axon app.

Axon Call-to-Closure Ecosystem

Hardware layer: Body cameras, TASERs, fleet and sensor devices capture real-time data in the field.

AI & cloud layer: Evidence.com securely stores, manages, and analyzes digital evidence.

Productivity tools: Draft One uses AI to generate police reports from audio/video.

Records & workflow: Axon Records unifies evidence, reports, and case management.

User interface: Axon App enables mobile, in-field access and workflow execution.

An end-to-end, AI-driven public safety SaaS ecosystem with high recurring revenue and strong customer lock-in.

In departments that have adopted it, report writing time drops by 50% or more. That's hours per officer per week returned to patrol duties.

Years of video evidence, report templates, chain-of-custody logs, and workflow integrations create technical and operational lock-in that makes CrowdStrike's endpoint dominancelook modest by comparison.

The Valuation Gap

Axon trades like a hardware company.

The market assigns it a multiple that reflects its body camera business. But compare the unit economics to pure software plays like CrowdStrike or Palantir, and you find a meaningful disconnect.

CrowdStrike trades at roughly 18x forward revenue with similar growth rates.

Palantir commands 30x+ despite lower growth.

Axon sits around 12x forward revenue. The composition shift to 40% high-margin recurring revenue hasn't fully translated into valuation rerating.

The ETF positioning reinforces this misperception.

Axon appears in defense and public safety ETFs like $DFEN and $PSC. These funds treat it as an industrial play. It's rarely positioned alongside software and AI names despite having better unit economics than many companies in $ROBO (Robo Global Robotics & Automation ETF).

That creates opportunity for investors who understand where the business is actually headed.

Do you agree that the market is mispricing Axon as a hardware company?

Growth Vectors

Axon's domestic police market penetration is mature. The company doesn't break out exact figures, but most major departments already run Axon equipment and tools.

Future domestic growth comes from three sources: refresh cycles on aging hardware, upselling software additions to existing customers, and expansion into federal agencies.

The refresh opportunity is real. Axon Body 4 launched recently with significant hardware improvements. Departments running Body 2 or Body 3 cameras will need to upgrade over the next three to five years. But the bigger revenue impact comes from attaching software subscriptions to those hardware refreshes. Each camera refresh is a chance to sell Draft One, expanded Evidence.com storage, and Real-time Operations licenses.

Federal expansion represents genuine white space. Local and state law enforcement adoption is high. Federal agencies lag significantly. The total addressable market there runs into billions, and Axon has barely scratched it.

International markets offer the most significant long-term upside. Axon's international revenue remains a small fraction of total sales.

Most developed countries have active procurement processes for body cameras and evidence management systems. The U.K., Australia, and parts of Europe have started deployments, but adoption rates are far behind the U.S.

Risk Factors

No analysis is complete without honest risk assessment. Axon faces real headwinds that could derail the growth trajectory.

Competitive pressure exists despite the monopoly position.

Motorola Solutions has resources and customer relationships. They're investing in competing offerings. Other smaller players continue to bid on contracts. But Axon is still dominant.

Public sector budget constraints matter. Police departments operate on tight budgets. Economic downturns or fiscal crises at the municipal level directly impact purchasing decisions.

Regulatory and political risk is inherent to the business. Public sentiment toward policing and surveillance technology shifts over time. Privacy concerns around facial recognition, AI-powered analytics, and data retention could trigger regulatory restrictions.

Axon has navigated these issues carefully, but one significant controversy could impact growth.

Technical execution risk increases as the company pushes deeper into AI and cloud infrastructure.

Draft One and similar AI tools need to work reliably. One high-profile failure where AI generates an incorrect report that leads to wrongful prosecution would create serious liability and reputation damage.

The Software Inflection Point

That 123% net revenue retention number deserves more attention than it typically receives. It confirms customers are expanding their Axon footprint aggressively. This isn't slow, incremental adoption.

Departments that start with cameras are rapidly adding software tools across the stack.

The trajectory on Cloud and Services revenue growth speaks for itself. Growing at 44% while the hardware business grows at mid-twenties percentage rates means the mix shift is accelerating.

If that continues for another two years, software could represent 50% of revenue with blended gross margins above 70%.

At that point, the comparison to hardware companies becomes absurd.

The business model looks like enterprise SaaS with a hardware component, not hardware sales with software attached. The market will need to reprice accordingly.

Position Sizing Considerations

Axon fits as a high-conviction position in the software/AI allocation with public sector and defense exposure providing diversification benefits. The monopoly position in body cameras offers downside protection.

The software transition provides meaningful upside optionality.

$AXON has run significantly over the past two years. Entries at current levels require conviction that the software narrative will continue to play out and eventually drive multiple expansion. Patient capital can build positions across the year, using any pullbacks on broader market weakness or company-specific concerns.

For portfolios seeking pure software exposure, Axon offers an unusual profile. It's not priced like traditional SaaS, but it's increasingly operating like SaaS.

That valuation-business model mismatch creates opportunity.

How do you view $AXON in a tech portfolio?

The investment thesis rests on one core belief: Axon's software ecosystem will continue converting hardware customers into high-margin, recurring revenue relationships.

Everything else is noise.

If you believe that thesis, the current valuation leaves room for material appreciation as the market recognizes the transformation already underway.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.