Global waste generation will hit 3.4 billion tons by 2050.

That's a 70% jump from today's levelsб and it's growing faster than population by more than double.

For investors watching markets gyrate and sectors implode, this matters. Because trash doesn't stop. Recessions don't make garbage disappear.

The VanEck's Environmental Services ETF, $EVX, gives you direct access to this defensive sector.

The Numbers Don't Lie

During the 2008 financial crisis, when the S&P 500 dropped and the broader market tanked, Waste Management $WM posted a positive return above 4%.

Not just survived, actually gained.

In 2020's pandemic chaos, when revenue across industries collapsed, WM’s revenue declined only 4-5% while maintaining over $2 billion in free cash flow.

The data from 2000, 2001, 2008, and 2018, all hard years for equities, show consistent outperformance from waste services.

These companies returned to pre-recession stock prices by April 2011, while the S&P 500 took until March 2012. That's a full year of relative gains while everyone else was still recovering.

Revenue stayed remarkably stable even during COVID's worst quarter. Q2 2020 saw Waste Management's revenue drop 9.9% YoY, but free cash flow, the metric that actually matters, declined only 3.7%.

WM just announced that its Board of Directors has approved a capital allocation program that includes a planned 14.5% increase in the 2026 dividend rate.

The company maintained dividends. Maintained operations. Maintained the infrastructure nobody else could replicate.

The Moat Is Real

Here's the uncomfortable truth about starting a waste company: you can't. Not really.

Landfills operate under what industry analysts call a "wide moat"—and that's not hyperbole. The regulatory barriers are massive.

Getting approval for a new landfill takes 10-15 years of legal battles. Communities fight them with every tool available.

Existing operators sit on irreplaceable assets.

Waste Management $WM controls 47% of the landfill market and 30% of collection services.

Republic Services holds another 24% and 17% respectively.

That's not market share you compete with better software or a viral marketing campaign. It's infrastructure monopoly built on decades of permits, contracts, and physical assets that take years to replicate, if regulators even allow it.

The collection business runs on long-term municipal contracts. These aren't month-to-month subscriptions. Cities sign 5, 10, or 30-year deals. The switching costs are prohibitive. The alternatives don't exist in most markets. You either use the incumbent or you don't get your trash picked up.

From Trash to Energy

But here's where it gets interesting.

The waste giants aren't just sitting on their moats collecting fees. They're transforming landfills into energy infrastructure.

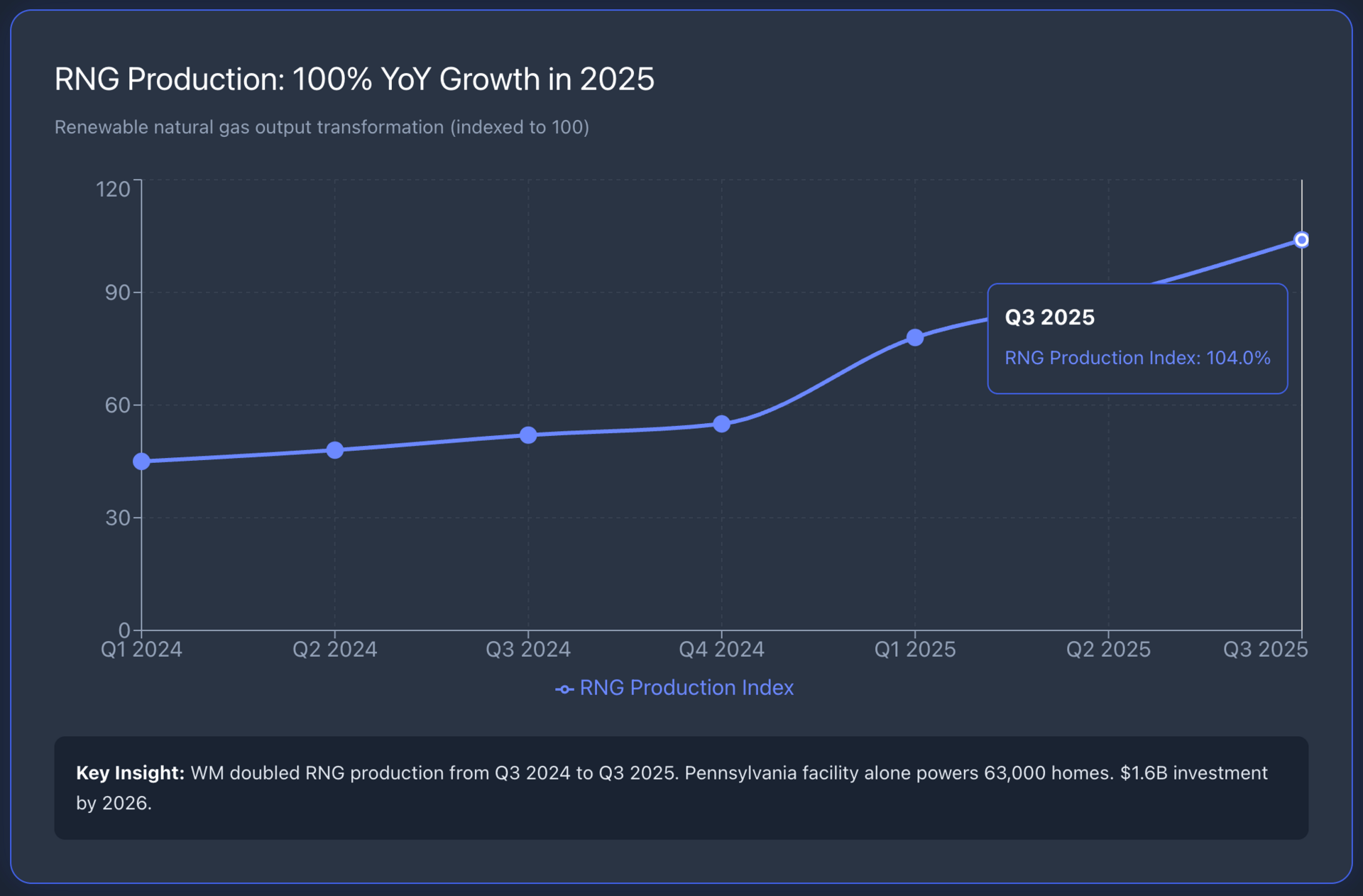

RNG is going to replace fossil natural gas. Waste Management plans 20 new renewable natural gas (RNG) facilities by 2026, with 10 already operational as of Q3 2025. These plants convert methane from decomposing waste into pipeline-quality renewable natural gas.

The $1.6 billion investment will generate enough energy to power 1.7 million homes annually.

The Pennsylvania facility alone, a $131 million plant that opened in April 2025, produces 3 million MMBtu of RNG per year. That's equivalent to powering 63,000 homes. And WM owns the entire value chain: the landfill producing the gas, the facility converting it, and the natural gas truck fleet consuming it.

Republic Services took a different path but arrived at the same destination. Their partnership with BP through Archaea Energy created the Lightning Renewables joint venture, 40 planned RNG facilities using standardized modular designs. The first plant in Fort Wayne processes enough gas to heat 25,000 homes annually. Republic now operates over 100 landfill gas-to-energy projects.

This isn't feel-good sustainability theater. It's revenue diversification that adds hundreds of millions to EBITDA.

The federal Renewable Fuel Standard creates guaranteed demand. California's Low Carbon Fuel Standard provides additional credits. States are mandating renewable energy adoption. And waste companies control the feedstock.

The economics work because the gas is free. It's already being produced by decomposing waste. Capturing it reduces environmental liability while creating a sellable commodity. WM doubled its RNG production in the first nine months of 2025 compared to 2024. That's not incremental growth—it's a business transformation happening in real-time.

Do you believe Landfill-to-Gas (RNG) is a legitimate growth engine or just "green theatre" for valuation?

The Structural Growth Story

Waste generation increases from 2.01 billion tonnes in 2016 to a projected 3.40 billion tonnes by 2050. This growth rate outpaces population growth by more than 2x.

That's not a forecast dependent on GDP growth or consumer spending. It's a function of urbanization and middle-class expansion in developing nations. High-income countries already generate 0.74 kg of waste per person daily on average. As emerging markets climb the income ladder, their waste generation accelerates.

Sub-Saharan Africa's waste stream will more than triple by 2050. South Asia will double its output. Even in developed markets, daily per capita waste generation is projected to increase 19% by 2050.

The trend line points in one direction: up.

For investors, this means guaranteed volume growth. Waste Management doesn't need to take market share. The market itself expands annually. Collection routes get denser. Landfills receive more tonnage. Tipping fees increase with scarcity. It's volume-driven revenue growth with pricing power layered on top.

The Defensive Positioning

Operating leverage in waste services works differently than in tech. Collection costs are largely fixed—trucks, routes, labor. But as volumes increase, incremental tons drop straight to margin. The first 100 tons on a route might break even. The next 100 are pure profit.

Waste Management's operating EBITDA margin stayed flat during 2020's revenue decline. That shouldn't be possible in most industries. But fixed-route collection means cost structure doesn't flex with volume swings. The defensive characteristic isn't just about demand stability—it's about cost structure rigidity protecting margins.

Free cash flow generation remained strong throughout 2020. Even with nearly 10% revenue decline in Q2 2020, Waste Management generated over $15 billion in trailing twelve-month revenue with only 1.33% decline. Profitability increased 0.45% during the same period. That's not what happens in cyclical industries.

Dividends provide another defensive layer. Waste Management has increased dividends for over 15 consecutive years. The payout ratio sits around 42%, leaving 58 cents of every dollar in net income for reinvestment. That's sustainable even if earnings compress 30-40% in a severe downturn. The dividend doesn't get cut. Income investors stay put. Stock price stabilizes faster than growth stocks with no yield.

The ETF Strategy

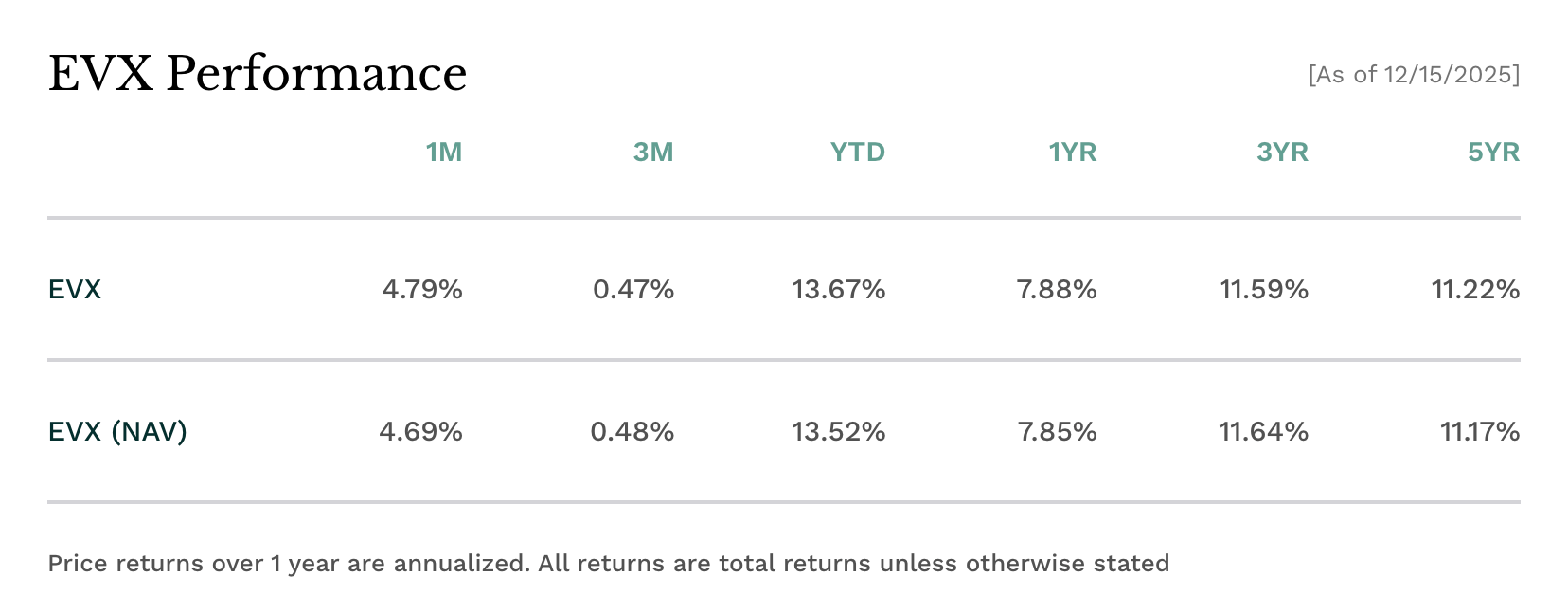

The VanEck's Environmental Services ETF (EVX) Performance (etf.com)

$EVX holds 21 individual positions beyond just Waste Management and Republic Services.

Ecolab contributes 10.07% exposure to the water treatment and sanitation side of environmental services.

Donaldson Company adds 4.76% in filtration and industrial products.

This diversification matters during sector-specific stress.

The ETF structure also means no single-company risk. If Waste Management faces an operational issue or regulatory challenge, the portfolio doesn't collapse.

For defensive positioning during volatility, the fee structure matters less than the volatility dampening characteristics of the underlying holdings.

What This Means

Waste services offer structural growth.

Utilities face flat or declining power demand in developed markets.

Consumer staples companies fight for share in mature categories. Waste volumes grow automatically as population and income increase.

It's defensive positioning with an embedded growth kicker.

The RNG transformation adds optionally to that base case. If renewable energy adoption accelerates faster than expected, waste companies benefit disproportionately. If it stalls, they still operate profitable landfills and collection routes. The downside is protected. The upside remains open-ended.

Correlation to broader equity markets exists but remains lower than most industrials. During market selloffs, $EVX doesn't crash as hard.

During rallies, it doesn't surge as much. That's exactly what defensive positioning should deliver—dampened volatility with acceptable returns across cycles.

The Case Against Isn't Compelling

Bears point to several concerns. Municipal budget pressures could reduce collection contracts.

Recycling economics remains challenged. Landfill capacity could become oversupplied in certain regions. These risks exist but lack magnitude.

Recycling's margin compression hurt earnings in 2018-2019 when China stopped accepting contaminated materials. Companies responded by raising collection fees and building domestic processing capacity. The RNG investments partly replace lost recycling revenue with higher-margin energy sales.

New technologies like waste-to-energy or advanced sorting could disrupt the model.

But waste companies own these facilities. They're the ones deploying the technology. Disruption that occurs within the existing oligopoly isn't disruption. It's capital redeployment by the same players who control the system now.

The Verdict for Volatility Protection

If the broader market drops 20% in 2025, where are you parking your cash?

$EVX won't make you rich quickly. This isn't a double-in-twelve-months opportunity.

It's a position that holds value when everything else is falling.

Returns stay positive when S&P 500 goes negative. Dividends get paid when other companies suspend distributions. The business model simply works across economic cycles.

For investors building portfolios to survive the next crisis, not just profit during the rally, waste management deserves serious consideration.

The moat is real. The growth is structural.

And the energy transformation creates additional value that markets haven't fully priced in yet.

During market chaos, boring and stable beats are exciting and volatile every single time.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.