Why are NVIDIA’s robots sitting like this? The answer is alarming. (from Behind the Markets)

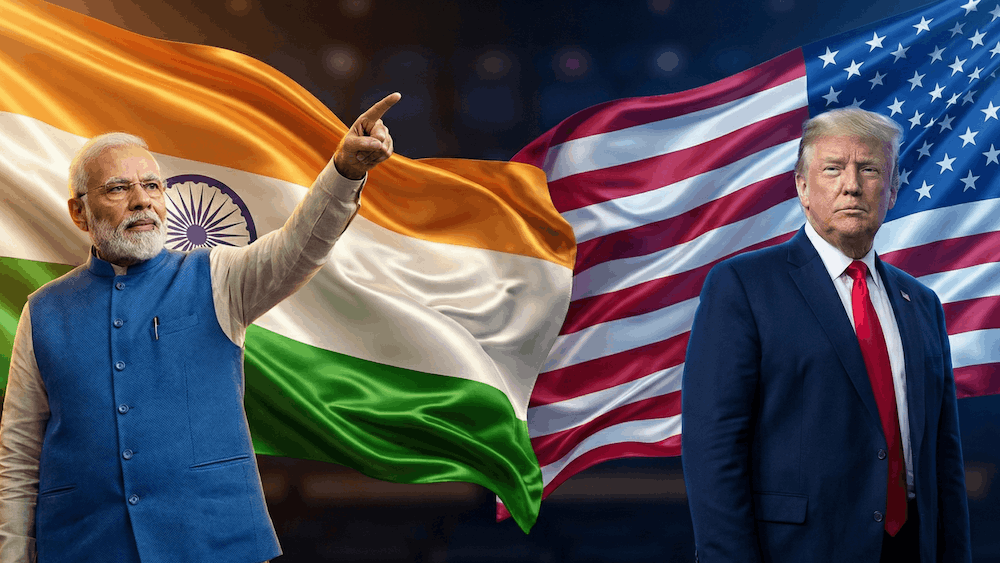

The US and India just secured a landmark trade framework slashing tariffs from 50% to 18%.

It’s establishing bilateral cooperation on critical minerals, a strategic move positioning both nations to develop supply chain alternatives for materials essential for defense, clean energy, and advanced electronics.

Here's what we know.

The Tariff Math

Marco Rubio and Indian External Affairs Minister Subrahmanyam Jaishankar finalized discussions on Tuesday that extend beyond conventional trade mechanics.

The deal formalizes cooperation on critical minerals exploration, mining, and processing: three components where Chinese companies currently process approximately 60-80% of global refining capacity across lithium, cobalt, and rare earth elements (IEA).

The tariff reduction from 50% to 18% represents more than relief for Indian exporters.

India now holds a marginal competitive edge over Vietnam and Bangladesh, both facing 20% tariffs, creating procurement advantages for U.S. companies sourcing technology components, textiles, and pharmaceutical ingredients from the subcontinent.

The $500 Billion Question

President Trump announced India committed to purchasing more than $500 billion in U.S. energy, technology, agricultural products, and goods. But here's the thing: that figure includes existing project pipelines alongside new spending in data centers and energy infrastructure.

This isn't fresh capital deployed tomorrow. The commitment blends contracted obligations already underway with projected future investments across sectors where Indian demand was trending upward regardless. For investors evaluating immediate market impact, distinguish between incremental new flows versus repackaged existing commitments.

The Russian oil dimension adds complexity. Trump stated India agreed to halt Russian crude purchases. Modi hasn't confirmed that condition explicitly. India remains among Russia's largest oil customers, acquiring discounted crude since Moscow's Ukraine invasion. Any actual cessation would redirect roughly 1.5-2 million barrels per day currently flowing from Russia to India, creating opportunity for U.S. energy exporters while simultaneously tightening India's energy procurement costs.

Which component of the U.S.-India trade deal creates the most significant long-term investment opportunity?

Critical Minerals: The Strategic Core

The timing tells you everything. Jaishankar's visit coincided with the inaugural Critical Minerals Ministerial hosted by Rubio at the State Department, drawing delegations from over 50 nations.

It represents coordinated infrastructure to reduce dependence on Chinese-controlled supply chains for minerals powering defense systems, electronics, and clean energy technologies.

The U.S. circulated a draft framework requesting participating countries commit to standards for mining, processing, and recycling critical minerals. By establishing alternative sourcing networks with environmental and labor standards that differentiate from Chinese operations while building redundancy into materials supply chains.

Why this matters for portfolio positioning:

India possesses significant reserves of titanium, chromite, graphite, and rare earth elements. Current extraction remains underdeveloped due to regulatory frameworks, infrastructure gaps, and capital constraints. U.S. partnership brings technical expertise, capital access, and market certainty.

For defense contractors, renewable energy manufacturers, and electronics producers facing supply chain fragility, diversified sourcing from allied nations reduces geopolitical risk premiums currently embedded in procurement planning.

Companies dependent on Chinese rare earth processing—which includes virtually every advanced manufacturing operation—gain optionality they presently lack.

Broader Economic Implications

US Secretary of State Marco Rubio with India's Foreign Minister S Jaishankar (AP Photo/Jacquelyn Martin)

Jaishankar met with Treasury Secretary Scott Bessent on Tuesday, discussions centering on economic ties advancement and supply chain security.

These conversations operate on a different plane than tariff percentages. They address financial architecture supporting bilateral trade, currency settlement mechanisms, and investment frameworks enabling the $500 billion commitment, assuming it materializes beyond political announcement.

The agreement follows India's separate free trade deal with the European Union finalized last week, covering nearly all goods between India and the bloc's 27 member states. Modi termed that agreement "the mother of all deals," creating a free trade zone between economies representing approximately 25% of global GDP.

Connect those developments. India simultaneously locked preferential access to U.S. markets while securing European market integration.

ETF Exposure Analysis

Investors seeking exposure to this thematic shift should evaluate funds capturing Indian equities, critical minerals producers, and U.S.-India trade beneficiaries.

INDA (iShares MSCI India ETF) and INDY (iShares India 50 ETF) provide differentiated Indian equity exposure with $9.5B and $630M in AUM respectively. INDA tracks approximately 100 large and mid-cap companies across sectors with a 0.61% expense ratio, while INDY concentrates on the 50 largest stocks at 0.65%. Both captured immediate market reactions to the trade announcement with +2.1% and +1.9% weekly gains, though YTD performance diverges at -1.4% vs -3.6% reflecting concentration differences and sector allocation disparities.

REMX (VanEck Rare Earth/Strategic Metals ETF) holds 24 global miners producing critical minerals with $1.1B in AUM and a 0.58% expense ratio. Current allocation includes approximately 25% Chinese producers, creating structural complexity for investors seeking pure-play non-China exposure. The fund's exceptional +20.3% YTD return substantially outpaces the modest +0.8% weekly gain, indicating markets await concrete bilateral mining development timelines and infrastructure commitments.

LIT (Global X Lithium & Battery Tech ETF) targets 41 lithium producers and battery manufacturers with $1.7B in AUM. India's energy transition acceleration through U.S. technology imports could drive downstream demand for lithium-ion battery production domestically, benefiting constituent holdings positioned across the supply chain. The +8.1% YTD and +1.2% weekly gain reflect measured investors' optimism.

XME (SPDR S&P Metals & Mining ETF) captures 43 U.S. mining operations positioned to supply critical minerals under bilateral cooperation frameworks with $4.7B in AUM, the second-largest fund in this comparative analysis. The 0.35% expense ratio provides the most cost-efficient access to domestic producers. Strong +14.5% YTD performance showcases existing momentum in U.S. mining equities independent of India-specific catalysts.

How are you adjusting portfolio exposure following the U.S.-India trade framework announcement?

Risk Factors

Several variables could derail anticipated benefits:

Implementation uncertainty. Framework agreements don't equal executed contracts. The joint statement expected "within days" needs conversion into binding commitments with delivery timelines, payment structures, and enforcement mechanisms.

Russian oil dynamics. If India continues Russian crude purchases despite U.S. expectations, diplomatic friction could undermine broader cooperation. Alternatively, halting Russian imports raises India's energy costs, potentially slowing economic growth and reducing import capacity for U.S. goods.

China's response. Beijing won't passively watch critical minerals supply chains reorient away from Chinese control. Expect countermeasures ranging from production quota adjustments to preferential pricing for nations maintaining exclusive supply relationships.

Regulatory execution in India. Mining development requires environmental clearances, land acquisition, infrastructure investment, and regulatory consistency—areas where Indian bureaucracy historically creates project delays measured in years, not quarters.

Which risk factor concerns you most regarding the U.S.-India trade deal actual implementation?

- $500B commitment includes existing pipeline (not all new spending)

- Uncertainty around India actually halting Russian oil purchases

- China's potential countermeasures in critical minerals markets

- India's regulatory delays in mining sector development

- Political volatility affecting long-term framework stability

What Investors Should Monitor

Track several indicators over the next 90-180 days:

Concrete contract announcements beyond framework language, particularly in energy infrastructure and data center construction where $500 billion commitment should manifest earliest.

Indian mining license approvals and foreign investment inflows into domestic extraction operations, signaling actual implementation of critical minerals cooperation.

Trade flow data showing Indian exports to the U.S. responding to the 18% tariff rate, with particular attention to technology components and pharmaceuticals where pricing sensitivity is acute.

Chinese rare earth export pricing and quota policies, revealing Beijing's strategic response to U.S.-India supply chain initiatives.

This deal represents structural realignment, not tactical adjustment.

For portfolios positioned in emerging markets, materials, and defense technology, the U.S.-India partnership creates both opportunities and complexities requiring active monitoring rather than passive exposure.

The critical minerals component especially warrants attention.

Supply chain security transitioned from operational concern to national security imperative.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Trump's Fed Pick Sends Gold Crashing: What Investors Need to Know Now

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.