The United States now controls the world's largest oil reserves.

Not through discovery. Through force and strategic positioning in Venezuela after the January 3rd military operation that removed Maduro from power.

Venezuela holds 303 billion barrels of proven reserves, more than Saudi Arabia. Trump signed an executive order creating a financial firewall protecting $3-50 billion in immediate oil sale revenues from creditors.

He announced $100 billion in private capital to rebuild PDVSA infrastructure during a January 9th White House meeting with oil executives.

But the commitment isn't there yet.

ExxonMobil's CEO Darren Woods called Venezuela "uninvestable" during that meeting, citing nationalization history and legal risk.

Trump's response: he's "inclined" to block Exxon from participating in Venezuelan opportunities, saying they were "playing too cute."

No major oil company made binding commitments.

Chevron showed willingness to scale existing operations. Smaller players expressed tentative interest. But the $100 billion figure remains a projection, not deployed capital.

That gap between Trump's political push and commercial reality changes the risk calculus significantly.

When will Trump’s $100B investment in Venezuela oil actually deploy?

The Numbers Behind the Monopoly

The operation gives the U.S. effective control over 55% of global oil reserves when combined with domestic holdings. That's the core strategic shift.

Venezuela can produce 30-50 million barrels immediately from existing wells, with potential to restore 600,000+ barrels per day from the Orinoco Belt heavy oil fields. The breakeven cost sits at $80 per barrel, higher than conventional plays but viable at current pricing.

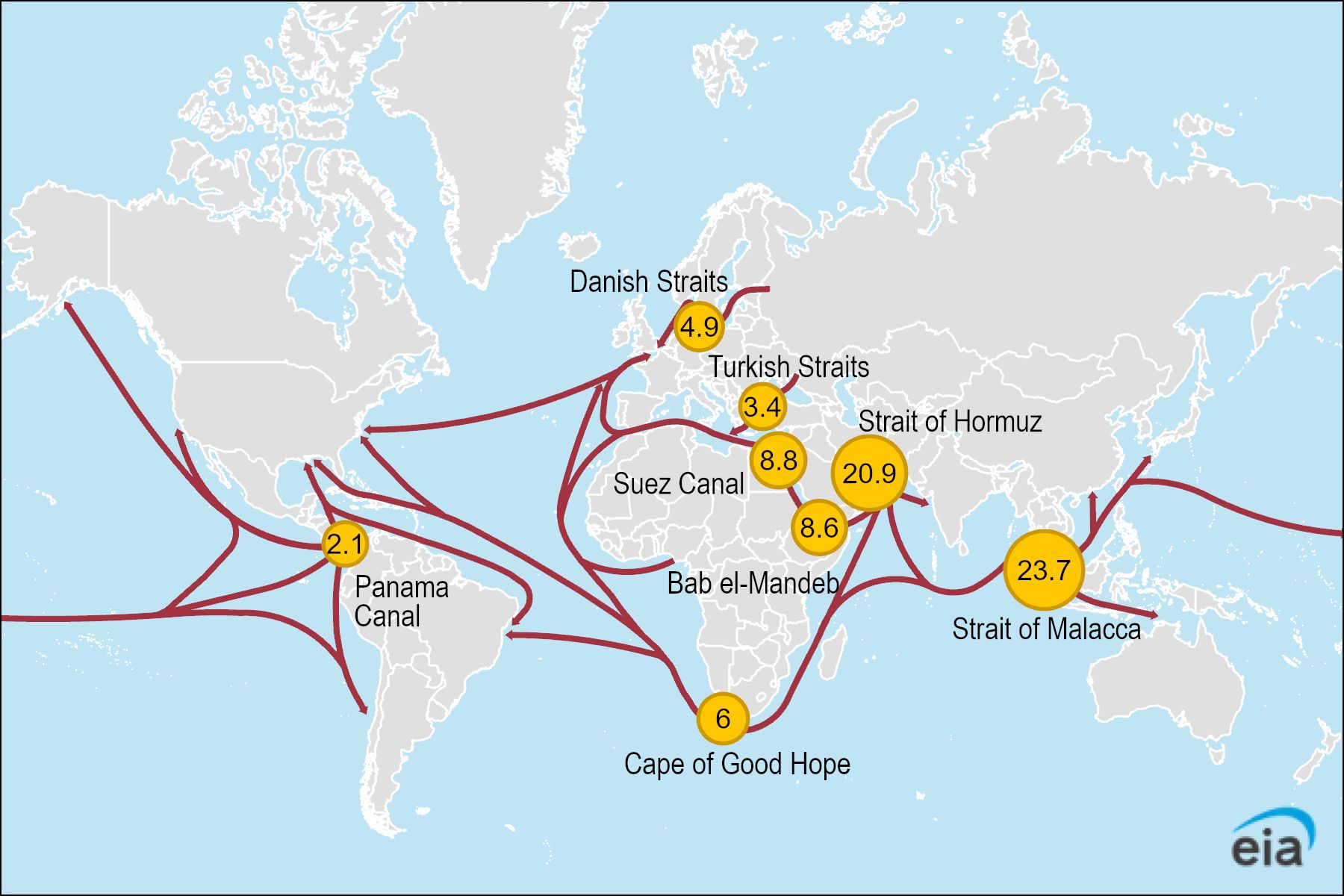

But here's the thing: this isn't just about production volume. It's about transport corridors and monopoly positioning.

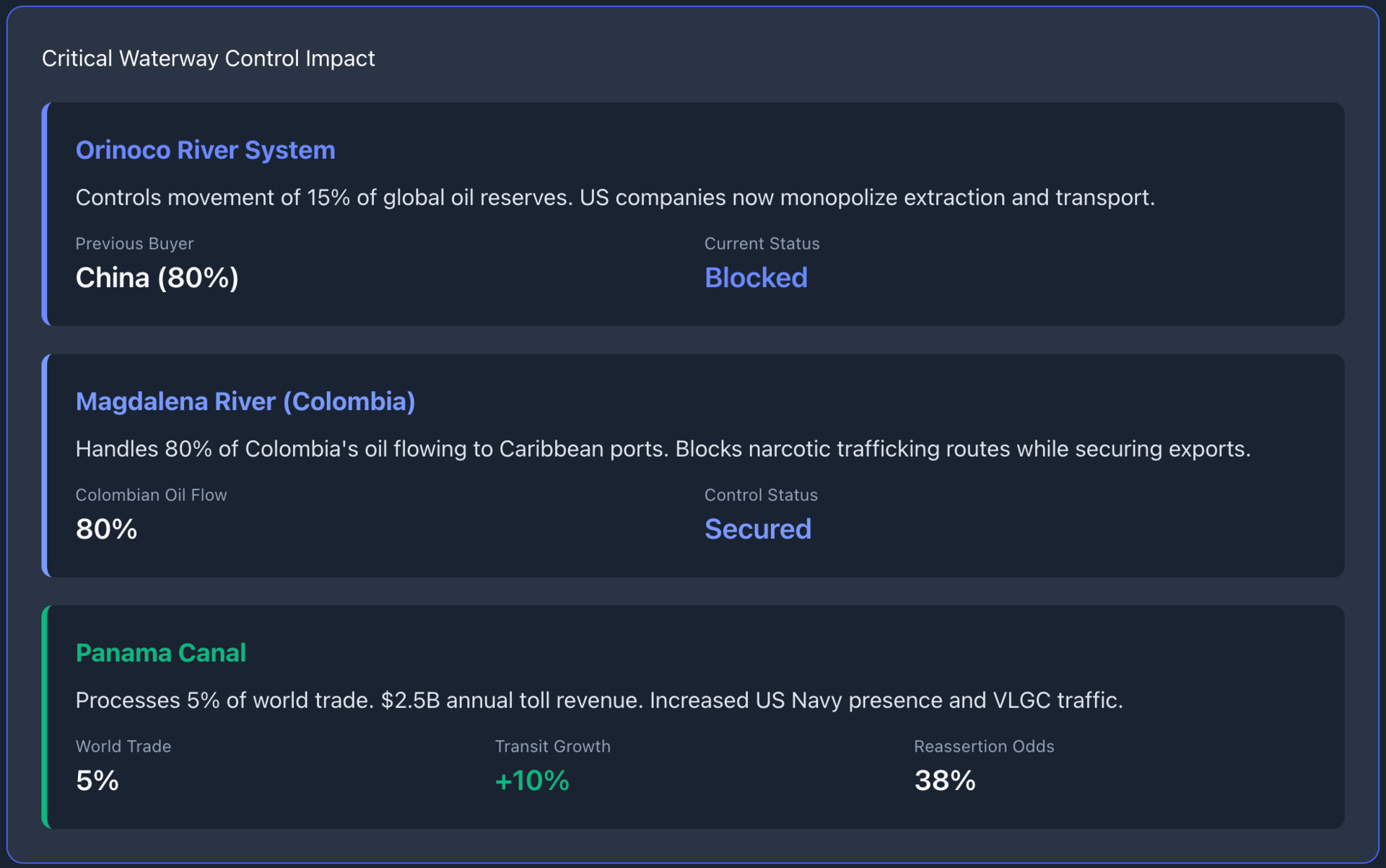

Three Critical Waterways Under U.S. Influence

The Orinoco River system moves 15% of global reserves. U.S. companies now monopolize extraction and transport, effectively shutting out Chinese buyers who previously took 80% of Venezuelan exports.

The Magdalena River in Colombia handles 80% of Colombia's oil flowing to Caribbean ports. Control here blocks narcotic trafficking routes while securing export channels. President Petro received a blunt message: comply or face consequences.

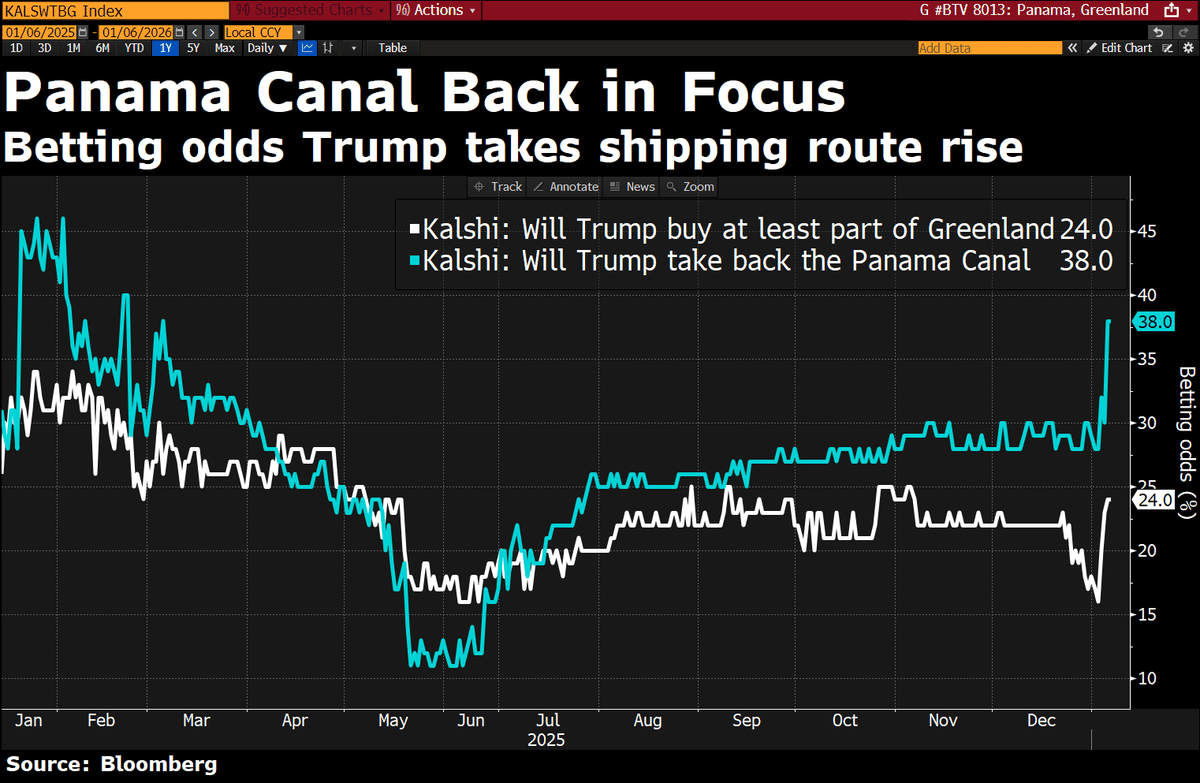

The Panama Canal processes 5% of world trade and generates $2.5 billion annually in tolls. Increased U.S. Navy presence and VLGC traffic show +10% transit growth post-blockade. Odds of U.S. reasserting direct control: 38% according to current analysis.

Which waterway matters most for the Venezuelan oil monopoly?

The Tanker Blockade Reality

As of early January, 12+ tankers entered "dark mode" to evade sanctions—transponders off, destinations concealed. U.S. forces captured 5 vessels.

Cuba lost 35,000 barrels per day in guaranteed shipments, forcing negotiations.

Real on-the-ground enforcement changed the equation. Not threats. Actual interdiction.

What This Means

WTI and Brent crude stabilized with +1.5% gains on monopoly expectations. The market priced in reduced competition and centralized control.

Energy sector ETFs responded predictably:

$XLE ( ▲ 1.21% ) gained +3-4% on volatility as investors positioned for higher sustained oil company earnings. The fund tracks major U.S. producers—Exxon and Chevron are top holdings. They're the direct beneficiaries.

$VDE ( ▲ 1.17% ) showed similar movement (+3-4%) with broader energy stock exposure dampening single-company risk.

$USO ( ▲ 2.11% ) demonstrated higher sensitivity to spot price moves but carries the futures roll problem. Short-term tactical gains don't translate to long-term value here.

Defense contractor exposure through $ITA jumped +5% as military logistics supporting the operation increased procurement.

That gap between equity-based energy funds and commodity futures matters more than you might think. The structural costs of contango in USO will eat returns over quarters, while XLE and VDE capture the sustained earnings boost from higher realized prices.

The Investment Case Breakdown

Oil majors are recovering expropriated assets from the 1976 and 2000s nationalizations.

Exxon and ConocoPhillips have outstanding compensation claims exceeding $20 billion. The executive order framework will protect oil revenues specifically for "U.S. foreign policy goals," which includes settling these claims before other creditors.

This creates a direct value recovery mechanism separate from new production economics.

For institutional positioning, the thesis splits into three layers:

First layer: Equity exposure through XLE or VDE captures the monopoly rent without futures market friction. Expense ratios under 0.10%, dividend yields around 3%, and $27.6 billion in XLE assets provide deep liquidity.

Second layer: Tactical commodity plays through USO make sense only for short-duration bets on specific price catalysts. The 0.79% expense ratio and contango drag make this unsuitable for anything beyond 30-60 day windows.

Third layer: Targeted E&P or services exposure via XOP or OIH offers leveraged upside if the $100 billion infrastructure rebuild accelerates faster than consensus expects. Higher volatility, smaller asset bases, but direct correlation to drilling activity and capex deployment.

Best way to play the Caribbean oil monopoly thesis?

Risk Factors Worth Monitoring

The Orinoco Belt $80 breakeven cost remains above many conventional plays. If WTI drops below that threshold, production economics deteriorate quickly.

Mining Arc security issues persist. Criminal networks operating in the region create operational risk for field personnel and equipment.

Chinese response through antitrust investigations and alternative supply chain development could fragment the monopoly positioning over 12-24 months.

Colombia's Petro remains unpredictable despite pressure. Any supply disruption through Magdalena River routes would impact export timelines.

OPEC+ faces internal pressure from this supply addition. Coordination around production cuts becomes more complex when a non-member controls the largest reserve base.

The Blunt Assessment

Trump's statement that "American talent will rebuild Venezuela" reflects confidence in execution capability. The $100 billion private investment commitment backs that up with actual capital allocation.

But execution timelines matter. Restoring degraded infrastructure in the Orinoco Belt will take 18-36 months minimum. The immediate 30-50 million barrel release provides cash flow, but sustained 600k+ barrels daily requires completed repairs and operational stability.

For portfolio positioning, the energy equity play through XLE or VDE offers the cleanest exposure to this monopoly structure. The dividend yield provides a downside cushion while monopoly rents compound. Defense exposure through ITA captures the security and logistics premium.

Commodity speculation through USO only makes sense around specific catalysts—tanker seizures, OPEC+ meeting outcomes, or production milestone announcements. The structural headwinds in futures-based products don't justify buy-and-hold strategies here.

The geopolitical framework now favors centralized U.S. energy control across Latin America. Cuba and Colombia become dependent buyers. Panama's canal provides the enforcement mechanism. Venezuela's reserves provide the supply.

That's the Monroe Doctrine 2.0 in practical terms: control the reserves, control the transport, control the region.

The market is pricing in roughly 3-4% energy sector premium on this shift. The question for institutional allocators is whether that adequately captures the monopoly value or underestimates the duration and scale of U.S. dominance in Caribbean energy markets.

Based on reserve scale, infrastructure investment commitments, and transport corridor control, current pricing likely undervalues the structural advantage by 200-300 basis points over a 24-month horizon.

But that assumes execution delivers on timeline and without significant security deterioration.

The risks are real. The opportunity is measurable. The capital is committed.

Watch infrastructure rebuild milestones, tanker interdiction rates, and OPEC+ response coordination for leading indicators on whether this monopoly thesis holds or fragments under pressure.

Will Trump's Donroe Doctrine reshape Caribbean energy markets?"

Subscribe to ETF Alert for real-time market news.

We track the trends that move billions, before they hit mainstream headlines.

What's catching investor attention today: Greenland: Trump’s Vision of the New World Order

Disclaimer: This is not financial or investment advice. Do your own research and consult a qualified financial advisor before investing.