VanEckTraditional sector ETFs use a classification system called GICS (Global Industry Classification Standard) that forces every company into exactly one sector bucket. This made sense in 1999 when the system was created, but it's badly outdated today.

Here's the real problem: The biggest, most important companies in each sector don't fit neatly into traditional categories anymore.

When you buy a "technology" ETF expecting pure tech exposure, you're actually getting a consumer products company that happens to make phones.

The Concentration Problem

Here's where it gets worse. Traditional sector ETFs have legal restrictions that prevent them from putting more than 25% of their money in any single stock. This creates a bizarre situation:

The ETFs are forced to underweight the exact companies that define their sectors.

In practice, this means:

Technology ETFs own too little Apple, Microsoft, and NVIDIA

Consumer ETFs own too little Amazon and Tesla

The ETFs have to overweight smaller, less relevant companies to fill out their portfolios

The result? Your "technology" ETF performs worse than the actual technology sector because it can't properly invest in the companies that drive tech performance.

VanEck's Solution: TruSector ETFs

VanEck recently launched two ETFs (TRUD and TRUT) that try to solve this problem with a new approach called "TruSector."

Instead of forcing companies into single buckets, TruSector looks at what companies actually do:

Multi-Factor Classification: Rather than "Apple = Technology," they might see Apple as 60% consumer products, 25% digital services, and 15% technology hardware.

No Artificial Caps: They use a hybrid structure that lets them invest properly in the biggest companies without hitting legal limits.

Dynamic Rebalancing: They can reclassify companies as their business models evolve, instead of waiting years for official GICS updates.

Real-World Impact

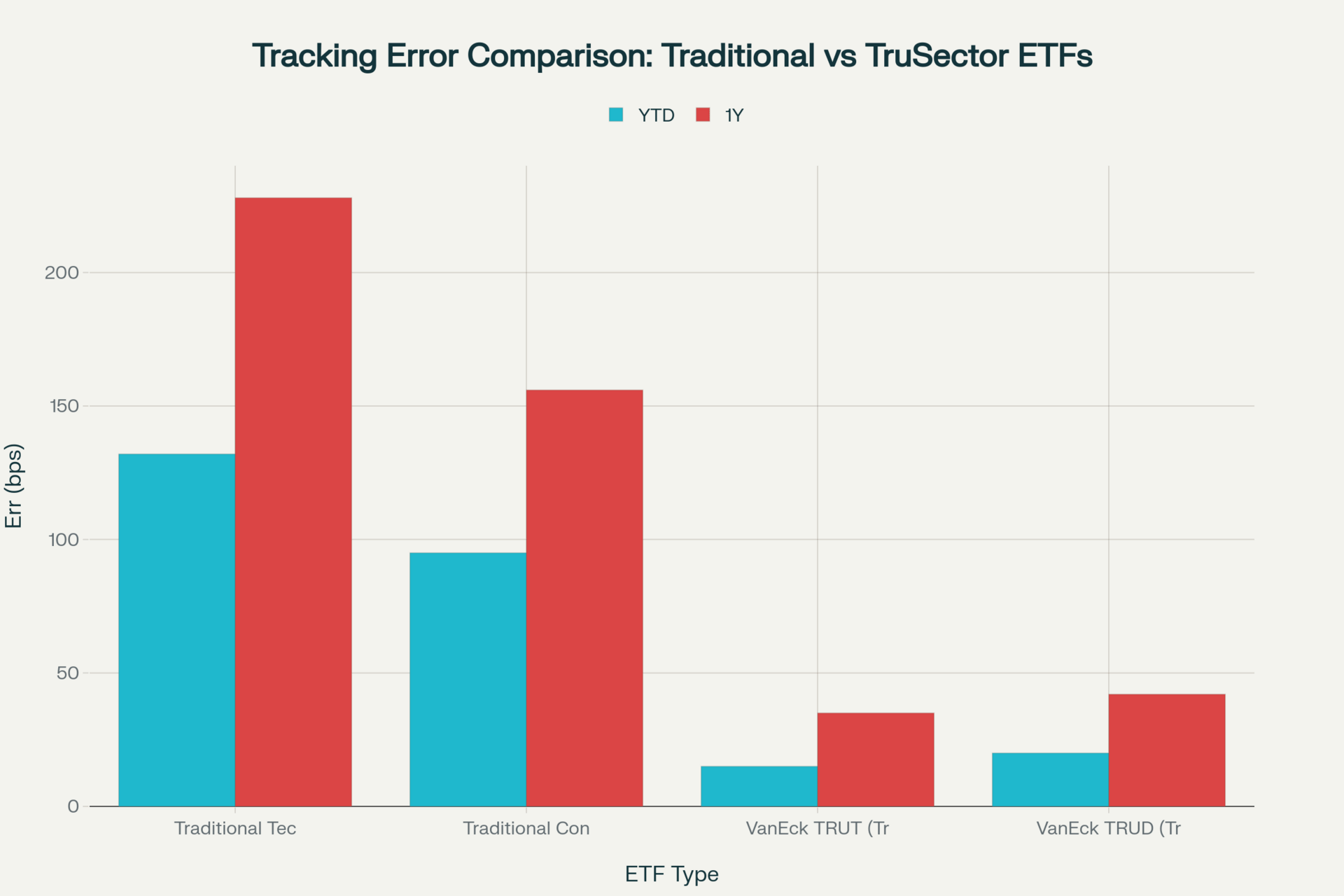

The numbers show how big this problem has become. As of mid-2024:

Traditional tech ETFs underperformed their benchmarks by over 2% annually

This underperformance comes directly from being unable to properly weight sector leaders

The gap is widening as market concentration increases

What This Means for Regular Investors

You don't need to buy VanEck's specific products to benefit from this thinking. Here's what you should consider:

1. Question Your Sector Exposure

Look at what your sector ETFs actually own. That "technology" fund might have more exposure to old-school hardware companies than to the AI revolution.

2. Consider the Concentration Reality

The stock market is increasingly dominated by a few giant companies. Fighting this trend with artificial diversification requirements might hurt returns.

3. Think Beyond Traditional Sectors

The most interesting investment opportunities often span multiple traditional sectors. Electric vehicles involve technology, manufacturing, and energy. AI involves chips, software, and services.

The Bigger Picture

This isn't just about ETFs, it's about how we think about the modern economy. Traditional sector boundaries made sense when:

Companies did one thing well

Industries were clearly separated

The biggest companies were banks, oil companies, and manufacturers

Today's economy is dominated by platform companies that do everything. Amazon is retail, logistics, cloud computing, and media all at once. Google is search, advertising, cloud services, and artificial intelligence.

What Comes Next

The investment industry is slowly waking up to this problem. Expect to see:

More "pure play" thematic ETFs (AI, cybersecurity, clean energy)

Flexible classification systems that can handle multi-business companies

Less reliance on traditional sector definitions

For now, the key insight is simple: Don't assume your sector ETFs give you the exposure you think they do.

Before buying any sector fund, look at its actual holdings and ask yourself: "Do these companies actually represent the economic trend I want to invest in?"

The answer might surprise you.

The future of investing isn't about putting companies in boxes—it's about understanding what they actually do and how they make money. The sooner you start thinking this way, the better your investment decisions will become.