HO HO HO! Happy Holidays!

May your ETF flows be positive, your rebalancing be seamless, and your holiday season overflow with passive income and active joy!

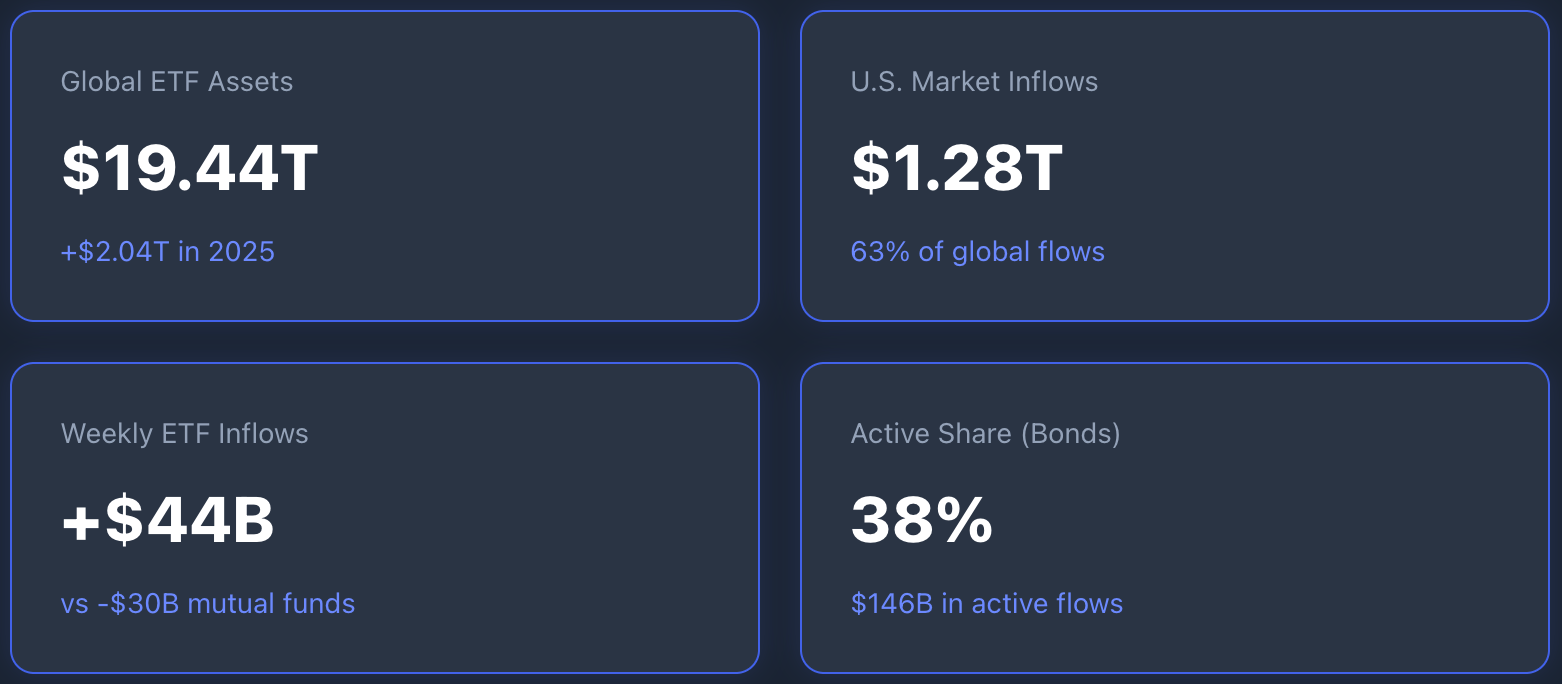

As we know, global ETF assets hit $19.44 trillion by November 2025.

Net inflows reached $2.04 trillion, the highest figure on record.

That's 22% more than 2024's already impressive $1.67 trillion. The U.S. market alone pulled in $1.28 trillion, with assets now standing at $13.2 trillion.

They're the final numbers from a year that redefined how capital moves through markets.

The Great Migration Continues

Investors withdrew capital from mutual funds for the third consecutive year. At the same time, ETFs captured record inflows across every major asset class.

The pattern held week after week. Recent data from the Investment Company Institute shows mutual funds losing roughly $30 billion weekly while ETFs gained $44 billion.

Over the past decade, ETFs accumulated $6.1 trillion in net inflows. Mutual funds shed $2.4 trillion. The structural shift isn't slowing—it's accelerating.

The data shows a massive shift, but what does your portfolio look like?

In 2025, mutual fund managers launched 40+ conversions to ETF structures, representing $29 billion in assets.

Data from BofA shows the average converted fund lost $150 million in the two years before conversion, then gained $500 million after switching to the ETF wrapper.

Why Transparency Beats Tradition

Three factors explain the exodus.

First, costs. ETFs charge lower expense ratios for comparable exposure.

Second, tax efficiency. The ETF structure allows for in-kind redemptions, minimizing capital gains distributions that hit mutual fund holders annually.

Third, transparency. Real-time pricing and daily holdings disclosure matter to institutional buyers who need to know exactly what they own.

But 2025 added a fourth factor: behavioral adaptation. Something changed this year.

When the S&P 500 dropped 9.1% in early April, its worst weekly performance of the year, investors poured $27 billion into U.S. equity ETFs the following week. That's 70% above the average weekly inflow.

Compare that to 2024, when flows typically fell 18% after negative weeks.

Investors stopped treating ETFs like trading vehicles. They started treating them like long-term building blocks.

Fixed Income Leads the Charge

Equity ETFs grabbed headlines, but fixed income drove the real story.

Bond ETFs pulled in $344 billion through October, already surpassing 2024's $294 billion record.

That represents a 20% organic growth rate. Fixed income now accounts for $2.19 trillion of total ETF assets, roughly 17% of the market. Two years ago, that figure was 13%.

Active strategies captured 38% of all fixed income flows in 2025, totaling $146 billion. That share exceeded active's footprint in any other asset class. Why? Interest rates stabilized near decade highs, making security selection valuable again.

Duration management mattered. Credit rotation mattered. Managers could actually add alpha. Investors noticed, directing capital to strategies that combined ETF tax efficiency with active decision-making.

Do you believe Active ETFs will outperform Passive Indexing in 2026?

Ultra-short duration products led the way. The iShares 0-3 Month Treasury Bond ETF recorded $35 billion in inflows, extending its streak to 25 consecutive months of net additions.

Ultra-short allocations captured 53% of all Treasury flows—nearly double 2024's share.

Macro Conditions Created Demand

Political uncertainty doesn't typically boost investment flows. But 2025 proved different. Tariff announcements in April sent markets down.

A prolonged government shutdown followed. Policy ambiguity remained elevated throughout the year. Instead of pulling back, institutional investors doubled down on liquid, transparent exposures.

Low rates persisted longer than expected. Corporate debt levels stayed elevated. Geopolitical risks remained omnipresent. In that environment, standardized ETF structures became the default choice for portfolio construction.

Institutions needed building blocks they could trade, hedge, and rebalance without embedded tax liabilities or redemption restrictions. ETFs delivered exactly that.

The data supports this thesis.

Equity ETFs saw inflows even during market pullbacks.

Fixed income ETFs attracted capital regardless of rate movements.

Alternative strategy ETFs grew from $88.5 billion in June to $118 billion by year-end.

The rally wasn't concentrated among a few issuers, it spread broadly across managers.

Winners & Losers

Active strategies weren't the only beneficiaries.

Thematic ETFs reversed years of outflows, capturing renewed investor interest. Gold and precious metals products saw substantial demand as investors sought inflation hedges.

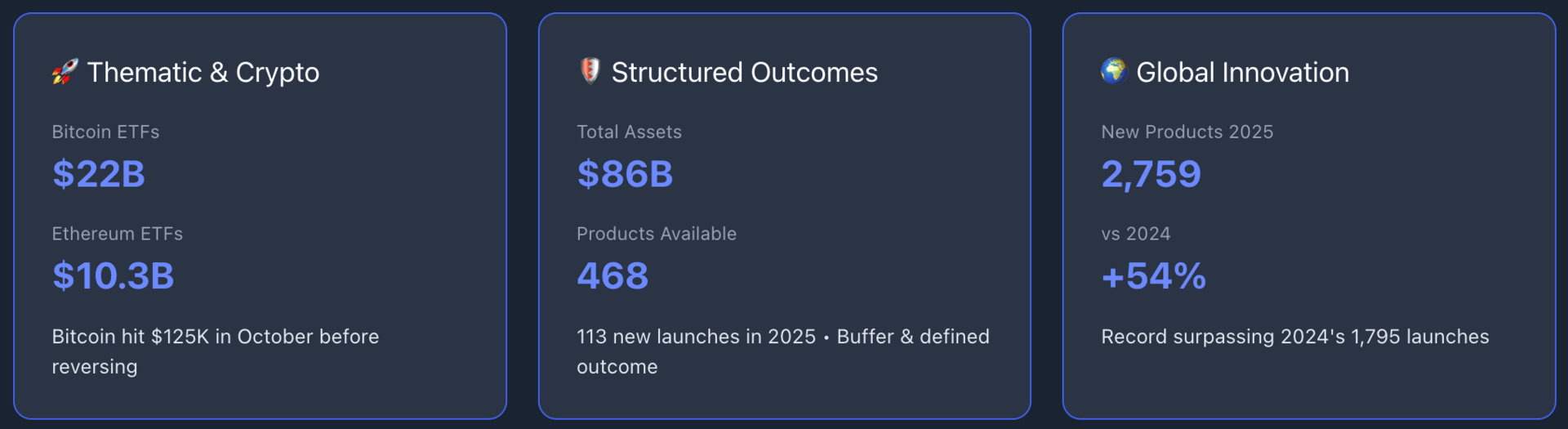

Crypto ETFs added $22 billion in Bitcoin exposure and $10.3 billion in Ethereum—though Bitcoin faced volatility after hitting $125,000 in October before reversing course.

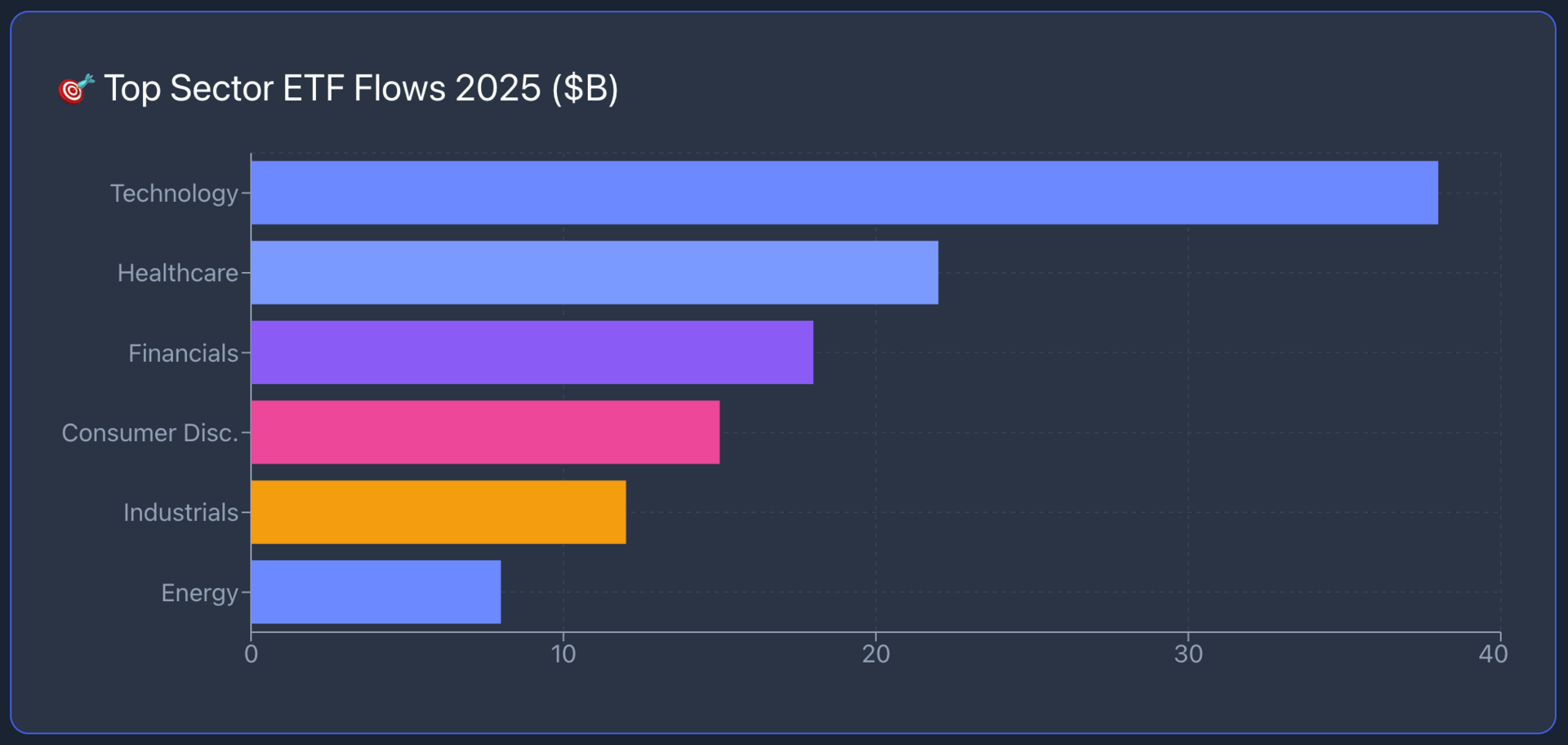

Tech sector ETFs led flows with $38 billion, maintaining positive inflows in 10 of 11 months.

Sector-specific allocations represented nearly 10% of all equity ETF flows in 2025—more than double 2024's 4% share.

Small-cap ETFs, however, struggled despite positive performance from the Russell 2000. Flows didn't match returns, suggesting investors remained cautious about extending down the market cap spectrum.

Structured outcome products—buffer and defined outcome ETFs—crossed $86 billion in assets with 113 new launches.

These products now number 468 in the U.S. market, mostly providing exposure to the S&P 500, NASDAQ-100, and Russell 2000 with downside protection.

Portfolio Construction Implications

The numbers tell a clear story about portfolio evolution.

ETFs have become the default wrapper, not the alternative. Advisors now build core allocations in ETF structures first, adding individual securities as tactical overlays. Model portfolios increasingly use ETFs exclusively, driven by operational efficiency and tax management benefits.

This shift changes how we think about asset allocation. ETFs aren't just passive index trackers anymore. They're vehicles for active management, alternatives exposure, thematic strategies, and structured outcomes. The wrapper separated from the strategy. That separation allowed capital to flow toward the most efficient structure rather than being constrained by legacy fund formats.

Looking forward, the trend shows no signs of reversing. With 2,759 new products launched globally in 2025—a record that surpassed 2024's 1,795—the innovation pipeline remains full.

More mutual fund conversions are pending SEC approval. Active managers continue entering the ETF space. Infrastructure for alternatives in ETF wrappers is expanding.

For investors, the message is straightforward: ETF structures now dominate capital flows across asset classes.

Understanding this shift isn't optional.

It's fundamental to understanding how modern portfolios are built, managed, and optimized.

What's catching investor attention today: $1.28 Trillion Poured Into ETFs in 2025. The Biggest Wealth Shift in a Decade

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.