Market dynamics shift as geopolitical policies reshape investment opportunities in chip leaders

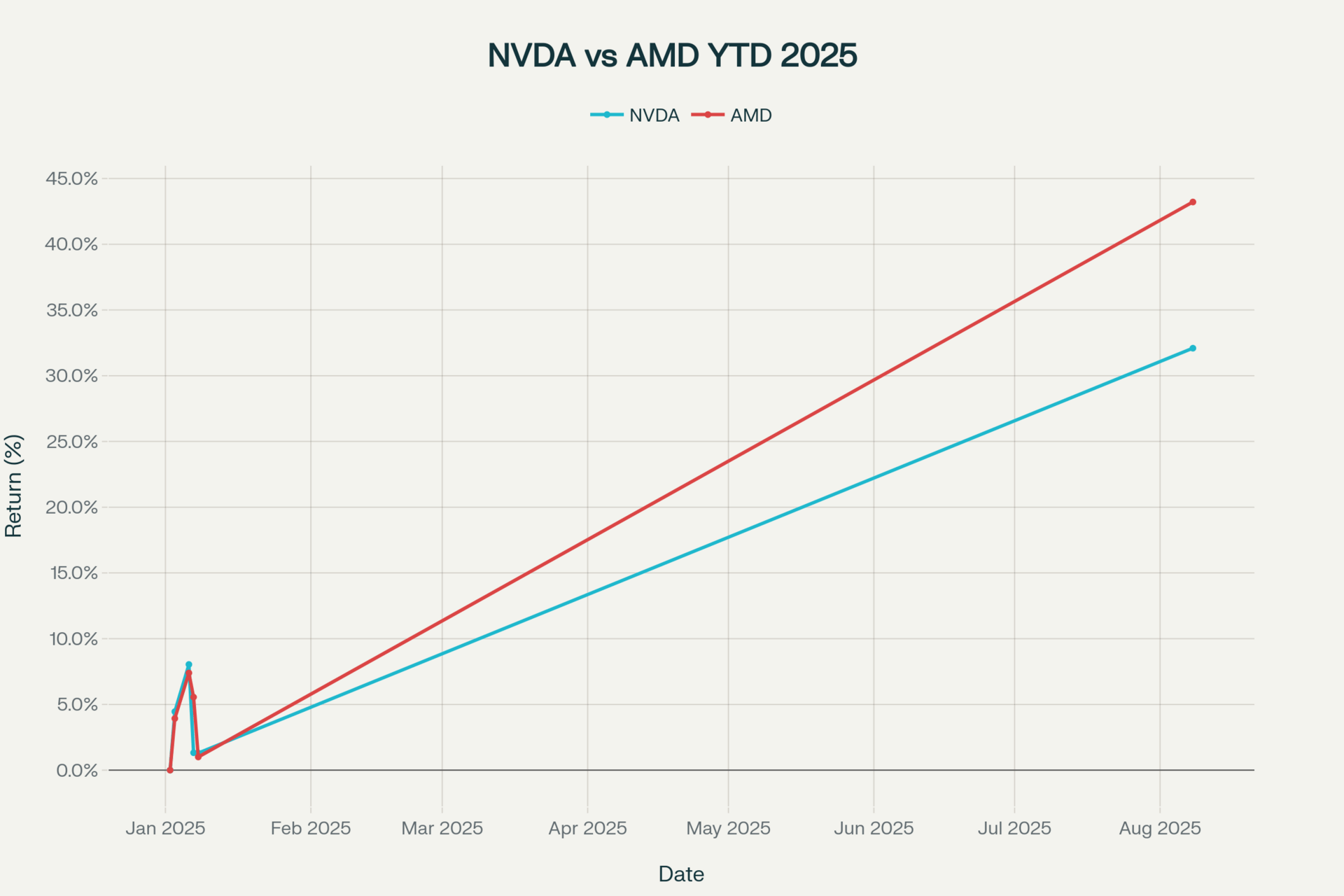

As we assess the semiconductor landscape on August 11, 2025, both NVIDIA (NVDA) and Advanced Micro Devices (AMD) find themselves at a critical inflection point. Recent developments in trade policy, combined with evolving competitive dynamics, present a complex but potentially lucrative opportunity for ETF investors focused on technology exposure. While NVIDIA maintains its dominant market position with a $4.5 trillion market capitalization, AMD's remarkable 43.2% year-to-date outperformance versus NVIDIA's 32.1% gain signals a fundamental shift in investor sentiment and market opportunities.

Market Snapshot: Current Financial Standing

NVIDIA's Fortress Position

NVIDIA continues to demonstrate financial dominance with record Q2 2025 revenue of $30.04 billion, representing a 122% year-over-year increase. The company's data center segment generated $26.3 billion in revenue, up 154% annually, driven by insatiable demand for its Hopper architecture and anticipation for the Blackwell platform. With gross margins of 75.1% and a current stock price near $182.74, NVIDIA trades at a P/E ratio of 58.89, reflecting premium valuations but strong fundamental execution.

The company's guidance for Q3 2025 revenue of $32.5 billion, plus or minus 2%, demonstrates continued momentum despite geopolitical headwinds. Key metrics underscore NVIDIA's market leadership: the stock reached an all-time high of $183.88 on August 8, 2025, with analysts maintaining predominantly bullish ratings—34 of 38 analysts rate the stock a "Buy".

AMD's Competitive Resurgence

AMD reported Q2 2025 revenue of $7.69 billion, up 32% year-over-year, with particularly strong performance in its Client and Gaming segment, which surged 69% to $3.6 billion. Despite facing an $800 million inventory writedown due to U.S. export controls on its MI308 AI chips to China, the company maintained robust operational momentum. AMD's data center revenue reached $3.2 billion, up 14% annually, while the company projects Q3 2025 revenue of approximately $8.7 billion, exceeding Wall Street expectations of $8.3 billion.

The company's strategic positioning has garnered increased analyst attention, with CFRA upgrading AMD to "Strong Buy" and raising price targets to $165, citing the competitive potential of the upcoming MI350 series against NVIDIA's Blackwell architecture. Goldman Sachs analyst James Schneider notes that AMD's data center GPU solutions are gaining "strong traction," particularly with the MI355 offering expected to drive double-digit quarter-over-quarter growth.

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Geopolitical Catalyst: The New Trade Policy Framework

The 15% Revenue Sharing Agreement

The most significant development affecting both companies involves the unprecedented agreement to remit 15% of AI chip sales revenue to China to the U.S. government in exchange for export licenses. This arrangement, finalized following NVIDIA CEO Jensen Huang's White House meeting with President Trump, applies to NVIDIA's H20 chips and AMD's MI308 processors. The deal could generate over $2 billion annually for the federal government, based on projected $15 billion in H20 sales for NVIDIA and $800 million for AMD.

This arrangement represents a fundamental shift in export control policy, transitioning from pure security-based restrictions to revenue-generating mechanisms. Former trade officials have described this as "unprecedented and dangerous," suggesting it could be perceived as an export tax—constitutionally prohibited—or potentially resembling "bribery or blackmail". However, the agreement enables both companies to access the massive Chinese market while addressing U.S. national security concerns.

Semiconductor Tariff Implications

President Trump's announcement of a 100% tariff on imported semiconductors adds another layer of complexity. However, companies manufacturing or committed to manufacturing in the United States receive exemptions, potentially benefiting both NVIDIA and AMD given their domestic operations and investments. The tariff framework, implemented under Section 232 national security provisions, aims to strengthen domestic semiconductor manufacturing while protecting established players.

The European Union negotiated a reduced 15% semiconductor tariff rate, while South Korea and Japan secured similar favorable treatment. This tiered approach creates competitive advantages for allied nations while maintaining pressure on other suppliers, particularly those from China.

Future Outlook: Expert Consensus and Growth Projections

Short-Term Catalyst Analysis (2025-2026)

NVIDIA's Trajectory: Goldman Sachs raised its price target to $200, up from $185, citing robust AI chip demand and solid execution. The firm expects NVIDIA to exceed Q2 earnings estimates driven by Blackwell production ramp, H20 chip compliance in China, and margin sustainability. However, 24/7 Wall St. presents a more conservative year-end forecast of $147.70, suggesting potential 17.79% downside from current levels.

AMD's Acceleration: HSBC doubled its price target to $200, representing nearly 40% upside, based on the competitive positioning of the MI350 series. The firm's new forecast for AMD's AI GPU revenue in 2026 calls for $15.1 billion, 57% higher than the $9.6 billion consensus view. TipRanks projects AMD could see 53% EPS growth in 2025 and 39% in 2026, potentially outpacing NVIDIA.

Long-Term Industry Dynamics (2026-2030)

The World Semiconductor Trade Statistics (WSTS) projects the global semiconductor market will reach $760.7 billion in 2026, growing 8.5% annually. This expansion will be broad-based across regions and product categories, with Memory and Logic segments leading growth. The industry expects to exceed $1 trillion by 2030, driven by AI infrastructure, automotive semiconductors, and edge computing applications.

Key Growth Drivers:

AI acceleration through data center expansion and edge deployment

Automotive semiconductor integration in electric and autonomous vehicles

Industrial IoT and smart manufacturing adoption

5G infrastructure buildout and next-generation networking

ETF Investment Implications

Technology ETF Positioning

The Vanguard Information Technology ETF (VGT) provides excellent exposure to both companies, with NVIDIA representing 16.77% of holdings and AMD comprising 1.31%. This $99.4 billion fund offers a low 0.09% expense ratio and has delivered 21.6% annualized returns over the past decade. The Technology Select Sector SPDR Fund (XLK), with $83.9 billion in assets, provides similar exposure with a slightly higher concentration in mega-cap names.

For investors seeking focused semiconductor exposure, the VanEck Semiconductor ETF (SMH) offers targeted access with NVIDIA accounting for nearly 23% of the portfolio and AMD maintaining significant representation. The fund's 25.7% ten-year annualized return reflects the sector's outperformance, though concentration risk remains elevated.

Specific Metrics for ETF Investors

Monitor These Key Indicators:

Data Center Revenue Growth: Both companies' data center segments serve as primary AI revenue drivers

Gross Margin Trends: Indicates pricing power and production efficiency amid competitive pressure

China Revenue Impact: Export license approvals and revenue sharing compliance

Capital Expenditure Allocation: R&D spending ratios and manufacturing capacity investments

Market Share Evolution: Relative positioning in AI accelerator and CPU markets

Risk Factors to Track:

Geopolitical escalation affecting trade relationships

Competitive product launches and technological leapfrogging

Economic slowdown impacting corporate IT spending

Regulatory changes in AI development and deployment

Investment Recommendation

Based on current fundamentals and evolving market dynamics, both NVIDIA and AMD present compelling investment opportunities for technology-focused ETF portfolios. NVIDIA offers stability and market dominance with premium valuations reflecting its leadership position. AMD provides growth potential with more attractive risk-adjusted valuations and significant competitive momentum.

The 15% revenue sharing arrangement, while unprecedented, demonstrates both companies' commitment to maintaining Chinese market access—critical for long-term growth. The semiconductor tariff framework favors established players with domestic operations, creating competitive moats against new entrants.

For ETF investors, broad technology exposure through VGT or XLK provides balanced access to both companies while mitigating single-stock concentration risk. Those seeking higher semiconductor exposure should consider SMH, accepting elevated volatility for potential outperformance as the AI infrastructure buildout continues.

The semiconductor sector's trajectory toward $1 trillion by 2030 supports sustained growth for leading players. Both NVIDIA and AMD are well-positioned to capitalize on this expansion, making them essential components of any technology-focused investment strategy. The key differentiator will be execution capability amid rapidly evolving competitive and regulatory landscapes.