The Death of the "Peace Dividend"

Between 2026 and 2035, European countries alone will add ≈ $2.8–3.2 trillion in new defense spending (based on NATO Secretariat & SIPRI estimates). The U.S. has already locked in $1.01T+ for 2026. This isn’t a cycle—it’s the new baseline.

For the last 30 years, investing in defense was a cyclical game. You bought the conflict, sold the peace. That era is officially over.

As we move through Q4 2025, we are witnessing a fundamental repricing. With the rise of "Sovereign AI" and a multi-polar landscape, governments are treating defense contractors less like vendors and more like regulated utilities: essential, guaranteed, and permanently funded.

Here is why iShares U.S. Aerospace & Defense ETF ($ITA) is the ETF to own.

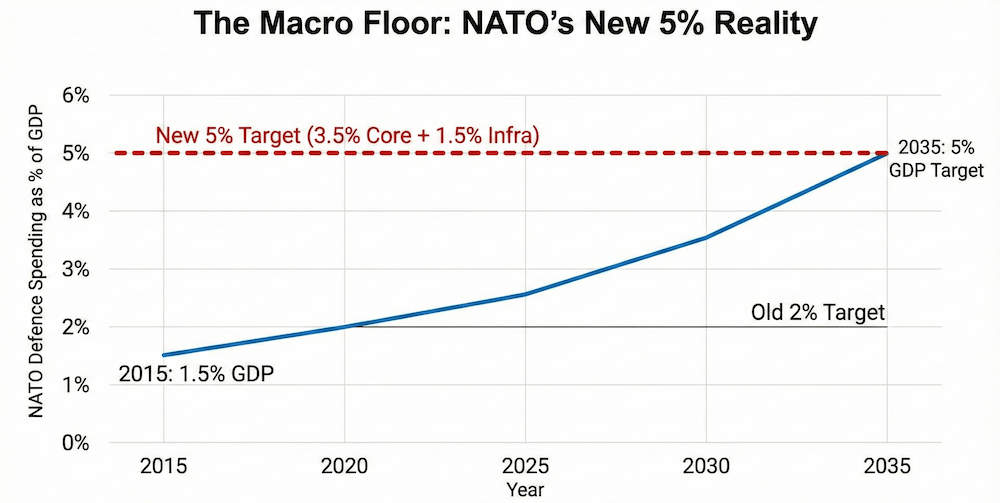

The Macro Floor: NATO’s New 5% Reality

At the recent NATO Summit in The Hague, the alliance effectively abandoned the old 2% GDP target. The new structural commitment is 5% of GDP (3.5% core + 1.5% infrastructure).

While Spain remains a notable exception (~2.1%), the broader trend is undeniable. Sweden has already boosted spending to 2.8% of GDP in its 2026 budget—an 18% year-over-year increase.

$3 Trillion in New Money Already Flowing into the Sector by 2035

The U.S. Budget: Crossing the Rubicon

In September 2025, the Pentagon shattered the psychological barrier. The total defense capability budget has officially hit $1.01 Trillion.

Historically, budget cuts followed wars. Today, despite no large-scale deployment of US troops, the budget is growing at ~13-15% YoY.

Procurement: ~$197-205 Billion allocated for hardware.

The AI Pivot: A historic $13.4 Billion specifically for AI & Autonomy.

This AI spending is not research; it is operational implementation. Defense primes are becoming tech integrators with government backing.

$1 Trillion Is Now the Floor, Not the Ceiling

The "Utility" Model: Sticky Revenue

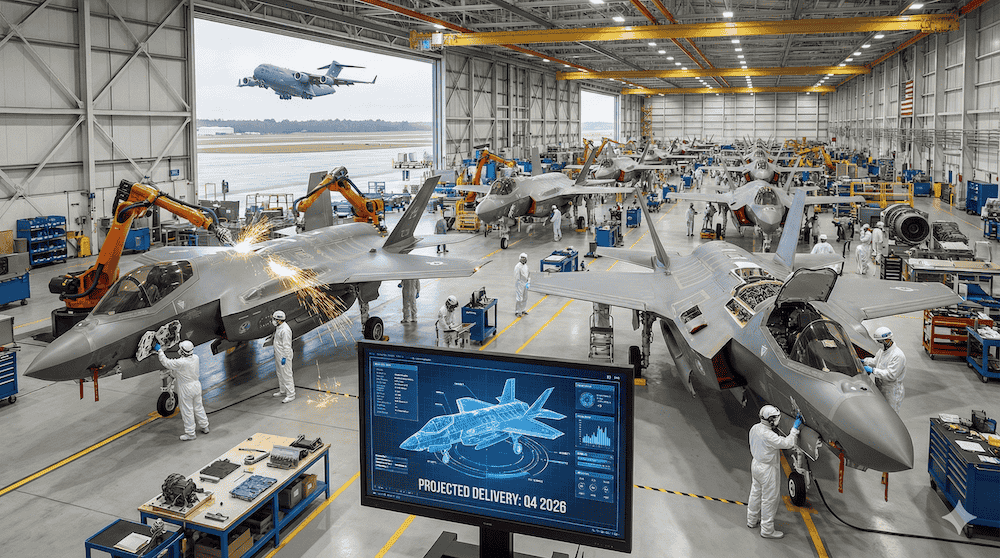

Why compare Defense to Utilities? Revenue Stickiness. Utility companies have power purchase agreements. Defense primes have the F-35.

Global Fleet: Projections exceed 3,500 aircraft.

2025 Deliveries: Lockheed Martin targets 170-190 deliveries this year.

The "Lock-In": The UK’s purchase of 12 new nuclear-capable F-35As proves that even with delays, contracts are never cancelled. The cost of switching is too high.

A Backlog Bigger Than the GDP of Many European Nations

The Risks: A Reality Check

But before you rush to buy, let’s honestly look at the risks—there aren't many, but they exist.

Program Delays (Block 4): The F-35 "Block 4" upgrade faces software hurdles, potentially pushing full capability to 2031.

Political Shifts: While the $1T budget is proposed, specific allocations (tanks vs. drones) can shift.

Valuation: If interest rates stay "higher for longer," 2-3% dividend yields face competition from risk-free cash.

The ETF Play: Why $ITA?

$ITA (iShares U.S. Aerospace & Defense) offers the purest exposure to this thesis.

Key Stats (Dec 2025):

AUM: ~$11.86 Billion

Top Holdings: Concentrated in the "Primes" like GE Aerospace (~21%), RTX Corp (~15%), and Boeing (~7.8%).

The Opportunity: There is currently a valuation arbitrage. While GE Aerospace has soared, giants like Lockheed Martin have lagged. As the market digests the $1.01T floor, we expect capital to rotate into these undervalued giants, lifting the ETF.

The Bottom Line

As the Bank of America Global Research team recently noted: the defense sector is moving from a "geopolitical hedge" to a "foundational portfolio allocation."

$ITA is not a 2026 trade. It is the new "utility" position for the next 10–15 years.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.