Companies will spend $213 billion on cybersecurity in 2025.

That's not a prediction. That's what Gartner forecasts as the new baseline for corporate survival.

Traditional defense contractors built empires selling missiles and fighter jets to governments.

But modern warfare doesn't follow those rules anymore.

A hospital shutdown in London causes more chaos than a drone strike. A ransomware attack on a food supplier creates instant shortages across grocery stores.

The battlefield moved from deserts to data centers, and most companies weren't ready.

The Numbers Tell the Real Story

Gartner, 2025 CIO and Technology Executive Agenda: Grow the Digital Vanguard (Louis Columbus/LinkedIn)

Global cybersecurity spending jumped 10% between 2024 and 2025.

Two factors drove that increase above everything else: the rise of generative AI tools creating new attack surfaces, and a massive shortage of qualified security professionals forcing companies to pay for outside help.

IBM analysis shows companies now prioritize security services, security software, and network security as their top three spending categories.

Cloud migration accelerated this shift. Organizations moving operations to cloud environments discovered they needed different security tools.

Cloud access security brokers and cloud workload protection platforms will reach $8.7 billion in spending by the end of 2025, up from $6.7 billion in 2024.

The SEC Rules

The SEC changed the game in 2023 with new disclosure requirements.

Companies now have four business days to report material cybersecurity incidents on Form 8-K. That's not four business days to investigate. That's four days from determining an incident is material to filing the report.

The SEC issued guidance clarifying that companies can request reporting delays only when disclosure poses substantial risk to national security or public safety, not when the incident itself creates those risks.

This distinction matters. Companies can't hide breaches behind vague safety concerns.

Enforcement followed quickly. In October 2024, the SEC charged several technology companies with making materially misleading disclosures about cybersecurity risks, with penalties ranging from $990,000 to $4 million.

These cases targeted two specific problems: disclosures that mentioned incidents but omitted material details, and disclosures that didn't change after major breaches occurred.

The message from regulators is direct.

Update your disclosures when reality changes. Keep policies and procedures ready to escalate incidents fast. Don't downplay the severity of breaches in public statements.

Critical Sectors Under Siege

Hackers shifted tactics between 2024 and 2025.

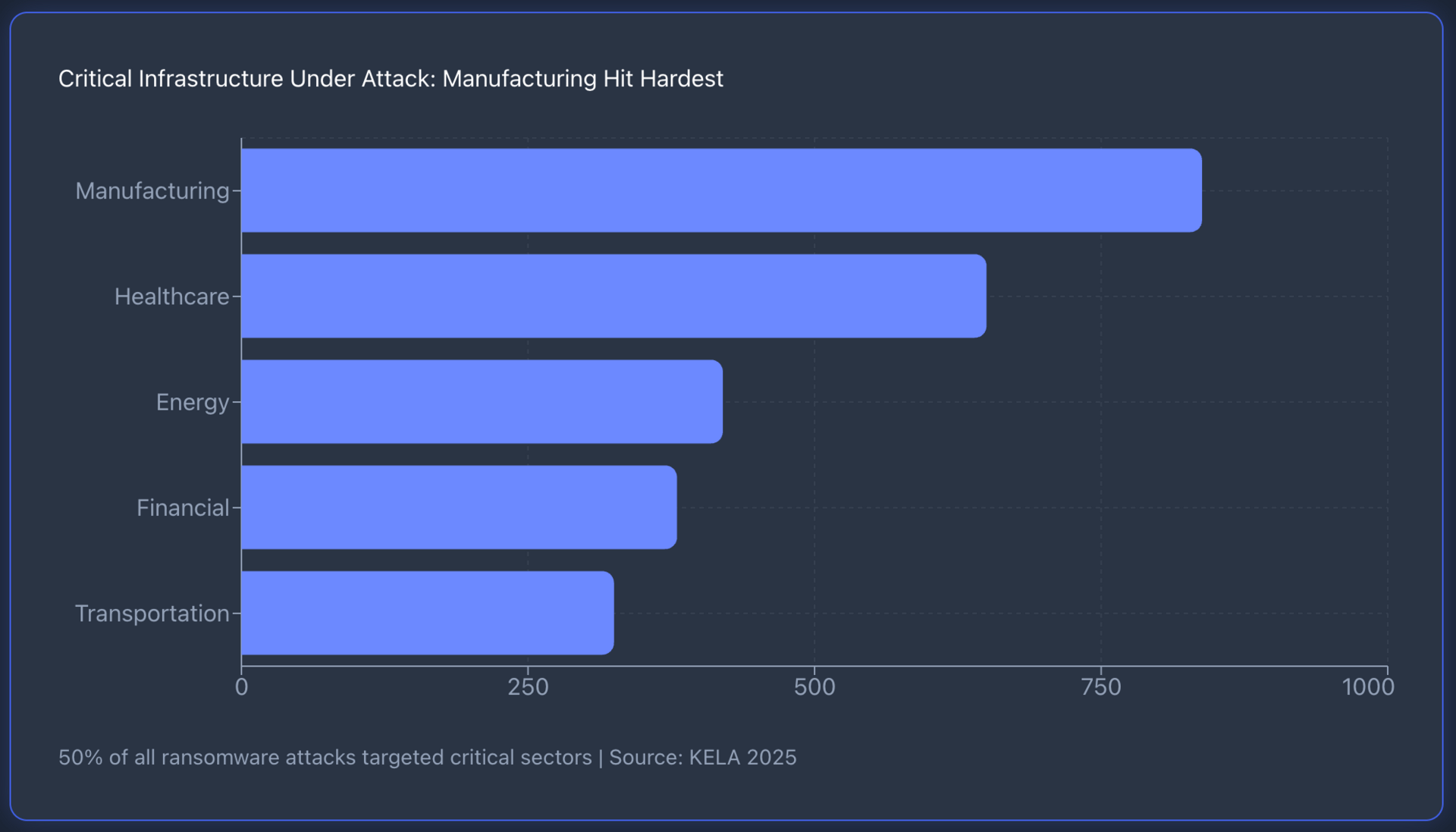

Half of all cyber attacks in 2025 targeted critical infrastructure sectors, with 4,701 incidents recorded globally between January and September, up 34% from the same period in 2024. Manufacturing saw the sharpest increase at 61%.

Why target factories instead of banks? The answer is leverage.

Manufacturing attacks create immediate production shutdowns and supply chain failures. Healthcare breaches disrupt patient care across entire regions. Energy sector compromises threaten power grids serving millions.

The United States accounted for roughly 1,000 incidents, about 21% of global attacks in 2025. Five ransomware groups caused nearly 25% of all incidents globally: Qilin, Clop, Akira, Play, and SafePay.

Real examples show the scale of damage.

Change Healthcare suffered an attack in 2024 that paralyzed payment systems for doctors across the United States for weeks, costing over $800 million.

London hospitals cancelled thousands of surgeries after the Synnovis breach.

United Natural Foods faced supply chain disruptions affecting grocery stores nationwide.

What This Means

Defense spending isn't disappearing. It's diversifying.

Traditional contractors like Lockheed Martin and Raytheon still generate revenue from government contracts for physical weapons. But the growth is happening elsewhere.

Cybersecurity ETFs tracking companies like $CIBR, $HACK, and $BUG represent the new defense infrastructure.

These funds invest in firms providing cloud security, endpoint protection, managed security services, and threat intelligence platforms. The companies in these portfolios don't wait for government contracts. They serve the private sector dealing with attacks right now.

$CIBR (First Trust NASDAQ Cybersecurity ETF) holds network security leaders like Palo Alto Networks and Fortinet, companies selling firewalls and threat prevention.

$HACK (ETFMG Prime Cyber Security ETF) spreads weight across endpoint detection firms like CrowdStrike and identity management platforms.

$BUG (Global X Cybersecurity ETF) focuses on pure-play cybersecurity companies deriving most revenue from security products.

All three ETFs emphasize cloud workload protection and zero-trust architecture.

Corporate budgets for cybersecurity keep increasing regardless of economic conditions. Organizations assess cybersecurity as mandatory spending, not optional investment, driven by regulatory requirements and the expanding threat landscape. Recession or growth, companies need to protect their operations.

The global shortage of cybersecurity professionals creates sustained demand for security services. Companies without in-house talent hire outside help through security consulting services, professional services, and managed security providers. This trend shows no signs of reversing.

Corporate budgets for cybersecurity keep increasing regardless of economic conditions. Organizations assess cybersecurity as mandatory spending, not optional investment, driven by regulatory requirements and the expanding threat landscape. Recession or growth, companies need to protect their operations.

The global shortage of cybersecurity professionals creates sustained demand for security services.

This trend shows no signs of reversing.

The Reality Check

Half of cybersecurity professionals report their budgets remain underfunded. Two-thirds say their jobs are more stressful than before. Only 40% feel confident their teams can handle a major attack.

That gap between what companies spend and what security teams need reveals the core problem.

Money alone doesn't solve cybersecurity challenges. Organizations need skilled people, tested incident response plans, and leadership that understands digital risk as business risk.

Traditional defense stocks will continue generating returns from government contracts.

But investors watching where money flows next should follow corporate security budgets. That's where companies bet on their actual survival.

The battlefield moved, and so did the spending.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.