Nvidia agrees to invest $100 billion in OpenAI.

OpenAI spends tens of billions buying Nvidia chips. Oracle drops $300 billion on a cloud deal with OpenAI, then turns around and buys more Nvidia hardware.

See the pattern?

Some world's top financial analysts just shared fears of an AI bubble.

Market Concentration Trends

Current data shows notable concentration in market performance:

A significant portion of S&P 500 gains this year came from tech and AI-related stocks

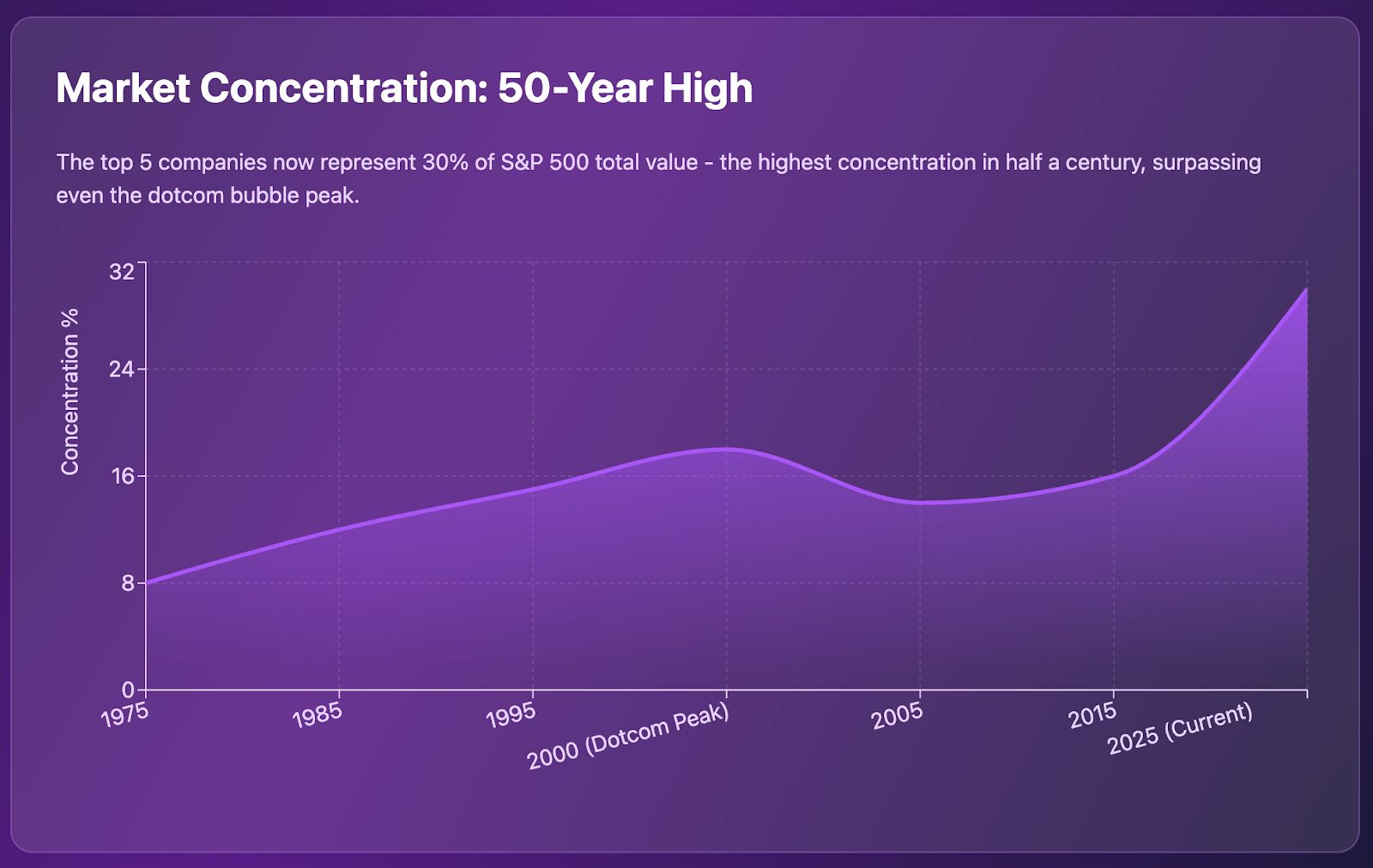

Five companies, mostly AI plays, now make up 30% of the S&P 500's total value

That's the highest concentration in 50 years.

Capital expenditures in the AI sector have reached substantial levels

Morgan Stanley's lead analyst isn't mincing words. He's "very concerned" about what he's seeing. The IMF and Bank of England just joined him. Their message? ‘Buckle up.’

Share price valuations on U.S. stock markets were similar to those seen near the peak of the dotcom bubble on some measures… 30% of the U.S. S&P 500's valuation was made up by the five largest companies, the greatest concentration in 50 years.

Experts’ Comments

The International Monetary Fund dropped some comments that caught Wall Street's attention.

Uncertainty is the new normal and it is here to stay

Seems an AI trade is fragile, and everyone knows it.

The Bank of England went further. "The risk of a sharp market correction has increased," their Financial Policy Committee stated in their quarterly update.

They're not talking about a minor dip. They're warning about an AI-triggered market slump with "material" spillover risks to Britain's entire financial system.

Reuters reported that ‘stock valuations are now tracking near dotcom bubble peak levels.’

That's not hyperbole.

Not everyone sees disaster ahead.

Several analysts note critical differences from 2000. Today's tech giants generate substantial profits and real cash flows, unlike the dotcom era's revenue-free ventures.

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Circular AI Deals

Look at the Bloomberg chart. Follow the arrows.

Nvidia invests in OpenAI. OpenAI buys from Nvidia. Microsoft invests in OpenAI. OpenAI signs cloud deals with Microsoft and Oracle. Everyone involved buys more Nvidia chips.

It's a closed loop. Money flows from tech giants to AI startups, then right back to the same tech giants selling the infrastructure. AMD gets in on the action by deploying GPUs for OpenAI while giving OpenAI the option to buy 160 million AMD shares.

This isn't diversification. It's the same dollars moving in circles, inflating valuations each time around.

Morgan Stanley's analyst, widely considered one of Wall Street's sharpest minds, sees echoes of Cisco's moment in 2000. Back then, Cisco was the "must-own" infrastructure play. Then the music stopped. The stock fell 86% over two years.

What the Data Actually Shows

Business Insider points out that valuations, while stretched, aren't quite at 1999 levels when you adjust for interest rates and earnings quality.

Fair point. Nvidia's earnings are real. So are Microsoft's and Oracle's.

These companies have proven business models, strong balance sheets, and actual earnings to support their valuations.

The AI infrastructure being built serves genuine demand across industries. While concentration is high, the underlying fundamentals are considerably stronger than 1999's speculative frenzy.

What Smart Investors Are Watching

The Bank of England used the word "material" to describe spillover risks.

That's regulatory speak for "this could break things beyond just stock prices."

The IMF doesn't typically wade into market timing. But Georgieva's warning about persistent uncertainty signals something shifted. Central banks are nervous. Not about AI as technology—about AI as a financial structure built on leverage, concentration, and circular capital flows.

The question isn't whether AI is real. It clearly is.

The question is whether $4.5 trillion in Nvidia market cap, $500 billion in OpenAI valuation, and $3.9 trillion in Microsoft makes sense when the same money keeps flowing through the same companies.

The AI Bubble Fears

30% concentration in five stocks. Check.

Massive capital expenditures chasing future growth. Check.

Valuations that assume perfect execution for years. Check.

The parallels to 2000 are uncomfortable. Experts paid to watch for systemic risk—the IMF, Bank of England, Morgan Stanley's top minds—are saying it out loud now.

Unlike 2000, today's tech giants have profits backing their valuations. Strong fundamentals and actual cash flow support current AI investments.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.