Markets don't sleep anymore.

While you were busy, Trump doubled down on Greenland with military threats, tech giants battled for AI chip supremacy at CES, and geopolitical chess pieces moved across three continents.

$2 trillion in market cap now hinges on semiconductor supply chains, rare earth access could reshape global trade routes, and the Arctic just became the hottest real estate on earth.

Here's what you need to know.

Supreme Court Tariff Ruling

U.S. President Donald Trump, January 06, 2026 in Washington, DC. (Photo by Alex Wong/Getty Images)

The Supreme Court is expected to rule this Friday, January 9 on whether Trump's use of emergency powers to impose tariffs was lawful. The case challenges presidential authority under the International Emergency Economic Powers Act (IEEPA), and the outcome could invalidate major portions of the existing tariff regime.

Why it matters: This isn't just legal theory. A ruling against the administration could trigger $150 billion in refunds to importers, reshape executive trade authority, and eliminate a key revenue source the White House was counting on to fund defense and infrastructure proposals.

Three things to watch:

Market volatility on Friday: Prediction markets currently lean toward tariffs being struck down; expect immediate sector rotation

Treasury Secretary Bessent's positioning: He's defending tariffs publicly but preparing alternative revenue scenarios if the Court rules against them

Congressional response: A negative ruling could accelerate legislative efforts like the Trade Review Act to reclaim Congressional oversight of trade policy

How will the Supreme Court rule on tariff authority?

Trump’s Greenland Gambit

Source: NextBigFuture

The White House confirmed Trump is "actively" pursuing a Greenland purchase, and hasn't ruled out military force.

The U.S. needs what Greenland has: rare earth minerals, strategic positioning over the GIUK Gap (the naval chokepoint between North America and Europe), and control over emerging Arctic shipping lanes that could cut trade routes by 20-40%.

Why it matters: Denmark and Greenland reject the sale outright. European allies warn a forcible takeover could fracture NATO. But with Russia and China circling the Arctic, the U.S. sees this as existential for future supply chains and military dominance.

Three things to watch:

Rare earth leverage: Greenland's mineral reserves could break China's stranglehold on materials essential for EVs, semiconductors, and defense tech

Arctic trade routes: As ice melts, whoever controls Greenland controls shorter, cheaper shipping between Asia and Europe

NATO fracture risk: Allies are signaling this could be the issue that breaks the alliance if pushed too far

How does this play out?

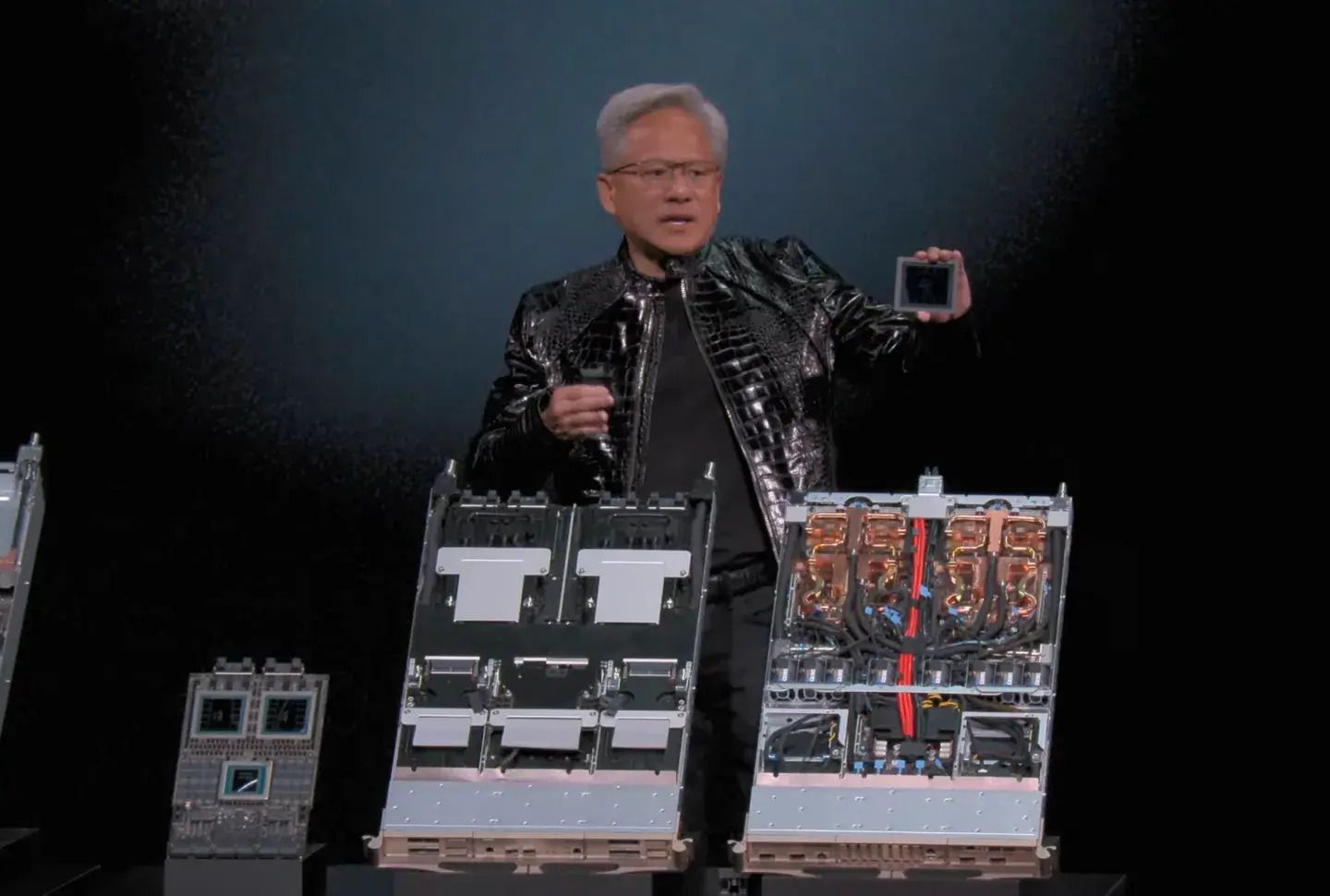

Nvidia Launches Vera Rubin Platform

Image: Nvidia

Nvidia unveiled its Vera Rubin AI computing platform at CES 2026, combining next-gen GPUs, CPUs, networking, and DPUs into a unified infrastructure stack. This is designed for trillion-parameter models and positions Nvidia to maintain its 80%+ data center GPU market share.

Why it matters: Every major AI lab needs this hardware. Training costs drop, inference speeds up, and Nvidia's moat gets deeper. The stock already trades at 40x forward earnings — this justifies the multiple or adds another leg up.

Three things to watch:

Enterprise adoption speed: Cloud providers need 6-12 months to deploy; watch AWS, Azure, and Google Cloud announcements

AMD's response timing: Competitor MI455X chips target the same workloads; pricing will determine real competition

Power infrastructure bottlenecks: Data centers can't add capacity fast enough; utilities become the constraint

AMD’s Novartis & MI455X

Image: AMD

AMD isn't conceding. Their Novartis AI platform pairs MI455X GPUs, promising performance parity with Nvidia at better power efficiency. They're targeting the $150 billion AI infrastructure market where Nvidia currently owns 8 out of every 10 dollars spent.

Why it matters: AMD's strategy is clear: undercut on price, match on performance, and win with total cost of ownership. If they capture even 15-20% market share, that's a $20-30 billion annual revenue opportunity.

Three things to watch:

TSMC capacity allocation: Both AMD and Nvidia need 3nm wafers; who gets priority determines who ships first

Enterprise validation: Meta, Microsoft, and Oracle need to publicly commit to AMD chips for credibility

Software ecosystem gap: Nvidia's CUDA advantage won't disappear overnight; AMD's ROCm needs major adoption

Will AMD meaningfully challenge Nvidia in AI chips by 2027?

Memory Shortage Hits Critical

Source: Samsung

AI chip demand is crushing memory suppliers. High Bandwidth Memory (HBM), the specialized DRAM that connects to GPUs, is sold out through 2026.

Samsung, SK Hynix, and Micron are racing to add capacity, but smartphone and PC prices will rise as consumer memory gets rationed to feed AI infrastructure.

Why it matters: You can build the fastest GPU in the world, but without HBM it's useless. Memory is now the constraint on AI deployment speed. Expect 10-15% price increases on consumer devices and continued supply tightness through 2027.

Three things to watch:

SK Hynix capacity expansion: They lead in HBM production; delays here ripple across the entire AI ecosystem

Samsung's 2nm pivot: Splitting foundry capacity between logic and memory creates trade-offs

Micron's AI revenue mix: They're gaining share; watch for guidance on HBM allocation

What breaks the memory bottleneck first?

TSMC's Chokehold Tightens

Almost every major AI chip announced at CES 2026, Nvidia, AMD, Qualcomm, manufactures at TSMC's advanced nodes. The company now produces 90%+ of cutting-edge logic chips globally.

Samsung won some Qualcomm business at 2nm, but TSMC remains the unavoidable dependency. TSMC Q4 revenue jumps 20%.

Why it matters: TSMC is the single point of failure for global AI infrastructure. Geopolitical risk (Taiwan), capacity constraints, and pricing power all concentrate here. If TSMC stumbles, the AI boom pauses.

Three things to watch:

Arizona fab progress: U.S. needs domestic advanced node capacity; delays matter for national security policy

Yield rates on 3nm: Lower yields mean higher costs; watch gross margin trends for signals

China export restrictions: Tightening rules could force TSMC to choose between markets

What's TSMC's biggest risk in 2026?

Lenovo-Nvidia "Gigafactory"

Lenovo and Nvidia announced a partnership to build AI cloud and hybrid infrastructure solutions, including a dedicated data center "Gigafactory." This isn't just hardware. It's a signal that enterprise AI is moving from experimental to production scale.

Why it matters: The $2.5 trillion enterprise software market is about to get rebuilt on AI infrastructure. Companies that control the stack—chips, servers, networking, software—win the next decade. Lenovo gets AI credibility, Nvidia gets distribution reach.

Three things to watch:

Dell and HPE response: They can't cede enterprise AI infrastructure without a fight; expect counter-partnerships

Pricing strategy: Will this undercut hyperscaler cloud costs enough to bring workloads back on-premise?

Regional deployment: China vs. U.S. regulatory environments could fragment the market

Where will most enterprise AI workloads run by 2028?

Trump Proposes $1.5 Trillion Defense Budget

President Donald Trump (AP Photo/Evan Vucci)

President Trump formally proposed a $1.5 trillion defense budget for FY2027, up from $901 billion in 2026. The administration frames this as building a "Dream Military" necessary for great-power competition with China and Russia, Arctic dominance, and technological superiority.

Why it matters: This is the largest proposed defense budget in U.S. history in nominal terms. It signals aggressive military modernization, but faces steep political hurdles. Fiscal conservatives question the debt impact, progressives want social program funding, and the Supreme Court tariff ruling today could eliminate the claimed revenue source.

Three things to watch:

Congressional approval path: Defense hawks support it, but budget math doesn't work without tariff revenue or cuts elsewhere

Defense contractor stock reaction: Lockheed Martin, Raytheon, Northrop Grumman already rallied on the news. Watch for contract guidance updates

Geopolitical signaling: This budget level tells China and Russia the U.S. is preparing for sustained competition, potentially accelerating arms races

Will Congress approve a $1.5 trillion defense budget?

Bottom Line

Control the hardware, control the future. Greenland's rare earths feed chip production. Chips enable AI. AI restructures global trade, defense, and economic power.

The moves this weekend weren't isolated. They're all connected.

And Friday's Supreme Court ruling could determine whether the U.S. has the fiscal capacity to execute this vision or needs to find another path.

The next 72 hours matter more than most realize.