The Secret to Regular $2,000 Checks – Revealed (from Awesomely)

‘Board of Peace’ ceremony lasted 47 minutes. Trump signed the charter.

25 countries stood on stage. Most of Europe stayed away. And defense stocks started pricing in a fundamental shift in global security architecture that nobody in Davos wanted to say out loud.

This isn't about Gaza. Not anymore.

The Board of Peace charter doesn't mention Gaza once across 11 pages of text. What started as Trump's post-war reconstruction committee morphed into something his secretary of state Marco Rubio described as having "endless" possibilities.

An alternative to the UN with Trump as permanent chairman and a $1 billion entry fee for permanent membership.

The real story isn't what Trump said on stage Thursday morning.

The real story is who showed up, who didn't, and what's happening in Moscow, Brussels, and Beijing right now.

The Putin Calculation Everyone's Missing

Steve Witkoff is the White House's Middle East envoy (BBC)

Vladimir Putin made his move Wednesday before the Davos ceremony even started. He told the Russian Security Council that Moscow could pay the $1 billion permanent membership fee using frozen Russian assets held in the United States. The same assets were frozen as punishment for invading Ukraine.

Let that sink in. Putin proposed using sanctions imposed against him as payment to join Trump's new international organization. And Trump's team is considering it.

Steve Witkoff and Jared Kushner flew to Moscow Thursday to meet with Putin. The official agenda covered both the Board of Peace and Ukraine peace negotiations.

Witkoff told reporters at a Ukrainian event in Davos that talks are "down to one issue" with significant progress made.

Here's what that really means for defense markets. If Trump accepts Putin's frozen asset payment, it signals that sanctions enforcement is negotiable. That the Board of Peace framework supersedes existing international sanctions regimes. And that Russia's return to international institutions is happening through Trump's structure, not through UN processes.

The implications cascade. European defense budgets would accelerate immediately as a hedging strategy. NATO countries that have been slow-walking the 5% GDP defense spending target by 2035 would treat it as urgent. Poland, the Baltics, Nordic countries—they'd rush procurement timelines forward.

Defense contractors positioned for rapid European rearmament win. Companies with existing NATO interoperability, established European partnerships, and production capacity outside the United States capture that surge.

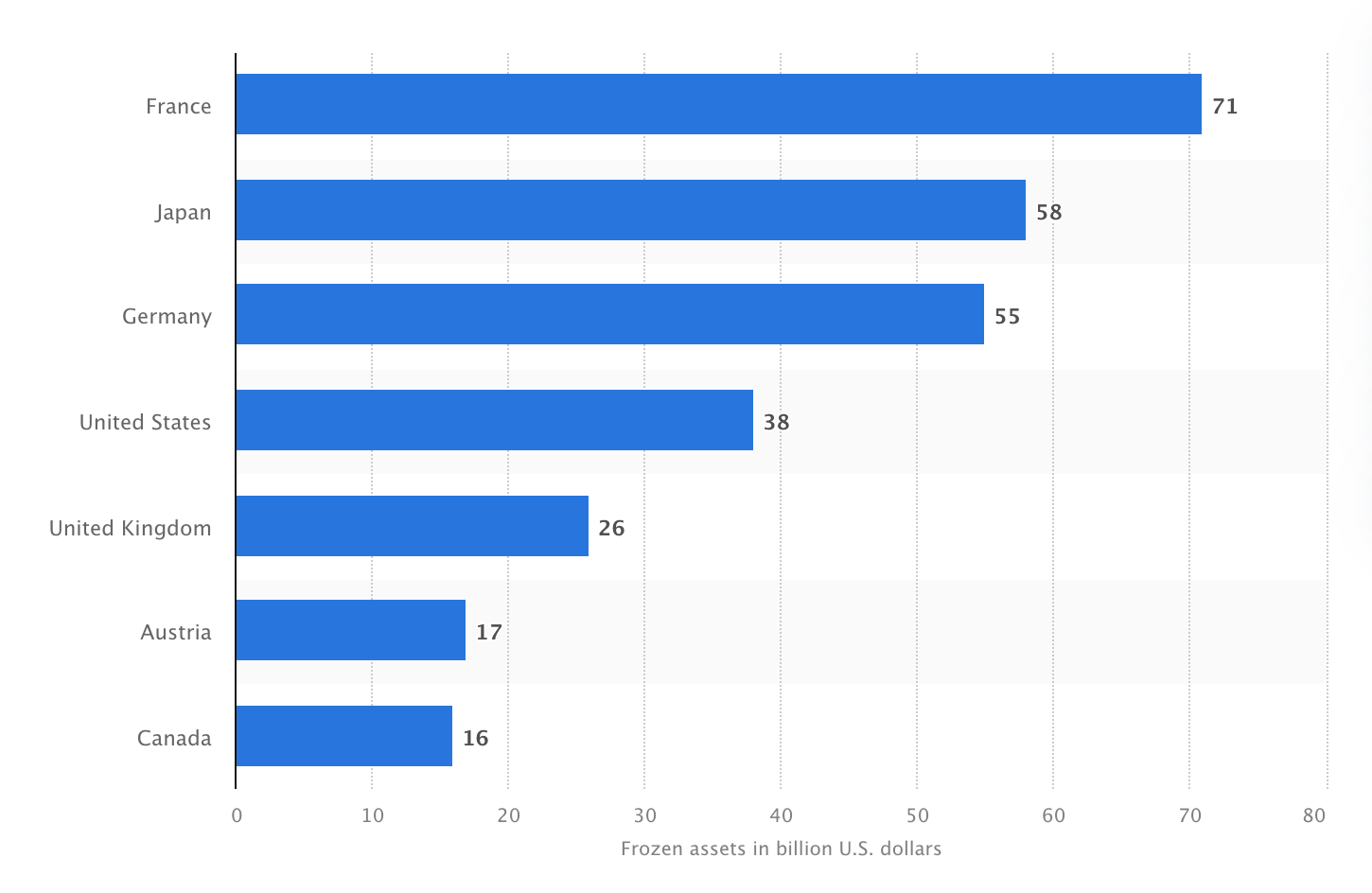

The Asset Math That Changes Everything

Value of assets of the Bank of Russia frozen due to sanctions (statista)

Russia has nearly $280 billion in assets frozen by Western sanctions.

Putin's proposal creates leverage. If the US unfreezes $1 billion for Board of Peace membership while Europe maintains their freeze, it fractures the sanctions coalition. It demonstrates that American policy operates independently of European consensus. And it opens negotiations for what happens to the remaining frozen Russian assets.

Putin already stated he's ready to commit additional frozen assets toward Ukraine reconstruction once a peace deal is reached. Not if. Once.

The market is pricing in a scenario where Putin joins the Board, pays with unfrozen assets, brokers a Ukraine deal under Board auspices rather than through UN or NATO frameworks, and redirects reconstruction contracts through Board member countries.

That shifts tens of billions in reconstruction spending away from traditional NATO/EU procurement channels toward Board member countries. Kazakhstan, Mongolia, Vietnam, Indonesia, Turkey, UAE, Qatar—these countries control critical mineral supply chains and rare earth elements that US defense contractors need for advanced weapons systems.

Board membership creates preferential access. Lower costs. Faster timelines. Better margins.

Should the US accept Putin's frozen asset payment for Board membership?

Europe's Fracture Is the Real Trade

Hungary stands alone. Orbán is the only EU leader who signed in Davos. France declined. Germany sent polite refusals. UK Foreign Secretary Yvette Cooper called Putin's potential role "concerning." Belgium's Deputy Prime Minister publicly corrected the White House after they incorrectly listed Belgium as a signatory.

This isn't just diplomatic disagreement. This is a fundamental split in how Western allies approach international security architecture.

The EU has been trying to build strategic autonomy for years. Common defense procurement. Integrated European defense companies. Reduced dependence on American weapons systems. The Board of Peace accelerates those efforts while simultaneously making them harder to achieve.

If European countries stay out while the Board becomes the primary mechanism for conflict resolution, they lose influence. If they join, they validate Trump's parallel structure and undermine the UN/NATO frameworks they've defended for decades.

Either way, defense spending increases. European companies positioned for autonomous defense production benefit. Rheinmetall, BAE Systems, Thales, Leonardo, Saab—these contractors have been building capacity for years in anticipation of European strategic autonomy.

The Board of Peace doesn't threaten those companies. It accelerates their growth trajectory by forcing European governments to hedge against American unpredictability through faster domestic procurement.

The Executive Order Nobody's Connecting

U.S. President Donald Trump during a signing ceremony for the “Board of Peace” at WEF on January 22, 2026 in Davos (Chip Somodevilla/Getty Images)

Earlier, Trump signed an executive order that defense analysts are treating separately from the Board of Peace announcement. They shouldn't be.

The order prohibits major defense contractors from stock buybacks and dividends if they're underperforming on contracts, underinvesting in production capacity, or failing to deliver on time. Executive compensation gets capped. Free cash flow metrics get replaced with on-time delivery and production expansion as performance measures.

The stated purpose is forcing contractors to prioritize warfighter capabilities over investor returns. The actual effect is redirecting billions in potential shareholder distributions back into factory expansion and accelerated production.

Why does that matter for the Board of Peace?

I rebuilt the military in my first term and continue to do so today. We have a budget of $1.5 trillion.

That money needs somewhere to go. Contractors can't pay it out as dividends or buybacks. They have to invest it in capacity.

New capacity creates new contracts. New contracts need new customers. The Board of Peace provides those customers through member countries buying American weapons systems with preferential terms.

It's a closed loop. Higher US defense budgets. Forced reinvestment into capacity.

Board member countries as guaranteed buyers.

Defense contractors get revenue growth without the ability to return cash to shareholders.

Stock prices rise on revenue growth. Valuations expand. ETF flows accelerate into defense sectors.

The Kushner Gaza Plan That Reveals the Playbook

Jared Kushner speaks after the signing of a Board of Peace charter during WEF 2026, Davos (AP)

Jared Kushner unveiled renderings at the Davos ceremony. High-rise coastal towers. Mixed-use development zones. 100,000 housing units in Rafah.

He called it "New Gaza" and said it would take two to three years to build, citing how Middle Eastern countries construct cities for two to three million people in that timeframe.

The plan uses "free market principles" to shift Gaza away from foreign aid dependence. Security comes first. Then demilitarization. Then reconstruction with private investment rather than donor funding.

This is the template. Not just for Gaza. For every conflict the Board of Peace touches.

Ukraine reconstruction follows the same model. Private investment. Board member countries providing security. Rapid construction timelines. Minimal UN involvement. Contracts flowing through Board executive committee members and their networks.

Tony Blair sits on that executive committee. Former UK Prime Minister with extensive Middle East business connections. World Bank President Ajay Banga is there too. Marco Rubio. Steve Witkoff. Jared Kushner.

These aren't diplomats. They're deal-makers. And the deals they're structuring channel reconstruction contracts toward specific companies in specific Board member countries.

Defense contractors with relationships to executive committee members or significant operations in Board member countries capture disproportionate contract flow.

The 'New Gaza' rendering: Visionary reconstruction or tone-deaf profiteering?

The Volatility Triggers to Monitor

Three scenarios spike defense ETF volatility in the next 30 days.

1st scenario: Putin formally joins by month-end after the UAE Ukraine talks conclude. Russia pays $1 billion from unfrozen assets. Ukraine peace deal gets announced under the Board of Peace framework. European defense stocks rally 15%+ on rearmament acceleration. US defense stocks rally 8-12% on reconstruction contract expectations.

2nd scenario: Germany or UK joins the Board despite initial resistance. Signals that European strategic autonomy efforts are subordinating to Trump's architecture. NATO spending targets get accelerated. Defense contractors with transatlantic operations surge. $ITA and $NATO ETF lead gains.

3rd scenario: Board of Peace collapses within the first quarter. Too many countries refuse. No major conflicts get resolved through Board mechanisms. Trump loses interest. Defense stocks give back 6-8% of YTD gains as reconstruction contract thesis evaporates. Traditional NATO procurement resumes as primary growth driver.

Current positioning suggests markets are pricing in scenario one at 60% probability. Scenario two at 25%. Scenario three at 15%.

Which scenario plays out in the next 30 days?

What the Charts Won't Tell You

Defense ETF performance year-to-date reflects this evolving thesis.

ITA up 9.8%. SHLD up 12.4%. NATO ETF up 11.6%.

But the composition of those gains matters.

SHLD leads because it holds defense tech and next-gen systems companies that benefit from both traditional procurement AND Board of Peace reconstruction contracts. Palantir, Anduril, Rheinmetall—these companies operate across both frameworks.

ITA and XAR provide traditional aerospace and defense exposure. They capture NATO rearmament spending but have less direct exposure to Board-directed reconstruction. Lower upside if scenario one plays out. Better downside protection if scenario three occurs.

NATO ETF concentrates on transatlantic defense cooperation. Highest beta to European rearmament acceleration. Maximum risk if Europe refuses to participate in Board frameworks.

The trade isn't picking one ETF. The trade is sizing positions based on which scenario you think plays out and adjusting as new information emerges.

Putin's meeting with US envoys happens Thursday. Watch for statements about frozen asset negotiations. Watch for Ukraine trilateral talks in UAE this week. Watch for European defense minister meetings in late January where Board of Peace participation gets debated behind closed doors.

Those are your signal events. Not Davos speeches. Not charter signings. Not press releases.

Real money moves on what Putin and Trump actually agree to regarding frozen assets. On whether Germany breaks from France and joins the Board. On whether Ukraine peace gets brokered through Board mechanisms or through traditional diplomatic channels.

Defense stocks are pricing in a world where Trump's Board of Peace becomes the primary conflict resolution mechanism for non-NATO conflicts. Where reconstruction contracts flow through Board member countries. Where Putin returns to international institutions through Trump's framework rather than through UN processes.

That world might arrive in 30 days. Or it might never arrive at all.

Position accordingly.

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Trump's NATO Shakedown at Davos: Defense Sector Poised for Historic Rally as $680B European Spending Hangs in Balance

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.