Asian equity markets posted strong gains Monday as President Trump signaled willingness to ease trade tensions with China.

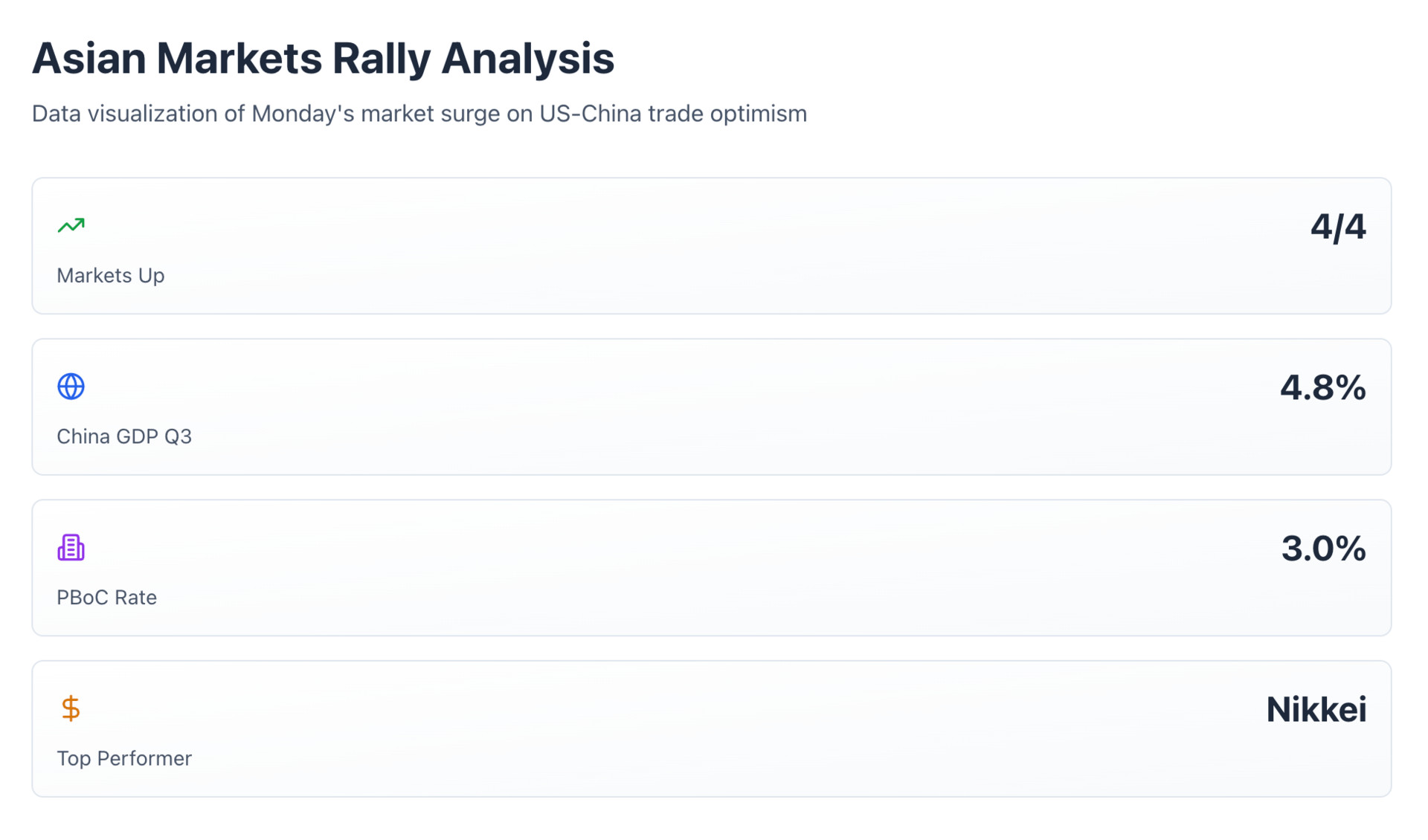

Nikkei 225 led the surge, climbing 3% to record highs after Japan resolved a political impasse.

Numbers That Matter

Hong Kong's Hang Seng jumped 2.1%, Shanghai Composite gained 0.74%, and South Korea's KOSPI added 0.36%.

Japan's breakthrough came on two fronts: progress on US-China dialogue and domestic political stability.

[AD North Digital]

What Changed

Trump acknowledged that 100% tariffs on Chinese goods are "not sustainable" and confirmed plans to meet with Xi Jinping at the APEC summit.

Scott Bessent is set to travel to China next week for direct negotiations.

I think we're going to be fine with China, but we have to have a fair deal.

The shift matters. After months of escalating rhetoric, both sides are preparing for substantive talks.

Markets responded immediately. It’s a clear signal that investors see room for compromise.

Japan's Political Reset

Japan's Liberal Democratic Party struck a coalition deal with opposition parties, clearing the path for Sanae Takaichi to become the nation's first female prime minister.

The Nikkei's $NI225 3% surge reflects investor optimism about continuity and potentially looser fiscal policy ahead.

Economic Backdrop

China's Q3 GDP grew 4.8% YoY, meeting expectations but trailing the prior quarter's pace.

The People's Bank of China held its benchmark lending rate steady at 3%, suggesting policymakers see no immediate need for stimulus adjustments.

Market Implications

Chris Weston from Pepperstone noted that markets "appear to be positioned for a favorable or at least less negative outcome" following Trump's comments. That assessment captures the current mood: cautious optimism rather than euphoria.

The data supports a nuanced view.

Growth across Asian indices was broad but measured.

Hong Kong's 2.1% gain reflects direct exposure to US-China relations, while Japan's 3% rally combines trade optimism with domestic political stability.

What's Next

Three factors will determine whether this rally has legs.

First, Bessent's China trip needs to produce concrete progress, not just diplomatic niceties.

Second, any tariff adjustments must address structural trade imbalances, not just headline rates.

Third, China's economic trajectory matters more than one quarter's GDP print.

The gap between current tariff levels and a sustainable framework remains wide. Trump's acknowledgment opens the door, but actual negotiations will test both sides' willingness to compromise on issues like technology transfer, market access, and enforcement mechanisms.

Japan's political stability adds a regional dimension. A new government with clearer policy direction could accelerate fiscal measures and strengthen Japan's role in US-Asia economic strategy.

Bottom Line

Monday's rally reflects relief that dialogue is replacing ultimatums.

But markets are pricing in progress, not resolution. The next few weeks will show whether this week's optimism was warranted or premature.

For now, the data shows investors betting on de-escalation.

Hong Kong and Shanghai gains suggest confidence in Beijing's negotiating position.

Japan's outperformance indicates broader regional optimism beyond the US-China bilateral dynamic.

Looking ahead, you are most concerned about:

Watch the Bessent trip, APEC summit preparations, and any concrete tariff adjustments.

Those will be the real tests of whether this rally marks a turning point or just another pause in a longer trade conflict.