Holiday markets move differently.

Volume drops 40% before major holidays. Human traders step away.

But algorithms? They're just getting started.

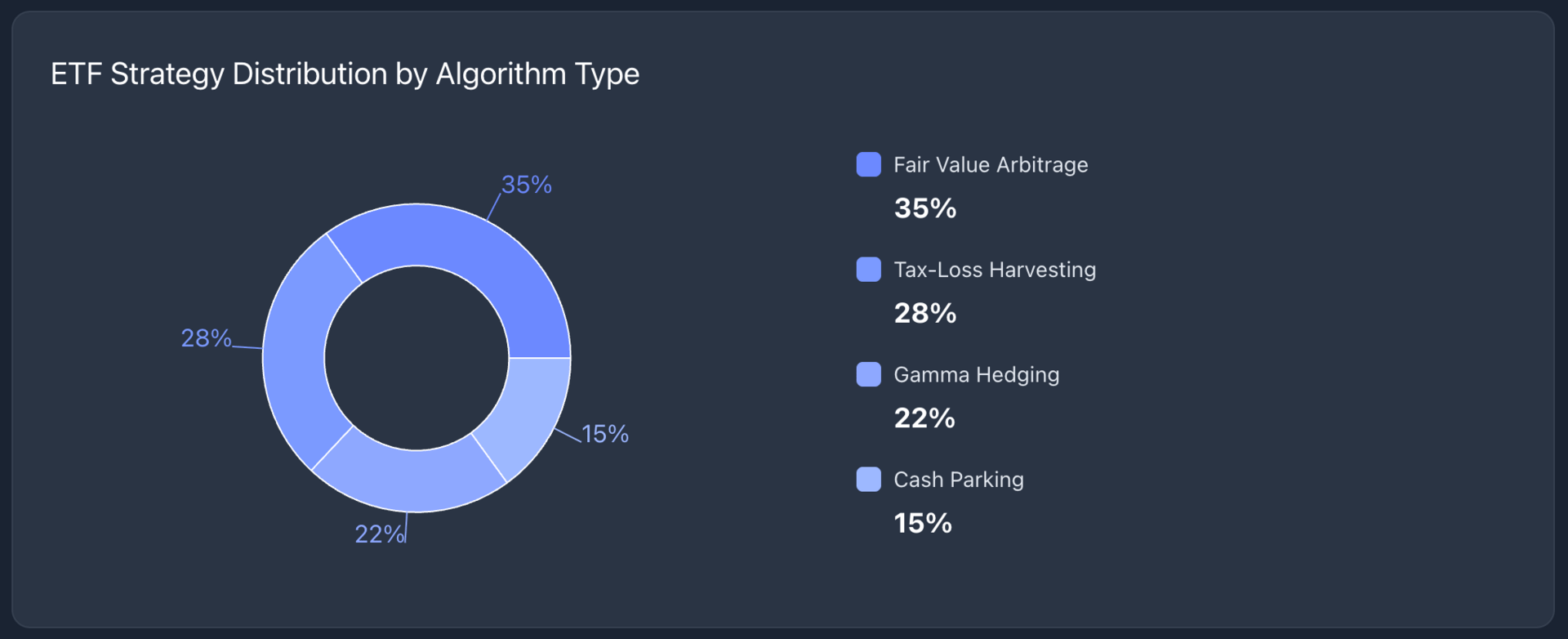

While retail investors close positions and institutional desks thin out, algorithmic trading systems are deploying ETFs as "liquidity proxies" to trade assets that are literally closed.

The scale matters, over $2.3 trillion in algorithmic ETF trades happen during low-liquidity periods annually.

That gap matters more than you might think.

Fair Value Arbitrage

Picture Thanksgiving Day. U.S. exchanges are closed. Tokyo and London are open. So how do algorithms trade a basket of American stocks when the NYSE is dark?

They calculate "fair value" for ETFs using futures contracts, currency moves, and correlated assets on open markets. Japanese ETFs listed in London keep trading even when Tokyo is closed for a holiday. Algorithms create synthetic prices using mathematical models while the actual stocks sit frozen.

The strategy works because ETFs provide continuous pricing. When the underlying market reopens, algorithms capture the spread between their model price and actual settlement.

Tax-Loss Harvesting

November and December trigger massive tax optimization programs.

This isn't risk hedging. It's tax hedging.

Algorithms scan portfolios for losing positions. Find Intel down 15%? The system sells the stock to lock in the loss for tax purposes, then immediately buys a semiconductor sector ETF like $SOXX ( ▲ 1.65% ) .

Why ETFs? They bypass the "wash sale" rule—the IRS prohibition on repurchasing identical securities within 30 days—while maintaining sector exposure. After 31 days, the algorithm can rotate back into the original stock if the model signals it.

The volume is substantial. Tax-loss harvesting drives roughly 12% of December trading volume in sector ETFs.

Gamma Hedging

Pre-holiday liquidity evaporates fast. Trading volumes in individual stocks can drop 60% the week before Christmas.

That creates serious problems for market makers holding options positions.

The issue: hedging an options position in a thinly traded stock can crater the price when there aren't enough buyers in the order book.

The solution: algorithms shift to highly liquid index ETFs— $SPY ( ▲ 0.84% ), $QQQ ( ▲ 1.45% ), $IWM ( ▲ 0.48% ) —for macro hedges. Instead of selling 50 different illiquid stocks before Christmas, the system sells one large ETF block that correlates with the portfolio.

This protects against gap risk, sudden price jumps when markets reopen after long weekends. Market makers learned this lesson the hard way after several holiday gap-down events in 2018 and 2020.

Cash Parking Strategies

Four-day holiday weekends create idle capital problems. Algorithms don't leave cash sitting in dollars.

They park free cash in ultra-short bond ETFs or money market ETFs to capture minimal returns over the weekend while maintaining instant liquidity for the first trading day back.

The mechanics are simple but effective. Money goes in Friday at 3:59 PM, comes out Tuesday at 9:31 AM, with a small yield captured in between.

What Investors Should Know

The holiday ETF strategies used by algorithms reveal a basic truth: liquidity is survival during thin markets. ETFs become technical tools rather than investment vehicles.

For individual investors, the takeaway is clear. Avoid placing market orders during holiday-adjacent sessions. Use limit orders.

Expect wider spreads. And understand that the prices you're seeing may be algorithmically generated fair values rather than true market clearing prices.

The machines keep trading when humans take holidays. Understanding how they operate gives you an edge in knowing when to step in and when to stay out.