This just in!

The Trump administration just signed an executive order that will reshape the AI race.

And it's not about chips. It's about power.

The order launches what they're calling the "Manhattan Project for AI."

The goal is simple: remove every regulatory barrier to building the massive data centers that OpenAI, Nvidia, and other AI companies need.

We're talking about 10-gigawatt facilities. That's enough electricity to power a small city.

Here's what we know. The administration is treating AI infrastructure as a national security priority.

They want the US to win the compute race against China. And they've decided the biggest bottleneck isn't talent or capital. It's electricity.

The Numbers Tell the Story

A single large AI data center can use as much power as 100,000 homes.

OpenAI's next-generation models will need even more. Current estimates put their requirements at 5-10 gigawatts just for training runs. That's roughly the output of five nuclear reactors.

Right now, the U.S. grid can't handle that load. Not even close.

The U.S.-China Economic and Security Review Commission laid this out in their 2024 report.

They warned that without massive energy infrastructure expansion, the US loses the AI race by default.

Trump's order responds directly to that warning. And it picks winners.

Nuclear and Natural Gas Win

The executive order makes one thing clear: AI needs baseload power. That means 24/7 generation.

Solar and wind don't qualify. They're intermittent. AI training can't stop because the sun went down.

The Trump administration is prioritizing Nuclear and Gas over Renewables for AI training centers due to "baseload" needs. Do you agree?

So the administration is prioritizing nuclear and natural gas. These are the only sources that can deliver constant, massive-scale power without weather dependency.

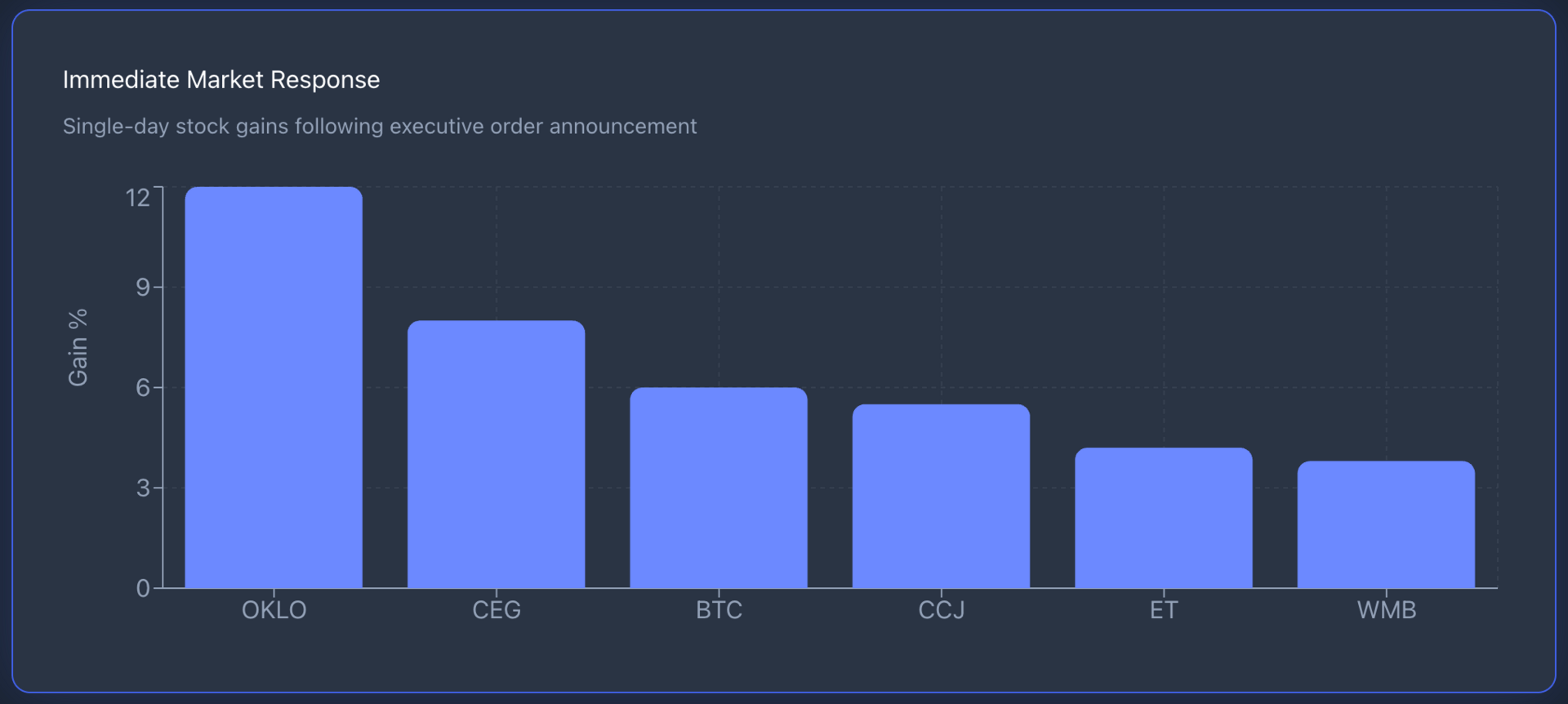

Look at the stock implications.

Nuclear operators saw immediate gains.

Oklo $OKLO, the small modular reactor company backed by Sam Altman, jumped 12% on the news.

Cameco $CCJ, which supplies uranium to U.S. reactors, hit a three-month high.

Constellation Energy $CEG, the largest nuclear fleet operator in America, climbed 8%.

But here's the thing. This isn't a short-term trade. The order removes permitting barriers that have strangled nuclear development for decades. New reactor projects that would have taken 10-15 years might now move in 5-7 years. That's still a long timeline. But it changes the entire investment thesis for nuclear energy.

Natural gas also wins. The order fast-tracks pipeline approvals and loosens environmental reviews for gas plants near data center zones.

Energy Transfer $ET and Williams Companies $WMB both gained ground.

These are the infrastructure plays that will feed the new AI power grid.

Traditional ESG funds face a problem. Many of them have explicit mandates against nuclear and fossil fuels. If the AI buildout depends on these sources, ESG portfolios will miss the entire movement.

Palantir Becomes Infrastructure

Palantir $PLTR and Anduril as key partners for the government's AI operations. This isn't a software contract. It's a designation as critical infrastructure.

Palantir will handle the data integration for the Manhattan Project. That means coordinating between the DoE, DoD, and private AI companies.

Wall Street already prices Palantir as a defense contractor. This order shifts that narrative. Palantir is now positioned as a sovereign technology asset. That's a different valuation framework entirely.

The defense angle runs deeper. The order explicitly ties AI development to military superiority. It mentions competing with China's military AI programs. That means sustained government spending on AI infrastructure for decades.

Lockheed Martin $LMT, Northrop Grumman $NOC, and other defense primes will compete for those contracts.

Crypto Gets Legitimized

The order includes language protecting Bitcoin miners who help stabilize the grid. This surprised analysts. But the logic makes sense.

Bitcoin mining operations already use massive amounts of electricity. They're flexible loads. They can ramp up or down based on grid demand. That makes them useful for balancing renewable energy fluctuations.

The order recognizes crypto mining infrastructure as dual-use for AI training. The hardware is similar. The power infrastructure is identical. Bitcoin miners can pivot to high-performance computing when demand shifts.

Marathon Digital $MARA and Riot Platforms $RIOT both announced they're expanding into AI hosting services. The regulatory protection in this order makes that transition safer. It removes the threat of future crackdowns on crypto energy use.

Bitcoin itself gained 6% following the announcement. The market reads this as formal government acceptance of crypto infrastructure as part of America's technology stack.

What This Means

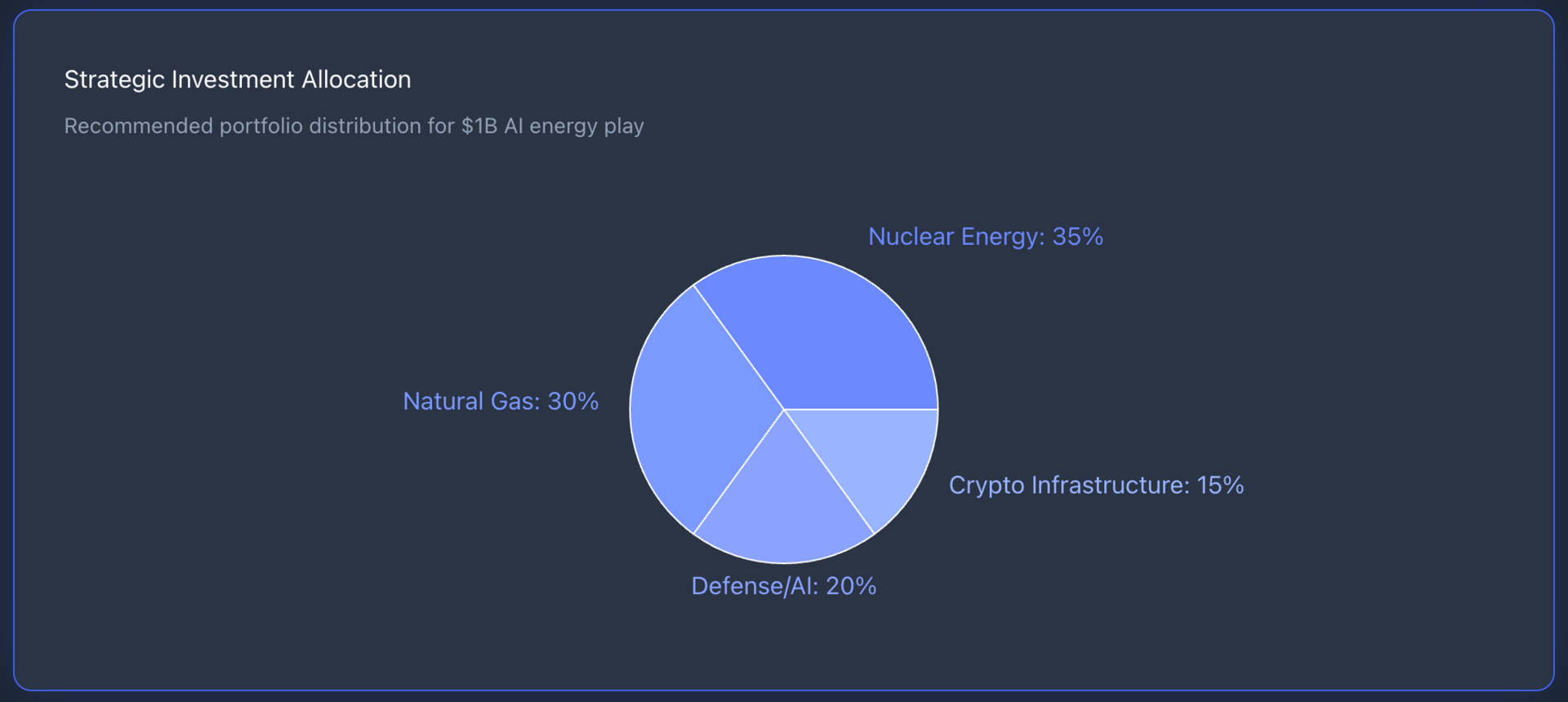

The investment thesis is straightforward. AI needs power.

The government just committed to delivering unlimited power. Buy the companies that generate and distribute that power.

The primary plays are:

Nuclear: Oklo $OKLO, Cameco $CCJ, Constellation Energy $CEG

Natural Gas: Energy Transfer $ET, Williams Companies $WMB, Cheniere Energy $LNG

Defense/AI: Palantir $PLTR, Lockheed Martin $LMT

Crypto Infrastructure: Marathon Digital $MARA, Riot Platforms $RIOT, Bitcoin

The broader energy sector ETF $XLE also makes sense as a diversified play.

The timeline matters. Nuclear projects won't deliver power for years. But the market prices these stocks based on expected future cash flows. The order changes those expectations today.

Natural gas infrastructure moves faster. New pipelines and plants can come online in 18-36 months. That's a shorter wait for actual revenue growth.

Are you rotating capital from Semiconductors to the Nuclear/Energy sector?

The Risk Factors

This strategy assumes the order survives legal challenges. Environmental groups will sue.

States will fight federal preemption of their energy regulations. That litigation could delay projects for years.

There's also execution risk. Even with regulatory approval, building 10-gigawatt data centers is hard. Supply chains for transformers, cables, and cooling systems are already stressed. If the physical buildout can't match the regulatory approval, these stocks could correct hard.

And there's political risk. A future administration could reverse these priorities. If the 2028 election shifts power, the entire AI Manhattan Project could be defunded.

The Bottom Line

The Trump administration just made energy the most important sector in the AI race. Chips get the headlines. Power generation gets the profits.

We're watching the largest infrastructure buildout since the interstate highway system. The difference is this one happens in five years instead of thirty.

Position accordingly.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.