The Secret to Regular $2,000 Checks – Revealed (from Awesomely)

What a wild week!

President Trump and Jensen Huang in Davos.

Elon Musk makes his first appearance at WEF 2026 today.

After weeks of escalating threats to acquire Greenland, including tariffs on eight NATO allies and hints at military force, he announced a "framework of a future deal" with NATO Secretary-General Mark Rutte.

The tariffs are off. The rhetoric cooled. And markets rallied.

But here's what that actually means for defense investors.

The Greenland Framework: What We Know

President Donald Trump and NATO Secretary-General Mark Rutte (AP Photo/Evan Vucci)

Trump and NATO Secretary-General Mark Rutte agreed to a "framework" on Arctic security.

The deal involves U.S. mineral rights, Golden Dome missile defense deployment, and trilateral talks between Washington, Copenhagen, and Greenland. Denmark's sovereignty remains intact, for now.

The announcement came hours after Trump's Davos speech, where he ruled out using "excessive strength and force" to take Greenland. That was the headline. But the substance matters more.

Trump described it as a "concept of a deal" involving mineral rights and theGolden Dome defense system. He told CNBC the framework is "a little bit complex" but centers on U.S. access to Greenland's rare earth minerals and expanded Arctic defense infrastructure.

They're going to be involved in the Golden Dome, and they're going to be involved in mineral rights, and so are we.

The details remain vague. But the pattern is clear: This isn't about territorial acquisition. It's about strategic access: to resources, to military infrastructure, and to Arctic positioning against Russia and China.

What Trump Said at Davos

President Donald Trump at WEF 2026, Davos (Fabrice Coffrini / AFP via Getty)

Trump's speech laid out his rationale. He framed Greenland as a national security necessity, not a real estate deal.

"No nation in position to secure Greenland other than the US." He argued only America can defend the Arctic from Russian and Chinese encroachment.

"We never asked NATO for anything, we never got anything." A dig at European allies who, in his view, haven't pulled their weight on defense spending.

"There's so much rare earth, we need it so much for national security." This is the economic angle. Greenland holds massive deposits of minerals critical to defense tech.

"Don't want to use excessive force for Greenland." Walking back earlier suggestions of military action.

The message: Greenland is about Arctic supremacy, not territorial expansion. And Trump's willing to negotiate rather than force the issue.

The Golden Dome Factor

The Golden Dome is Trump's proposed space-based missile defense system for North America. Think Reagan's Star Wars, but updated for hypersonic threats from Russia and China.

Trump positioned it as a shield for Canada and the Arctic. He suggested Canada "should be grateful" for the protection. Greenland's geography makes it critical for early warning and interception infrastructure.

Real on-the-ground defense contractors stand to benefit if Golden Dome moves forward. That means radar systems, satellite components, missile interceptors, all sectors where U.S. defense companies dominate.

What's the biggest defense opportunity from Trump's Greenland framework?

Jensen Huang's AI Pivot

BlackRock CEO Larry Fink and NVIDIA CEO Jensen Huang at WEF 2026, Davos (Nvidia)

Nvidia CEO Jensen Huang called AI robotics a "once-in-a-generation opportunity" for Europe. His pitch: Europe's industrial manufacturing base can leapfrog the U.S. software era by fusing AI with physical production capabilities.

Huang's Davos address shifted the conversation from software to hardware. He argued Europe doesn't need to catch up on cloud computing. It can jump straight to physical AI — robots, autonomous systems, and AI-driven manufacturing.

You can now fuse your industrial capability, your manufacturing capability, with artificial intelligence, and that brings you into the world of physical AI, or robotics.

European defense giants are already moving. Siemens, Mercedes-Benz, Volvo, and Schaeffler all launched robotics projects in 2025. The U.S. isn't sitting still either, Tesla's Optimus robots, Google's DeepMind robotics models, and Nvidia's partnerships with Alphabet show where the money's flowing.

The Energy Problem

Huang warned Europe faces a critical constraint: energy.

AI infrastructure demands massive power. Europe has some of the highest energy costs globally. Without fixing that, Huang said, Europe risks missing the AI robotics wave entirely.

If Europe can't build the energy infrastructure, U.S. and Asian companies will dominate AI-driven defense tech. That creates opportunities for American defense contractors with energy-efficient systems and for companies supplying nuclear and renewable energy to data centers.

Why This Matters for Defense Investors

Huang pushed back on bubble fears. He called AI infrastructure buildout "the largest in human history," trillions of dollars over the next decade. Defense applications are central to that.

Autonomous drones, AI-guided missiles, cyber defense systems, space-based surveillance—all require the chips, software, and physical infrastructure Nvidia and its partners supply.

If Huang's right, the defense tech sector is entering a multi-year growth cycle.

Is Jensen Huang right about AI robotics being a "once-in-a-generation" opportunity?

Elon Musk at Davos

Elon Musk at WEF 2026, Davos (Fabrice COFFRINI / AFP via Getty Images)

Elon Musk made his first-ever World Economic Forum appearance today, and dropped three specific timelines that investors should track.

Optimus Goes Public by The End of 2027

Tesla's humanoid robot, Optimus, will be available for consumer purchase within 24 months. Musk said robots will eventually outnumber humans, with "everyone on earth going to have one and going to want one."

The company already has Optimus units performing simple factory tasks, with more complex assignments planned for late 2026.

AI Surpasses Human Intelligence in 2027

Musk predicted AI will be "smarter than any human" by next year and "as smart as all of humanity combined" soon after.

This timeline accelerates previous estimates and signals faster-than-expected AI development from both Tesla and xAI.

SpaceX Achieves Full Rocket Reusability

The "big breakthrough" SpaceX is chasing is complete rocket reusability, bringing costs down dramatically and making Mars colonization economically viable. Musk joked he wants to "die on Mars, but not on impact."

Today’s session with BlackRock CEO Larry Fink marked a reversal for Musk, who previously called Davos "boring" and questioned whether the WEF was "trying to be the boss of Earth."

His attendance signals pragmatic recalibration as Tesla, SpaceX, and xAI scale globally.

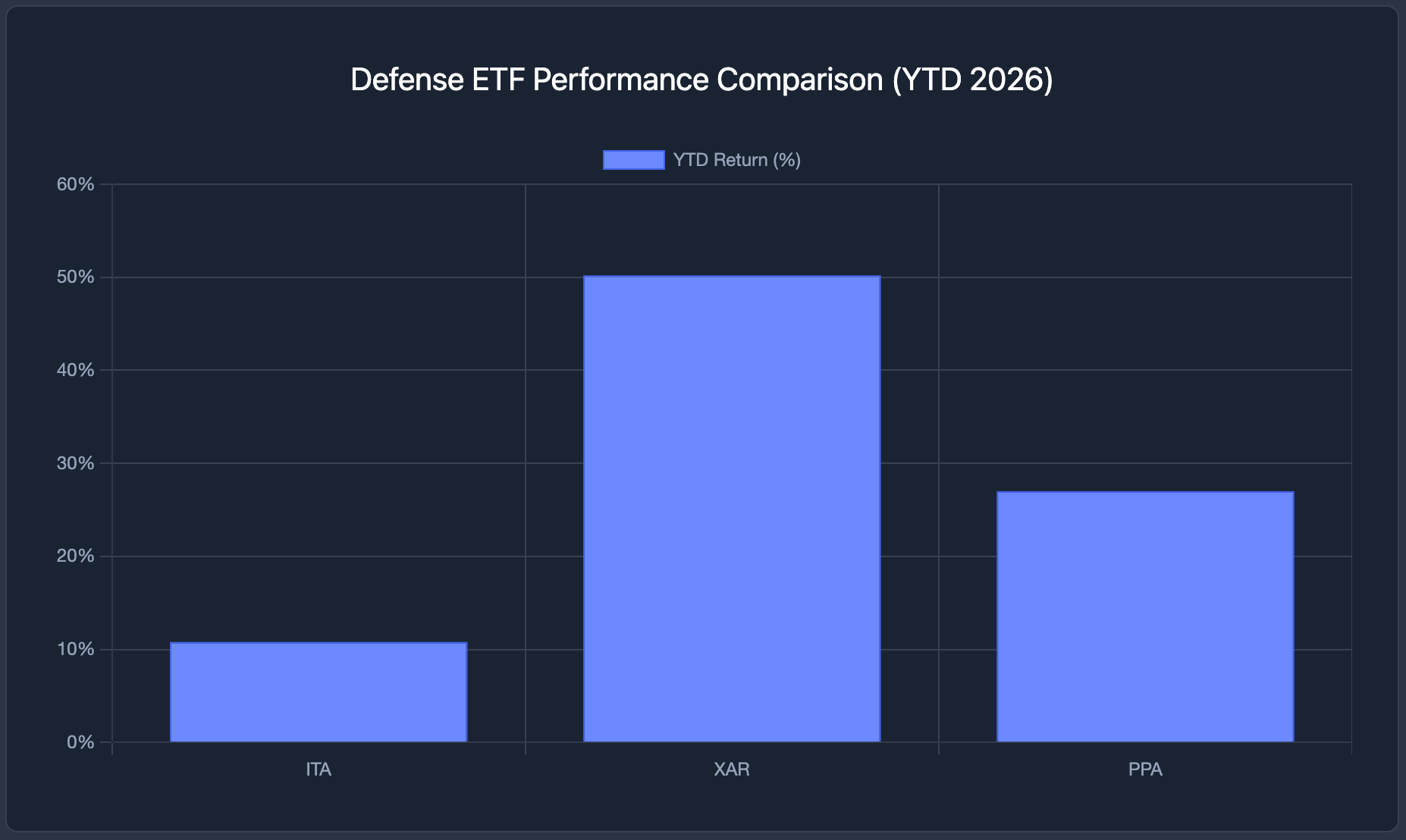

Defense ETF Analysis: Where to Position Now

Trump's Greenland framework and NATO's 5% GDP defense spending commitment create a clear thesis: Defense budgets are rising. European rearmament, Arctic infrastructure, and AI-driven modernization all point to sustained demand for U.S. defense contractors.

Three ETFs dominate the space. Each has a different approach.

Which ETF Makes Sense Now

XAR delivered the strongest returns over the past year, up 50%, with the lowest expense ratio (0.35%). Its equal-weight approach reduces Boeing concentration risk and captures mid-cap defense tech firms benefiting from modernization spending.

PPA offers the smoothest ride. Lower volatility, better downside protection, and broader sector coverage make it the conservative choice. But you're paying 0.58% annually, the highest fee in the group.

ITA is the mega-cap play. If you believe GE Aerospace, RTX, and Boeing dominate the next defense cycle, ITA gives you concentrated exposure. But Boeing's production issues remain a drag.

Which defense ETF are you adding to your portfolio after Trump's Greenland framework?

The Arctic Defense Angle

Trump's Greenland framework means one thing: Arctic infrastructure spending is coming. Radar systems, missile defense, communications networks, cold-weather equipment: all beneficiaries of increased U.S. and NATO Arctic presence.

Firms with Arctic capabilities include RTX (radar and missile systems), Lockheed Martin (F-35 Arctic deployments), and smaller players like Kratos Defense (unmanned systems) and AeroVironment (tactical drones). XAR captures more of those smaller names than ITA or PPA.

What Investors Should Watch Next

The Greenland framework is preliminary. Trilateral talks between the U.S., Denmark, and Greenland continue. But the direction is set: More defense spending in the Arctic, more focus on rare earth minerals, more infrastructure for missile defense.

Key catalysts ahead:

NATO's 5% GDP spending target implementation. European defense budgets could surge by hundreds of billions over the next decade.

Golden Dome funding decisions. If Congress appropriates funds, expect contracts for Northrop Grumman, Raytheon, and Lockheed.

Greenland rare earth mining deals. U.S. companies competing with Chinese interests for critical minerals.

AI robotics defense contracts. Huang's thesis plays out if autonomous systems become standard in NATO arsenals.

The Bottom Line

Trump's Greenland pivot isn't about acquiring territory. It's about locking in strategic access—to minerals, to Arctic positioning, to defense infrastructure.

That creates a multi-year tailwind for defense contractors focused on Arctic operations, missile defense, and AI-driven systems.

Jensen Huang's robotics push adds another layer. If Europe follows through on AI-physical manufacturing integration, U.S. defense tech companies supplying AI chips, autonomous systems, and cyber infrastructure stand to benefit.

For investors, the question isn't whether defense spending rises, it's which companies capture the most value.

The ETFs above offer different paths. XAR for growth and mid-cap exposure. PPA for stability. ITA for mega-cap concentration.

The Arctic is heating up. Defense budgets are expanding. And Trump's Davos framework just confirmed the direction of travel.

Watch for Golden Dome funding announcements, NATO defense spending updates, and Greenland mineral rights negotiations.

Those will determine which defense subsectors outperform over the next 12-24 months.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Trump's NATO Shakedown at Davos: Defense Sector Poised for Historic Rally as $680B European Spending Hangs in Balance

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.