Agriculture is facing a structural supply crisis that you’re missing.

While headline food price indices show recent declines, the underlying commodity dynamics tell a different story—one that points to sustained pressure on soft commodities and significant opportunities for positioned capital.

The Supply-Demand Imbalance

The global population continues its relentless climb past 8 billion.

Meanwhile, arable land is shrinking. The math doesn't work unless something breaks.

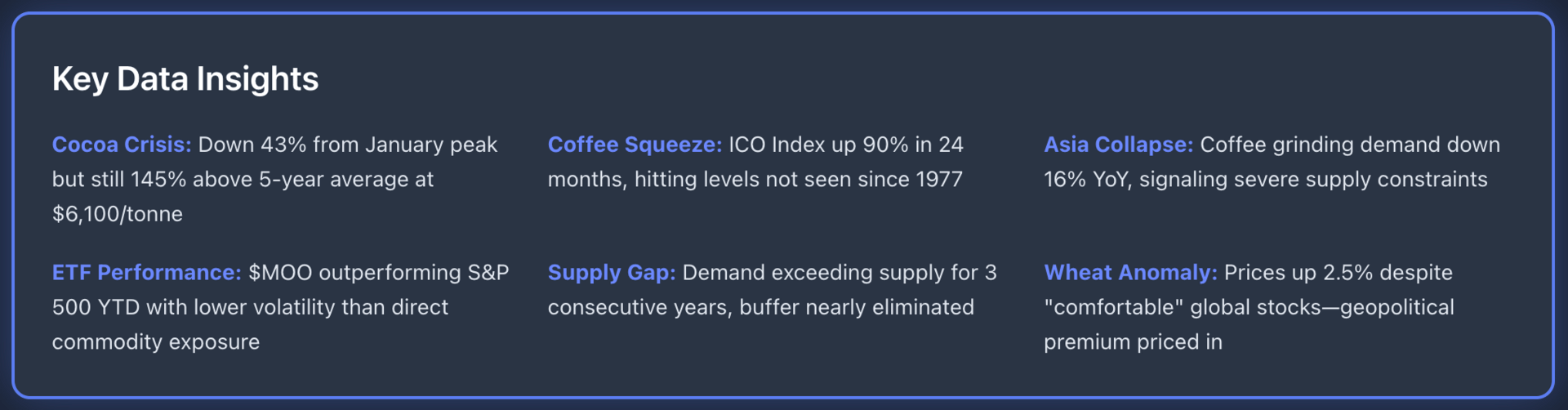

The November 2025 USDA WASDE report shows production adjustments across major crops. US corn production sits at 16.8 billion bushels, down 62 million from September estimates. Soybean output fell 48 million bushels to 4.3 billion. These aren't massive cuts. But they signal the margin squeeze happening in agricultural production.

Global cereal stocks are projected to hit a record 925.5 million tonnes. That sounds comfortable. But here's the problem: demand is growing faster than supply can scale. The FAO reports world cereal utilization expected to increase 2.1% this year. That gap matters more than you might think.

Why This Time Actually Is Different

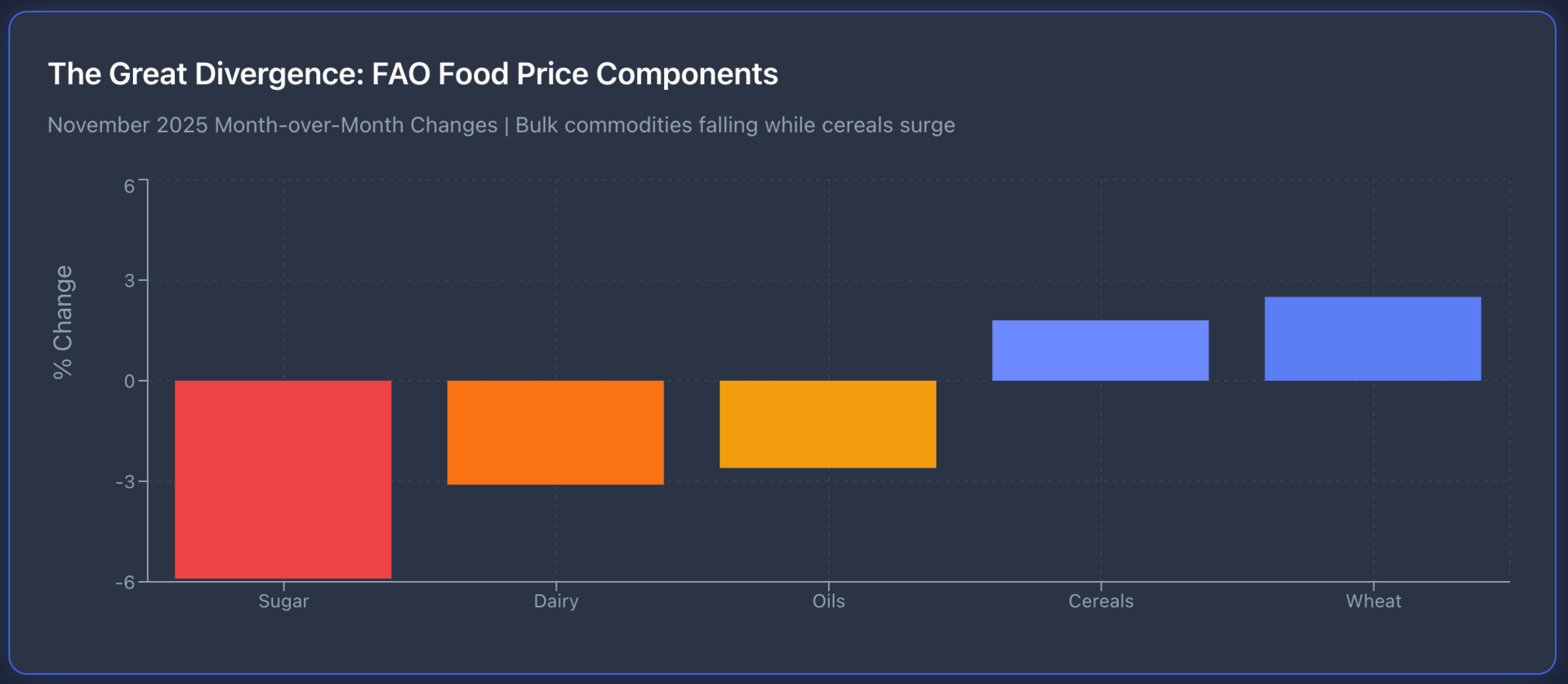

FAO Food Price Index, November 2025 (fao.org)

The FAO Food Price Index averaged 125.1 points in November 2025, marking three consecutive monthly declines. Sugar prices collapsed 5.9% MoM. Dairy dropped 3.1%. Vegetable oils fell 2.6%.

Most analysts see this as proof that food inflation is dead. They're wrong.

Look at what's rising: cereals climbed 1.8% in November.

Wheat prices jumped 2.5% despite generally comfortable supply outlooks.

The drivers include potential Chinese demand for US supplies, ongoing Black Sea hostilities, and expected reduced plantings in Russia. More importantly, these increases are happening against a backdrop of what should be favorable conditions.

The divergence between bulk commodities and specialty soft commodities reveals the real story.

The Cocoa Crisis

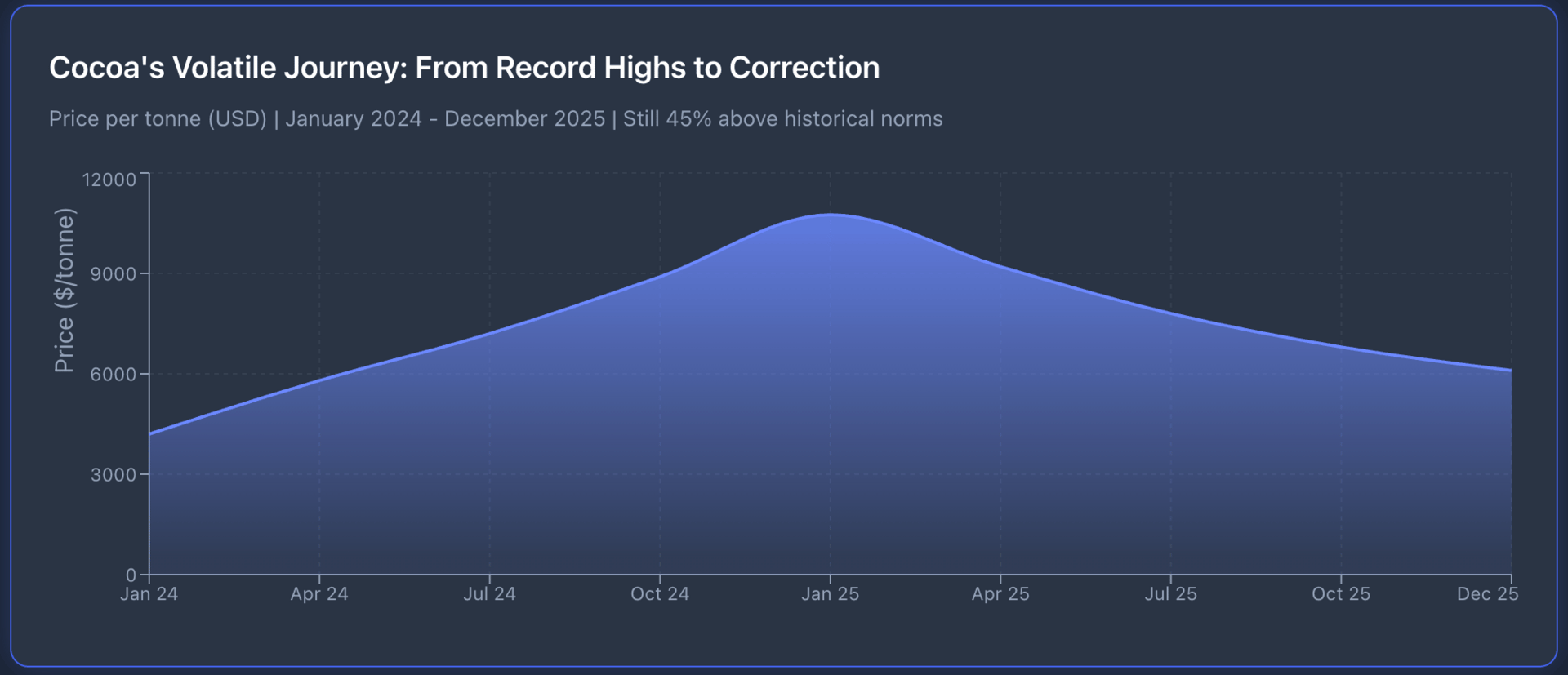

Cocoa futures are trading around $6,100 per tonne as of mid-December 2025. That's down sharply from the January 2025 peak of $10,750 per kilogram—a 60-year record. But don't mistake the correction for resolution.

The International Cocoa Organization slashed its 2024/25 global surplus estimate to just 49,000 metric tonnes from 142,000 MT previously.

Production in West Africa, which supplies over 70% of global cocoa, remains fragile. Ivory Coast's mid-crop is projected at only 400,000 metric tonnes, down 20% from historical norms.

El Niño-induced weather extremes, swollen shoot virus, and deteriorating bean quality aren't temporary issues. They're structural problems in a supply chain that has decades of underinvestment. Political risk looms with Ivory Coast's electoral cycle. Industry cover sits at just 1-2 months.

What happened to cocoa is happening in slow motion across multiple agricultural commodities. Climate volatility is the new normal. Production infrastructure is aging.

The buffer between supply and demand is disappearing.

Coffee Tells the Same Story

Coffee prices have surged over 90% in the past two years.

The ICO Composite Indicator averaged 330.44 US cents per pound in November 2025, up 1.2% from October. More critically, it hit record monthly averages earlier in 2025, surpassing levels last seen in April 1977.

Robusta coffee is particularly tight. Vietnam production, while recovering, faces ongoing challenges. Coffee grindings, a key demand measure, show geographical stress: Europe down 7.2% YoY in Q2 2025, Asia collapsed 16%, North America fell 2.8%.

These don't demand destruction from economic weakness.

They're supply constraints forcing industrial adjustment. Manufacturers are rationing raw material use and reformulating products because they can't access beans at workable prices.

Coffee prices are up 90% in two years. Where does it go in 2026?

The Investment Case

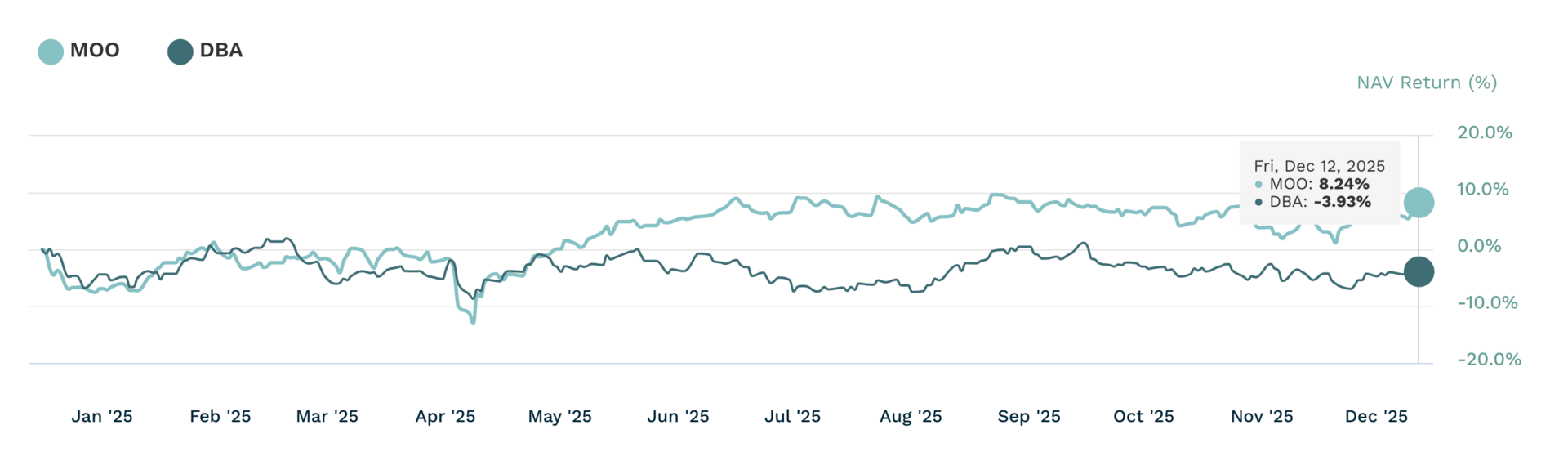

ETF Comparison, MOO vs. DBA (etf.com)

Most investors approach agricultural exposure wrong. They buy commodity futures or trackers and wonder why returns disappoint. The opportunity isn't in betting on price spikes. It's in owning the infrastructure that benefits from structural scarcity.

The VanEck Agribusiness ETF ($MOO) provides exposure to companies across the agricultural value chain: agri-chemicals, animal health, fertilizers, seeds, farm equipment, and agricultural trading. Year-to-date returns sit at 14.73% as of December 11, 2025. The fund yields 3.01%.

$MOO's holdings aren't pure commodity plays. They're industrial and consumer staples companies that extract value regardless of where prices settle. When wheat prices surge, fertilizer and seed companies benefit.

When cocoa hits records, agricultural trading firms profit from spread volatility. When climate stress forces production changes, equipment manufacturers sell solutions.

The Invesco DB Agriculture Fund ($DBA) offers more direct commodity futures exposure across grains, softs, and animal proteins. It tracks the DBIQ Diversified Agriculture Index and currently yields 4.11%. For tactical positioning or portfolio diversification, $DBA provides liquid access to agricultural commodity performance.

How much exposure do you currently have to agricultural soft commodities or Ag-equities (like $MOO)?

The Real Money Moves

The investment thesis doesn't require predicting the next El Niño or modeling crop yields. It rests on three durable trends:

First, global food demand is non-negotiable. Population growth and rising middle-class consumption in emerging markets create structural demand increases that don't reverse.

Second, supply constraints are worsening. Climate change isn't a future risk—it's a current operational reality for agricultural producers. Arable land per capita continues declining. Water stress is intensifying. These aren't cyclical issues.

Third, agricultural technology and infrastructure investment lagged for decades. The industry now faces catch-up spending requirements that will generate sustained returns for companies providing solutions.

Traditional inflation hedges like gold or TIPS offer protection but not growth.

Agricultural equities and commodity exposure provide both inflation correlation and secular growth drivers.

When food prices rise, these investments benefit directly.

When productivity improvements are needed, the companies in $MOO's portfolio sell the solutions.

The Downside Case

No investment thesis is complete without addressing risks. Agricultural commodity exposure carries volatility that most equity investors underestimate. Weather can shift rapidly. Policy interventions distort markets. Currency fluctuations affect returns.

The recent decline in the FAO Food Price Index demonstrates that commodity corrections can be sharp. Sugar falling 30% year-over-year shows how quickly oversupply can emerge. Technology could unlock productivity gains faster than anticipated.

For $MOO specifically, the fund's correlation with broader equity markets means diversification benefits are limited during systematic selloffs. The ETF's performance during the 2022-2024 period was poor, highlighting that agricultural investments can underperform for extended stretches.

$DBA carries contango risk in futures markets and lacks the fundamental cash flows of equity investments. Tracking error and roll costs can erode returns during sideways markets.

If you had to pick one hedge for the next decade:

Positioning for the Next Cycle

The setup for soft commodities looks better than at any time since the 2007-2008 supercycle. But that doesn't mean returns come easily or quickly.

Agricultural investments require patience and understanding of the cyclical nature of the sector.

For institutional allocators and sophisticated individual investors, a 3-5% portfolio weighting split between $MOO (for equity exposure and income) and $DBA (for tactical commodity positioning) offers meaningful exposure without concentration risk.

The time to build these positions is before the next supply shock becomes obvious. Once wheat or soybeans hit multi-year highs, the opportunity to enter at attractive valuations closes.

Climate volatility isn't priced in correctly. Population growth continues unabated. Production capacity faces structural constraints. That's not a thesis. That's arithmetic.

The only question is timing and positioning.

Smart capital positions ahead of inevitability, not in response to crisis.

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.